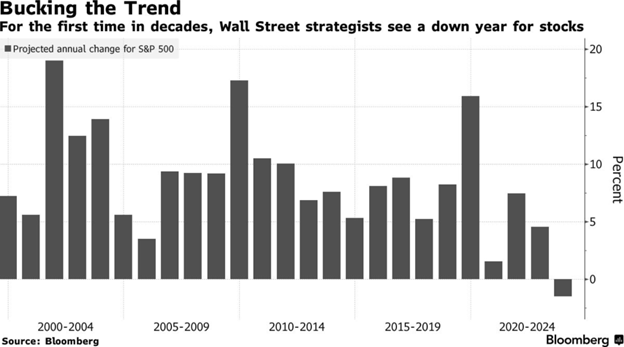

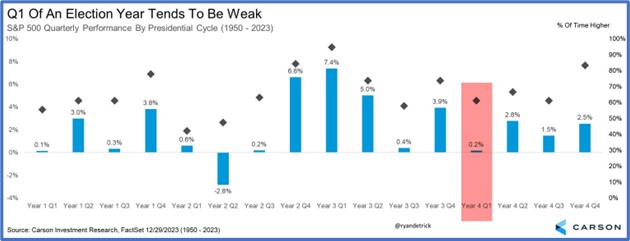

Well, looks like no one at the big Wall Street firms got their 2023 predictions correct, in fact (below) most predicted that the S&P 500 would end up lower in 2023 than 2022. And no, these are not cartoons.

Turns out, the S&P 500 ended up at 4770 and posted a blockbuster 26% total return for the year (rounded).

Consider this yet another reminder that forecasts are nothing more than guesses and in the context of portfolio strategy, meaningless. Fun? Sure! We did them at the beginning of 2023 for fun and spoke about them on our market recap podcast. (Speaking of: Our 2023 Recap + 2024 Outlook podcast drops next week – don’t forget to subscribe!)

But let’s review in what I’ll attempt to be a truncated format. Since we all KNOW what happened, I’ll just highlight it without a ton of detail:

- Most forecasters on Wall Street analysts affiliated with the big-name firms forecasted a negative year for the market in 2023. Please reference that plus 26% return on the S&P. End of data. Any additional commentary should be inferred while picturing me with a smirk. The best forecast is that patience and discipline will drive your future investing success. You can write that down.

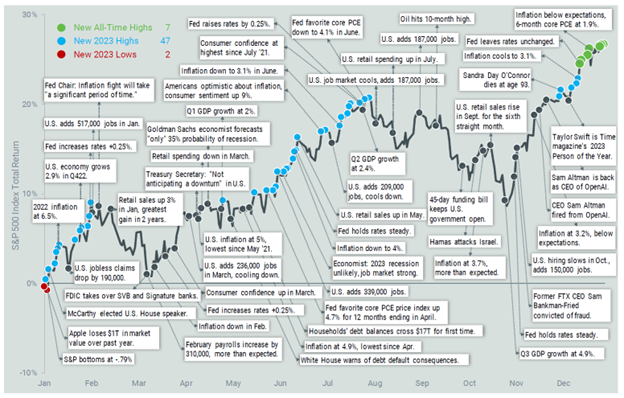

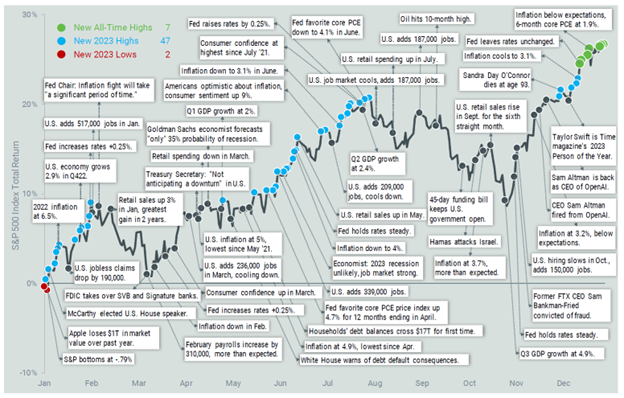

- A close second place to the incorrect forecasting for market returns was the expectation that crisis after crisis would continue to drive the market down in 2023. There was no shortage of doom and gloom on the television as news such as a banking crisis, the prediction of the demise of the US dollar, a debt downgrade, a government shutdown, a constitutional crisis in the House, as well as plenty of mini crisis’s created non-stop negative news commentary and space for total jackasses to predict the end of the world. I mean, just look at this graphic while remembering the 26% total return on the S&P 500. (Hat Tip: American Century Investments)

