Most of the comments below were written on Friday the 21st, before the equity sell-off accelerated into the late afternoon. At present, the S&P is off ~3.0%, the 10-year treasury just hit 1.37% and the 30-year is at an all-time low of 1.83%. Gold is up, oil is down. The best performing sector of late, Technology, is the second worst performing sector of the day behind only…what else…Energy. Basically, anything tied to “risk” is getting smashed, and it’s not fun. Today is a good reminder of what a drawdown feels like. Today also happens to mark the 26th correction of greater than 5% since the March 2009 lows. [Side note: I just ran some figures, and drawdowns are more the rule, not the exception. There have been 17,655 trading days since 1950, and the S&P is at an all-time high on only 1,336 of them, or ~8% of the time.] And contrary to most headlines, this is not a one-dimensional sell-off. Yes, the far-reaching effects of the events in China are likely a massive component, but you also have a non-zero probability of an avowed socialist entering the White House in January 2021, plus a number of anecdotal events that many might construe as “only occurring at tops” (i.e. Morgan Stanley purchasing E-Trade, frenzied retail trading, etc.). We have three weeks until the next Federal Reserve meeting…

(Dave here, weighing in on the political stuff–The Dems need to look no further than the 2016 Republican Primary to see that attacking everyone EXCEPT the leader just helps the leader. Think Trump and how Jeb, Marco and Ted just attacked each other. Everyone likes a winner and if Bernie comes out of the next debate and Super Tuesday the winner, it’s over and Bernie will be the candidate. Forget the Super Delegates, his ground game has that well-covered this year, I’m sure.)

I cringe at the thought of writing about the coronavirus, but I feel obligated to make a few comments…

When it comes to the market–Does it matter? Is it a big deal? Should you worry? I’ve admittedly been somewhat flippant about the subject since the initial news broke in mid-January, but I’ve recently decided to walk it back. Rather, couch it in different terms. Of course, it matters. A big deal? I honestly have no clue, but there are myriad people way smarter than me that seem to think it is; big deal or not, what really matters is that the crowd thinks it’s a big deal. And evidence is mounting that this will have some longer-term ramifications. China is a country predicated on control, and authorities are showing they’re having a hard time exerting it. Companies, meanwhile, are lowering forward guidance. Should this cause you to radically alter the composition of your portfolio? Probably not. And if it does, then you were likely misallocated to begin. Should you worry? No. But again, if you are, there is likely the same fundamental mismatch. Everyone has a high-risk tolerance when the market is humming along with minimal volatility. This is a good reminder that you’ve got to earn your return, though nothing is guaranteed.

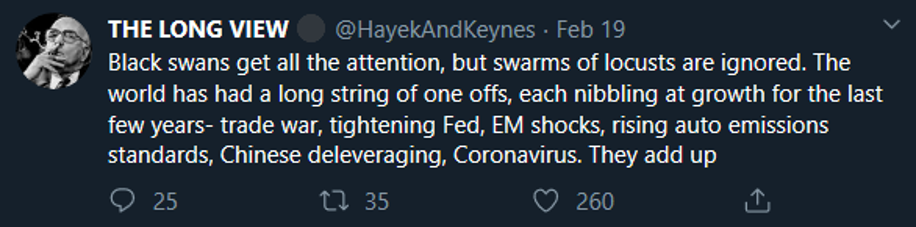

My plea here is for us not to engage in binary, mutually exclusive thinking. It is one hundred percent advisable to ignore the firehose of headlines and the inevitable parade of charlatans pushing their unaudited trade ideas for which they will never be held accountable (hey, at least they try). At the same time, it is intellectually lazy to wholesale dismiss the coronavirus as a “nothing burger.” Everything matters, though it is impossible to disaggregate the effects of a chain of events like we’re witnessing right now. A higher order thought: everything is consequential, in varying degrees, and will create the fault lines that will cause the next recession or global panic, whenever that occurs. We’ll only know how consequential something like the coronavirus is postmortem, and even then, history will be up for debate. Hell, we are still debating the true causes of 2008. Here’s a snip that nicely encapsulates my sentiment:

