Monument Wealth Management Articles

What is Direct Indexing? Customization, Taxes, and More

Share on your favorite platform, or by email

There are endless combinations of investment strategies and products when it comes to building an asset allocation. The obvious questions are always: how to select the best strategies/products, and how to manage them. I want to focus on the “how to manage them” part.

Many people prefer to simply invest their savings in low cost, passive exchange-traded funds (ETFs), or mutual funds; parking them there as broad diversification to the equity markets. For some that may be good enough, but thanks to innovative technology, there are now other low cost and more tax efficient ways to better customize your investment strategies.

Direct indexing, also known as custom indexing, can be an efficient way to capture the risk and return profiles of your selected investment factors or indices while retaining the ability to customize your investing strategies to a surprising degree. This might not be the right strategy for smaller accounts or investors, but understanding how direct indexing works is a great example for how man and machine can work in perfect harmony.

Direct Indexing vs ETFs: Customization Benefits

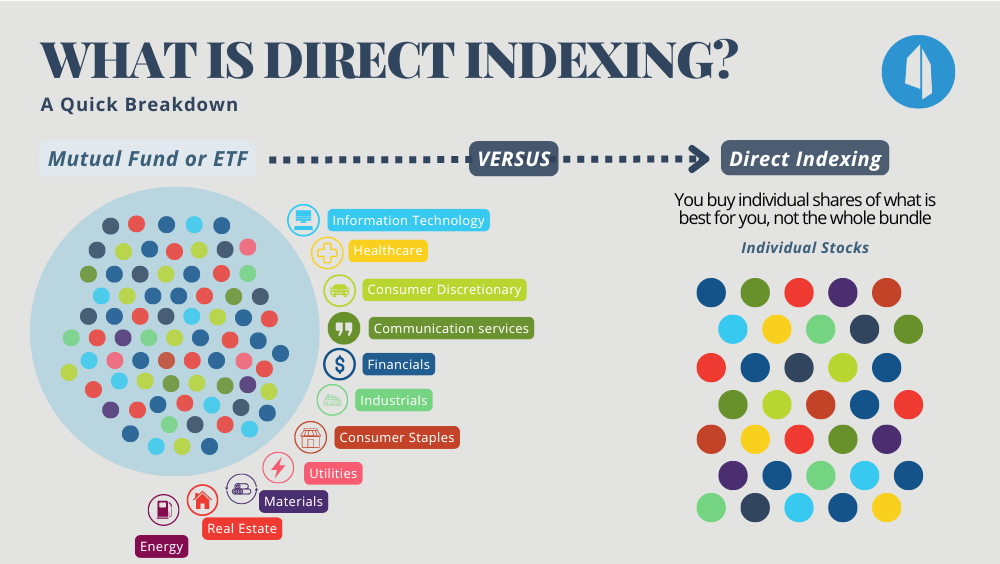

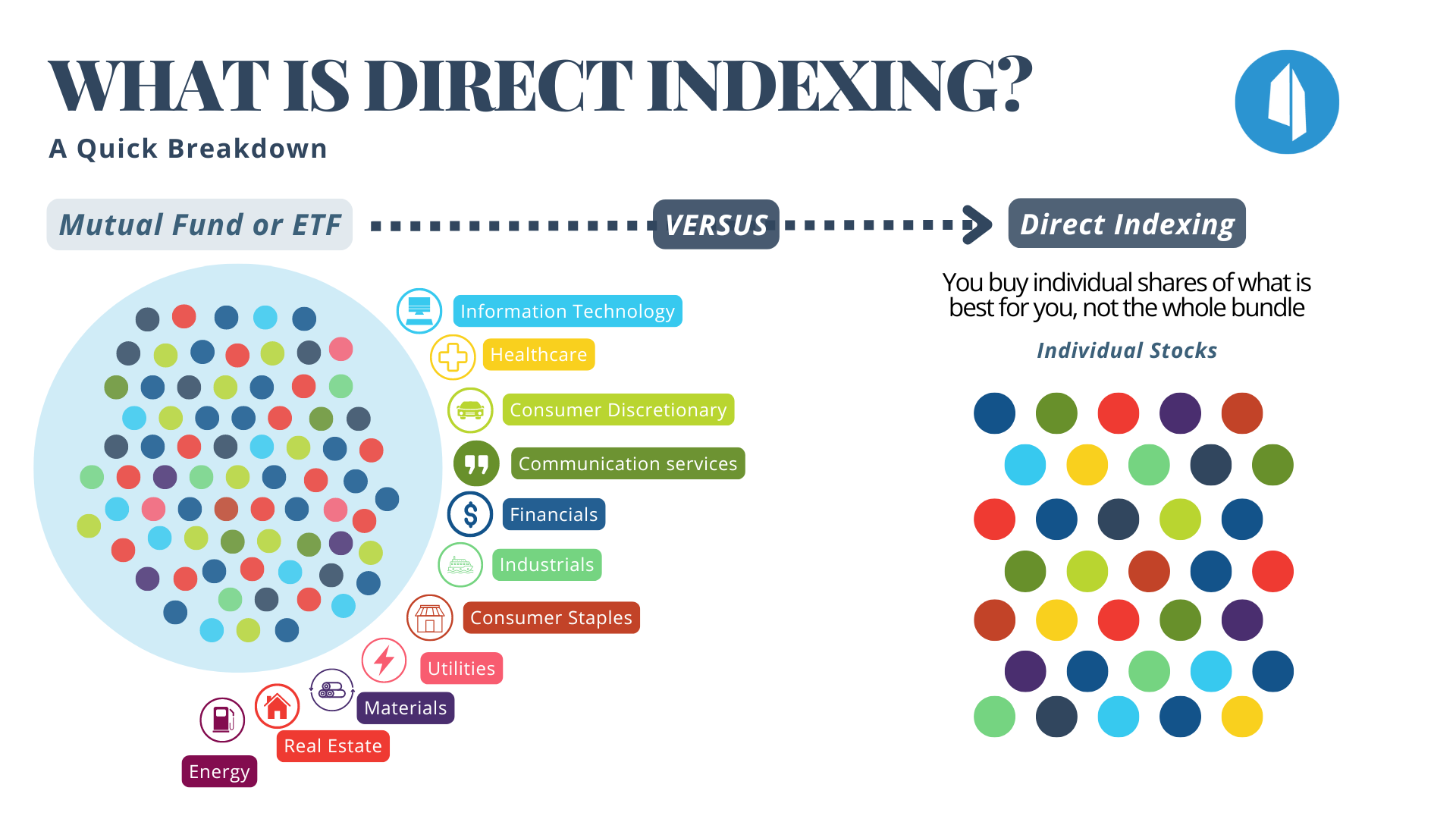

Traditionally, the cheap and easy way to manage a diversified stock portfolio is to buy a passive exchange-traded fund (ETF) or a mutual fund that is just mirroring a chosen index. In this case, you are buying into the fund’s strategy, and it’s not going to factor in each individual investor’s wants and needs. In other words, when purchasing an ETF or mutual fund, you don’t get any input on the underlying securities being purchased by the fund.

