Last week’s trading was pretty volatile. One needs to look no further than Thursday’s broad sell-off followed by Friday’s rebound which left the major domestic indexes slightly higher for the week. On the economic front, the ISM Manufacturing and Services data came in very strong last month (more later). The June jobs report indicated economic strength with nonfarm payrolls climbing to +220K last month, which was well ahead of expectations of +178K. May’s poor report of +138K was revised up to +152K.

Overall, the employment report was decent for anyone worried about economic weakness. Like the past 8 years, the economy remains growing at a very tepid pace.

Also reported were average hourly earnings which rose +0.2%…below expectations for a +0.3% increase. Year-over-year earnings rose just 2.5%, which signals to me that there is still a lack of inflationary pressures due to wages increasing. Personally, I think that this limits the Fed’s case for a more aggressive tightening campaign this year UNLESS tax reform happens and we see a bigger boost to the economy. Most economists feel the Fed (technically the Federal Open Market Committee or FOMC) remains on target for a December rate hike…we’ll see.

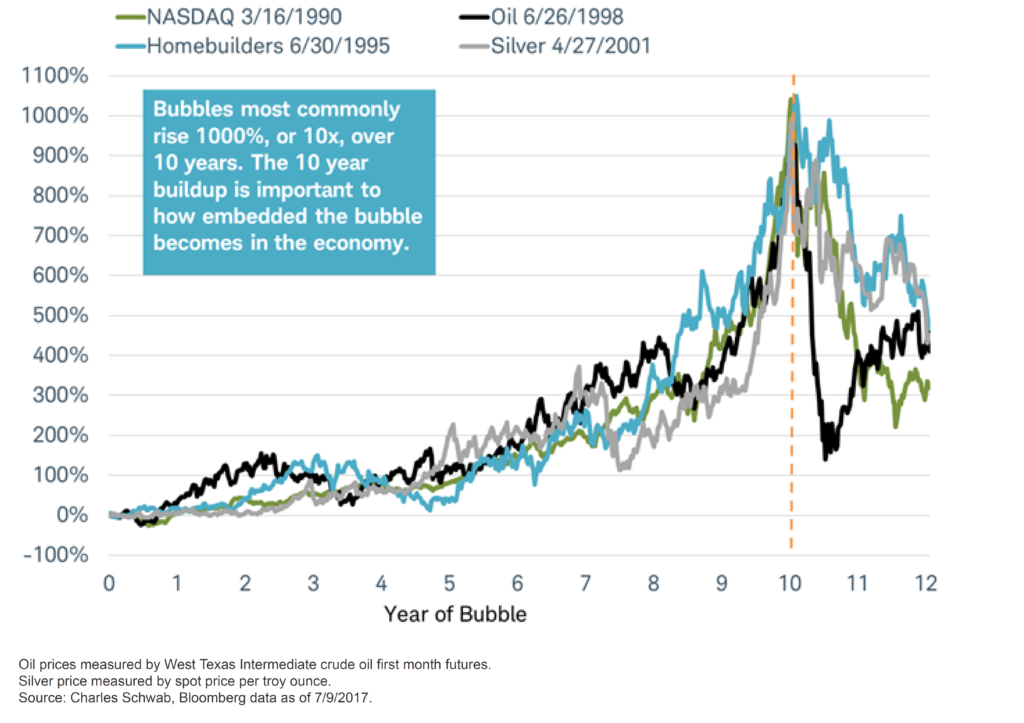

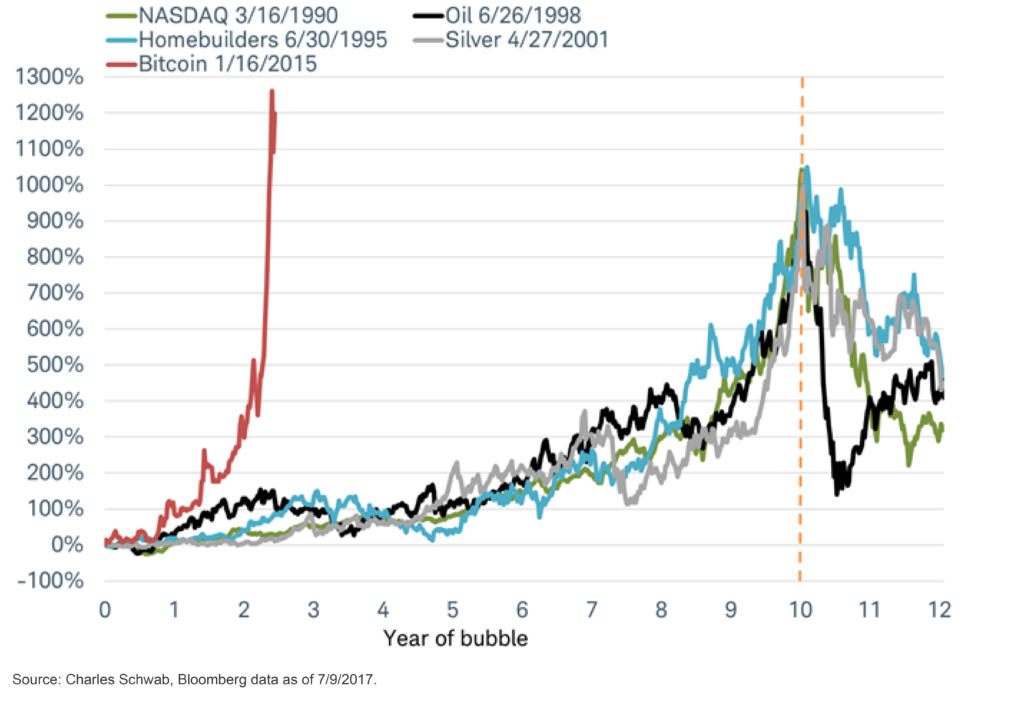

Bubbles

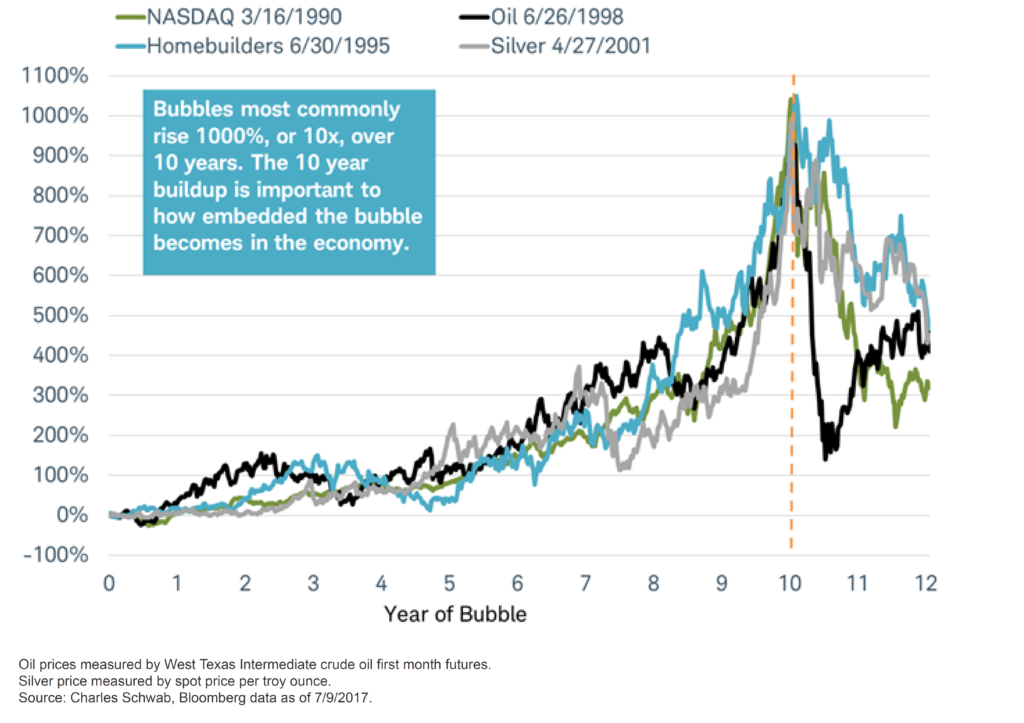

These two charts below are from Jeffery Kleintop at Schwab. Read the blue box.

