Monument Wealth Management Articles

Federal Estate Tax Exemption Sunset: The Sun Is Still Up, But It’s Setting Soon

Share on your favorite platform, or by email

Did you panic in 2021 when Congress was discussing lowering the federal estate tax exemption amount? Did you ask yourself, “Should I be doing something?”

Congress ultimately nixed any changes to estate tax laws as part of the Build Back Better (BBB) negotiations. Great, no one needs to rush into any decisions.

BUT the federal estate tax exemption is still going to be cut in half in 2026, which begs the question again: Should you be doing something?

[Estate Planning Sidebar: Right now, the federal estate tax exemption—the amount of your gross estate at death not subject to federal estate tax—is at an all-time high. In 2024, it’s $13.61M for individuals and $27.22M for married couples. The Tax Cuts and Jobs Act (TCJA) of 2017 doubled the federal estate tax exemption, but only for a limited number of years. After 2025, the exemption amount will “sunset” (a fancy way of saying “end”) back to the pre-TCJA levels: around $7M for individuals and $14M for married couples when adjusted for inflation. Unlike the possible changes discussed during BBB negotiations, this date is not a guess—it’s a certainty unless Congress acts to extend or change the provisions.]

Yes, an actual change in 2026 is a lot better for planning purposes than a hypothetical change in the immediate future. But this isn’t a “tomorrow problem” for two reasons:

- Thoughtfully crafting your estate plan takes time. Why would you want to put together your estate plan in a mad down-to-the-last-minute dash? Wouldn’t you rather carefully consider your options at your own pace? Use the benefit of time to consider methods for lowering your gross estate (if estate tax is going to be an issue for you) in conjunction with your trust and estate attorney and wealth management team. 2026 will be here before you know it.

- Assets that are growing can heighten your estate problems. If your gross estate is looking like it will owe estate taxes, why wouldn’t you want to get appreciation of significant growth assets (like a business or high-performing stock) out of your estate sooner rather than later? It may make sense to transfer assets that are going to grow out of your estate now to avoid compounding gifting and estate tax issues later on.

Should You Be Doing Something?

