There are so many things I look forward to during Pumpkin Spice Season, but thinking about paying Uncle Sam isn’t one of them! However, as a wealth planner, I know that facing the music in October, with a few months left to optimize my tax situation, goes a long way in managing my tax liability. It also helps me make informed decisions about actions to take that are in line with my broader financial goals.

Too often, we focus on minimizing taxable income at all costs in a single tax year, whether it advances our long-term priorities or not. But with a little planning, it doesn’t have to be this way. Check out these simple tips for moves to make before year-end to ease the pain come April 15th and beyond, while keeping your big picture goals in mind.

1. Avoid Surprises with Your Investment Portfolio – Check Out Realized Gains & Income to Date

Knowing what you are earning at work is pretty transparent. Knowing what’s going on inside of your investment portfolio is a different story for many busy professionals. Ideally, you should keep tabs on this throughout the year to see if estimated taxes need to be paid, but I’m a realist.

If you are just coming to terms with tax planning for the year, ask your advisor for a report showing realized gains/losses for non-tax-deferred accounts as well as a report showing income from your investments that may be taxable (like interest and dividends). Don’t have an advisor? You may be able to generate reports yourself showing this information or check your most recent statement for year-to-date activity. Here are a few things to pay attention to:

Interest-Bearing Savings & Money Market Accounts

Though interest rates are coming down, most savings and money market accounts are still paying higher rates of interest than in the past. Don’t forget to check these out, as in most cases, the interest will be taxed at your ordinary income tax rate (not the advantageous rate for qualified dividends or long-term capital gains).

Actively Managed Accounts and Mutual Funds

Just because you didn’t sell any investments throughout the year or request a sale in your account, doesn’t mean that you won’t have realized capital gains. If you have an account managed by an advisor or own mutual funds, you may have realized gains because of this active management or redemption requests from other investors in mutual funds.

Mutual funds often pay out any capital gains toward the end of the year. If you own mutual funds, you should be able to get a projection of capital gains that will be passed through to you as an owner of the fund (separate from any gain or loss you have on the actual shares of the fund due to selling them).

The good news is, there are options for tax efficiency inside of your portfolio through strategies like direct indexing if you are concerned about realized gains adding to your taxable income.

Investment Income from Dividends and Interest

Investment income generated by just owning an investment in a non-tax-deferred account is often overlooked, especially if dividends or interest are reinvested. Reinvesting doesn’t mean that you won’t owe taxes the year that the income was generated so don’t forget to take a look!

In reviewing the taxable income from your portfolio, you will be able to get a sense if you’ll be subject to the Net Investment Income Tax. This is a 3.8% tax applied to net investment income for single filers with more than $200,000 in modified adjusted gross income ($250,000 for married couples filing jointly). The tax is only applied to the lesser of your net investment income or the portion of your modified gross income that exceeds the thresholds noted above. This is often an unpleasant surprise in April – there may be time to take action before the end of the year to minimize net investment income (read on to number 2).

2. Review What’s Lurking Under the Surface in Your Investment Portfolio

Did you discover more realized income from your portfolio than you expected? The good news is you have a few months left to try to reduce that. Request an unrealized gain/loss report from your advisor or check out your unrealized gains/losses online in your non-retirement accounts. Even if you are comfortable with where your realized gains are, there may be opportunities to better your tax situation over the long-term.

Look for positions that are showing an unrealized loss. By leveraging the practice of tax-loss harvesting, investors can sell any securities that have declined at a loss, offsetting the tax burden of gains from other investments. Subsequently, the proceeds of a sale can be reallocated to a similar security, allowing individuals to lower their tax bill while at the same time maintaining their desired asset allocation.

The inevitable caveat

There are some restrictions to this strategy. For example, losses must be applied in sequence—long-term losses must first be applied to long-term gains, while short-term losses must first be applied to short-term gains. Additionally, the IRS stipulates that these trades should not violate the “wash sale” rule, meaning that losses can’t be claimed if the security repurchased is “substantially identical” to the security sold (and bought within a 61-day window).

