Last week saw the S&P 500 close above 2600 for the first time. The Dow was close to closing at an all-time high as well. The U.S. economy continues to do well, as do the rest of the global economies. Today I write about manufacturing, the flattening yield curve and finally I introduce the 2018 MWM Forecast at the end of the blog.

Manufacturing – Solid Gains are Positive for Next Year

If you routinely read my blogs, you know I often mention the ISM Manufacturing Index which has been posting solid gains this year. While I don’t often dive into many of the other related surveys or reports because they don’t pass my “Mom Test” (if my Mom writes and says she does not understand what I wrote, it did not pass the test), there has also been strength in the regional manufacturing surveys from regional Federal Reserve banks. Finally, one last piece of important related data has fallen into place – Industrial Production. Industrial Production had been lackluster until last week when the Fed reported that October Industrial Production rose 0.9% along with material upward revisions to previous reports. This suggests the strong October report wasn’t a one-time event.

A stronger global economy, rising U.S. exports and moderate support in energy are all aiding the industrial sector. As you know, we have an overweight to this sector across a few different Monument portfolio strategies.

So What?

There has been a close correlation between the manufacturing economy and the S&P 500 Index since 1995 – so an acceleration in the manufacturing sector lends support to U.S. equities.

What About Further Growth?

I read this gem over the weekend:

“The U.S. Leading Economic Index (LEI) increased sharply in October (its best reading ever), as the impact of the hurricanes dissipated…The growth of the LEI, coupled with widespread strengths among its components, suggests that solid growth in the U.S. economy will continue through the holiday season and into the new year.” – Director of Business Cycle Research at The Conference Board

The LEI reading is the latest in a string of economic indicators that is pointing to respectable growth as we get set to enter 2018.

Like some of the other surveys and reports I’ve mentioned above, I understand that the LEI isn’t necessarily a household name, so here’s the scoop – the LEI is designed to forecast turning points for the U.S. economy, such as the onset of a recession or the beginning of an economic recovery. It is made up of ten separate economic reports and these components are sometimes called…ready for this? Leading Indicators. Anyway, the LEI will generally presage how the U.S. economy may perform.

Please note the words “generally” and “may”…nothing is even close to perfect, but it is one of many tea leaves that can be used to determine some sort of probability of where we are, and where we are (or are not) heading. Because it is made up of ten indicators, I think it offers a clearer picture than simply one or two would.

Now I know this begs the question, “How accurate is the LEI in predicting recessions?”

There have been seven recessions since 1970 with the LEI peaking anywhere from seven to 20 months prior to the onset of a recession. Basically, this is an average lead time of 12 months. If we look at the last two recessions, the LEI peaked 10 months before the 2001 recession and 20 months before the 2008 recession.

As I alluded to above, no economic indicator will forecast with perfection. There is a wide gap between when the index has hit a top and the arrival of a recession. But it’s also true that the tally of the components has done a good job of signaling an impending recession.

Now, drumroll please…the LEI’s current direction is suggesting the current expansion not about to roll over. Given the gap between an LEI peak and the onset of a recession, I maintain that we are not close to the beginning of a recession caused by any economic event. As always, a major geopolitical event could cause a recession to quickly start, but those are different than recessions caused by the economic landscape.

The Yield Curve and Recession Risk

Just because the Yield Curve is flattening, it does not mean we are about to enter a recession or Bear Market, or that there is any looming threat to equities. Look at some of the charts below and you can see that during environments similar to today, the markets have continued to gain and recessions usually happen well over a year after time flatter than today. That said, don’t be surprised if you keep seeing the Yield Curve flatten since the Fed will be raising rates further. Keep reading.

