For those of you whom I have not had the pleasure of meeting yet: welcome to my first post! I recently joined Monument as a portfolio manager, having previously been a research analyst here in the D.C. area and before that an advisor to high-net-worth families in Oklahoma. I was drawn to Monument from the moment I read the job posting. In addition to a unique section devoted to “Who Should Not Apply” the job description included a lot of their philosophies and their convictions. Boiled down, they matched with mine – patience, discipline, models, and rules.

Speaking of Oklahoma, I went to the University of Oklahoma. I’m still a Sooner football season ticket holder so along with investing, college football is always top of mind. Especially this time of year.

This past weekend, the Army Black Knights football team played the Michigan Wolverines in Ann Arbor, Michigan. Most casual football fans expected a lopsided game, as the Wolverines were favored to win by at least three touchdowns. While I am not an expert, I have watched a lot of college football. In fact, this time last year, I saw these same Black Knights come to Norman, Oklahoma and almost topple my #4 ranked Sooners team in Norman.

So, I knew last week’s Army Michigan game was going to be close, but not just because they almost beat my team. It was because I have never seen a team so ruthless in their adherence to a game plan.

Army, like the other service academies and only a handful of other NCAA programs, runs an old-fashioned but highly effective offense called the “triple option.” Admittedly, this strategy is borne out of necessity because Army is unable to recruit NFL caliber talent due to the mandatory service requirement.

But despite being unable to land blue-chip athletes like Alabama or Clemson (this is me taunting Dave who is a diehard Gamecock fan), Army has success offensively. The triple option – when well executed – is brutally effective and highly demoralizing to play against. Especially when the opponent sees this rare offense once every blue moon. (Again, hardly anyone runs it anymore!)

Unlike modern “spread” and “air raid” offenses, the option is almost exclusively a running attack. It is designed to gather 3-4 yards per play, picking up as many first downs as possible while controlling the time of possession. There is an old saying in football, “Your opponent cannot score without the ball.” For all intents and purposes, it is boring.

Beautiful. But boring. Remind me again why the two are mutually exclusive?

You will almost never see an 80-yard touchdown pass from Army. Heck, you will rarely see a forward pass. In 2018, Army ran the ball 824 times. They attempted only 98 passes. In its game with Michigan, they threw it four times. Four. One-two-three-FOUR, and that includes the two overtime periods.

Michigan won Saturday’s game after Army took the Wolverines to overtime. And to be honest, Army had every opportunity to win the game.

But the outcome is not the focus here. The process is.

At a certain point in the second half, it looked as if Army was going to attempt a fourth down conversion. Prior to the play, TV commentator Joel Klatt relayed a conversation he had earlier in the week with Army’s coach, Jeff Monken. In that conversation, Monken described to Klatt the Black Knights’ rules-based approach for determining when to “go for it.” There are many inputs, but the two primary metrics are yards to gain and placement on the field. Army does not deviate from the rule. Just as they don’t deviate from their option attack when an opposing defense seems to have figured it out. Army will not let the emotion of a game interfere with their offensive strategy.

This anecdote, combined with Army’s use of what many call an outdated offensive strategy, offers some obvious investment parallels.

- A world-class or optimal investment strategy is useless if you cannot stick to the strategy.

- Conversely: A sub-optimal investment strategy, well-executed, can yield very good results, but only if you can adhere to the strategy.

- Taking the emotion out of decision making is a sound tactic for sticking to your strategy.

Here’s an imperfect way to describe the “optimal” versus “sub-optimal” investment strategy bit.

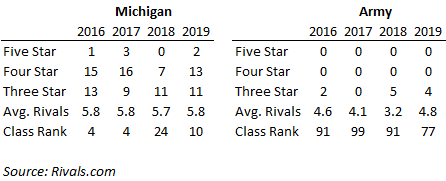

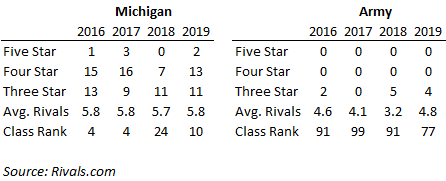

I have summarized the past four years of recruiting data for both Army and Michigan, as a proxy for athletic talent. A roster of 4-and-5-star recruits gets you closer to an “optimal” roster. Obviously, I’m not labeling Army’s athletes “sub-optimal,” only illustrating the disparity in recruiting between the two programs. More players with more stars: this tends to correlate to program success. Just ask Alabama and Clemson (sorry Dave).

DAVE HERE: Clemson plays a schedule that is one notch tougher than my local 6th-grade PeeWee schedule vs. the Gamecocks who play the nations toughest 2019 schedule AND are playing more ranked teams this year than Clemson will face over five regular seasons. So when the bar for going undefeated is laying on the floor, it’s pretty easy to jump over.

To drive this point home further: know that casual Michigan fans, like so many other fan bases (myself included), will often scoff at the news that their latest recruit is a lowly “3-star.” Michigan routinely puts players in the NFL. In the 2019 draft, Michigan had two first-round picks and five picks overall. Army has not had a player drafted since 2008 and only two drafted since 1969.

Oh, I forgot to mention: Michigan coach Jim Harbaugh earns $7.5M per year. Army’s Jeff Monken earns just over $900K. Michigan won 10 games in 2018 and lost 15-41 to the Florida Gators in the Peach Bowl. Army went 10-2 and obliterated the Houston Cougars 70-14 in their post-season bowl game.

There’s an expense ratio joke in there somewhere.

Last weekend, Michigan eventually beat Army. But on paper, it should have been a cakewalk, not an overtime nail biter. How is it that Army, with its “sub-optimal investment strategy” (un-rated recruits running a 1980s offense), was able to take mighty Michigan to the wire?

Unflinching discipline and dedication to the plan. Not just during the game, but over the months and years leading up to the game.

But unlike football, investing is not a head-to-head matchup. As an individual investor, you are not pitted against a stock and bond-picking foe, with arbitrary rules and time restrictions. You are up against ever-changing life circumstances. Against the vagaries of the market. Against your own behavioral biases and other’s as well. Against an infinite list of known and unknown variables. Defending a modern air raid offense is quite simple in comparison.

With investing, you know with certainty that there will be periods of pain. In football parlance: there will be failed fourth-down conversions (a missed stock call). There will be turnovers (you bought something you didn’t fully understand). There will be losing streaks (your strategy goes out of favor). And you will be tempted to go to cash because it “feels good.” Or to reach for yield. Or to switch up your strategy entirely.

I’d encourage you to take a page out of the Army offensive playbook instead.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice.

A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Monument Wealth Management | Alexandria, Virginia |

Are We A Fit?