I think most investors have internalized the idea that getting from point A to point B is rarely a linear process. In the realm of single stocks, Amazon is the poster child. We know that $10K invested at the IPO is now worth $11M, and that getting there required stomaching a 90% drawdown and the discipline to hold the stock as it charged higher over the subsequent two decades. It’s admittedly well-worn territory. Yawn. But what about equities in general? Did you realize that stocks as an asset class once underperformed bonds for a staggering 68 years? While that level of underperformance seems unlikely on a go-forward basis, Meb Faber notes the eye-opening statistic and asks the question: how long can you handle underperforming? My take from Meb’s informal Twitter polling: few investors appreciate the fact that truly transformational returns require an enormous threshold for pain. A corollary: a lot of our clients (and those of you whom we’d love to work with) have already experienced transformational returns through their own entrepreneurial activities. Is chasing further transformational returns – at the expense of modest returns, or even capital preservation – even advisable? What’s transformational, what’s acceptable, and what’s realistic? Questions worth asking.

This article by Kevin Muir begins to tackle something that I believe will be of much greater consequence than trade deals, the coronavirus or even the 2020 presidential election: negative-yielding sovereign debt. Global markets are interconnected now more than ever (see above: everything matters, and everything is related), and low yields in the EU have ripple effects in other parts of the world. It seems perverse for someone to lock in a negative yield for 10+ years, but you must consider who that “someone” is. European life insurance companies are faced with enormous liability mismatches: the value of their longer-dated liabilities is rising much faster than that of their shorter-dated assets, and to rectify the problem, these insurers have been chasing yields even lower. It’s a vicious cycle, and the eventual unwind (Kevin speculates major changes to German fiscal policy), set against the backdrop of Europe’s deteriorating demographics, will likely have more of a lasting impact than anything in today’s headlines. But to link it back to my opening comments: it all matters, just in varying degrees.

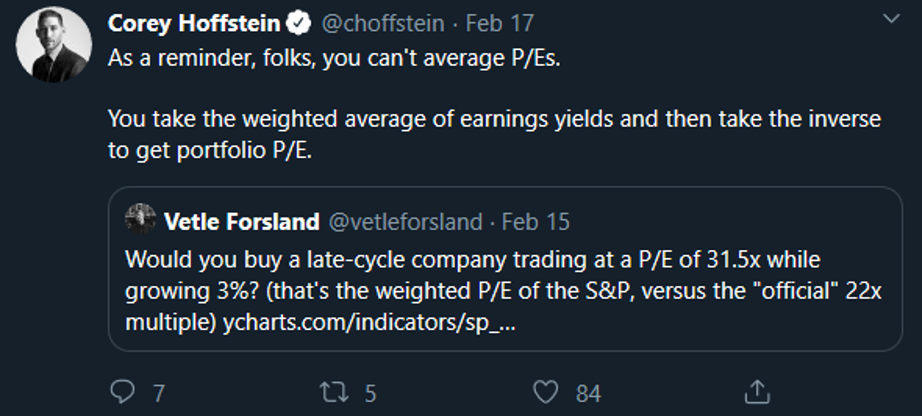

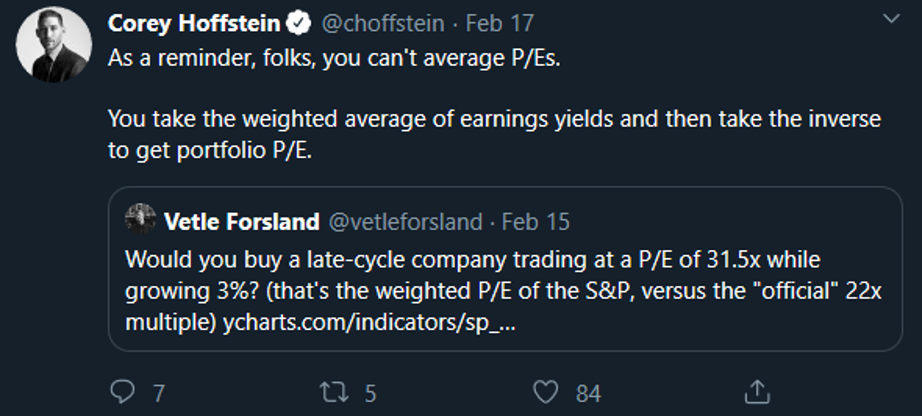

To end, here are three tweets that I kept coming back to.

