Any relatively consistent reader of this blog will have a good idea of my thoughts on market timing. I’ve said over and over that it’s like flipping a coin to get out of the market and then flipping it again to get back in. The odds are low of being right, and if you don’t need the liquidity, why would you even bother?

Please take some time and re-read this blog titled, “Monument Blog is About Reverse Psychology, Don’t Even Think About Reading it.”

I think it’s so important that you re-read it, that here’s another chance.

So, back to my point, this chitter-chatter and speculation on interest rates increasing is about as interesting to me as the movie Magic Mike XXL. Yet there are many out there who claim some insight into the direction of stocks. I’ve referred to them as “charlatans” (and fools) a few times over the years (November 2015, June 2013).

It’s just David B. Armstrong, CFA in the raw.

I have my beliefs and they are rooted in the experiences I’ve had since I started in this business in 1999. Here’s the deal – no one has a crystal ball and no one can accurately and consistently call turning points in shares. End of story, finito, period. Thanks to Senorita Schnurr, 7th grade Spanish… If there is any doubt about my feeling on this, be sure to see my “From the Department of Zero Value Added” blog post.

But that does not make the trends, favorable or unfavorable, any less interesting. You know, these are the “tailwinds” or “headwinds” you hear about in the press and in the markets.

Which brings me to this reminder – the biggest factor in longer-term stock market performance are profits and expectations of future profits. Companies are bought and sold on their ability to produce income and dividends. Without income, prospects for a firm typically dim. Don’t even get me going on how people think a car company that sells something like 40,000 cars a year can be seen as more valuable than a car company that sells, oh I don’t know…10 MILLION CARS A YEAR but whatever…

Anyway, among a number of other commoditized tasks they do for a living these days, equity analysts review earnings for the broad-based S&P 500 Index as a whole.

Let’s take a look!