No blue box explanation needed here, right? This is what a bubble looks like…

If you are thinking about Bitcoin, you should be very careful.

Just sayin’.

Bear Market Checklist

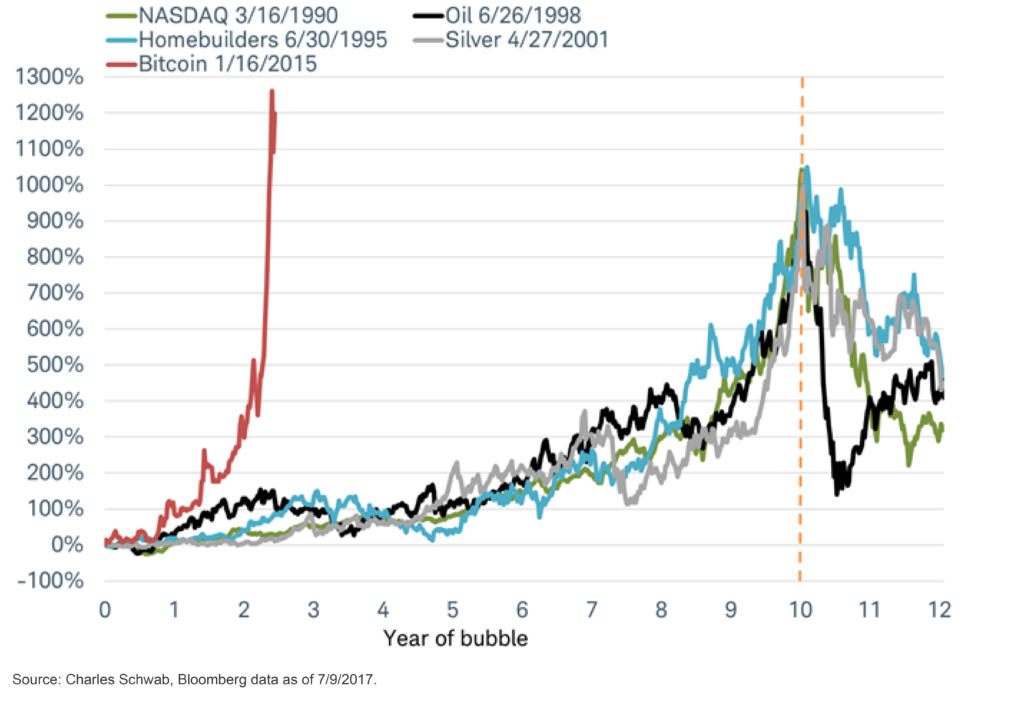

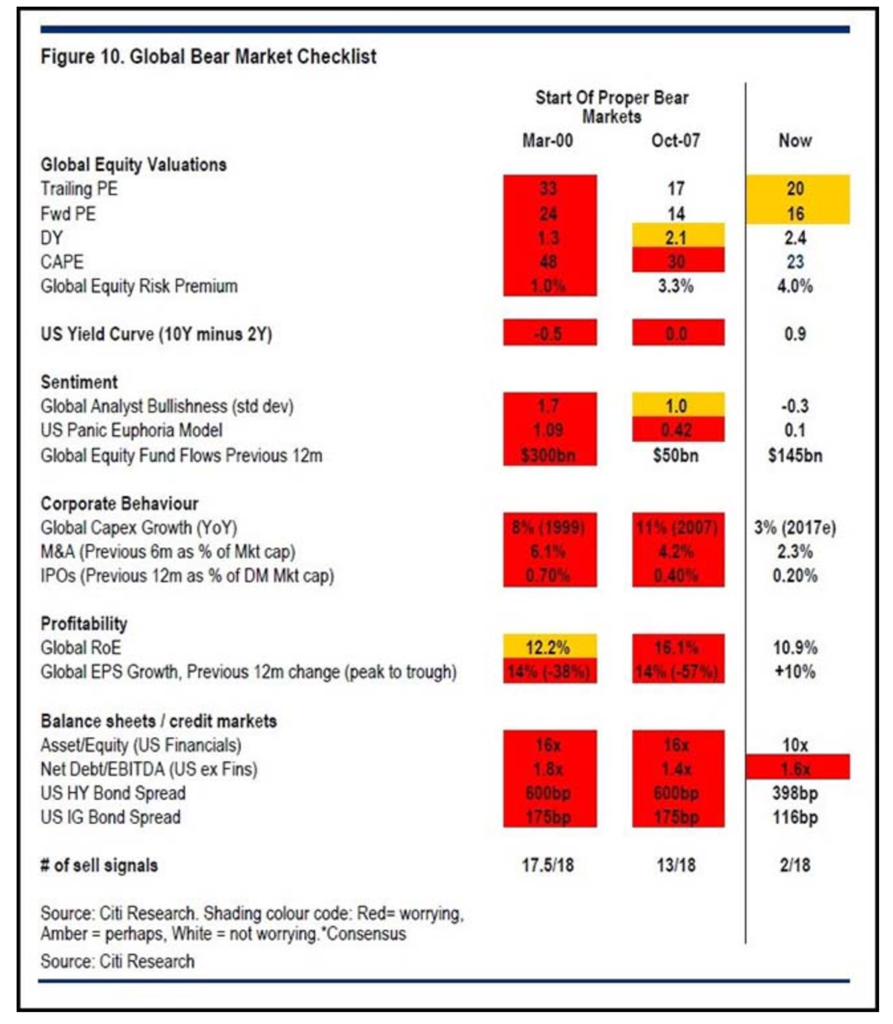

Speaking of bubbles, there are a lot of people worried about the market being over extended and the possibility of a pullback.

For the record, I do not believe that this market is in a bubble.

Here’s a snapshot of a Citi report comparing 2000, 2007 and today. Only 2 out of 18 signals can be seen in the current environment. Maybe investors should be more worried about being in cash.