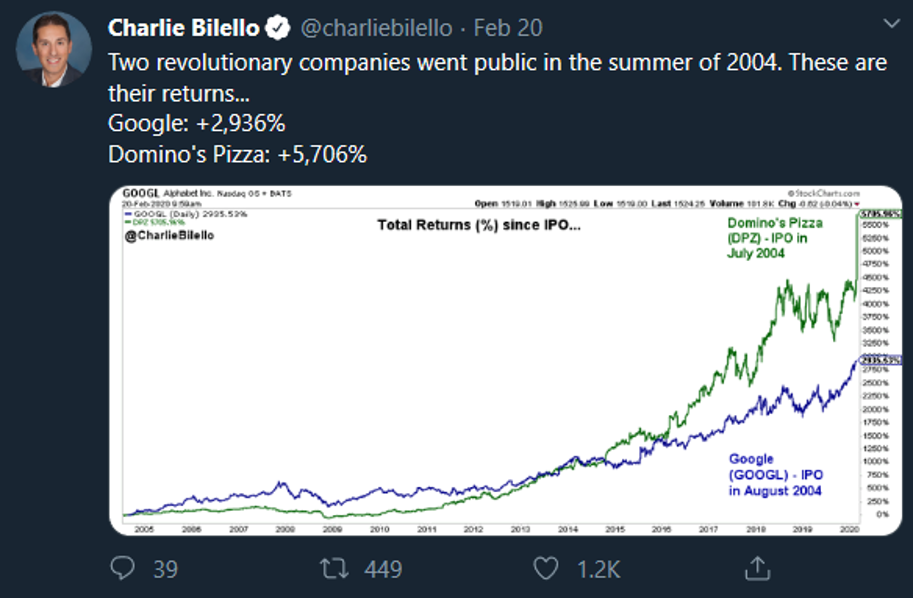

1. Yes, x1,000. For you mathletes, here is a refresher.

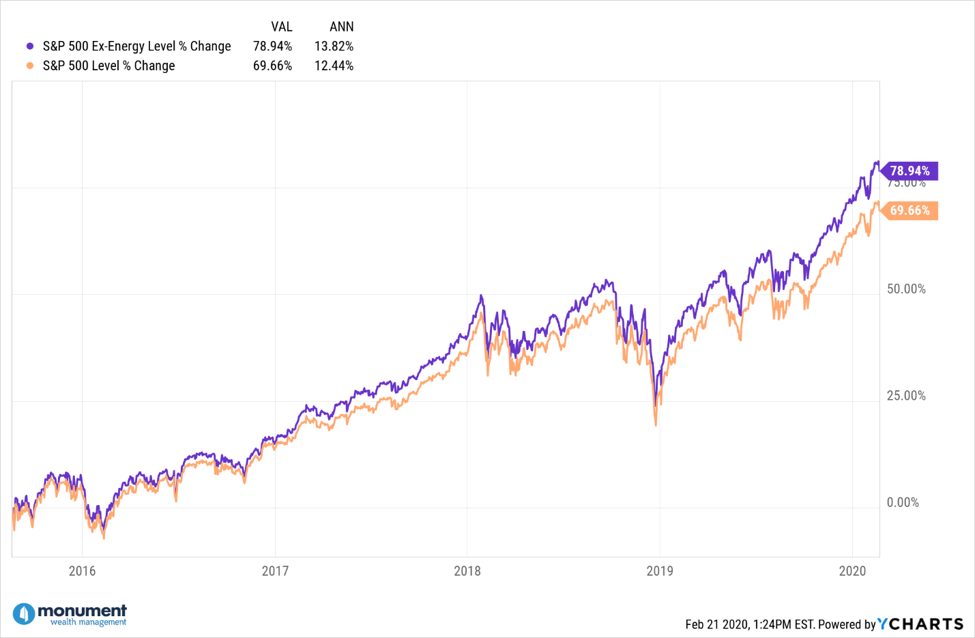

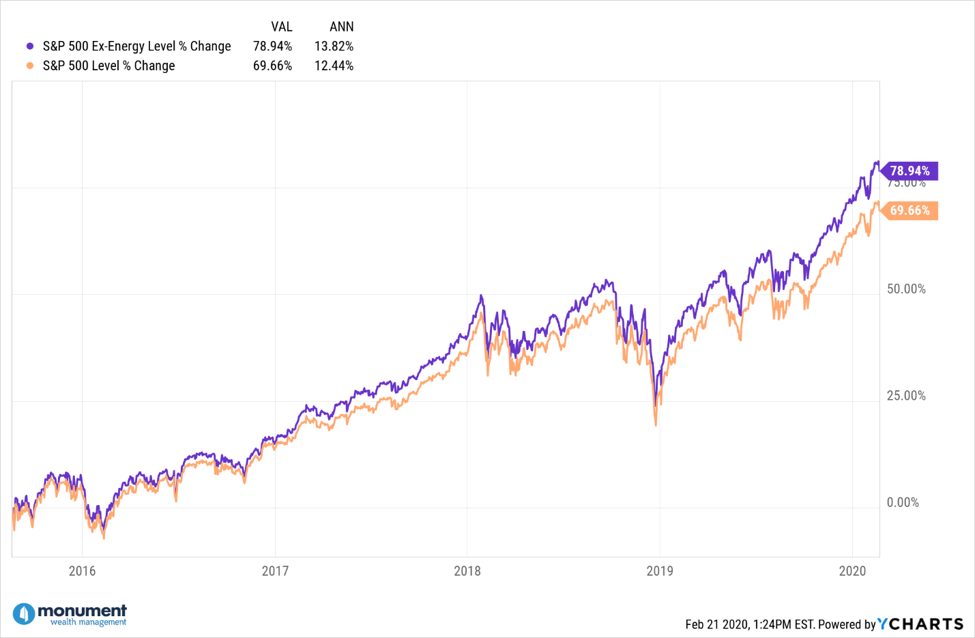

2. Index minus Energy?

This tweet got me thinking how it would have played out with the S&P. Over the past 5 years, excluding energy would have been good for 140 basis points per