If you are SERIOUSLY asking yourself or anyone else any version of the question, “What should I do now?” you have an investment strategy problem that needs to be fixed because it’s probably too late to figure out what you should do in the middle of something like the past few days.

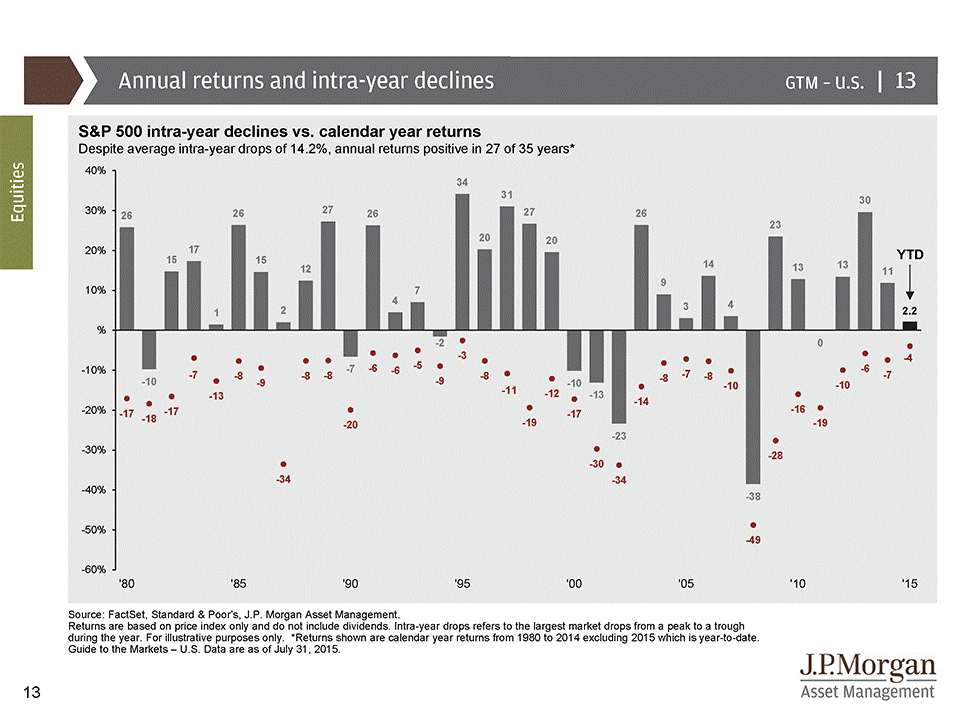

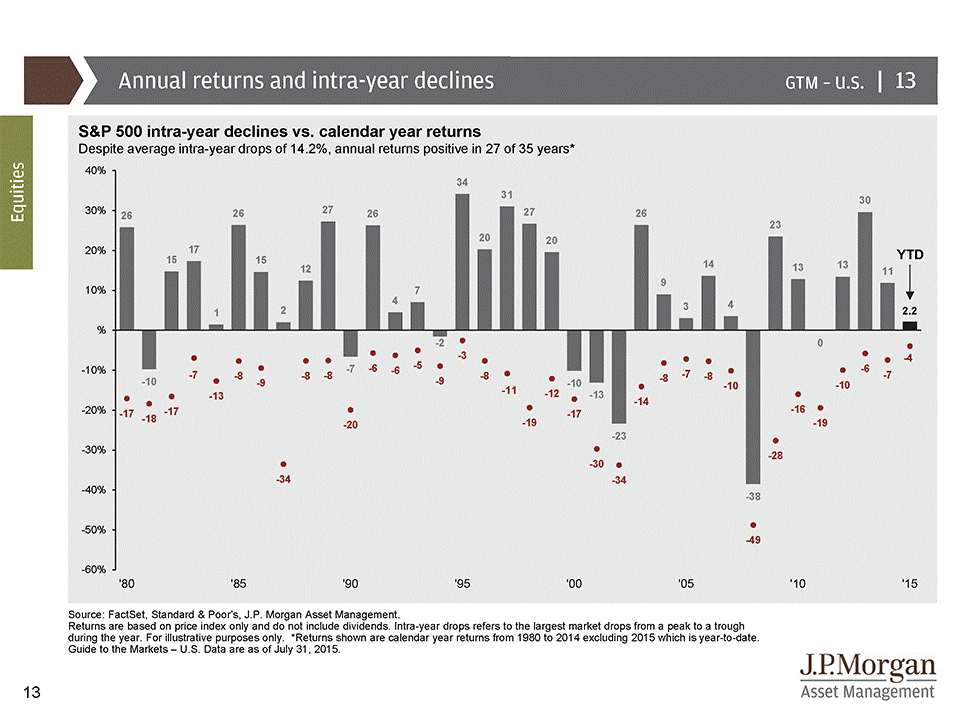

The good news is that if you have done nothing, you are probably going to end up okay. I’m going to review the nuts and bolts behind that statement a little further down, but first please take a look at the chart below provided by J.P. Morgan Asset Management. I recently took in a presentation by Dr. David Kelly, CFA who runs their Global Market Insights Strategy Team where he discussed this slide in great detail.

