Now that the S&P 500 has gone 52 consecutive weeks without a +/- 2% weekly change, the question now is, “What’s next???” Well, even though this is only the second time in history the S&P has done this, did you know there is another milestone that could very possibly happen at the end of December that has never before happened (well since 1927)? I discuss this in this week’s blog.

Before I get into the blog, I first want to introduce two new members of the Monument Team: Emily M. Harper, CFP® and Eitan Z. Boral, CFA.

Emily is our newest Financial Planning Associate and started with Monument in the middle of September. Many of you have already met Emily in person or spoken with her on the phone. She brings with her several years of experience across various leadership roles at T. Rowe Price and is also a graduate of the University of Virginia. The thing we immediately loved about her was that she was an ART HISTORY MAJOR! Yes – you read that right. So why did we love that? Well, it takes someone with a lot of passion for planning and working with clients to go to school at night then study for, take and pass the CFP exam. At Monument, we feel passion eclipses all else and when you meet her you are sure to agree. See Emily’s video bio and background here on our website.

Eitan is our newest Associate Portfolio Manager and started with Monument right after Thanksgiving. He is a CFA Charterholder with over 10 years of relevant and applicable portfolio management experience. Eitan comes to us from Austin, TX where he was a Portfolio Manager at another Registered Investment Advisor very much like Monument. Eitan was a walk-on wrestler at the University of Wisconsin and his competitive spirit was immediately evident to everyone here. He exhibits a true passion for the industry, his role at Monument and working in the best interests of clients. Eitan is working side by side with Spencer Rand, CFA learning everything from trading to running our equity models while also helping us transition over to Orion, which is our new internal AND client facing technology we will begin launching in stages beginning in Jan of 2018. See Eitan’s video bio and background here on our website.

Well, Barron’s trotted out their annual Outlook issue last weekend with all the experts weighing in on the annual guessing game that is called “forecasting.” We published an exhaustive (insert sarcasm) forecast in my last blog that can be found here but I’ve copied it below as well.

The MWM 2018 Forecast for Normal People Who Just Want to Invest for the Future

- We think the stock market will be up next year, but not anywhere close to the amount it was up this year. This is just playing the probabilities – since 1980, the market has finished with a positive annual return 28 out of 37 years…or 76% of the time notwithstanding annual average drops of -14%.

- We think recession risk is low and since many of the 9 negative years corresponded with a recession, low recession risk increases the probability that next year will be positive, too.

- THAT’S IT – end of forecast. To get any more granular than that would be guessing and to focus on events with lower probabilities than above is not constructive.

Anyway, the experts (who all by the way had NO enthusiasm for 2017 in the year ago issue) are all forecasting returns of between 8 and 10%.

Again – my forecast is above.

Here’s the deal – growth around the world is accelerating and as we enter 2018 I just don’t see anything pointing towards a reversal of that RIGHT NOW. On top of that, prospects of major tax reform (which regular readers know I’ve been suggesting would happen way back in May of 2017) are looking more and more likely…look no further than the market at all time highs for validation of that probability. I’ve got more on taxes below especially after the Alabama election last night. Frankly, I think I’ve spent more time watching a special election in Alabama that I have spent collectively watching NFL football all season. That’s kinda sad.

I think as we move on from tax reform we will start to see plans for a huge infrastructure program (probably in the range of a trillion dollars) which will boost the U.S economy and the overseas markets as well. We will be watching inflation but so far those pressures seem to only be building modestly at this point. The Fed (and in fairness, other central banks around the world as well) has a magic number of 2%. I’m no expert but it’s hard for me to imagine that it hits 2% in 2018 and frankly it does not matter if I’m right or wrong with that thought…we just simply watch it because “it is what it is”.

Mixing together real economic growth, continued regulatory rollbacks, cost controls, low interest rates and much higher corporate earnings makes for a solid recipe for loftier equity prices.

I just don’t see significant headwinds as we cross over into 2018 but patience will be a virtue. Solid portfolios and long-term financial plans will win the long race – missing out on bitcoin will not cause anyone’s plan or portfolio to fail. I promise. Currencies are being invented out of thin air and then people are buying it (to paraphrase Jamie Dimon). At least if you buy the Brooklyn Bridge you can see and touch it.

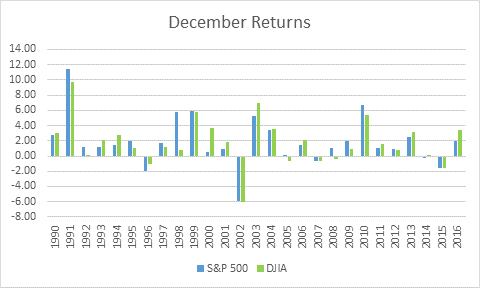

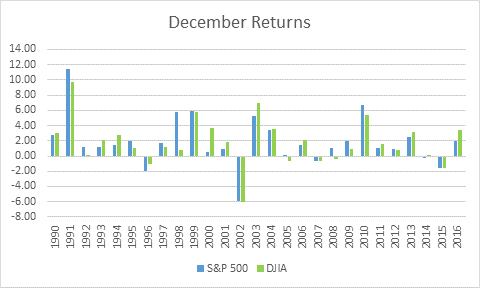

December Returns

Just a quick dump of trivia wrapped in some probabilities. Below, Eitan used FactSet to generate a chart for this blog that shows S&P 500 and Dow Jones returns for just the calendar month of DECEMBER going back to 1990. So out of 26 years, December has been negative FIVE TIMES for the S&P 500 and SIX TIMES for the Dow Jones.