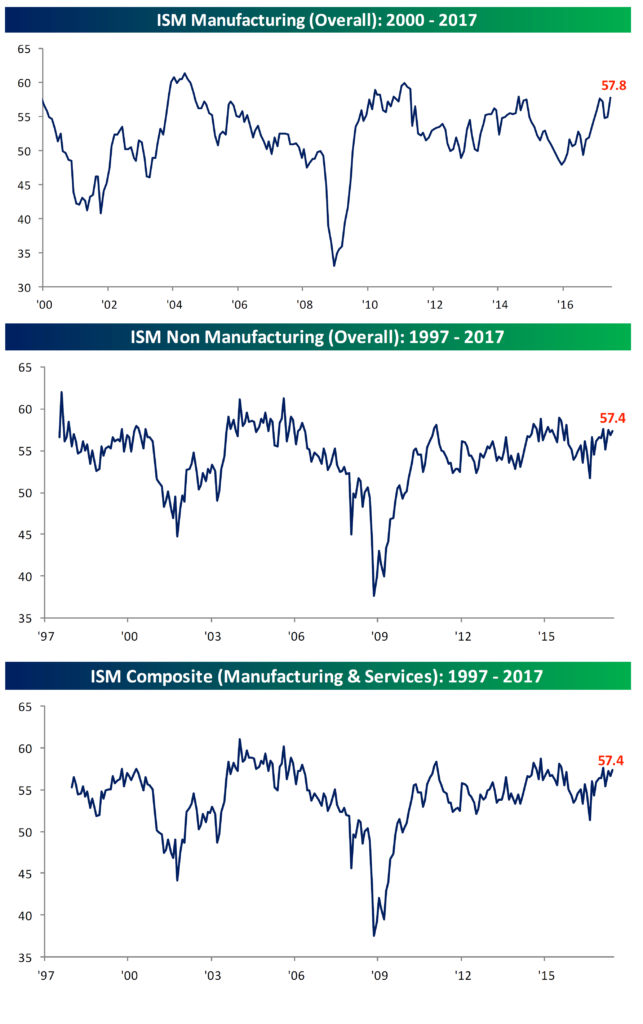

ISM and Relativity

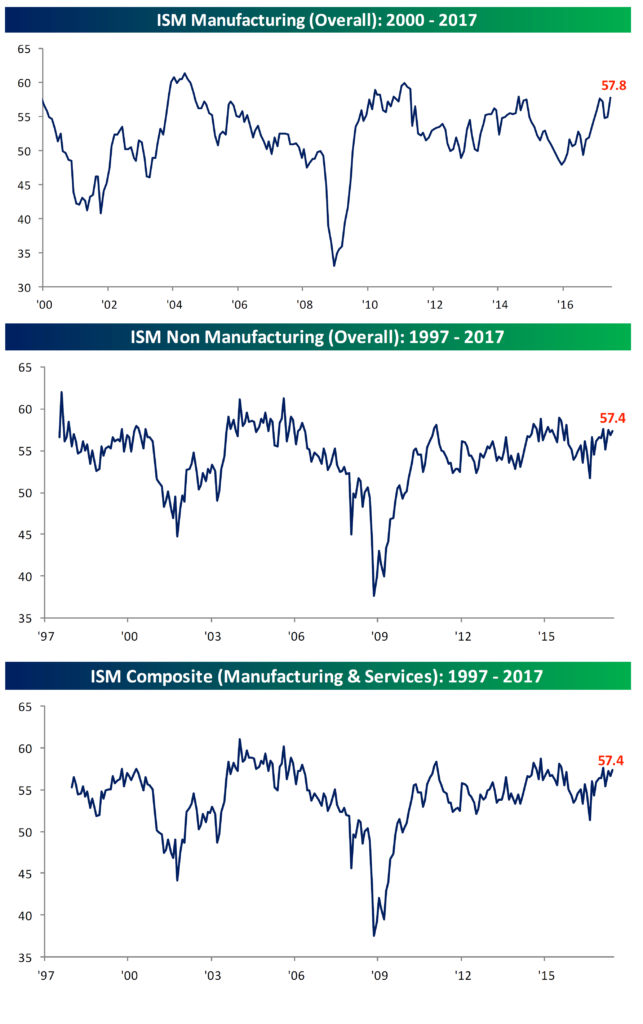

Data points are important, but it’s less about the actual value or “reading” and more about the reading relative to the expectations. Below is the data from ISM reports and my point will become more clear. Remember, ISM values above 50 are considered good (expansionary).

The first chart below, from Bespoke, shows that June’s Manufacturing ISM came in at 57.8 versus expectations of 55.3. That’s a good reading AND good relative to the expectation because it was the highest level since August of 2014 AND the largest beat relative to expectations since October of 2014.

In the second Bespoke chart, you’ll see that June’s Services ISM reading of 57.4 also exceeded forecasts, but not by as much as the Manufacturing sector. But 57.4 is a really good number.

The third Bespoke chart displays that on a combined basis, which factors in each sector’s overall share of contribution to the economy, the ISM Composite for June also came in at 57.4.

Please email me if you think these are the readings of an economy running out of steam, because I don’t see it that way at all.