For example, let’s say you work for a major company that’s in the S&P 500 index, and you already have a large position to the company’s stock in your employer retirement plan.

If you want to purchase broad equity market exposure through any number of ETFs tracking the S&P 500 Index, can you have them exclude that particular company’s ticker? The answer is no. If you buy the fund, you are getting exposure to the stock. You have no say of what goes into the fund. In that sense, ETFs and mutual funds generally aren’t flexible to each investor’s unique circumstances.

At its core, direct indexing allows investors to cost effectively customize their investing strategies like never before. Direct indexing uses individual stocks to mimic the risk and return of completely passive indices, active factor-based strategies, or combinations of both.

This works because you don’t necessarily need to own every company in an index to have a portfolio with very similar risk and return metrics over time. Using the S&P 500 as an example, you can get similar amounts of risk and return for your portfolio without owning all 500 companies that make up the index. You may only need to own 100 to 250 of the companies to achieve your desired allocations and goals. You can own substantially fewer than 500 stocks and still achieve the vast majority of the desired risk and return “exposures.”

Because you don’t have to always own every single holding in an index to achieve an index-like allocation, that opens the door to customizing your holdings. It gives each investor the ability to set unique portfolio parameters including ESG considerations, specific security restrictions and unique tax or capital gains budgets, by more effectively managing the underlying individual holdings inside an account.

