What will 2025 bring? It can be fun to make predictions about what’s to come this year (An AFC team other than the Chiefs in the Super Bowl? I really hope it’s the Ravens and Lamar! The Bear continuing to dominate awards season as a “comedy”?), but the thought of an uncertain future can also bring anxiety. A new administration and the changes that may bring, along with ongoing geopolitical tensions, and looming questions about the Fed’s interest rate policy and its impact on the economy are enough to invoke nerves in even the most confident investors heading into 2025.

The good news is that our financial success over the long term doesn’t have to be determined by these externalities. Whether you are accumulating wealth for goals like retirement or creating a legacy, enjoying the lifestyle that your wealth enables, or you just want to be financially unbreakable, consistent behavior and a focus on what’s in our control is key. Read on for some things to consider as the new year unfolds.

1. Save & Invest No Matter the Environment

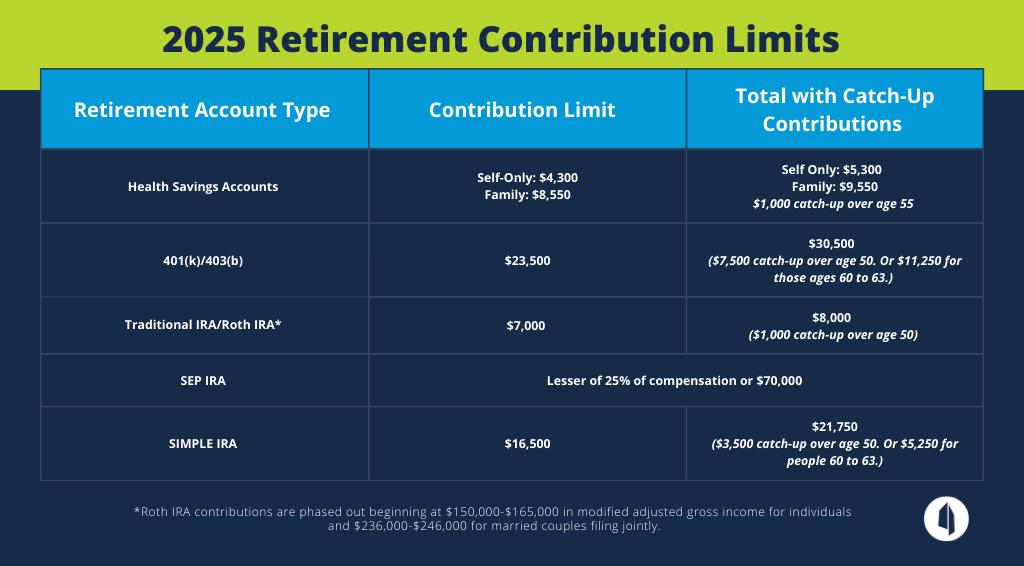

The start of the year is a great time to review current contribution limits for tax-deferred accounts like retirement accounts and Health Savings Accounts. Make sure you are set to effortlessly maximize these as you are able. Setting up regular automated contributions to retirement and even taxable investment accounts makes it more likely that you will continue investing and not get derailed when things get tough in the market. Automatic doesn’t mean “set it and forget it” though. Contribution limits change annually, and various provisions of the Secure Act 2.0 are kicking in, changing the retirement savings landscape.

Here are the 2025 Contribution Limits:

Contribution limits have increased year over year for employer-sponsored retirement plans. IRA contribution limits have not changed, though income phaseouts for Roth IRA contributions and pre-tax IRA contributions have. The Secure Act 2.0 also introduces some changes in 2025:

- Catch-up contributions for workers between 60-63: Starting in 2025, those between 60-63 who are still working may make a higher catch-up contribution of $11,250 to their 401k, 403b, or 457 plan. For SIMPLE IRAs, the higher catch-up contribution is $5,250.

- Pre-Tax vs. Roth catch-up contributions for high-income earners over 50: You have at least another year before catch-up contributions to a 401(k) are required to be Roth vs. pre-tax (This provision was supposed to begin in 2024, but you may have until 2026.) Take advantage of this now because once this goes into effect, it will limit the ability to reduce your taxable income with pre-tax contributions beyond the standard 401(k) deferral limit. This goes for anyone whose wages exceeded $145,000 in 2025.