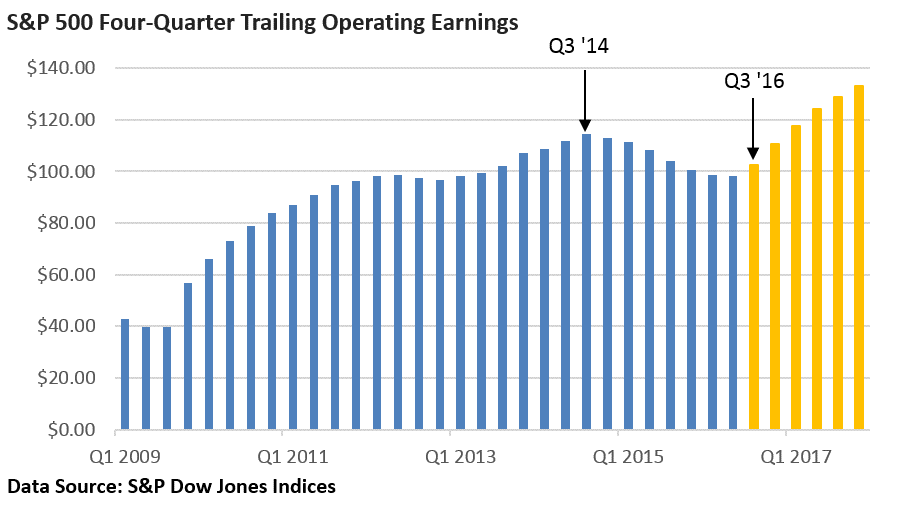

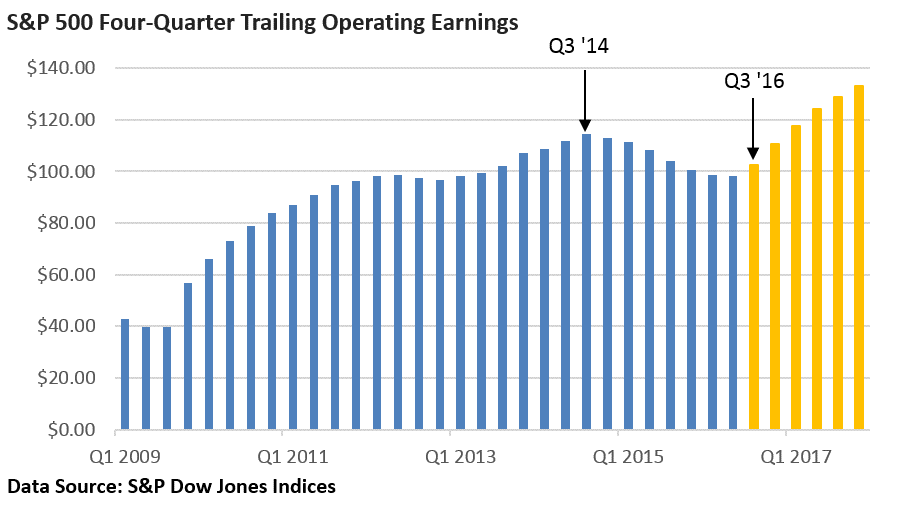

The chart below shows that operating earnings (profits) for the S&P 500 Index peaked in the third quarter (Q3) of 2014 at $114.51 per share. See the leftmost arrow, which represents adding up the quarterly earnings for Q4 2013 through Q3 2014. The other arrow at Q3 2016 represents the forecast for Q3 2016 plus actual earnings for each of the 3 prior quarters (data is through 8/31/16). Blue bars are actual, and orange are forecasts.

So what you hear a lot of is that the slide in earnings (all the blue bars to the right of Q3 2014) highlights a worry about a recession because it indicates economic weakness. In addition to the recession worry, falling profits hamper a firm’s ability to expand and invest.

Just think about it, if you take a pay cut in your job, you probably are not remodeling the kitchen in your home.

However, queue the Sir Mix-A-Lot track, because here comes a big “BUT”….

BUT, the overall earnings (profit) decline can be principally pinpointed on both the collapse in oil prices, which have been crushing to the energy industry, AND the rise in the U.S. Dollar, which reduces the value of goods and services sold overseas.

Now look at the orange bars…analysts are forecasting a slight increase in 12-month profits beginning in the current quarter, with further gains in 2017.

Okay, okay…there are risks to the outlook. I get that and any projections beyond one quarter get fairly, well, muuuuurky. What will happen to oil prices, the dollar, and the economy in general (the biggest influence on profits) can’t be forecast with certainty – albeit the charlatans and fools will try.

BUT, let’s just say that the analysts are correct for a second…stronger earnings would create a longer-term tailwind for stocks and a bull market that currently ranks as the second longest since WWII.

We had a horrible day in the market last Friday and that prompted me to dig up and re-read one of the most popular blogs I have posted in years from February 11th, 2016…at the bottom of the sell-off. You remember that big sell-off, right? I know it was a LONG TIME AGO. I pointed this out:

“Here is what’s causing all this panic:

1. Earnings estimates continue to decline.

2. People are worried about the possibility of a recession later in the year.

3. I still believe that the falling oil prices reflect an oversupply, but the panic sales of one asset (oil) can spill over into another (stocks).

4. There is a lot of warranted worry about weak global growth – this is pressuring shares around the world.

5. There are a lot of junk bond jitters in the world, which is causing credit conditions. This is not a “red zone” issue but lending standards have tightened for businesses.

6. China and the yuan – China is going to have to do something…so this remains a negative overhang.

7. The talk of negative interest rates in Europe and Japan are adding to the uncertainty.

8. The euro has been rising on concerns over financial stocks overseas, so this is another headwind.

I tried to make an even 10…I just couldn’t.

My thought is that while all of these things exist, the data is simply not showing that we will have a recession in the U.S. and I think that the economy will slog through 2016. The consumer continues to spend and while low gas prices hurt manufacturing, it lends support to spending.”

The reality is that not only has the market (S&P 500) massively recovered since the middle of February, but it’s up over 6% year-to-date (YTD) as of today, and that’s post BREXIT and post last Friday.

However, a lot of those 8 issues STILL EXIST!

I guess the point is that if we nosedived in January and February, recovered, sold off in June and now we are up 6% on the S&P 500 after a 2.4% LOSS on Friday (a 400 point dive on the Dow) while a lot of those issues still exist…imagine if we get an improved outlook on earnings!

Last chance.

P.S. Thanks to our client “N” who complimented us on addressing the last part of our previous blog:

“I’m still a little speechless about the usefulness of this type of information. I guess there are people out there who manage money for people based on this type of narrowness…but we don’t. And we won’t.

I have a lot of fun writing my blog and I take pleasure and pride in its lightheartedness. I’ve never been one to take myself too seriously but that should NEVER be mistaken for not taking our business and our clients’ money seriously.

We are deadly serious about it. Everyday.

Acting on “analysis” like the above is like trying to pick a turd up by its clean end – you still end up with crap on your hand. We don’t play guessing games with other people’s money. It’s an attempt to manipulate your behavioral biases. Don’t let charts and research like this endanger your journey to building wealth over time in accordance with your long term plan.”

Have a great week. I’m out on vacation all next week fly fishing with my Dad in Idaho and I’m not sure I’ll be writing unless it’s really poor weather. See you in two weeks. If you need anything from Monument, please buzz into the office.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.