After what felt like an endless presidential campaign, we now have a President-Elect. (I know, it’s not official yet… but let’s keep this a politics-free zone.) Of the many changes facing the nation with a new administration is President-Elect Biden’s tax proposals, a subject I know many of you reading this are keeping a close eye on.

Bottom line up front: we don’t know what changes will be made to the tax code, if any. So much depends on the results of the Senate run-off race in Georgia. If Republicans win both of those seats, it’s unlikely that major changes to the tax code will be made. If Democrats win both seats, it’s possible that they will decide to first focus on pandemic relief and health care legislation, pushing tax legislation later into the year, which could increase the likelihood that any changes to the tax code would be effective in 2022. But could they make changes retroactive to the start of 2021? Absolutely, there’s precedent for that.

We are all between a rock and a hard place on being able to make insightful tax planning decisions.

So, my point is that everything below is still in “wild speculation” territory. I will highlight some of the proposals President-Elect Biden has made and how they may impact you. But like so many things in wealth management, what you choose to do comes down to risk tolerance and YOUR big picture: What is your risk tolerance for rising taxes and how do they impact your goals?

Tax Rate Change on Income Over $400,000

The Proposal:

- Biden has pledged to not change taxes for those making less than $400,000 in income

- For those making more than $400,000, the ordinary income tax rate would change to a top bracket of 39.6%

Now, how is “$400,000 income” defined? Is that per person income (single) or total household income (married filing jointly)? All TBD, although there is reason to believe that this may be per person (again, wild speculation).