- By the way, by the end of 2023, not only did all that stuff happen in the above chart, but in additional to stocks ending up near an all-time high, gold was at an all-time high, homes were still hovering near all-time highs, bonds were up 5% after two full years of shit returns, personal net worth was at or near all-time highs and debt to income was NOT at an all-time high.

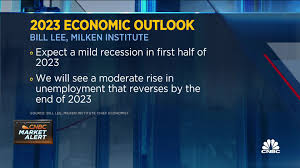

- Now let’s talk about that recession. You know the one that never materialized? The constant calls for a recession were unrelenting. Not only was there no recession after forecasters generally agreed that GDP would be negative for the entire year, but we actually saw a real after-inflation GDP growth of about 2.6%. As Jeff Spicoli said in Fast Times at Ridgemont High, “Not. Even. Close. BUD!” None of these people below had any facts about the future (because, say it with me), “They don’t exist.”

My novel idea: What if you IGNORED THEM ALL and just focused on having the cash you need to live on for a year or two safely tucked away and the rest was invested in a well allocated portfolio for longer term?

- Now, that said, I will admit that I was not in the camp that believed the Fed would achieve a soft landing but so far it looks like they pulled off the impossible. Inflation has come down, the economy is intact, and the stock market reflected both of those things. Inflation is now hovering around a normal historical reading, unemployment is still below 4%, and by the end of 2023 the market was hovering near and all-time high. Please direct me to anyone who predicted that in January of 2023 because I wanna send them a Monument branded Yeti coffee mug.

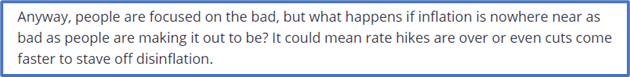

- Wait…what about inflation? This may have been the one topic I could have been accused of pounding the table on. I had a few different blog and video postings along with some podcast commentary going out on a limb suggesting inflation COULD BE correcting faster than consensus and insinuated the market would react positively to that discovery. I wasn’t making a call (read: I was, but I gave myself an out) but I was asking anyone who listened to CONSIDER what would happen. Like everyone above, I had/have NO FACTS ABOUT THE FUTURE except I do have conviction and here it is: Having cash to live out of during selloffs and staying invested is the best way to manage portfolios for people who need to grow wealth. Below is the cover of June 2023 issue of The Economist followed by a snapshot of a paragraph from my August 2023 Blog titled “Why is Everyone Still Twisted-Up About Inflation? Let’s Look at the Terminology”. (More thoughts on this in my 2024 section below).

- Bond prices were CRAY CRAY! Did you know that from 2001 to 2021, bonds usually had around 10 days in each year where their prices moved by more than 1/2 of a percent or more? AND – did you know that in both 2022 and 2023, bonds averaged about 66 days where prices moved by 1/2 of a percent or more? That’s a lot of volatility and no one was expecting it. Bond interest rates are yielding levels I have not seen since I started in the business and they warrant attention. Also, if you say you don’t like bonds at their current yields, just go ahead and admit you will NEVER like bonds and go figure out how to safely construct a 100% equity portfolio that works for you, and just OWN IT.

Of course, there was a lot more to 2023, but those are the things I thought were interesting enough to have some fun writing about.

What About 2024?

