Every morning, I get a tear sheet of stocks making big pre-market moves, alongside a one sentence explanation of the movement. For obvious reasons, my eyes go immediately to our current model holdings. If we have a ticker that’s gapping up or down, I want to know so I can get a sense of how it might affect our trend and relative strength readings in the coming days or weeks, and how to best communicate that information to our clients in future model updates.

But every now and then, I’ll see a former model constituent make the morning rundown, which will also pique my interest. Not so dissimilar from seeing an ex-girlfriend in the news or on social media. Sometimes it’s an engagement notification. Other times it’s a mugshot.

On Monday morning, this blurb caught my eye:

ADM: Lowered guidance after announcing CFO change due to SEC investigation over practices.

That’s not good. Mugshot territory, if you will.

Stock indicated down 15% pre-market. Down 20% by mid-morning. Ends the day down nearly 25%. Biggest one day loss in company history.

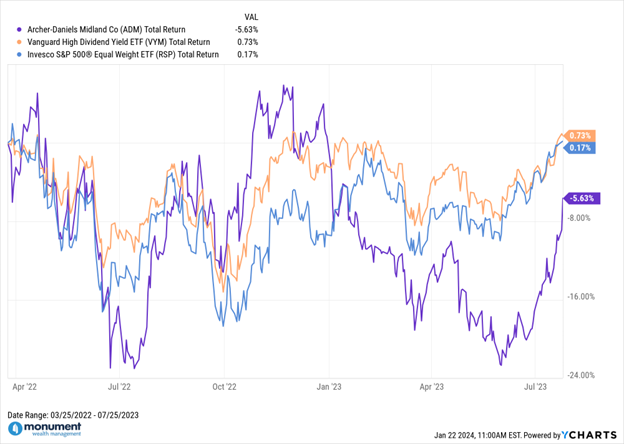

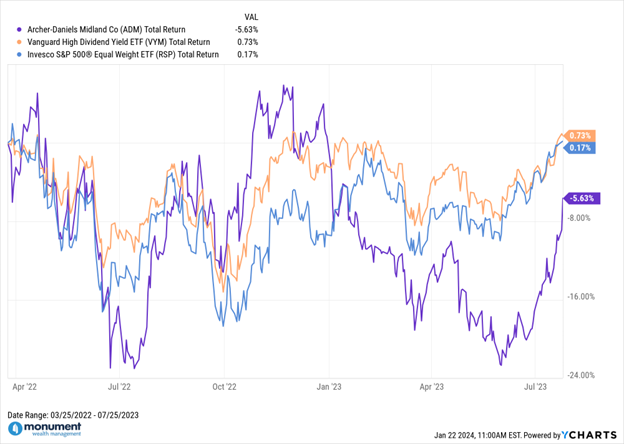

Now, before you panic: Monument does not currently have this stock in one of our investment models, but we did have it in our Dividend Model from March 2022 to July 2023. The following graphic represents approximate model performance during that holding period. Compliance note: this chart is indicative of the total return of $ADM for the relevant holding period using closing prices (not model entry and exit prices) and is not necessarily indicative of any client’s actual performance.

There’s nothing remarkable about this chart or this performance. The stock had displayed some impressive trend and relative strength in the time leading up to our entry, and truth be told was probably a good diversifier during the geopolitical turmoil of 2022. If you want a more qualitative narrative: the company benefited (albeit briefly) from rising agricultural commodity prices post-Russia’s invasion of Ukraine in 2022. However, it was to be short-lived, and those same trend and relative strength indicators deteriorated significantly towards the end of our holding period. So, we did what we always do: we cut our losses and moved on. This was a short-lived uptrend.

In fact, below is a monthly Relative Rotation Graph, or RRG, showing the long-term trend deterioration from March 2022 to August 2023. This graphic illustrates the growth of some material, longer-term underperformance against the broader market. As a reminder: you don’t want to be headed “southwest” in an RRG reading.

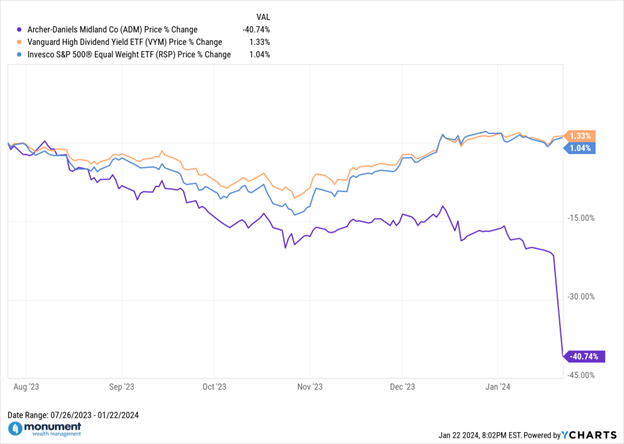

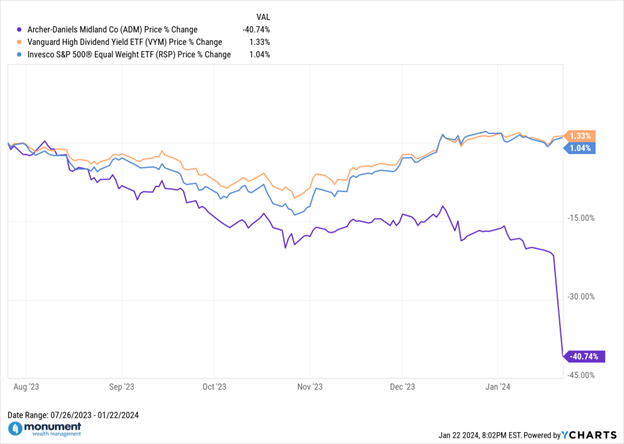

However, after Monday’s ADM news, I decided to look at that stock’s performance since we decided to exit. Remember, there are two sides to every model trade. And we often only consider the performance of the new (current) model entrant while rarely reflecting on whether it was a good idea to dump the former stock in the first place. Back to the ex-boyfriend/girlfriend analogy: was this a stock we should have given a second chance (“I can fix him!”), or was this a stock that “none of my friends really liked anyway?”