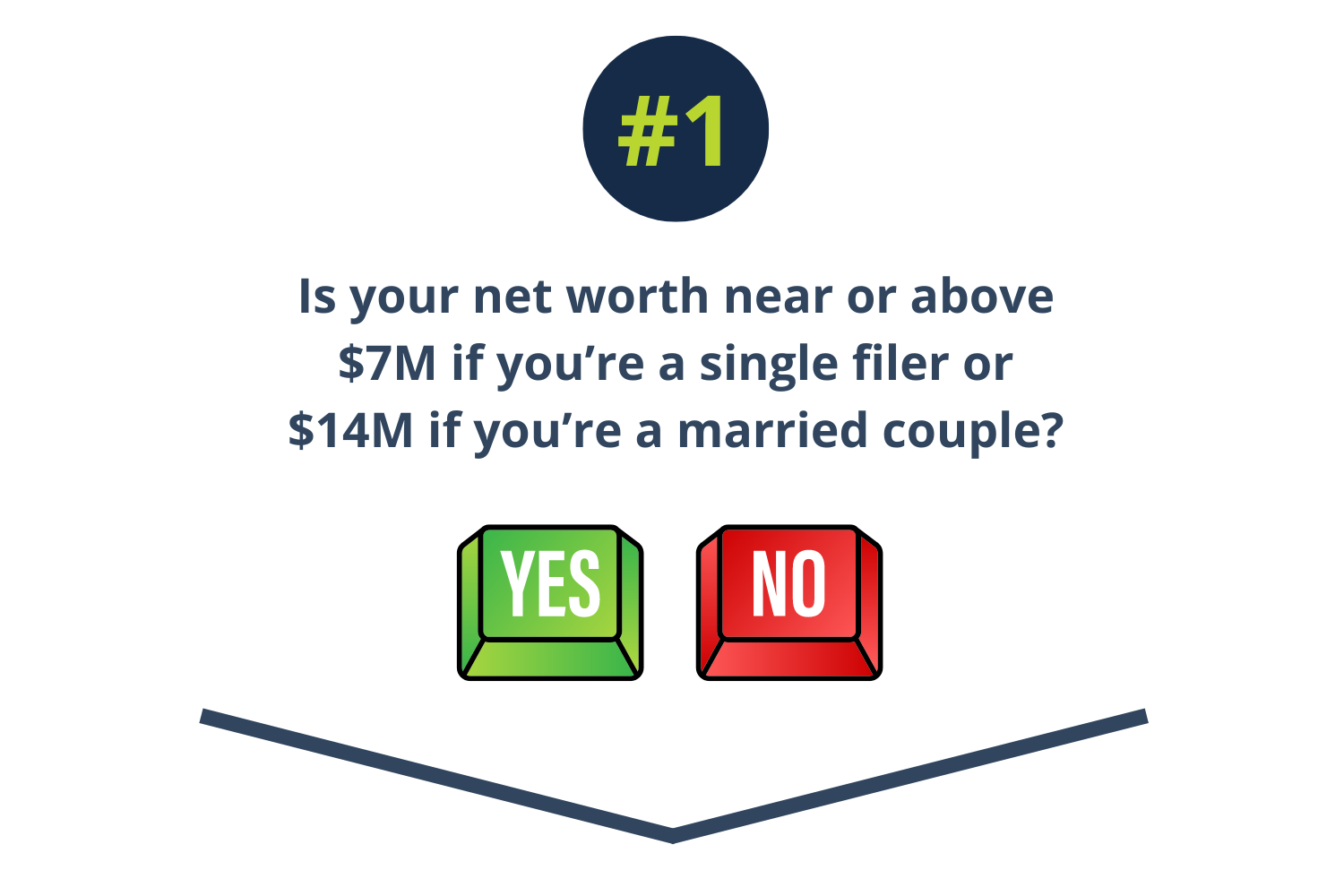

Let’s do a magazine-style quiz (because I’m trying to make estate planning as much fun as possible).

If you answered “no”—and assuming you don’t own any specific assets (like a business or stock options) that are going to experience such significant growth in the future that you would be near these levels—then your course of action is one of my favorites: do nothing. You aren’t going to have a federal estate tax problem when the exemption sunsets. Don’t leap to options that would unnecessarily limit your control of and access to all your assets. Keep an eye on your net worth in case Congress discusses lowering the exemption amount further in the future, but otherwise you are in “sit tight” mode. (Obviously this doesn’t negate keeping your core estate documents up to date… more on this below.)

If you answered “yes,” meaning your gross estate is near or above the post-sunset exemption amounts, then you should definitely reach out to your trust and estate attorney and wealth management team. You need to be considering your options. And there are many, including:

- Gifting significant assets—to family and friends, and/or an irrevocable trust that you don’t have control of or access to—while the exemption amount is higher (there is no claw-back if your total lifetime gifts through 2025 exceed the lower exemption amounts in 2026)

- Purchasing a permanent life insurance policy to pay estate taxes (which will be less expensive the younger you get the policy)

- Making significant contributions to charity or a donor advised fund during life or at death (perhaps the simplest plan to avoid estate taxes is to say “at my death, everything above the exemption amount goes to charity, and my heirs get the rest”)

- Just planning for your estate to pay estate taxes, whatever the exemption amount may be at your death