year. Now, energy is only 4.4% of the index, down from ~15% in 2014, so this bias will likely have less of an impact going forward. Note: these are price returns.

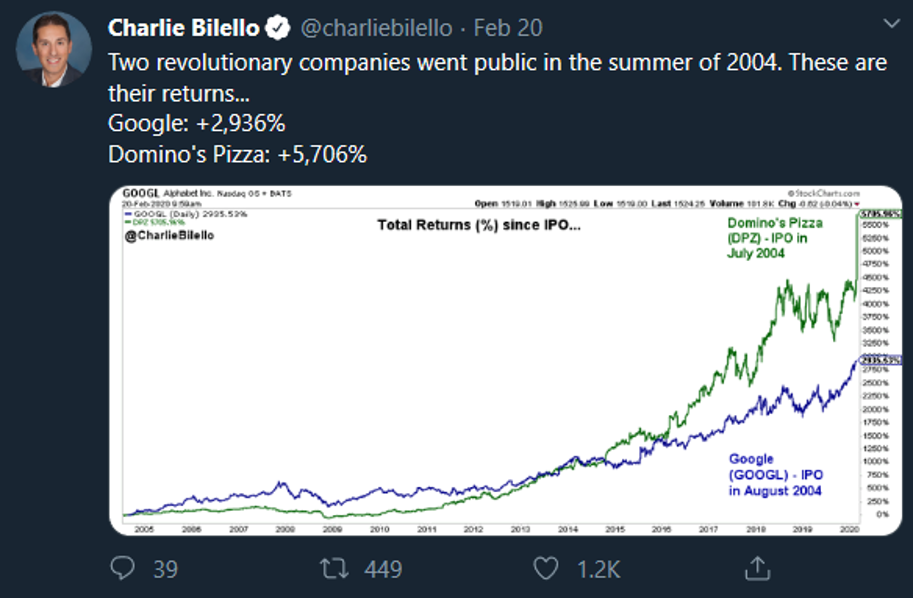

3. This is quite shocking.

What’s Next?

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice.

A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.