“So what” you ask?

Well from my perspective, that means December has a pretty good probability of being a positive month by the last trading day of Dec 2017.

Double so what…

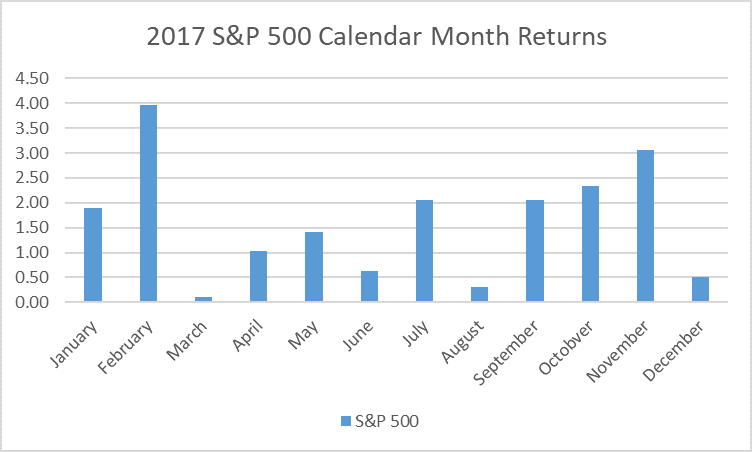

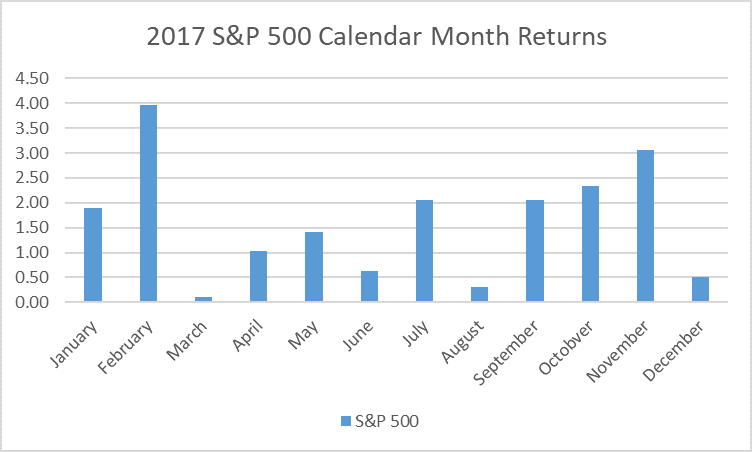

Well if December ends up positive then this will be the only time the S&P 500 has had each calendar month end with positive returns ever (well, since 1927). So far it looks like it is in the cards. See below. Returns for December are through 12/11/2017.

Taxes

Alabama has not elected a Democrat to the Senate since 1992…and I don’t really think he was much of a Dem since he converted over to Republican in 1994.

Yeah – Alabama is that RED.

Ok politics…blah blah blah…bickering, CNN, fake news, real news, everyone hates everyone…yab yab yab…

HOW DOES THIS IMPACT TAX REFORM????

Roy Moore’s loss does not really impact things too much on taxes because Senator-elect Doug Jones will most likely not be seated until January (election needs to be certified by the state of Alabama and then it will be the holiday season…etc).

I think this actually helps get the legislation passed. Losing a seat narrows the voting surplus from 52 to 51 so they can only lose one vote right now (VP Pence breaks a tie) but I like that this also introduces a year-end deadline since they still have 52 republicans through the end of the year. Deadlines create compromises – remember the Fiscal Cliff? So if deadlines foster compromises and compromises create conclusions, I suspect this gets done by Christmas. Republicans need all the help they can get in 2018…tax legislation is a win they can carry into 2018.

Now for the scoreboard…I’m thinking I end up right with my thesis I’ve had most of this year that tax reform gets done and I’m thinking I may end up being wrong about getting some Dems to cross the aisle to get to 60 votes by using the State and Local Income Tax (SALT) as a bargaining chip.

As for 2018…

You must be patient to let a lot of 2018 unfold. I suspect we will see some volatility and downturn in the market in January…people have some big gains this year and may use Jan to trade out, raise money for April tax bills and defer the liability of those gains for 16 month (April of 2019). Patience is different than complacency – as things unfold, portfolios will change. For those of you readers who are Monument clients, we take care of this tactically at the portfolio level for you. Strategically, your asset allocations should not change unless you have a change of personal circumstance that requires a modification to your financial plan OR you have a need for liquidity.

Keep looking forward – Dave

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.