First, after all this, are you interested in what we said LAST year at this time? Here you go. But here’s a highlight:

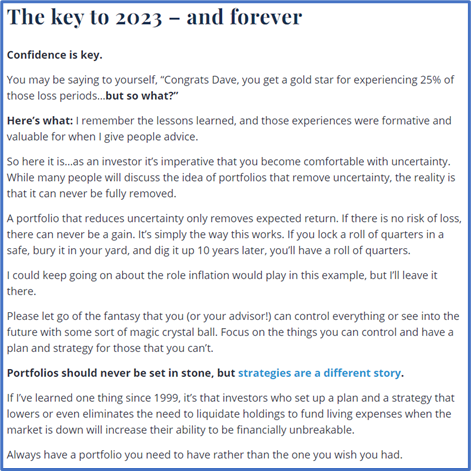

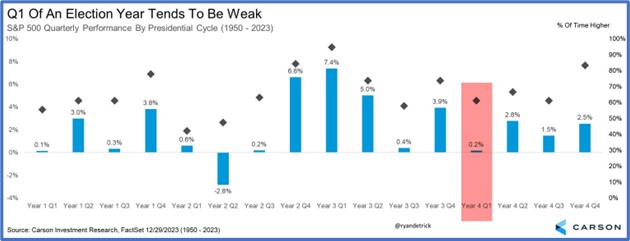

Second, the first quarter of an election year has historically been weak with the rest of the year doing well. Be prepared for that if it materializes. Below

(It’s kinda cut off but the diamond in the chart represents the percentage of time that the market is higher – Hat Tip @RyanDetrick).

Third, but attached to the second point, my gut tells me that January 2024 could be volatile just based on the fact that people will diversify out of some gains they had in 2023 and to give them 16 months to deal with the tax bill. Institutional portfolio managers will reset asset allocations by selling winners and allocating to other classes that are underweight based on performance. This is NOT for action; I’m just passing along a gut feeling.

Here’s the Real Secret

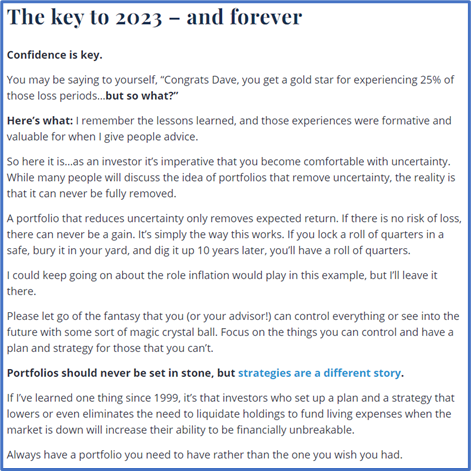

Some things in investing never change: Investor overconfidence, emotions (both fear and greed), recency bias (I wrote about that here and here), loss aversion, mental accounting and confirmation bias (I wrote about that here). Especially confirmation bias…people are on a never-ending quest to find the investing information that aligns with their beliefs.

But here’s the real secret…the real edge…the REAL opportunity…

None of it matters. All the information people seek or think they have is already priced in. There are six billion people on this planet, and there is no (legally) actionable information or intellectual edge that exists or really matters.

Just ask this guy…he’s a billionaire who runs the largest hedge fund in the world. He may carry more money in his pocket than I have to my name, but he doesn’t have any more facts about the future than I have.

Look I may not know shit about the future, but to the best of my knowledge, no Monument portfolios were down -7.6% last year, either. And people are likely paying this hedge fund guy 2% per year management fees on their assets on top of surrendering 20% of profits above some threshold.

So, what’s my point? The real edge in investing comes from chopping wood and carrying water – the hard, unglamorous, repetitive, mundane chores that must be done.

Master the basics because the basics aren’t actually basic. Simplify shit, understand shit, and be a better investor.

What’s Important to Know About Us

In a world focused on niches, our niche is working with people who are sick and tired of getting bad advice from financial salespeople who sound and talk like timeshare salespeople.

Giving people unfiltered opinions and straightforward advice is our value proposition. It’s no more complicated than that.

Oh, well, we also love dogs in the office, so when you work with us, you get that value too. Look for them on our Instagram account @monumentwealth.

Keep looking forward and let’s have a great 2024,