Tax-loss rules are relatively complex and will require careful consideration of claims and their qualifications. When deployed strategically, however, tax losses can be quite valuable over the long-term as they can be indefinitely carried forward and applied until they are exhausted.

Sometimes you may want to harvest gains

If you have less income than is typical, have net realized losses, or find yourself in a lower tax bracket than expected, it may make sense to harvest long-term capital gains before year-end to minimize taxes paid on those gains. Seems counterintuitive, but I will explain.

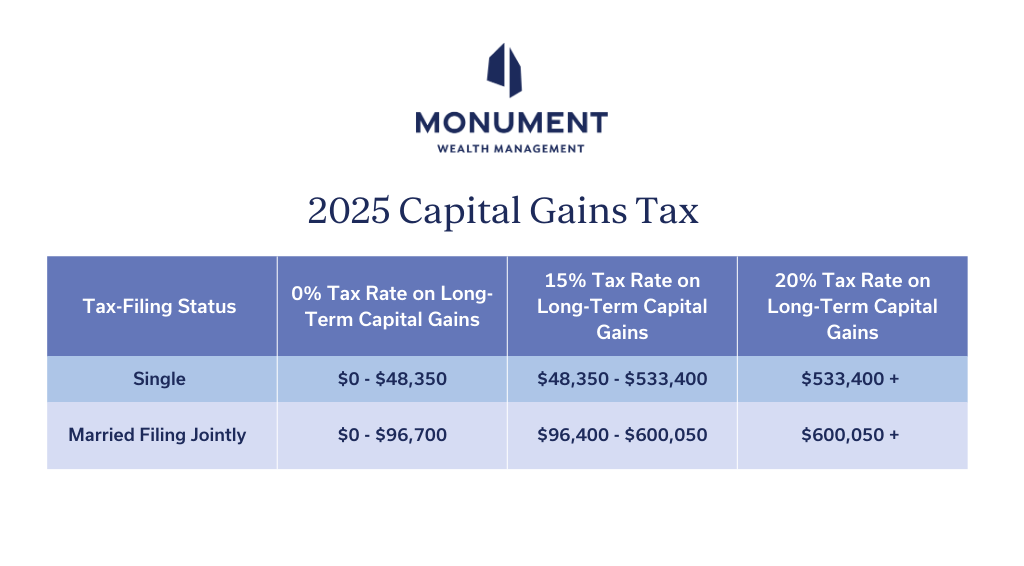

Unlike your W2 income and other kinds of investment income, long-term capital gains are taxed at lower rates driven by your taxable income.

Here’s how capital gains are taxed in 2025:

This is a great example of how tax-planning requires forward-thinking of the big picture. By selling a winner, you can re-set your cost basis in the position and possibly pay less in taxes than you would in the future on the gain under the right circumstances.

3. Get a Handle on Contributions Made to Tax-Deferred Accounts

If you want to lower your taxable income before the end of the year, taking on the full spectrum of tax deductions can feel like an overwhelming task. An easy place to start is with tax-deferred accounts to make sure you’re maximizing these opportunities.

Workplace Retirement Accounts

Pre-tax contributions to workplace retirement accounts are one of the biggest ways to reduce taxable income while saving for long-term goals. Log in to your retirement plan portal to see how much you’ve contributed to date and how much you are set to contribute through year-end. There’s still time to adjust, likely without major impact to your cash flows as a high-income earner, and these will likely go further than IRA contributions, whose deductibility is limited for high-income earners. Unlike IRA contributions, workplace retirement plan contributions must be made by December 31st. The limits for 2025 are:

Health Savings Accounts

With a health savings account (HSA), you can lower your current taxable income and create a source of tax-free wealth available to cover current or future medical expenses. Not everyone can contribute to these accounts, but if you are part of a High-Deductible Health Plan (see the HSA contribution limits below), make sure you are maximizing this opportunity! Luckily, you have until your tax filing deadline to make this contribution, not December 31st.