What this slide shows is the full year price return of the S&P 500 going back to 1980 represented by the bars, and the biggest peak-to-trough return in that same year represented by the red dots. Since nothing in life moves in a straight line, the red dots are inevitable for each year as there is always some give back off the S&P 500 high each year. The AVERAGE intra-year drop is around 14.2%.

AVERAGE DROP = 14.2%

Result? 27 of the past 35 years, damn near close to 80% of the time, the market has a positive return for the calendar year. History is on the side of those investors who do not over-react.

Here’s What We Know, and What We Think.

I don’t think that the normal everyday investor pays attention to the Volatility Index called the “VIX”, but it is currently at levels that were seen on the day that Bear Stearns collapsed … and there is really no specific news like that today.

I mean think about that for a second … there is no real single news event such as the collapse of a global investment bank, yet the volatility levels are the same as back then?

Okay, so let me highlight what IS NOT CURRENTLY HAPPENING:

- There are no global liquidity issues, nor is there any global banking issue.

- As I state in this video series, recessions are generally what kill a bull market. In the cases when it’s not a recession that kills a bull market, it’s due to extreme over-valuation of stocks … like the 2000 tech bubble. By the way, we DO NOT have extreme overvaluation now.

- There is no inverted yield curve.

- Employment is not rolling over and getting worse … in fact, it’s the opposite.

- The Institute for Supply Management (ISM) Purchasing Managers Index (PMI) has been at a reading of 50 or better for 71 of the last 72 months (November of 2012 was the only hiccup). It is generally assumed that when the reading is below 50, it’s a recessionary signal. It’s not even close to 50 right now.

- There may be a global slowdown going, but a 0% growth situation is way different than a global recession. In the famous words of a now banned advisor in the industry, “Don’t get it twisted.” We may have zero growth but a global recession is not happening right now.

- Housing. Yeah, that. One newly constructed house accounts for roughly $280,000 of new economic activity (source is unknown – I heard it on the radio this morning and jotted it down without hearing the person’s name) and the creation of four new jobs. Housing starts are around 1.1 million right now in a tight housing market … so do that math. It’s not insignificant. In fact, I get numbers on my calculator that are in some weird scientific notation. That means they are big.

- The Fed is not tightening. I’m not saying they won’t, but this makes it tough and as of right now, they are not.

- Oil is at around $40. That’s good for gas prices, and two weeks from now I’ll bet we see gas $0.20 less than it is right now. The consumer is 70% of GDP (by the way, U.S. trade with China is responsible for about 1% of our GDP) so when gas prices are low, it’s a huge economic lever. Okay, next time oil is at $125 a barrel, I want to see these boneheads that pay a PR firm to get on CNBC say, “we are expecting the markets to hit new highs now that oil is expensive.” Give me a f#$king break with this cheap oil causing a recession crap.

- The “Three Overs” are nowhere to be seen:

- There is no “over-spending.”

- The housing market is not a bubble.

- Business spending is under control.

- There is no “over-borrowing.”

- Credit card, consumer and business debt are all under control.

- There is no “over-confidence.”

- Consumer confidence is under control.

- Wage growth is flat-ish.

- Have you seen the market over the past few days? I’d say there are a lot fewer confident people today than last week, and last week’s confidence was not overly high.

It is OKAY that this panic has caused a rapid reassessment of risk. This is not an unhealthy correction, it’s just that the rapid, big number move is disconcerting. Nothing in life happens in a straight line.

What to Do Now

First, watch our Mid-Year Economic Review videos. Seriously. I think we made a lot of good points, and we filmed and posted it before all this even started. Nothing that has happened has changed anything said on the series.

From our standpoint, exactly nothing has been altered about the U.S. economic outlook in the last week or even month. It doesn’t matter that oil is below $40, stocks are in the process of what looks like a correction from all-time-highs, or yields briefly sagged below 2% on the ten year Treasury overnight … if we are correct in our assessment of a well-employed, sustainably spending, and under-levered household sector in the U.S., there are now extraordinary businesses and other asset opportunities available for those willing to buy at these levels.

However, a few things:

- You should know how much liquidity (cash) you need out of your portfolio and have it ready. You should not have to panic and ever say “What should I do now?” Have a plan and stick to it. Take a look at your fire drill now. If you don’t like it, rework your plan. It’s okay if this recent market activity got you to a point that you realize you don’t actually like the current riskiness of your portfolio. But panicking is not a way to change your plan.

- If you have a plan, stick to it.

- If you have long-term cash, consider investing it now. This may not be the bottom, but if you buy right now, I know you’ll be happy with where the investment ends up five years or so from today.

- Don’t listen to Charlatans or Fools … now or ever.

Call with questions or concerns.

Important Disclosure Information for “What Should I Do Now?”

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.