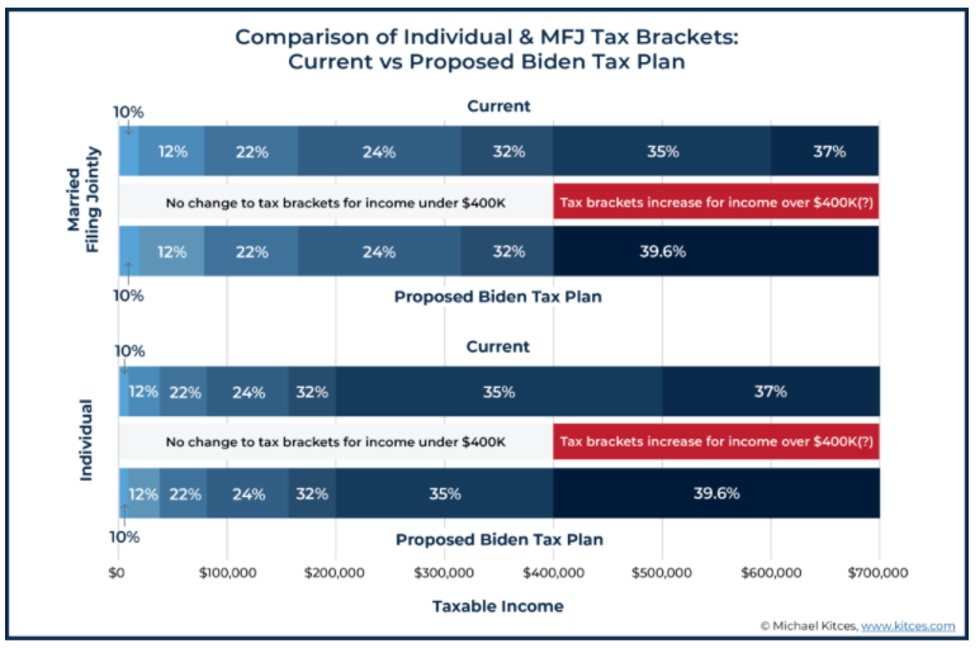

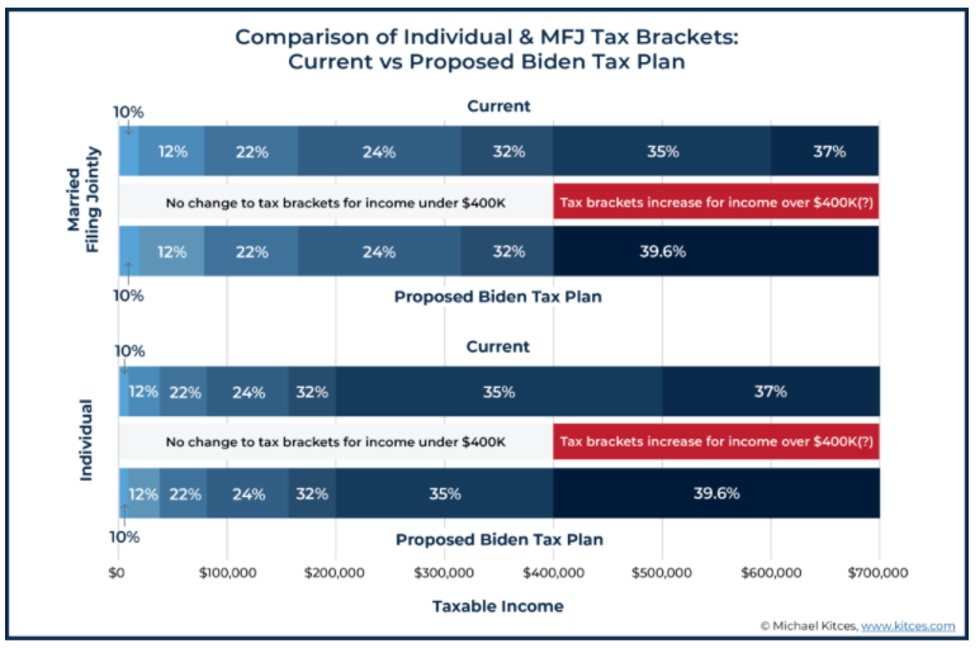

But let’s just assume it’s $400,000 flat. As the below chart shows, Biden’s proposal could push you from a 35% or 37% bracket into the 39.6% bracket. And if you’re on the cusp of $400,000 income, going “over the line” from the 32% bracket to the next highest bracket could mean a 7.6% increase in your tax rate.

Source: Thanks to Michael Kitces for the chart

(Here’s a reference to the 2020 Federal income tax brackets and rates, if you need it.)

What Should You Do:

- If you have less than $400,000 in income, avoid accelerating any income into 2020 because there is no reason to believe that your tax rate will go higher.

- If you are already in the highest bracket (37%) and you expect to stay there, consider accelerating income into 2020, because there’s not much downside to you being wrong. (If you’re wrong about the rate going up, you’re paying 37% taxes today when you could be paying 37% taxes tomorrow. If you’re right about the rate going up, you could be avoiding 39.6% taxes.)

- If your income is a little over $400,000, you’re in a tough spot. Accelerating income could push you unnecessarily into a higher bracket now, or it could look like a smart decision in retrospect if rates do change. If you want a guarantee that you won’t pay more than the 37% tax rate, then pay taxes now.

Here are some options to consider for accelerating income into 2020:

- Roth conversions, which will be taxed at today’s rates—but remember that you can’t reverse this change (the IRS no longer allows Roth recharacterizations)

- Business owners: Bill your customers now, not in January. Delay paying expenses until 2021. Forego any elective depreciation.

- Ask your employer if you can receive any bonus payments before year-end.

Cap on Itemized Deductions

The Proposal:

- Cap itemized deductions at 28% for taxpayers with income above $400,000, which would limit the value for taxpayers in higher tax brackets

- Repeal of the State and Local Tax (SALT) cap—NOTE: this is not a specific Biden proposal but likely in any Democratic-backed tax legislation

What Should You Do:

- If you are using the standard deduction, consider pushing out expenses that may not be fully deductible now due to the SALT cap (such as property taxes or estimated state taxes) into January 2021; you know you won’t benefit in 2020, but you could benefit next year if the SALT cap is repealed and retroactive to the beginning of 2021

- If you are itemizing deductions, pull forward whatever deductions you can into 2020. For example, considering a gift to charity or your Donor Advised Fund? You could save up to 37 cents on taxes by giving $1 to charity in 2020; in 2021, you may only be able to save 28 cents.

