I’ve been working in wealth management for over two decades now. It’s changed a lot, mostly for the better, but the one thing that has remained consistent is investor behavior.

One of the most often repeated statements I hear from investors is something along the lines of, “I want to have returns that outperform the S&P 500 without the same downside.”

In case you don’t know me well, I RAIL on the hedge fund industry. Why? Well, let’s start with a definition. Remember that a Hedge Fund is SUPPOSED to be a HEDGED Fund…meaning that it should be hedged against downturns and still earn money when times are tough.

But these days, their goal is more aligned with just maximizing returns rather than trying to reduce risk.

Disclaimer – I actively engage folks in the Hedge Fund debate as a sport and I piss more people off than I probably should on this topic (and a lot of others). I’m supposed to be growing my business by bringing on new clients, not driving them away…but if you know me, my opinion can run, how can I write this delicately, hot. Thankfully, Monument is successful enough for me to operate under the “I don’t need to resonate with everyone, I just need to resonate with SOMEONE” philosophy.

So, here you go.

I think Hedge Funds suck – they charge a 2% fee on the money they manage and then take 20% of any profits above some declared amount, such as 10%. So, the investor gets 80 cents on the dollar of each dollar earned after the first 10% of profits. They call this “Two and Twenty” and that’s what you pay them to maximize return while reducing risk.

The common argument I hear from people willingly paying this amount is, “They have an incentive to really hustle for that 20% and that’s why they should be able to maximize returns.” Oh yeah? If they are managing $1b, then they are banking $20m of fees on their 2% fee. A YEAR! Call me a dummy, but I’m going to be hustling to minimize the risk of getting fired, not maximizing returns.

But back to those two goals of maximizing returns and minimizing risk:

- Maximizing Returns – If this is your goal, you are exposed to a lot of risk. This is the one side of the, “I want to have returns that outperform the S&P 500…” statement. Attempting to outperform the S&P 500 requires you to be 100% invested in equities AND have overconcentration in a limited amount of securities.

- Reducing Risk – If this is your goal, you are not going to have the same return at the S&P 500 because you will probably not be 100% invested in equities and you are most likely trying to spread your risk out over a large number of securities versus being concentrated in a small number of securities.

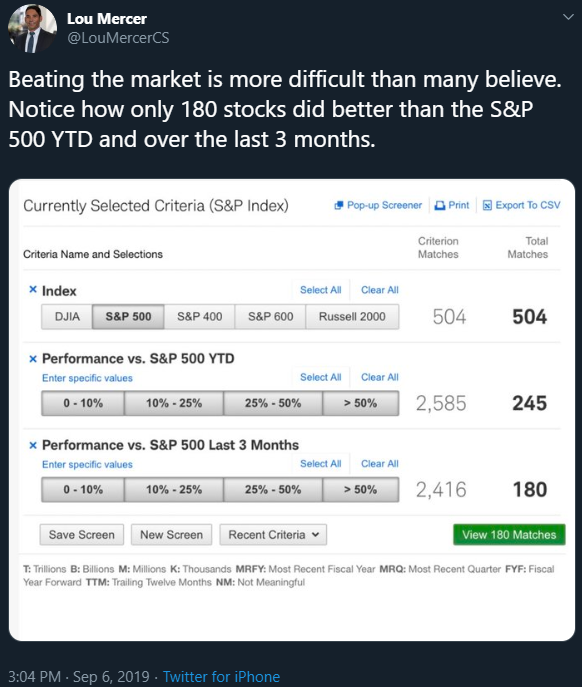

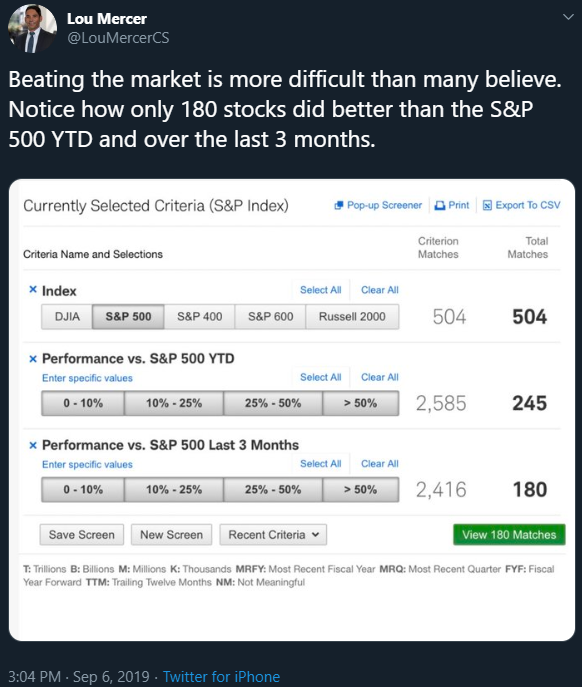

See why it’s hard to maximize returns while reducing risk? No? Okay – then see this from Twitter (@LouMercerCS)

Over the past 3 months, only 180 out of 504 stocks in the S&P 500 BEAT the S&P 500 index overall.

