My first post-vacation blog. I go on a two-week vacation and poof, the Nazis are back? Thank God I didn’t take three weeks off. WTF!?

I could not help but open with a little levity. We all could use some. For those of you who don’t get the reference to the picture, there was a great scene in The Blues Brothers where John Belushi says, “I hate Illinois Nazis!”

In all seriousness, I know everyone reading this is disgusted by the events that unfolded in Charlottesville.

I was walking home from the gym the other day wearing a UVA shirt. I passed four African American men chatting in front of a store. I’ve seen them before around my neighborhood but I didn’t personally know any of them.

One yells over to me, “Much love out to Charlottesville!”

I stopped, but was not really sure how to reply as a 50-year-old white dude so I said exactly what I thought, “Yeah, the other day was an embarrassing day for America. I think we are a better country than that.”

He came over and shook my hand and said, “Damn right we are.” We went on to speak for about 10 minutes about how what we both saw on TV was not indicative of where this country is as a whole and while it’s not perfect, it has come a long way and is not heading in the wrong direction.

All this over what I’d guess to be less than 10,000 total people acting like assholes and disgusting bigots.

Unfortunately, the President’s unwillingness to take a position on the hatred displayed by white supremacists, Neo-Nazis and the KKK lead to members of all political parties to criticize him, members of his own administration to speak against him, executives to quit his economic council and gave the media literally days of material to (appropriately) bash him.

This started calling into question his ability to pass his tax cuts and infrastructure spending.

Thankfully, Friday came and we saw news of firing Stephen Bannon who was siding with the ultra-conservatives. President Trump had to do it – that head had to be delivered as the first step towards reconciliation. That leaves us with an inner circle of Gary Cohn, Steve Manchin, Ivanka Trump and Jared Kushner…all of whom I believe are seen as much more moderate than Bannon.

Couple that with John Kelly being elevated to the role of White House Chief of Staff and I believe that real change is occurring within the administration. Colonel John Kelly was my commanding officer when I was a brand new Marine Corps Second Lieutenant. Believe me when I tell you that he is in firm control.

The guy does not F around. And you know what “F” stands for.

Now, the above commentary is not about whether people should or shouldn’t like the President and I’m not offering the above positivity about changes in the administration as any effort to influence opinions.

BUT.

No one wants to see the economy do poorly, no one wants this to cause the market to sell-off or world order to spiral into chaos. The above are positive signs that the chances of this happening have gone down. (See more economic information below.)

So back to the ability to press ahead with tax cuts…the Republicans will come back and need to follow through on their message of being the party of growth and opportunity. If they don’t, 2018 will be a blood bath for them. And they know it.

But while the Republican Party continues to be handicapped by the President’s continued undisciplined behavior, it should not be hard to regain any momentum lost over recess since the Democrats seem handicapped with a huge messaging problem themselves. I believe their problem is that they lack a clear message of their own on economic growth, a carry-over problem since the presidential election. They need new leadership to move them beyond a message characterized by economic redistribution and old, seemingly failed politics – that is if you believe huge losses of national and state seats along with governorships since 2008 equal a failed political message.

I’d love to see the Democrats come out with new and fresh messaging that focuses on revamping what I think are two huge impediments to economic growth that are not owned by the Republicans – Education and Prison/Legal System Reform. Fix schools and the ridiculous cost of college and you have a huge ramp to better jobs and economic well-being. Break the cycle of incarceration and give economically disadvantaged young men and women real hope of a better life and that’s another ramp.

Change those things and the Dems have a real chance of turning traditional, red southern states blue and winning elections for generations. Issues like tearing down old confederate statues, which does not create jobs, may just continue to alienate white southern voters, guaranteeing that a huge region of the country will remain solid red for a long, long time.

Why is this important in a blog written by a finance dude? Because I strongly believe that the Republicans, despite all the President’s missteps, know they need to get tax reform done. It should be easy, straight forward and signed by the President. Bottom line – tax reform gets done this year.

That’s a big deal for investors, business owners and anyone earning a paycheck.

Oh, and as for how my chat ended up, my new friend said, “You think I care about those statutes? No way. You know why?” I pause and he says, “Because in today’s America there’s nothing holding me back from anything.”

Please remember that America is bigger than that what the media is showing…and if the markets keep selling off, I believe that it will present the first big buying opportunity of the year.

The Economy…

Boy did consumers ring the cash registers. First, remember that the consumer is very important to Gross Domestic Product (GDP) since their spending accounts for 70% of GDP. GDP is the broadest measure of economic activity and it’s in the news a lot. It tells us how big our economy is, and rates of change tell us how the economy is performing.

