I think this is a pull back and not a recession. But I could be wrong – and here’s why…

I DON’T KNOW.

And here’s more bad news…

YOU DON’T EITHER.

And to make matters even worse…

NEITHER DOES ANYONE ELSE!

And for all those people out there about to unleash their “I told you so…” and their “I saw this whole thing coming,” you need to do a few things:

- Ask yourself why you were able to see something when EVERYONE else was so blinded. (The S&P 500 was up around 7% for the fourth quarter.)

- Better yet, go read Misbehaving: The Making of Behavioral Economics by Richard H. Thaler.

One of the problems with writing a blog and “being out there front and center” with my opinion is that one day, I will be wrong. It’s going to happen, and when it does, I will need to be right here owning up to it, eating crow and defending myself from the people saying, “I told you so” and “I knew you were wrong.” At least I will have my digital track record to educate people on “Recency Bias” and remind them of all the pullbacks where I stated my opinion based on the facts at the time and ended up being right.

BUT WHEN I’M EVENTUALLY WRONG, IT WILL NOT BE BECAUSE MY OPINIONS WERE GROUNDED IN STUPIDITY…IT WILL BE BECAUSE THE FACTS CHANGED.

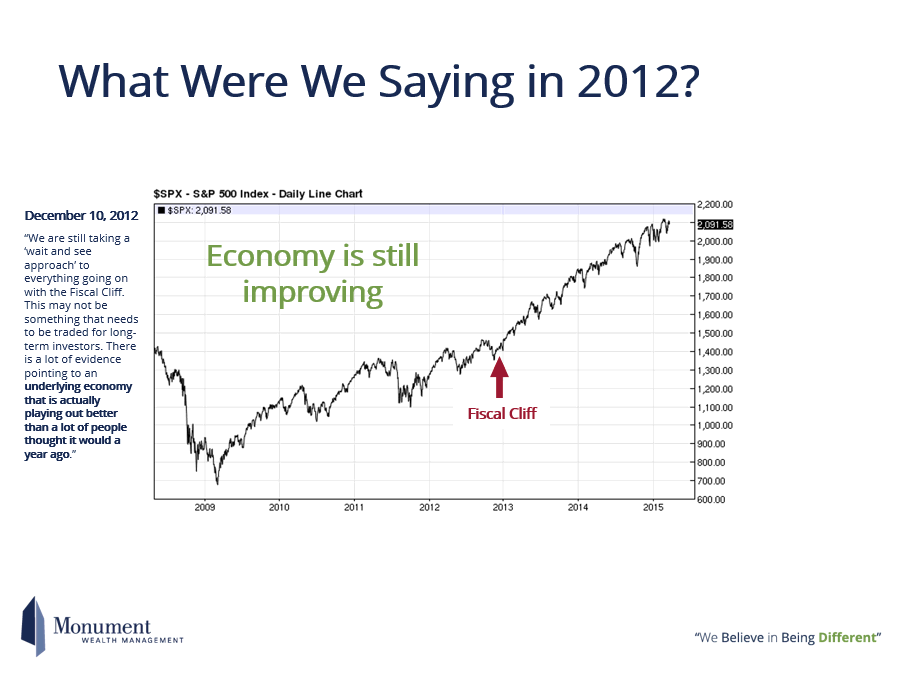

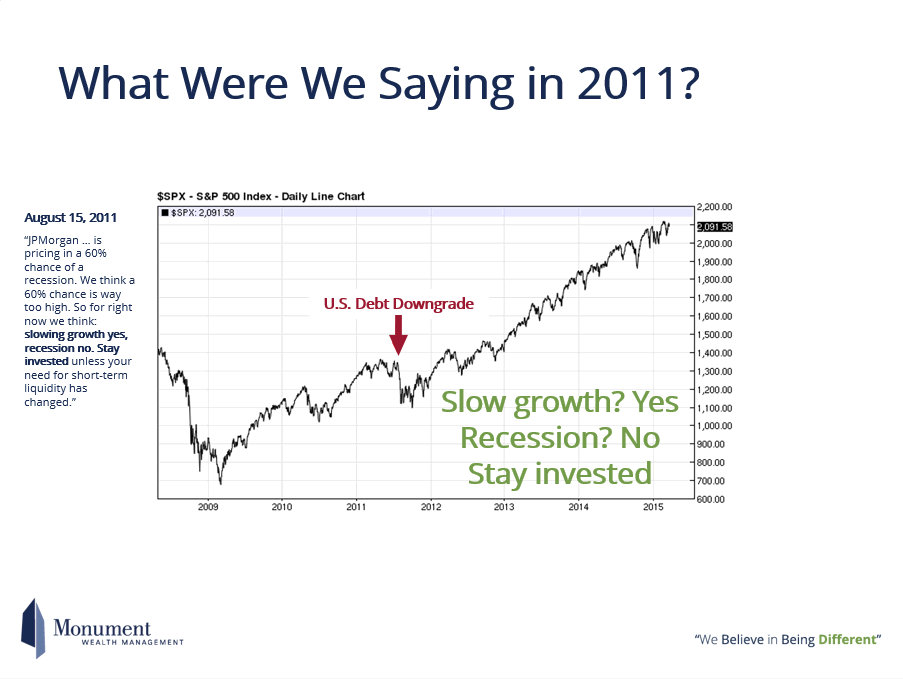

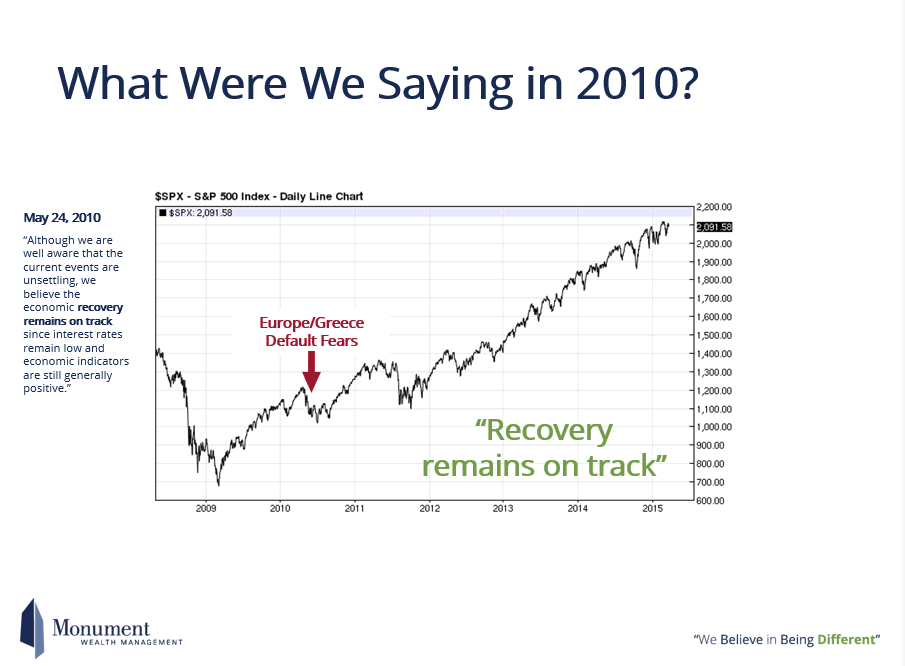

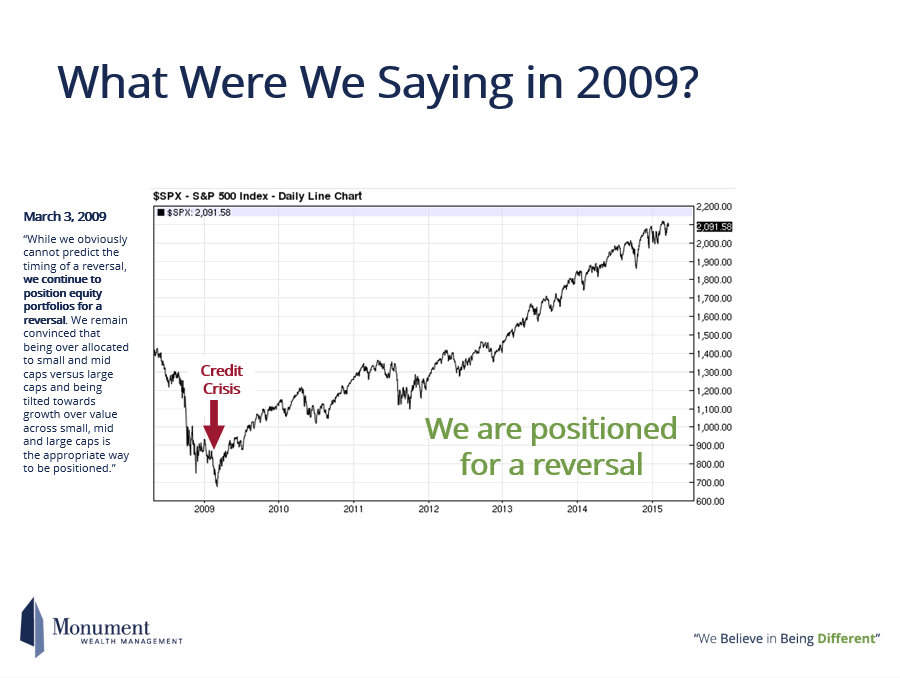

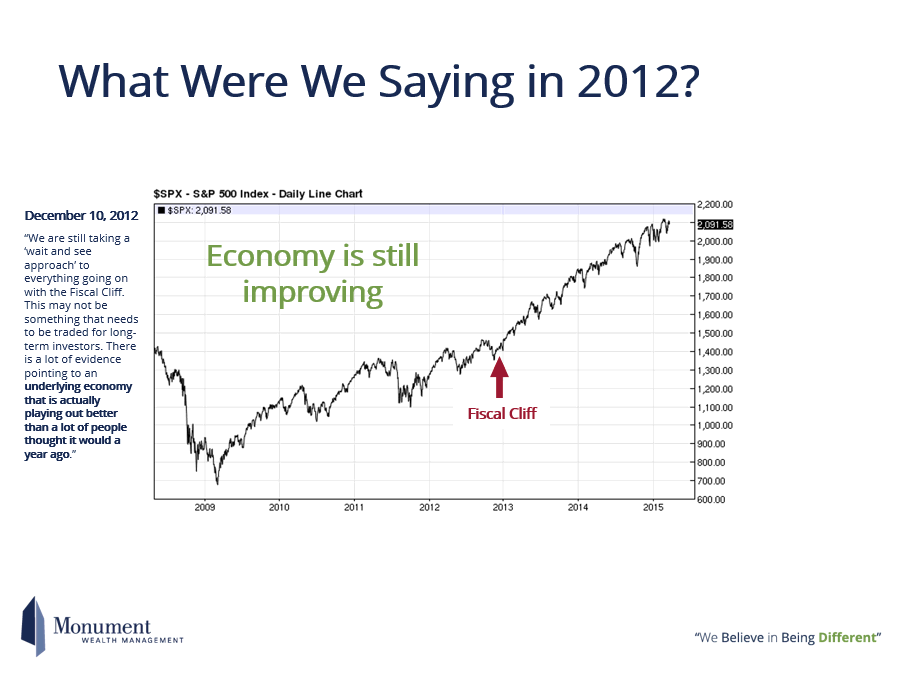

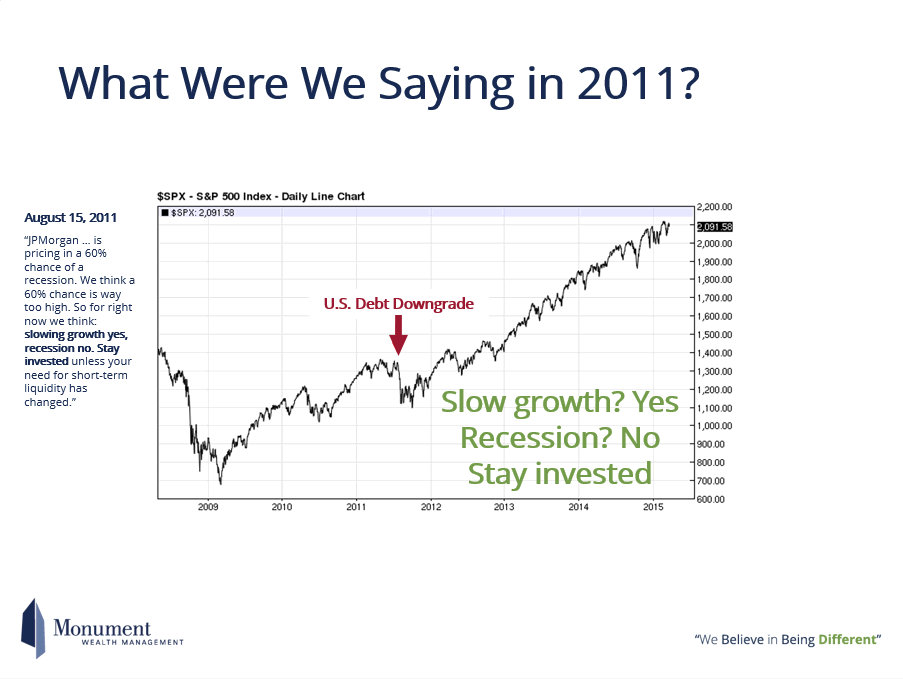

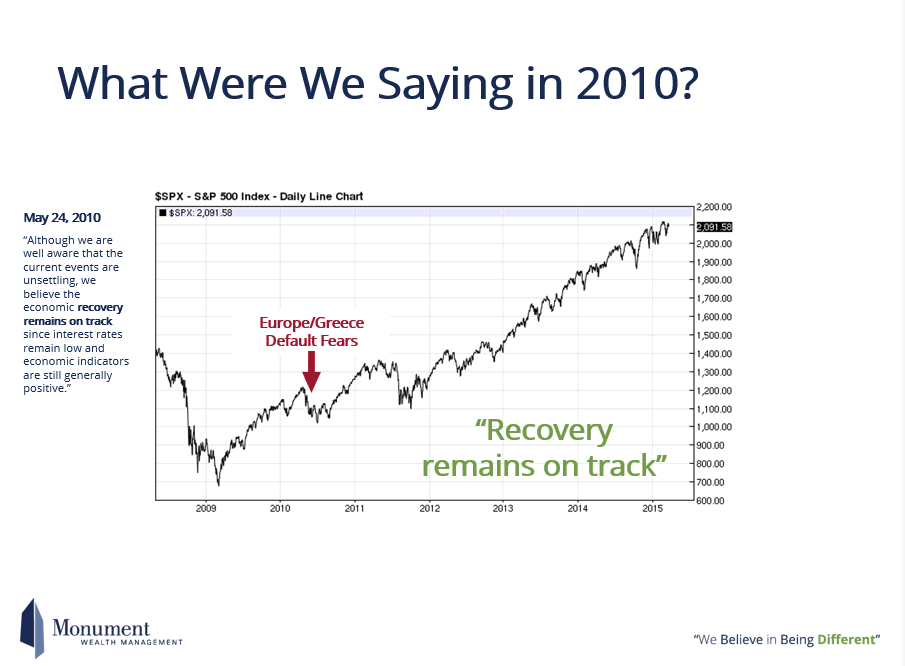

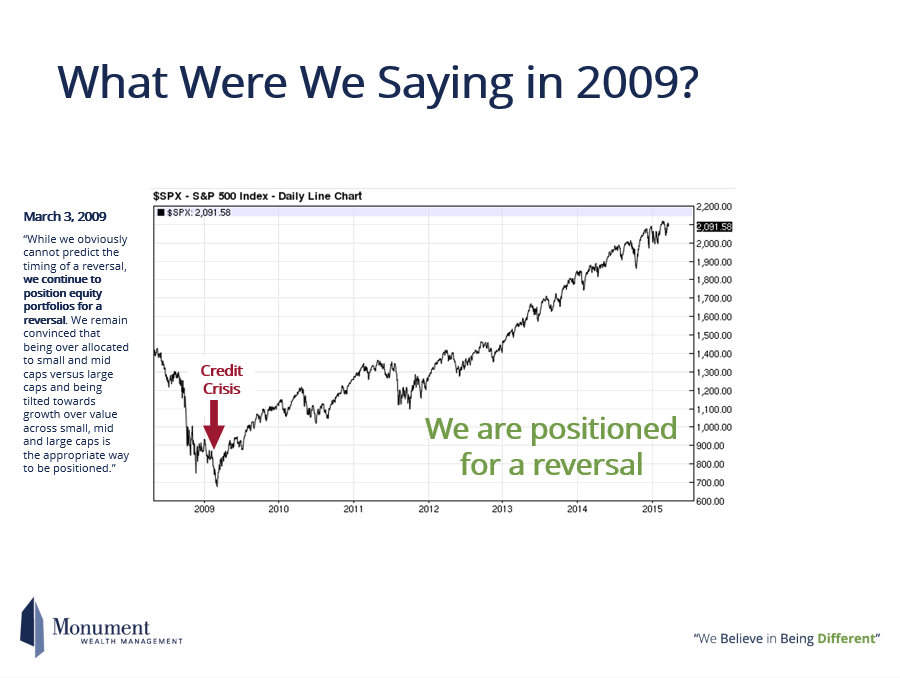

There are a ton of times since I started writing a weekly blog when the markets experienced volatility and pullbacks and I’ve relied on the facts at the time to form my opinions. Here are some below:

Now, what I do know is that while there is always some bad news out there, the facts suggest that we are not heading for a recession and we are not heading towards another 2008. 2008 will be a generational scar similar to the one borne by the generation that lived through the Great Depression, but the fear of that cannot drive emotional decisions outside of the context of facts.

So Here Are Some Thoughts

The U.S. economy has not stalled. The economy is still expanding and that lowers the odds of a recession this year.