Okay, back to the, “I want to have returns that outperform the S&P 500 without the same downside” statement…

It sounds great, but no rational investor should expect that. If you have money invested in risk-based assets like stocks, you are going to lose money in a downturn.

Let me emphasize that again…IF YOU HAVE INVESTMENTS IN STOCKS AND THERE IS A DOWNTURN, YOU WILL LOSE MONEY.

What you need to do is choose a balance…because investing to simply maximize your return is stupid. And just to be fair, investing so that you don’t have any risk is stupid too.

Now let’s consider a Pension Fund.

Do you think the California Public Employees Retirement System (CalPERS), which manages over $300b for over 1.6m people is trying to maximize returns when they pay out around $7b per year? Conversely, do you think they can afford to zero out all risk and just sit on $300b in riskless cash?

Of course not.

In simple terms, they have a goal – be able to pay out a certain amount of cash every year while staying invested for growth over the long term (in fact, indefinitely) for the future retiree payouts. They estimate the cash they must pay out by modeling assumptions of how many people they will pay benefits to next year, and the year after, and the year after…you get the point. They also model out how much their $300b will grow on an annualized rate and invest accordingly.

That should resonate, because that sounds a LOT like how individual investors need to manage their cashflows and investment portfolios. And yes, in some cases with an indefinite time horizon if one goal is to make sure wealth is passed along to future generations.

It’s about BALANCE.

How do you choose a balance? It’s easy, and this is where the value of having an advisor comes in handy. You determine goals for your money, now and into the future, and then you set up your investment strategy to FUND those goals.

You are essentially creating future liabilities and then allocating and investing your current assets to fund those liabilities.

Just like CALPers, you combine all those goals (liabilities) and funding sources (assets) together and then model it out and create a strategy.

That’s what we at Monument call a Private Wealth Design.

Thoughts and Points:

- Writing big checks over the next year or so for college or a down payment on a house?

- Fund that with a chunk of cash.

- You are 50 and plan to retire at 70?

- You don’t need that money for 20 years, so fund that goal with the riskier assets like stocks so when there is a downturn, there is plenty of time to recover.

- You are 68 and going to retire at 70, but you expect to live until you are 95?

- You need funding sources for now and the future, so those liabilities are funded with a combination of cash, bonds and stocks.

You don’t need an expensive Hedge Fund to maximize return and minimize risk, you just need to match up your liabilities (the goals you have) with the assets you have (current portfolio, current earnings, future earnings) and model them out.

Just like CalPERS.

Then, once you have those matched and modeled, you reduce risk with cash for immediate liabilities, bonds for near-term liabilities and then stocks for your distant liabilities.

Don’t let Hedge Fund investors tell you that it’s more complicated.

I’ll end today with a great comment I heard while I was in Denver at the Orion Ascent training conference. Dean and I were waiting for dinner at the bar of a restaurant in downtown Denver. It was on the ground floor of a big building that must have housed a bunch of financial advisors from the big firms. These two folks had no idea who Dean and I were, one was obviously a financial advisor and the other was someone he was pitching.

Advisor: “How is your portfolio doing relative to the S&P 500?”

Other person: “I don’t know, all I know is that it’s doing well enough that I have a 92% probability of meeting all the goals in my financial plan.”

Can’t make that up…I mean I can, but I’m not. I wanted to fist bump the guy.