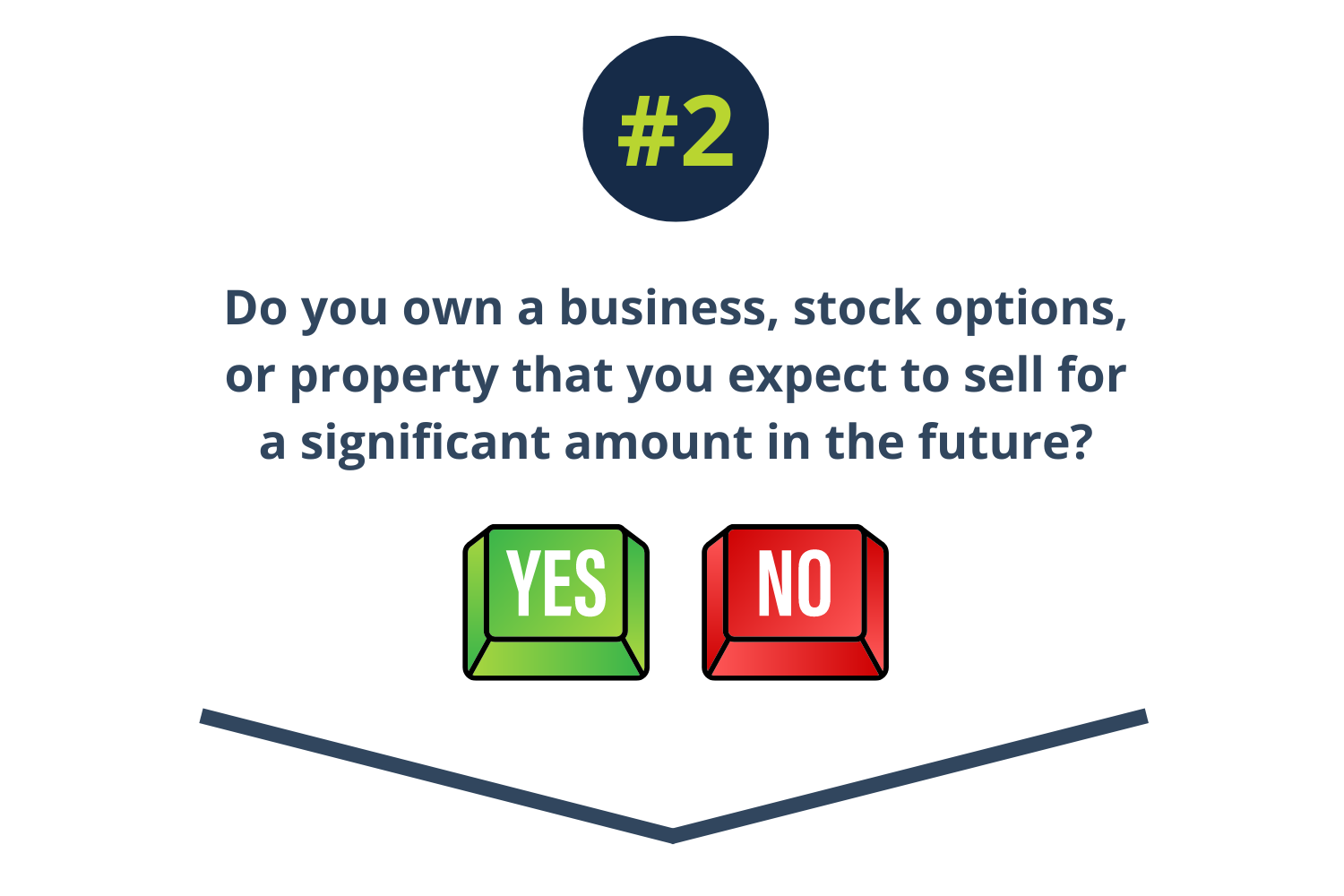

If you answered “no,” skip to #3.

If you answered “yes,” reach out to your trust and estate attorney and wealth management team. While these assets may be a modest value now, a significant sale that dramatically increases your net worth could create an estate tax problem where there previously was none. You can take steps now to transfer these assets—and, more importantly, their subsequent growth—out of your estate so they will not be subject to estate tax. If you’re calling up your attorney when you have a deal on the table, it’s too late—the opportunity has passed.

If you answered “no,” skip to #4.

If you answered “yes,” are they prepared to inherit significant wealth? Do protections need to be put into place to help them successfully manage this wealth? Your trust and estate attorney may need to create legal guidelines for your heirs that are unique to their life stage and circumstances. And your wealth management team can help guide a long-term conversation to prepare your heirs to inherit wealth.