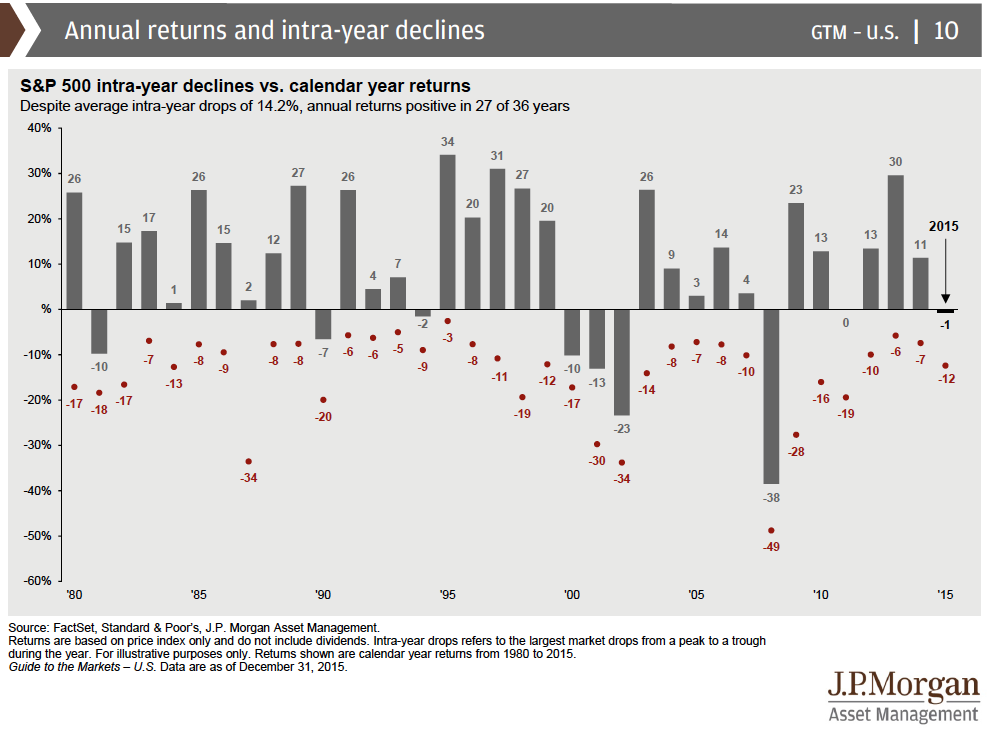

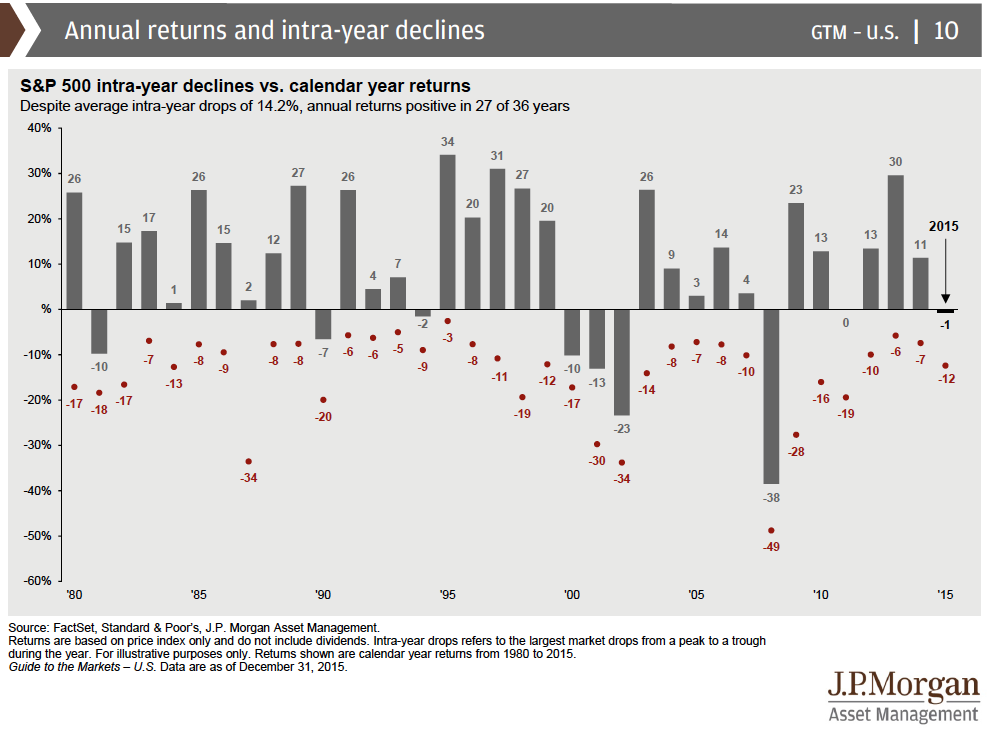

This drop from the 2015 index high isn’t that alarming. It’s not an un-standard correction, but the speed makes everyone think it is. See this JP Morgan chart below. The red dots show how much the S&P 500 dropped each year in a pullback. (The market would have to go up higher and higher EACH day in the year in order for there to be no red dot.)