Direct Indexing: Tax Loss Harvesting Opportunities

There are many benefits to a direct index trading strategy, but the most powerful may be the tax efficiencies created from active tax-loss harvesting. Direct indexing gives a portfolio the ability to frequently tax-loss harvest by realizing losses from selling any of the underlying individual stocks trading at a material loss, and immediately reinvesting the proceeds to other stocks that fit within the current strategy’s allocation.

For instance, if Target ($TGT) stock decreases in value, you could consider selling that position at a loss, and book a tax-loss for your account. With direct indexing, you can take action to book that loss because you own the individual $TGT shares in your account.

But if you own shares in a passively managed ETF or mutual fund that is only mirroring an index, like $SPY, there is no way for you as an individual to take advantage of the downward move in Target. You don’t actually own any $TGT shares instead just shares of $SPY, which probably wouldn’t be too affected by Target’s move alone.

Now that the sale is complete and a tax-loss is booked, we need to get the proceeds from that sale reinvested back into the current strategy ASAP. In our Target example, sometimes it’s as simple as buying Walmart ($WMT) to preserve the portfolio’s allocation. Sometimes it might be better to buy smaller amounts of five other individual stocks across various sectors that fit within the portfolio’s overall strategy. Either way, you must be careful about what you purchase to avoid wash sales.

What is a Wash Sale?

A wash sale is when an investor loses the tax benefits from selling a security at a loss (booking a tax-loss) because they repurchased the same security, or bought a similar security, within 30 days before or after the sale date. Losing out on tax losses you’ve already booked due to wash sales has a real impact on your after-tax returns. Wash sales can be avoided, but they need to be handled carefully. Every purchase in a direct indexing account needs to be well planned and custom to the portfolio since its trading history and realized losses are unique.

While we want to be tax-aware with these strategies, taxes should never be the sole driver behind investment decisions. Your allocation and goals need to remain the top priority. Ideally for these strategies, we want to book tax losses without materially changing the portfolio’s allocation and limit the amount of time any funds are uninvested.

Again, customization is key to driving the portfolio’s tax efficiency.

How to Use a Direct Indexing Strategy

Direct indexing is true portfolio customization on every level. It works around your annual tax or capital gains budgets and any unique securities preferences and restrictions, while also managing the ongoing trading activity to optimize tax losses and avoid wash sales.

Direct indexing is a powerful strategy when put to work correctly in your portfolio. Thanks to improvements in direct indexing technology, you don’t have to settle for investing in an ETF or mutual fund that might be “close enough” to your goals and values. Many investors are considering some form of direct indexing in their portfolio.

There are many direct indexing providers out there. Monument implements direct indexing strategies through our Tax Rebalanced Index Optimization (TRIO™) accounts, which utilize the Canvas™ technology suite operated by O’Shaughnessy Asset Management (OSAM). We run TRIO™ across various investment styles and mandates and build our custom TRIO™ strategies based on each client’s expressed wants and needs.

Check out our recent podcast with Pat McStay from OSAM to learn more about how their robust software makes running direct indexing strategies easy for our clients.

Is Direct Indexing Right for Me?

Direct indexing may be an ideal way to create a truly bespoke asset allocation that has ongoing, tax-aware management—but it is not easy. By working with a wealth advisor who leverages the right technology and understands the process, direct indexing can be a lot easier. This creates potential added value in terms of how your portfolio is traded and managed inside your overall asset allocation.

Currently, direct indexing is best suited for larger, taxable accounts but it can also be appropriate for retirement or other qualified accounts in the right situation. The decision to implement direct indexing, like the strategy itself, should be customized to you and your specific needs and goals.

Ready to Work with an Innovative Wealth Advisor?

Listen to our Podcast on Direct Indexing with Pat McStay of OSAM.

IMPORTANT DISCLOSURE INFORMATION

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Capital Management, LLC [“Monument”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Monument is engaged, or continues to be engaged, to provide investment advisory services. Monument is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice.

A copy of Monument’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.monumentwealthmanagement.com/disclosures. Please Note: Monument does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Monument’s website or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Monument account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Monument accounts; and, (3) a description of each comparative benchmark/index is available upon request.

Please Remember: If you are a Monument client, please contact Monument, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.