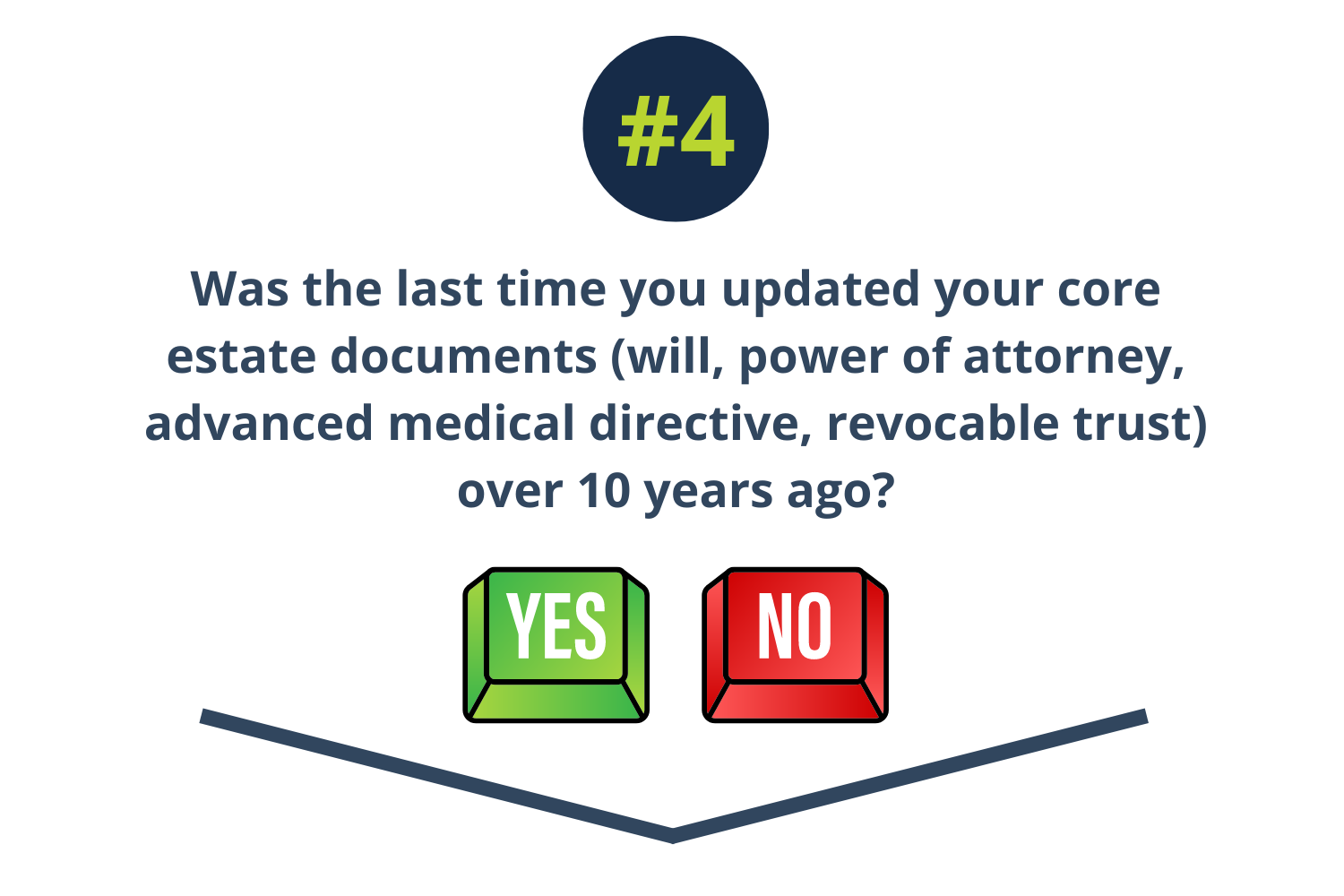

If you answered “no,” skip to the next section!

If you answered “yes,” then you need to update your documents. And if you’ve never had core estate documents, it’s time to write them. These documents are a baseline you should have, regardless of your level of wealth. And if you have minor children, then put this task in bold, double-underlined at the top of your to-do list for one specific reason: guardianship. If something were to happen to both parents, you want to decide what will happen to your kids rather than leave it to the courts. Also, make sure the people named to take over guardianship are still up to the task. No excuses, get this done.

What To Do Before the Sunset

When crafting your estate plan, there are a lot of considerations, among them:

- The exemption dollar amount changes over time

- Future growth and appreciation of your assets

- Not giving away so much that you don’t have enough to live on and meet your other goals

- Being strategic in determining who transfers what assets what so that you preserve as much exemption as possible after the sunset

The point is: you need to plan. If you avoid the planning, then you are agreeing that your plan is to possibly give money to Uncle Sam in the form of estate taxes—which is a perfectly fine plan, just do that intentionally.

And (yup, I’m going to say it again) you need to do this planning NOW. But you don’t need to figure out all the answers alone! Need help with this planning? Want to talk through your options? Need a referral to a trust and estate attorney? Call us. Monument can help.

It’s time to find clarity around your finances and remove the anxiety of the unknown.

Read our case study, “High Earners Eye Retirement,” to see how we helped one of our clients plan for the long term.

Ready for straightforward, unfiltered opinion and tailored advice for YOUR questions, not everyone else’s?

Recent Insights & Awards

By Nate Tonsager

IMPORTANT DISCLOSURE INFORMATION

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Capital Management, LLC [“Monument”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Monument is engaged, or continues to be engaged, to provide investment advisory services. Monument is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice.

A copy of Monument’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.monumentwealthmanagement.com/disclosures. Please Note: Monument does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Monument’s website or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Monument account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Monument accounts; and, (3) a description of each comparative benchmark/index is available upon request.

Please Remember: If you are a Monument client, please contact Monument, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.