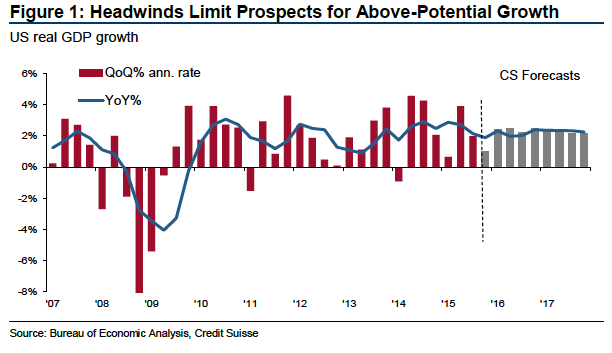

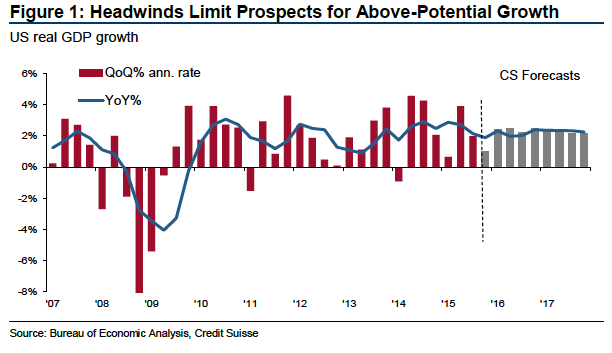

While new information becomes available each day, the information we have right now is not pointing to a recession (which by the way is defined by two back-to-back negative quarters of GDP). Here is a chart that shows the Credit Suisse Econ Team’s history and forecast of GDP. I certainly see a downward trend from the second quarter of 2015 (Q2 2015) to the Q4 2015 forecast…but I still see positive. Note there are some down red bars, so that happens too but it certainly was not a predictor. Also, PAY ATTENTION TO THE TITLE OF THE SLIDE, “Headwinds limit Prospects for Above-Potential Growth”…it does not say, “Headwinds Limit Prospects for ANY Growth.”

So you may be thinking, “Great, so Credit Suisse does not see a negative GDP, but what about the people who do, Mr. Smarty Pants?” Oh, you mean like the guy Andrew Roberts from RBS who basically yelled “Fire” in a crowded theater last week when he wrote that all of his clients should sell everything and go to cash? Yeah, well that guy has a great track record going back to 2008…

- 2008 – Crickets…

- 2010 – He had this gem of a prediction: “We cannot stress enough how strongly we believe that a cliff-edge may be around the corner, for the global banking system (particularly in Europe) and for the global economy. Think the unthinkable.” Thanks Hotrod…

- 2012 – Oh, then there was this predictive missive: “People talk about recovery, but to me we are in a much worse shape than the Great Depression.”

I’m not above recognizing that there are some pieces of bad news, so let me list them out.

- Weakening profit expectations in Q4 2015 – we will be seeing a lot.

- Paring back of Q1, Q2, Q3 2016 earnings expectations – this is called “lowering guidance.”

- Lingering worries about junk bonds – especially in Oil and Energy sectors.

- U.S. manufacturing woes – the ISM Manufacturing Index is below 50.

- Falling oil prices / falling commodity prices – This sucks … IF YOU ARE AN ENERGY OR OIL COMPANY.

- A stronger dollar – hurts earnings of multinationals and has been an issue for a while.

- Fed talk of four rate hikes in 2016.

- Renewed / lingering worries about China’s economy – falling China stocks.

- The depreciating Chinese yuan and a crisis of confidence in China’s ability to manage its economy.

- Geopolitical anxieties – Iran and Saudi Arabia are bickering, plus all the other usual stuff.

That looks like a long list, and even though this good news is a shorter list, each bullet is strong and in my opinion, offsets the bad news.

- Overall U.S. economy continues to expand (see above).

- Expectations profits will rise in Q1 and beyond. Even though guidance is being lowered, each consecutive quarter of profit is forecasted to be higher than the proceeding quarter.