Retirement Account Contributions

The Proposal:

- Eliminate IRA deductions and reduction in wages for making contributions to 401k, 403b, and similar retirement plans

- Replace with a flat rate credit for contributions to traditional retirement accounts (i.e., no impact on Roth accounts)

- The credit rate is unknown, but may be 26%—i.e., for every dollar you contribute to a retirement account, multiply that by 26% and that’s how much you’ll save on taxes

What Should You Do:

- No action needs to be taken before year-end, but if passed, this could flip retirement-savings planning on its head—for those in the 33%, 35% and 37% brackets, it may make more sense to contribute to the Roth version of your employer-sponsored retirement account (if offered); you’ll pay the tax upfront when you contribute, but at least you won’t have to pay additional tax when you take the money out

Capital Gains if Income Over $1M

The Proposal:

- If taxpayers have income over $1M, long-term capital gains would lose their preferential treatment—meaning they would be taxed at ordinary income tax rates

What Should You Do:

- If you have less than $1M in income, there’s not much of a case for accelerating any gains into 2020

- If you have more than $1M in income, considering pushing the sale of a large asset such as a business or vacation property into 2020 (if possible) to ensure that you will not be subject to higher tax rates—you’ll be paying taxes at 20% (plus 3.8% surtax) rate in 2020 vs. possibly 39.6% rate

- If you are selling a business in the coming years, consider an installment sale to keep your income below $1M each year (rather than selling all in one year)

- Consider non-dividend producing investments, municipal bonds or investment-only variable annuities as a way to avoid investment income

Assets at Death

The Proposal:

- Eliminate step-up-in-basis for assets at death—meaning, heirs will not be able to have a basis equal to the value of an asset at the grantor’s death date. For example, if you are the heir of your parents’ estate, the cost basis that determines how much taxes you will owe on an asset will be your parents’ cost basis, not the value of the asset on the day they died, potentially introducing a large tax bill on assets that may have been owned for many years.

- Death would be a taxable “realization event”—i.e., taxes would be owed on capital gains even if heirs don’t sell anything

- Revert the Federal estate tax exemption amount back to levels before the Tax Cuts and Jobs Act of 2017 (this could be $5.85M per person in 2021 or less)

What Should You Do:

- This isn’t an issue until someone dies, so no immediate action is needed—one option to help your heirs is to plan to slowly liquidate your investments over your lifetime or take advantage of annual gifting and charitable donations, including highly appreciated stock that will no longer benefit from a step-up in cost basis

- If your estate is well below $5.85M (or $11.7M for couples), it’s unlikely that you will need to worry about estate taxes

- If your estate is so large that you feel comfortable gifting away the full exemption amount ($11.58M per person, $23.16M per couple) this year without missing those dollars, then consider doing so now to maximize your gifting opportunity; know that any amount you gift this year will be counted against your lifetime gift total, even if that exemption amount changes (for example, if you gift $6M this year, and the lifetime gift exemption amount changes next year from $11.58M to $5.85M, you’ve used up your full lifetime exemption)

- If you have $11.58M in assets per person right now, you’re in a tight scenario—you may have estate tax issues if you die next year and the estate exemption amount reverts back to pre-2017 levels

- Talk to your trust and estate attorney about tools such as Grantor Retained Annuity Trusts (GRATs), Spousal Lifetime Access Trusts (SLATs) or Intentionally Defective Grantor Trusts (IDGTs) and if they make sense for your estate situation

Closing Thoughts

Phew! That was a lot. And as I said at the top, this is all speculation right now. A lot can happen between now and the Georgia run-off election and—even if we assume Democrats win both Senate seats—the House developing a plan, the Senate developing a plan, committees reconciling those plans, and so forth. If only we could predict the future…

If you have questions, call the team here at Monument. We thrive off crafting solutions to complex problems.

If you’re interested in reading more nitty-gritty detail and analysis about President-Elect Biden’s tax proposals, check out this report from the Tax Policy Center: https://www.taxpolicycenter.org/publications/updated-analysis-former-vice-president-bidens-tax-proposals

What’s Next?

Learn more ways to optimize your taxes on our blog, or reach out to our Team for personalized advice on your tax situation.

IMPORTANT DISCLOSURE INFORMATION

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Capital Management, LLC [“Monument”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument.

Please remember that if you are a Monument client, it remains your responsibility to advise Monument, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at https://monumentwealthmanagement.com/disclosures/. Please Note: IF you are a Monument client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Please Note: Monument does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Monument’s web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Monument account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Monument accounts; and, (3) a description of each comparative benchmark/index is available upon request.