529 Accounts

If you are saving for a loved one’s future educational costs and live in a state with income tax, you may benefit from making contributions to that state’s 529 plan. Deductibility of contributions varies from state to state, as well as contribution deadlines for receiving the tax deduction (though most are December 31st). Lowering your state income tax burden can be especially helpful given the limited deductibility of state and local taxes on federal income tax returns. There are even tax-efficient, long-term wealth benefits associated with 529s beyond education—thanks to the Secure Act 2.0; read here about new opportunities to roll unused 529 funds to a Roth IRA for the same beneficiary.

4. Look at Other Deductible Buckets

You don’t have to be a tax expert to have an idea of whether an expense you paid may lower your taxable income, or if it makes sense to take certain actions just for the sake of reducing your taxable income before year-end. Glancing at the federal Schedule A can help jog your memory on what you’ve done throughout the year, from charitable contributions to medical expenses, and give you a starting point for determining if you already have enough deductions to get over the standard deduction ($15,000 for single filers and $30,000 for married couples filing jointly in 2025).

If you are close to exceeding the standard deduction limit AND have charitable intentions, or other elective deductible expenses you may incur before year-end, you can act before December 31st to get above the standard deduction and further reduce your taxable income.

There are tax-savvy ways to give to charitable organizations beyond just writing a check:

- Donating appreciated shares of stock may remove the potential for future capital gains tax on appreciated assets.

- Setting up a Donor Advised Fund (DAF) may allow you to lock in a large charitable deduction when you need it (such as a year where you have exceptionally high income due to vesting stock-based compensation or a large capital gain) while allowing you to grant money to your favorite charitable organizations over time.

This is of course no replacement for speaking with your team of advisors, like your wealth advisor and tax professional! However, it’s always helpful to start a conversation with them from a place of understanding your big picture.

5. Check Out Current Tax Credits Available—Regardless of Income Level

Many high-income earners are unable to take advantage of tax credits available for having children, paying for childcare expenses, or pursuing higher education for themselves or dependents. For those considering energy-efficiency upgrades to their homes, this is the last year that tax credits available under the Inflation Reduction Act may be taken so now is the time to act.

The Energy Efficient Home Improvement Credit offers a credit of up to 30% of costs for improvements, capped at $3,200 though the cap may be lower depending on the kind of improvement. Things like windows, exterior doors, appliances, and insulation may be qualified if placed in service by December 31, 2025. The Residential Clean Energy Credit may allow homeowners to receive a tax credit equal to 30% of the cost to install qualifying renewable energy equipment, such as solar, wind, or geothermal, as well as battery storage technology. Again, the project must be completed by December 31, 2025, to be eligible, so there’s less runway with this tax credit. The IRS and your CPA can be the authority on this topic if you are thinking about home upgrades but be sure everything can be completed by December 31st if the tax credit is a significant factor in your decision-making!

Work with an Advisor Who Understands Your Big Picture

As the year winds down, it’s important to understand the big picture when it comes to your taxable income. When viewed from a broader perspective, you may be able to identify opportunities to lower your tax burden. High-income earners must also remain cognizant of timing when it comes to these opportunities, ensuring you’re prepared to take appropriate actions before the year ends.

This may all seem like a daunting challenge to take on, and if you’re hoping to create a long-term tax optimization strategy, it won’t be easy to go it alone, especially as your assets and financial picture grow in size and complexity. When it comes to metabolizing complexity for high-earning individuals like business owners and executives, the Team at Monument is well suited to help. We act as your “second brain” to help you spot opportunities for tax efficiency—or for achieving your other wealth goals. We research you just as deeply as we research the markets and deliver clear, concise recommendations that help you make high-impact decisions with confidence.

Is your tax planning strategy working for you? Learn about our Complimentary Wealth Check.