2. Get a Handle on Spending & What’s Normal Beyond Inflation

It’s been easy to blame higher spending on inflation the past few years. However, inflation doesn’t tell the full story. Lifestyle creep happens very easily, especially as salaries increase each year. As you start to make more money, you likely begin spending more money without really feeling like things have changed. One of the biggest drivers we see when it comes to long-term success of a wealth design is spending, which is something we all have control over to some degree. If your income has increased over the years but your saving hasn’t, it may be time to take a step back and get a handle on where the money is going, making sure that it’s in line with your answer to the question “What’s the money for?” not only today but in the future. Higher spending isn’t necessarily a bad thing – it’s just something to be aware of and understand how it impacts your ability to meet your goals over a lifetime.

3. Maximize the Benefits of a Historically High Exemption for Gift & Estate Taxes

As of this writing, elevated lifetime gift and estate exemption amounts ($13.99M/person in 2025) are set to expire at the end of 2025 if Congress doesn’t act to extend them. It is highly likely that the elevated exemption amount, along with many other provisions of the Tax Cuts and Jobs Act, will be extended given the results of the 2024 election.

Regardless, if you’ve accumulated significant wealth over your lifetime and you desire to see that wealth benefit the next generation with minimal tax impact, 2025 may be the year to take action or at least start developing a plan so that you understand how much your estate may grow over time and what options are available to you to reduce it in a way that allows you to balance your priorities. Previous years have shown us how fast things could change – remember Build Back Better and the panic of 2021?

- Annual gifting to loved ones while you are living can be a great way to reduce your estate over time while also seeing their enjoyment of the gift. In 2025, you can give up to $19,000 to any one individual ($38,000 for married couples) without filing a gift tax return.

- If providing funds for education for the next generation is important, 529 contributions can be a great way to earmark funds for that purpose and also make a sizable gift (5 years’ worth of the exclusion amount) all at once.

- Irrevocable trusts, such as Spousal Lifetime Access Trusts (SLATs), may also be an option for those whose assets exceed the exemption amount who also have sufficient assets to meet their personal spending goals without needing any assets transferred to a trust. These trusts can be complex and require deep thought when it comes to deciding how you want the funds to benefit your loved ones. Getting started now will increase the likelihood that you and your attorney can execute a trust and fund it with time to spare.

4. Plan for the Cash You Will Need

We may sound like a broken record on this, but we will continue to advocate for having the amount you know will need from your portfolio for spending or other short-term goals in 2025 in cash or a cash-like investment, such as a money market fund.

If you know you will need cash in 2025, let’s make a plan for that as early in the year as possible. This removes risk from the equation and gives us a longer runway to try to harvest losses that may offset gains realized on the cash raise where it makes sense, particularly in our strategies like TRIO that have ongoing, automated tax-loss harvesting built in.

We know that things come up that require you to act quickly, such as real estate opportunities or business expansions. If the need for cash is a temporary bridge, having a line of credit in place that you can draw on can allow you to stay invested in the market and access cash without realizing gains. This typically works best when there’s a clear plan and source of funds for paying the line of credit off. If you expect that you could need cash but aren’t certain about the need, it doesn’t hurt to preemptively set up a line of credit tied to your investment account that you can draw on if/when needed. Reach out if you think you could be in this situation and our team can talk you through the process for setting up a Pledged Asset Line at Schwab.

5. Review Risks Beyond the Market: Insurance Policies

Many people only think about stock market returns as a source of risk when it comes to meeting their financial goals. The reality is that everyday life presents risks that can change the financial picture overnight if they aren’t planned for and managed. While we can’t control what will happen to us, we can control how we protect ourselves against risk. If you haven’t looked at your insurance portfolio in a while (life, property, liability, disability, etc.) now would be a good time to brush off those policy documents and review them with a professional who has your best interest in mind.

- Inflation has driven up construction costs, and many people took on home improvement projects from 2020-2021 while interest rates were low. It’s possible that the replacement cost on your property insurance is insufficient and needs to be adjusted.

- Life happens fast and we don’t always take the time to step back and reassess our needs. If you’ve added children to your family, taken on liabilities, or experienced a significant increase in income that your family relies on, you may need to establish or increase your life insurance coverage.

Follow Your Own Plan & Path, Not Someone Else’s Predictions

Your vision and plans for the future are uniquely yours, but it can be tempting to act on the predictions that are no doubt flooding your inbox and assaulting your ears this time of year. Sticking to a wealth plan and focusing on the things that are in your control isn’t always fun or glamorous, but it will have a high probability of success for helping you get to where you most want to go, regardless of what’s going on in the world around you. Partnering with a wealth advisor who understands your big picture and the purpose of your wealth can go a long way in helping you gain the clarity to concentrate on the controllable aspects of your financial journey, paving the way for more favorable outcomes. I hope that 2025 brings joy, prosperity, and wellness. If anything, here resonated with you, make 2025 the year that you prioritize actions that help you realize your wealth’s purpose.