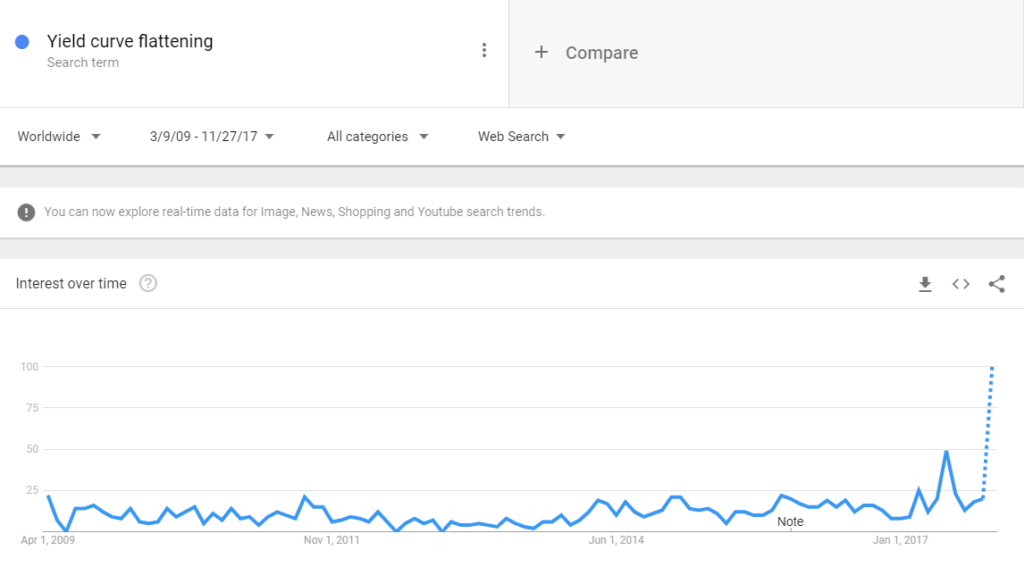

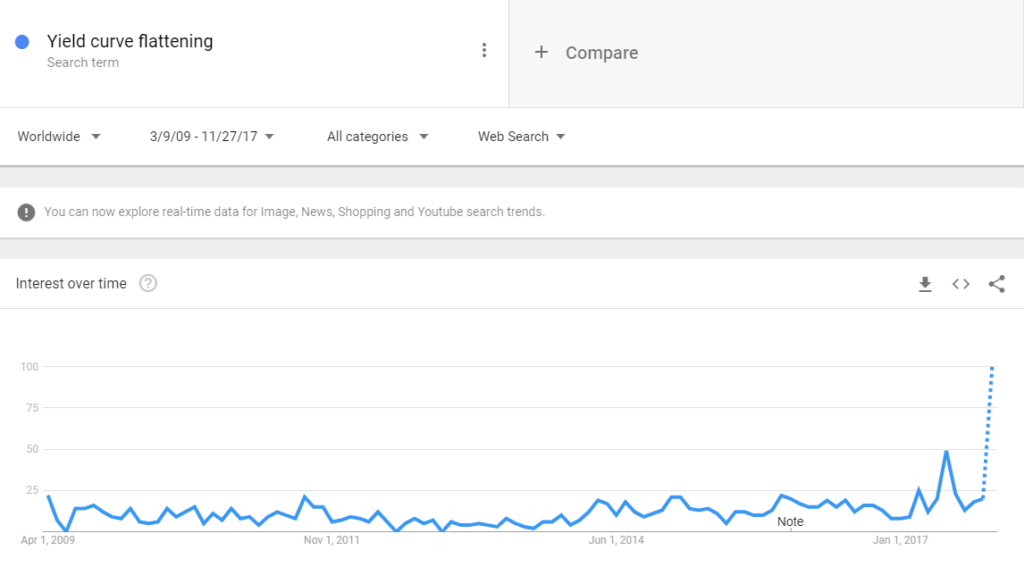

- “Yield Curve flattening” is becoming a popular Google search these days…kudos to the guy that originally posted this, but since I cannot rememeber who and don’t have his chart to attribute, I built my own below. Sorry dude…not meaning to scoop you here. The dotted line shows where the month is estimated to end.