Needless to say, consumer spending plays a significant role in overall economic performance.

A lot of stuff goes into the overall spending equation – consumer confidence, wage growth, and job growth are among the key variables. I’ve written about all of these before.

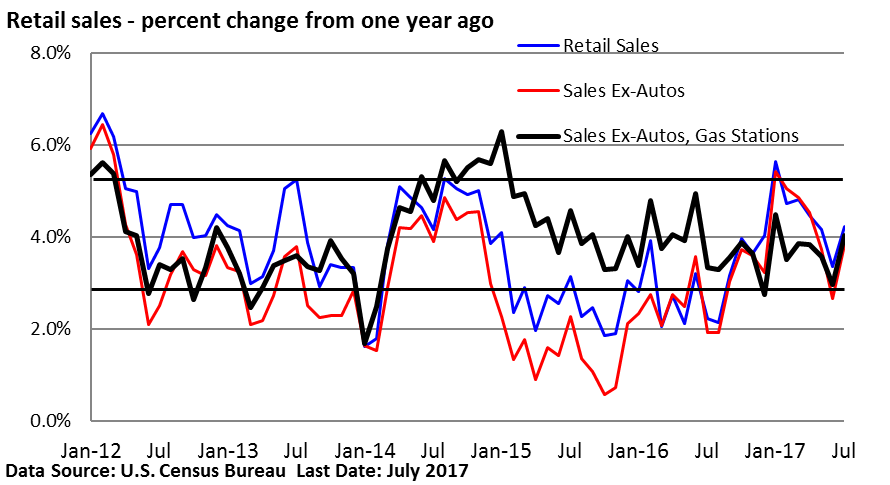

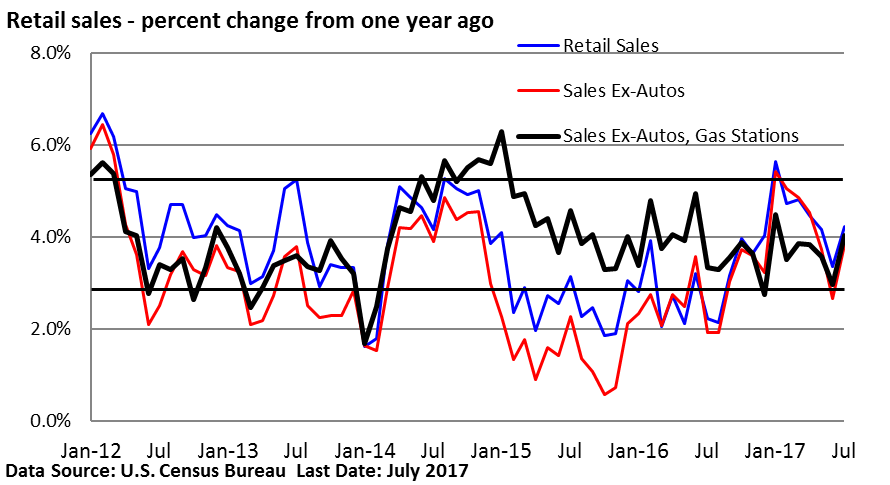

Last week, the U.S. Census Bureau reported that retail sales increased 0.6% in July. Excluding autos, sales rose 0.5%. If we remove autos and gas stations (helps filter for changes in gas prices), sales also rose a solid 0.5%. (I’ve been collecting some data on recent auto sales and I’m going to have a dedicated blog to that coming up.)

Moreover, June’s negative numbers were revised considerably higher and are now positive.

I’ve said this many, many times in previous blogs…the economy is growing at a very tepid rate, but growing is growing and that’s the opposite of shrinking. Everyone wants faster growth but tepid growth is way better than shrinking growth. This consumer data can’t necessarily be taken as a sign the economy is set to shift into a much higher gear.

Yes, it’s encouraging, but it’s only two months.

It’s not uncommon to get monthly back and forth in the data…some good numbers followed by some weak numbers, followed by some flat numbers. That’s what happens in a tepid economic expansion, where the growth rate trails many of the previous expansions we participated in following WWII.

It’s when everything is averaged together the data point to modest overall growth. Look at the chart below, which analyzes each category and compares sales to one year ago. Ex-autos and ex-gas stations (so-called core sales), sales have generally held in a modest-growth range going back to early 2012.

Look at the black line.

The bottom line is that the economy is moving forward, but it’s not moving at a fast clip. However, the data are not signaling that growth is set to stall. The key here is that this modest economic growth continues to support corporate profit growth and this is immensely important to overall stock prices. I do not think a recession is anywhere close to the horizon at this point. Investors should stay invested.

Please call with questions.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.