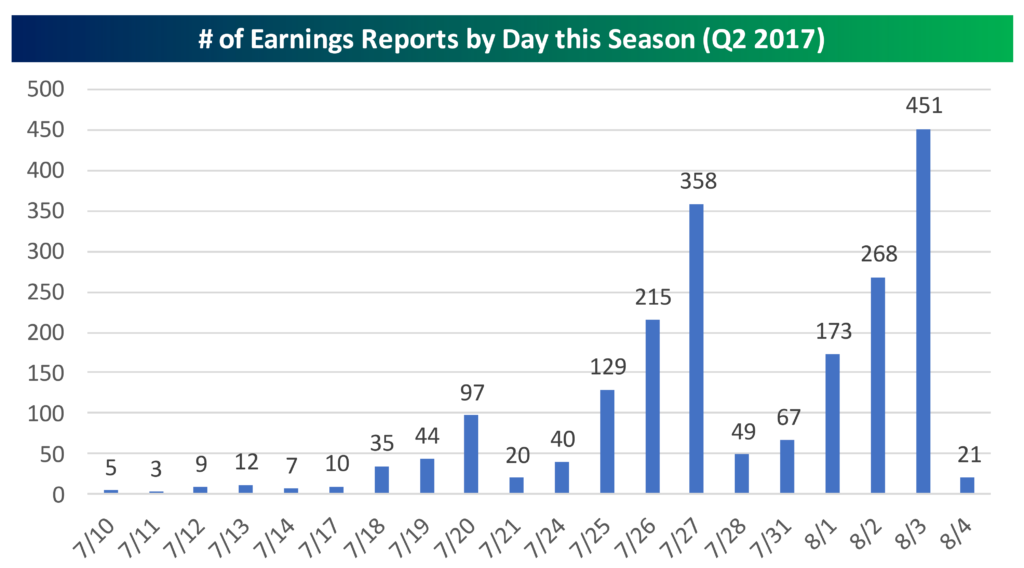

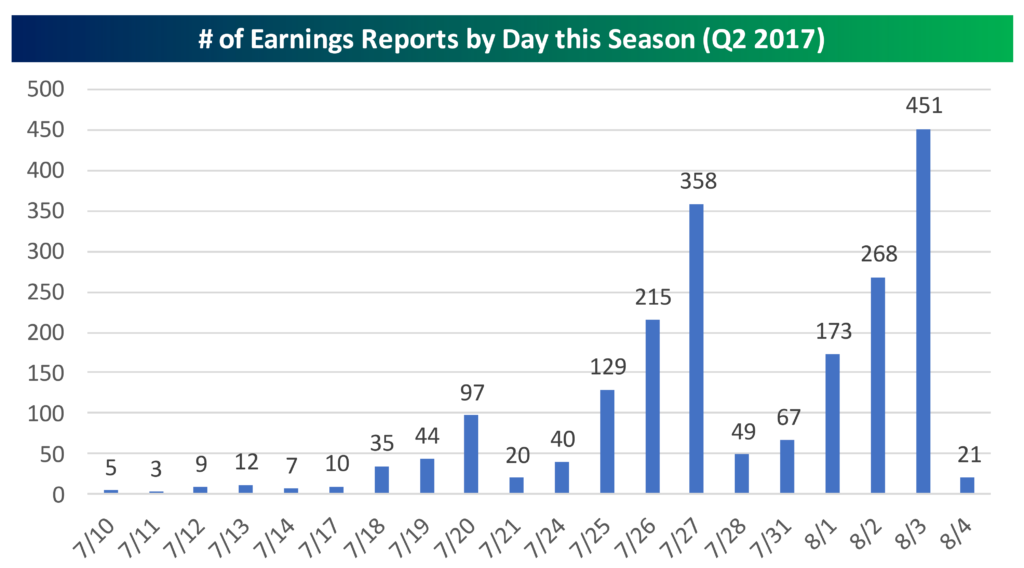

Earnings Season!

Earnings are announced all the time, but the unofficial, widely observed start to earnings season will be when Alcoa announces after the market closes on July 19th, 2017. While there are still some big names (specifically financials) reporting this week, we really don’t see a lot of volume until next week. See when to expect the earnings reports in this Bespoke chart, below.