- Interest rates remain low.

- Corporate stock buybacks remain strong.

China China China China China China China China China China China China China China China China China China China China China China China China China China China China China…I’ve previously written HERE, HERE, AND HERE why U.S. economic growth isn’t reliant on the world’s second largest economy. I’m not saying we are decoupled from them, I’m just saying we are not RELIANT on them…

But oh boy, when investors look in the figurative mirror and see those 2008 scars they will use any excuse to hit the sell button.

Here’s Where I Admit There is Some Uncertainty

Oil

- Oil is affecting what happens for Energy sector earnings, so low oil prices really suck…IF YOU ARE AN OIL COMPANY.

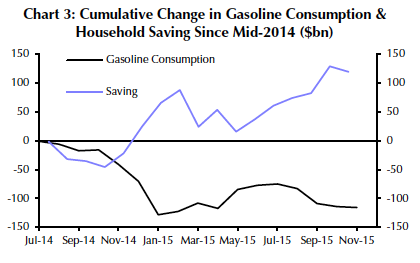

- The savings at the pump haven’t translated into a more robust showing for most non-energy dependent industries.

- I’ve been saying for a long time that lower oil prices will manifest into consumer spending. I’ve been wrong about the timing, since it has not happened as fast as I thought it would, but I stick to my guns that I will eventually be right.

- People are freaking out because they think that the price of oil and other commodities are dropping due to a DEMAND problem. I think that is false, and this is a SUPPLY problem.

- The worry is coming from investors (and the people on TV) who think this is signaling a slowdown in global demand and that any economic benefit everyone should be feeling from this is being offset by the cutting of investments and jobs by the oil and commodity sector.

- Basically they believe this: Oil prices down = Demand is low = Economic weakness

- But if this were true, we’d be seeing it in GDP, NOT oil prices.

- I think it’s more accurate to look at what the price of oil is telling about TOMORROW, but everyone wants to focus on the bad news and not the good news.

Look at these pictures I took at the pump yesterday. I drive an Eco Diesel…$1.99. When I bought the vehicle it was hovering at $3.80ish. So let’s round and assume that I’m now paying HALF.

Here’s the bill from my fill-up today.

So, because I had some gas in my tank, let’s assume that my fill-up costs for a whole tank is $40 now versus $80 in 2014.

- That’s $40 less.

- There are 210 million licensed drivers in the U.S.

- 210 million drivers * 40 bucks = 8.4 billion dollars … PER WEEK.

Because most people (me included) feel that this drop in oil prices should be boosting growth and earnings and that HAS NOT HAPPENED YET, people are now coupling the market prices for stocks to the price of oil.

- That’s why you are seeing stocks and oil moving together.

- I think this is temporary, but I’ve been wrong on the timing so far.

Here’s what’s happening to the gas savings (thanks to Steve Murphy at Capital Economics).

Earnings

- Q4 earnings season is off to a good start, BUT, companies are exceeding very low hurdles based on previously reduced profit forecasts. The one thing that I will say is something I’m not really happy about is that expectations for S&P 500 profit growth have fallen from +1.0% on October 1st to -3.7% on January 1st to -4.7% as of January 15th.

- So that’s a stinker, but looking out, forecasts for Q1 2016 to Q3 2016 are still positive albeit pared back.

- My opinion, and this is a little bit of an admission that I didn’t see something correctly, is that if we are going to see earnings growth fall by -4.7% and a lot of that has to do with oil, which has been falling since 2014 and is now in the $20’s, shouldn’t this be close to the end?

- If a 70% drop in oil led us to -4.7% drop in earnings growth, what’s earnings growth going to look like when oil stops falling and just stays low? I think that’s when I will finally start to look right.

- I think the number one thing that will get me to change my tune and get more bearish is if we see a massive deterioration in corporate profits forecasts and reports.

Uncertainty

All of this uncertainty creates a lot of emotion in the short-term, but remember, I think that the longer-term fundamentals are still positive. The silver lining there is that they may have prevented a deeper collapse in the markets.

To recap, here’s what I think:

- The headwinds are pointing to slower growth this year than most people were expecting. I think most analysts are coming in with 2016 GDP growth predictions in the 2.2 – 2.5% annual range. This range is a far cry from negative and recessionary territory.

- I think growth will probably be led by the consumer as well as services versus manufacturing sectors.

- I expect ordinary growth in housing, exporting companies to have a rough year based on the strength of the U.S. Dollar and sluggish yet overall positive corporate profit growth.