To state the obvious, we dodged a bullet with this one. And not because we were astute agricultural commodity modelers, or, given the context for this writing, forensic accounting experts. Trend got us in, but it also got us out. And with only minimal damage.

Two important points come to mind:

1 – Price leads narrative. I doubt many could have predicted an accounting scandal would have materialized here. Was the market discounting corporate fraud at $ADM? Maybe, but that’s beside the point. Without Monday’s downward gap, this stock was still trending in the wrong direction when better opportunities were available. And let’s not forget, even for stocks with “aristocratic” track records of dividend growth, we still aren’t going to hold a melting ice cube. Pure speculation on my part, but it wouldn’t surprise me if $ADM becomes the next dividend aristocrat to cut its payout, much like V.F. Corp in October 2023.

2 – This is anecdotal and less scientific, but very rarely will stocks “trap door” out of nowhere. Usually there are seismographic signs that are often detectable with trend. Again, very anecdotal in nature, but I can’t help but recall Silicon Valley Bank ($SIVB) in March of last year. In an otherwise flat/range-bound market, that stock was down nearly 50% in the 12 months leading up to its surprise March 8 offering, which sent the stock down another 25% after-hours en route to a very swift conservatorship and bankruptcy.

All of this is to say:

- Position sizing matters. Even with favorable trend readings, we didn’t go full-tilt in $ADM.

- These types of moves can happen to large companies. $ADM was a $30B+ market cap company, not a micro cap SPAC.

- Don’t fight trends. Going back to our ex-boyfriend/girlfriend analogy, you can’t “fix” them or hope they will reform.

- Always have an exit strategy. Unlike marriage, this isn’t “until death do us part.”

Okay, now that my serious points are out of the way, I can get to the more delicious and entertaining aspects of this story, which I posted Monday on LinkedIn. Believe it or not, this isn’t the first accounting scandal in the history of Archer-Daniels Midland. A fact thankfully not lost on others reporting on the story. As Bloomberg notes: “This isn’t the first scandal involving ADM. Back in the 1990s, it was implicated in a price-fixing conspiracy that later became the basis of the 2009 film The Informant!, starring Matt Damon. ADM pleaded guilty to the price-fixing charges in 1996. The company is also responding to different lawsuits over allegations of price manipulation involving its trading of cotton and ethanol.”

Where to begin?

- First, do yourself a favor and add “The Informant!” to your queue. Brilliantly written, and Matt Damon’s bizarre and childlike internal monologues alone are worth the price of admission. They’re basically “shower thoughts” on steroids. The late Roger Ebert would agree. He gave the film four stars out of four, calling it “fascinating in the way it reveals two levels of events, not always visible to each other or to the audience.”

- Second, Matt Damon. Tremendous actor, though arguably underrated as a comedic performer. And very savvy in his understanding and communication of the economics of Hollywood. Click on that link for a great clip from his “Hot Ones” interview.

- Third, Mark Whitacre (our story’s protagonist). Yep, a real person. Not only is he considered the highest-ranked executive of any Fortune 500 company to become a whistleblower in U.S. history, but he is also an Executive Director for another MWM Model constituent company: Coca-Cola Consolidated ($COKE). What a world. Oh, and since we used a few relationship metaphors earlier in this post, it’s worth noting that his wife, Ginger, stood by his side during his nine years in federal prison.

- Fourth and finally, please indulge me as I recap some of the film’s more memorable quotes. If you’re doing a table read, you might not think any of these are funny in isolation. But like most performance art, it all comes together in the execution.

Internal monologue: “What’s the German word for ‘corn?’ The word in German I really like is kugelschreiber. That’s ‘pen.’ All those syllables just for ‘pen.’”

More internal monologue: “‘Paranoid’ is what people who are trying to take advantage call you in an effort to get you to drop your guard. I read that the other day in an in-flight magazine.”

Even more internal monologue: “One of the Japanese guys told me a story. This lysine salesman is in a meeting with someone from ConAgra or some other company, I don’t know. And the client leans forward and says ‘I have the same tie as you, only the pattern is reversed.’ And then he drops dead, face down on the table. Alive and then dead. Brain aneurism. Maybe everyone has a sentence like that, a little time bomb. ‘I have the same tie as you, only the pattern’s reversed.’ Dead. The last thing they’ll ever say.”

The most memorable quote outside of Matt Damon’s character: “I’m not stupid. Mark committed a crime. He stole nine million dollars. That’s pretty indefensible. But these guys at ADM, they stole hundreds of millions of dollars from innocent people all around the world. Mark showed you that four white guys in suits getting together in the middle of the day, that’s not a business meeting — it’s a crime scene.”

And of course, the inspiration for this blog’s title (Whitacre, while speaking to FBI agents): “It’s not just lysine. It’s citric. It’s gluconate. There was a guy who left the company because he wouldn’t do it. He was forced out. The gluconate guy, he’s out of a job.”