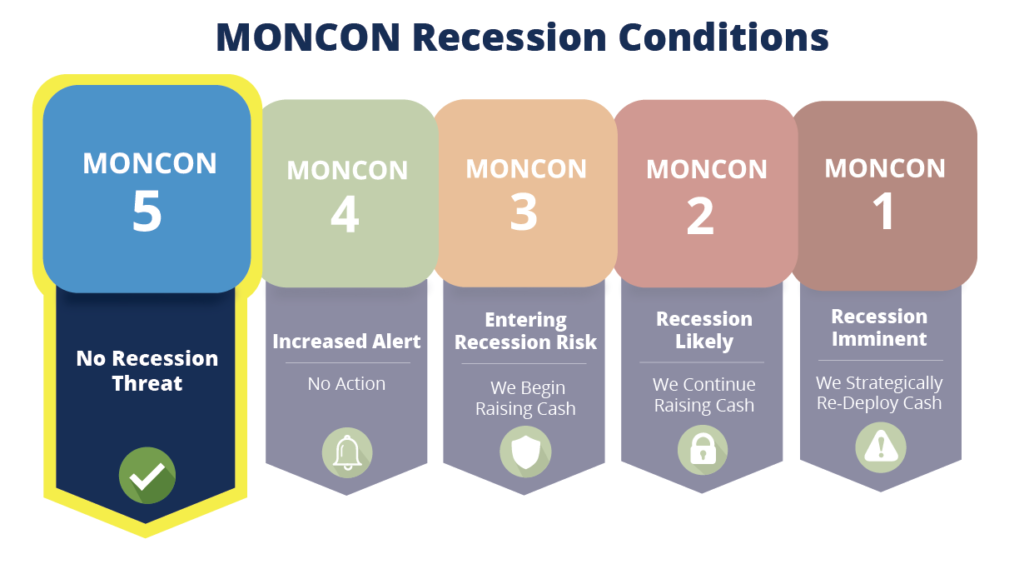

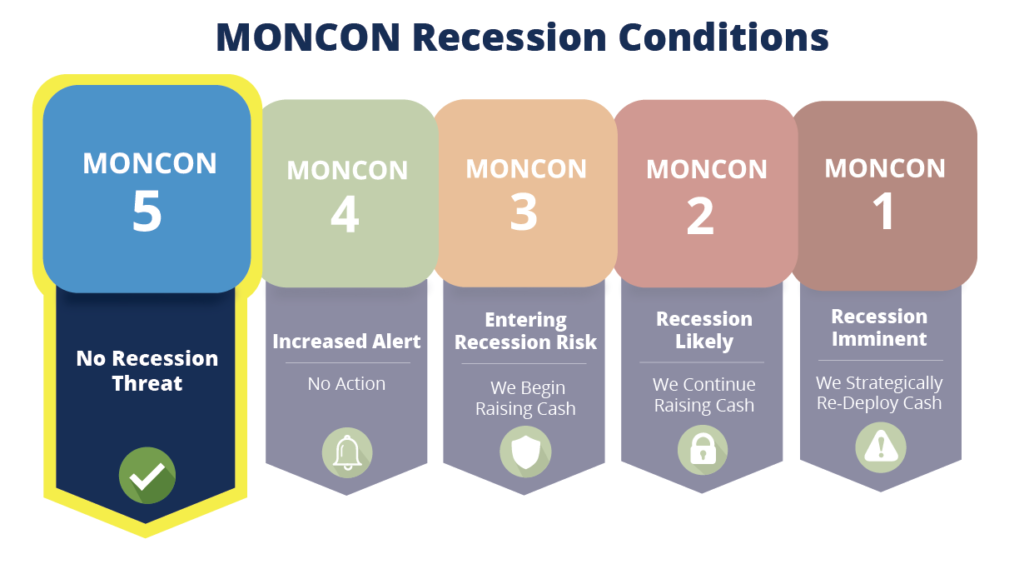

As for MONCON – Lately, we’ve seen some data that is not very good flow into the model. The model measures a lot of different things, so while the news may be bringing attention to some of them, the model remains at MONCON 5.

For those of you wondering if the model is broken or not reflective of reality, I counter with this…have you considered that it is right?

The S&P 500 was at 2,869.16 when the yield curve inverted (I’m using 8/27/19) and there was nothing but fear, human emotion and “Special Reports” on CNBC.

Today? The S&P 500 is at 2,978.77, an increase of 3.8%

For those of you who like the Dow, the reading was 25,777.90 on August 27th…today it closed at 26,840.68, an increase of 4.1%.

Again – We will have a recession; I just don’t know when. But I’m tracking the PROBABILITY of one in the next 6 months. That data is just not moving the needle (hat tip to my Latin connoisseurs) into a range that suggests the probability has materially increased.

If it moves to MONCON 4, I’ll let everyone know immediately. REMEMBER – MONCON 4 is not an actionable event, since it has a 50% chance of reverting back to 5.

Keep looking forward,

Dave

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice.

A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.