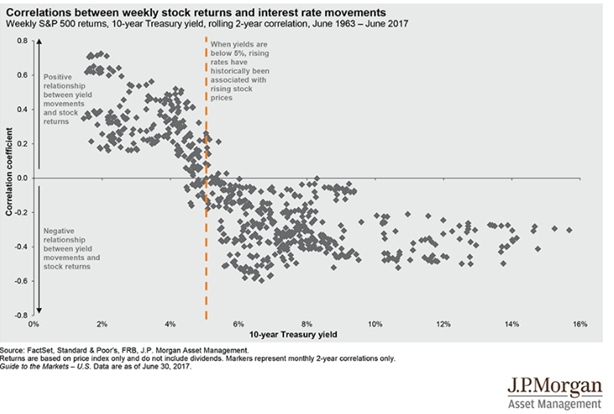

Fed Tightening

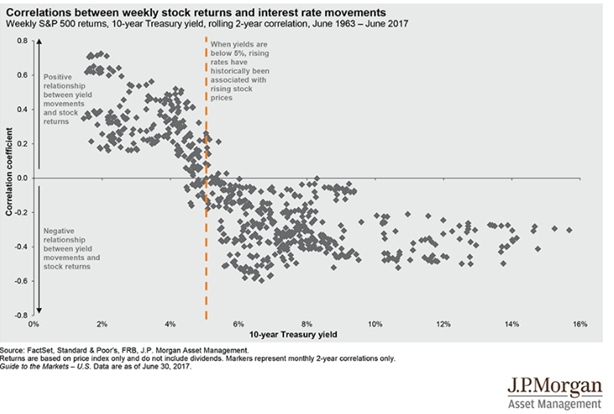

Last week I wrote a blurb about the yield curve. The chart below shows that stocks generally do well until the 10-year Treasury yield gets into the 4-5% range. This is a fantastic chart from J.P. Morgan Asset Management. (Their Asset Management group is completely different than their advisory groups, thank God…don’t get me going.) It looks confusing, but check out the dotted yellow line. The blurb next to it at the top reads, “When yields are below 5%, rising rates have historically been associated with rising stock prices.”

Finally – North Korea

I’m FAR from an expert in foreign affairs, regardless of my 2.95 undergrad GPA in Government and International Relations from 1990. However, since a few people brought up North Korea as a concern from an investing/uncertainty perspective, I’ll share my very short thoughts.

Fact: Nuclear weapons have been around for over 70 years with Nagasaki being the last time they were used. Over those +70 years, nuclear weapons have been in the possession of some leaders with some pretty checkered pasts in the human rights department…to put it nicely. Think China’s Mao Zedong, who killed somewhere between 40m and 70m people and Stalin, with an estimated 3m to 60m people killed.

Opinion: Mutually assured destruction (MAD) works and Kim Jong-un has no interest in seeing his entire country turned into glass. His interests are staying in power while having a seat at the table as a nuclear power and a global member of MAD. China does not care about a nuclear North Korea any more than we care about Israel or France having nukes, so they won’t step up no matter how much the President tweets they should.

Probability: Threats are totally different than events. Threats get concessions and we’ll give them…and so will the rest of the world. On the contrary, events make glass and no one wants that…neither the U.S., N.K., China nor South Africa for that matter. The market never moved when they tested an ICBM. Until they fire off a nuke that lands in another country and start a war, threats that result in a market downturn are probably buying opportunities.

Bottom Line

I thought jargon was way cooler when I started out in the business. I thought it validated being smart. But now I try to be more creative with my uses of vulgarity to express my intelligence rather than financial jargon and worn out cliché sayings. Even the piece of shit Huffington Post says smart people use swear words more.

However, I’m going to use a worn out Wall Street phrase to make a point…“climbing the wall of worry”…

Yeah, yeah, yeah, I know. But look, when the market keeps going up and the bear market checklist looks like it does above and the chart shows that stocks do well when the 10-year is below the 4-5% mark and the ISM readings are all very good…the market is going up while everyone is worried about the current level or the elevated (albeit not crazy) P/E levels. That’s where the phrase “climbing a wall of worry” comes from.

It may be cliché but that does not mean it’s irrelevant. Having a long-term financial plan coupled with an investing strategy which includes a plan for accessing liquidity in the short-term is the best way to deal with this current market.

Please call with questions.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.