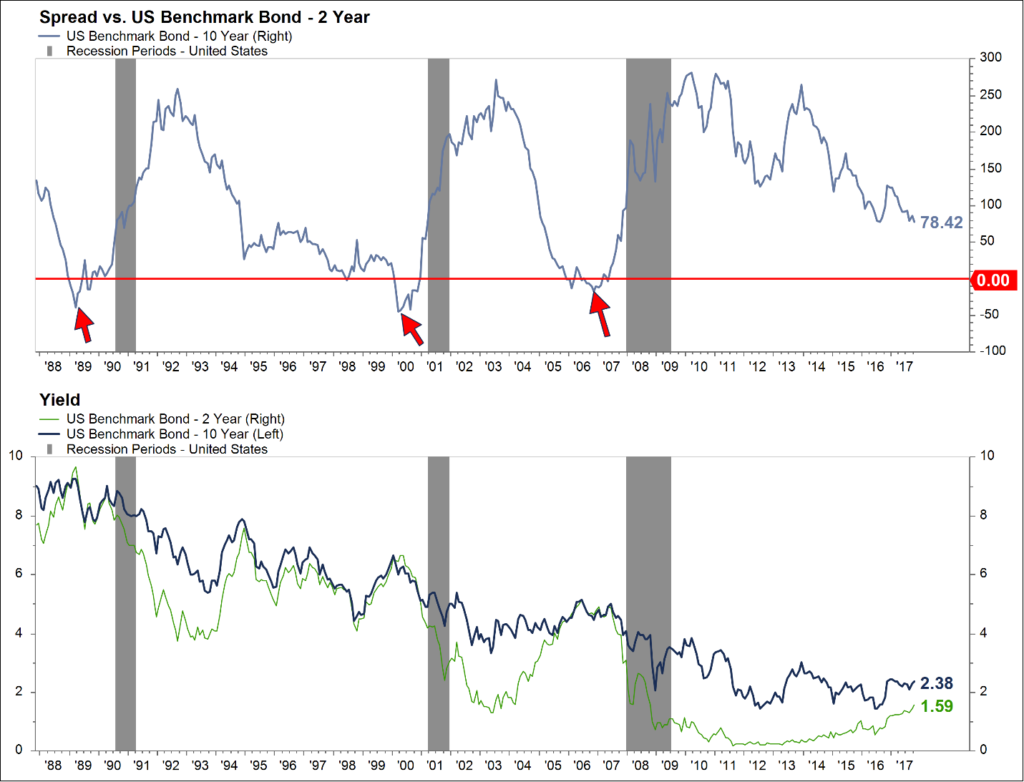

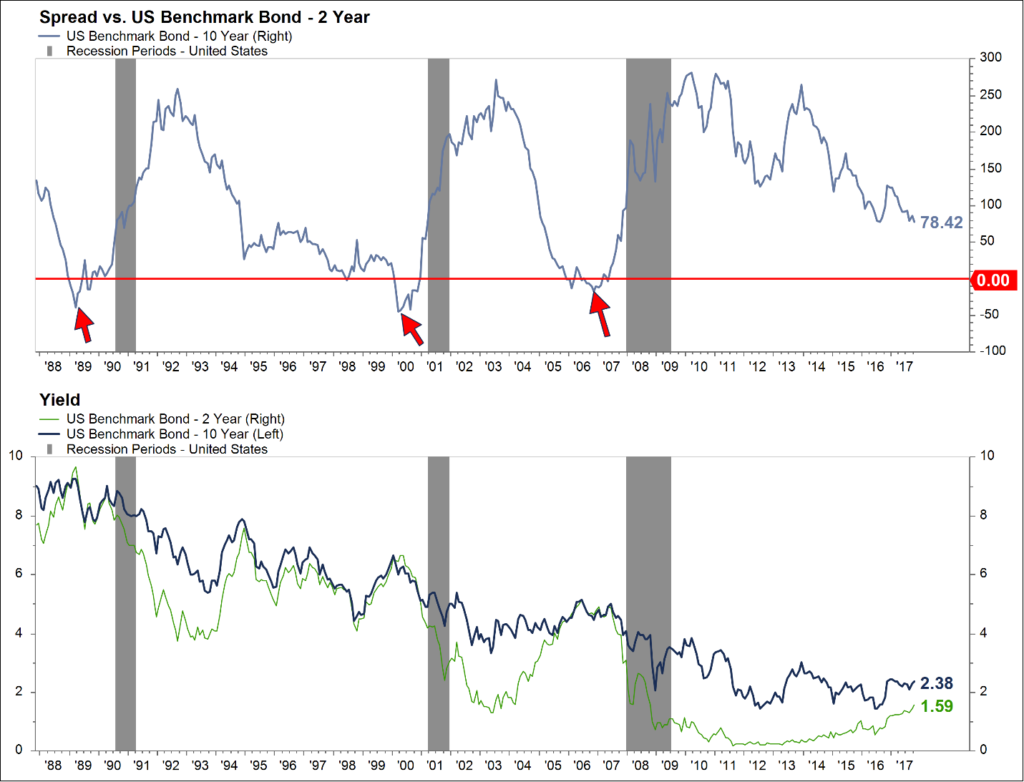

- Here’s a chart I built in FactSet today. Below the red line means it’s an inverted yield curve (yields on the 2-Year Treasury are greater than the 10-Year). Then I shaded the recessions in grey. See the gap between the inversion and the recession?

- Now note above that the current spread between the 2-Year and the 10-Year is positive at 78 basis points (or 0.78%). Also note how long the spread remained low from 1994 to right at 2000. Remember what the market did over that time?

So What About 2018?

There are people out there who will write huge research reports on their 2018 forecasts. I think most of what people will write is a bunch of bunk. So here’s my forecast.

And I’m being totally serious.

The MWM 2018 Forecast for Normal People Who Just Want to Invest for the Future

- We think the stock market will be up next year, but not anywhere close to the amount it was up this year. This is just playing the probabilities – since 1980, the market has finished with a positive annual return 28 out of 37 years…or 76% of the time notwithstanding annual average drops of -14%.

- We think recession risk is low and since many of the 9 negative years corresponded with a recession, low recession risk increases the probability that next year will be positive, too.

- THAT’S IT – end of forecast. To get any more granular than that would be guessing and to focus on events with lower probabilities than above is not constructive.

Please call with questions.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.