What to Do

This is simple. There are two things:

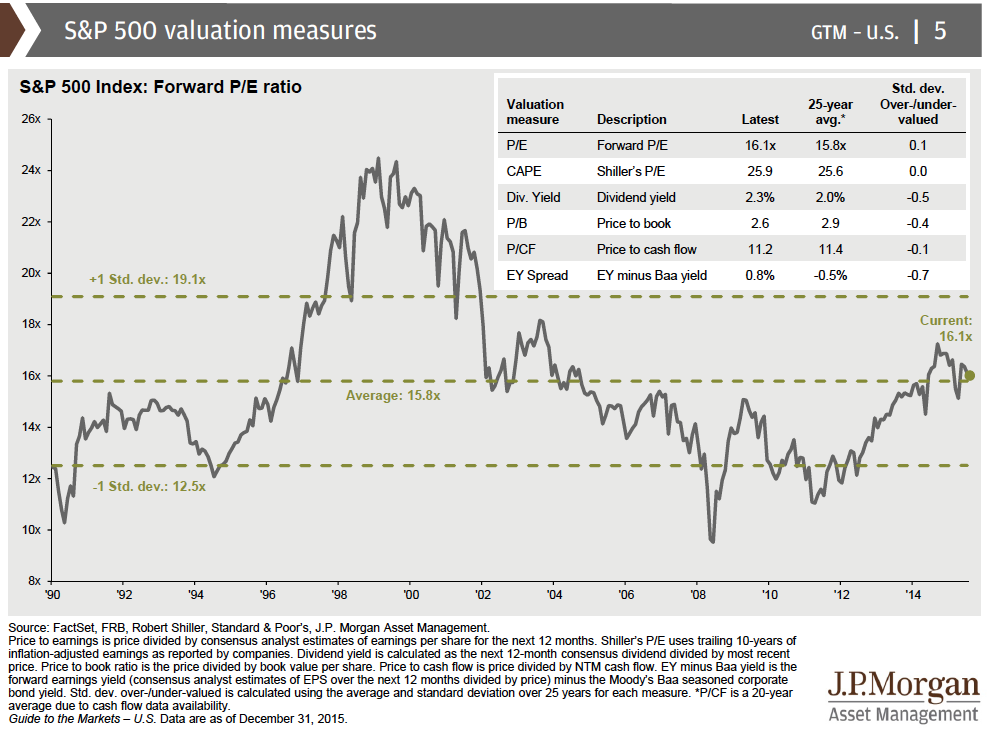

First, if you have cash AND you are a long-term investor with a plan to grow your money over time for something in the future like retirement, be a buyer right now. You may not invest at the exact March 9th, 2009 bottom, but in 5-10 years you will be very happy with your returns. Don’t wait for “things to get better,” because you have no idea when that will be and by the time you do feel better, it will be because the market when back up and “now you feel better.” See more dates in the second point below. Right now stocks are not expensive. See this JP Morgan Chart.

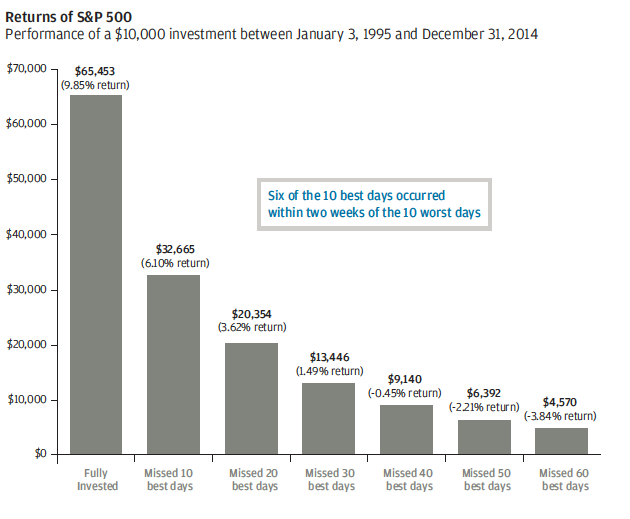

Second, do not panic and sell. Don’t panic and sell even if we go from 10% down to 20% down. My philosophy is that time is the only true silver bullet out there. No one knows what tomorrow will bring, but there is overwhelming data that shows investors what 10 years will bring. What is happening right now is anecdotal…there is a saying who I can’t remember who to attribute it to that goes like this, “the plural of anecdote is data.”

These last few weeks are anecdotal to an investor with a strategy and a plan. Here’s DATA from JP Morgan, saying “DON’T BE OUT OF THE MARKET!” The only money you should have out of the market is the money you think you may need in the next 18 or so months.

Important Disclosure Information for “What a Bear Market Means to You”

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.