First, before I begin, please know everyone here at Monument knows this bear market and steep sell-off is deeply painful and personal to each client. Please reach out if you need to speak about any personal concerns you have. We are here for you.

That said, I just want to keep providing context on the situation.

Today I want to frame the difference between a bear market and a recession and point out that just because we hit a bear market doesn’t mean we will automatically see a recession. That’s because there are different types of bear markets.

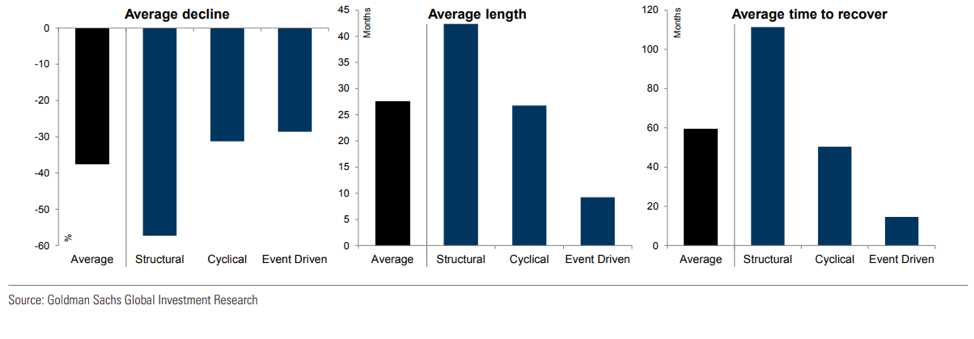

Some bear markets are triggered by one-time shocks or events – like this current one. Others are cyclical, which are a function of the economic cycle, interest rate increases and/or an aggressive Fed. Finally, there are those bear markets which are triggered by structural imbalances…such as extreme valuations (2001-2002) or some other imbalance (think 2008).

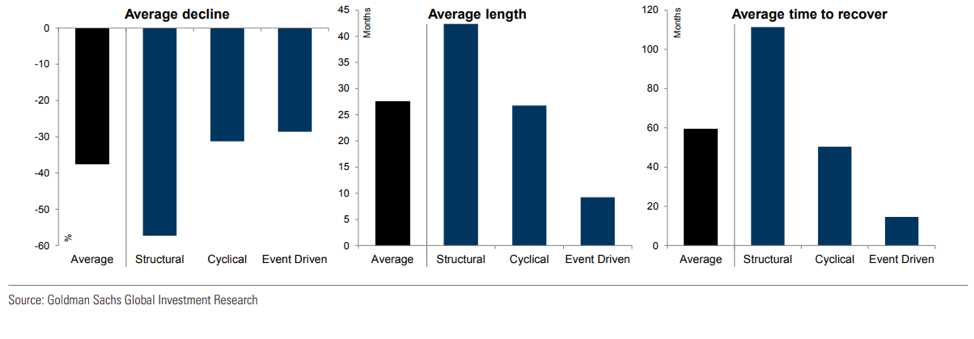

Here’s a chart from a Goldman Sachs report that shows some stats on the three different types of bear markets.

As you can see, event-driven bear markets see the least amount of decline off the all-time highs, have the shortest duration, and have the quickest recovery time.

Here’s a great chart that LPL Financial recently put out. Note the far-right column that shows whether or not a bear market led to a recession.

Remember, the determination of a recession is based on data that take some time to gather, while the market is a collection of rapid minute-by-minute reactions to news and speculation. So, it’s natural that the market can have some steep sell-offs during periods of time that don’t coincide with recessions.

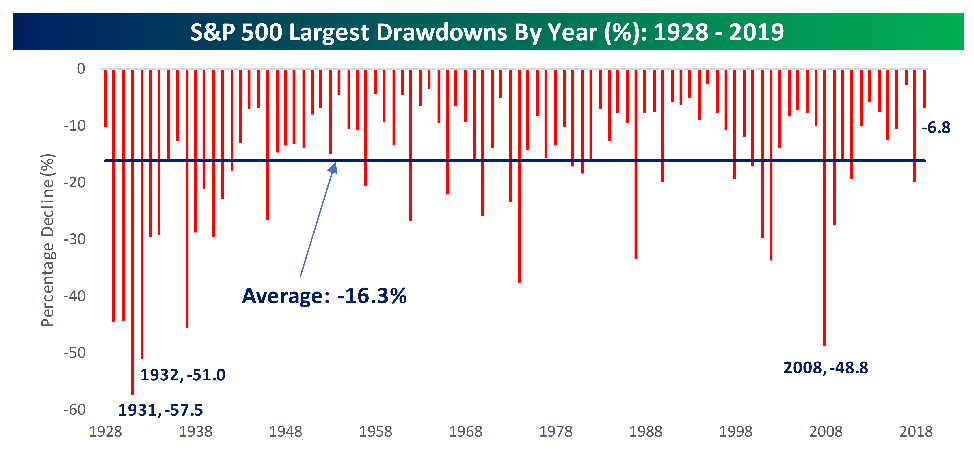

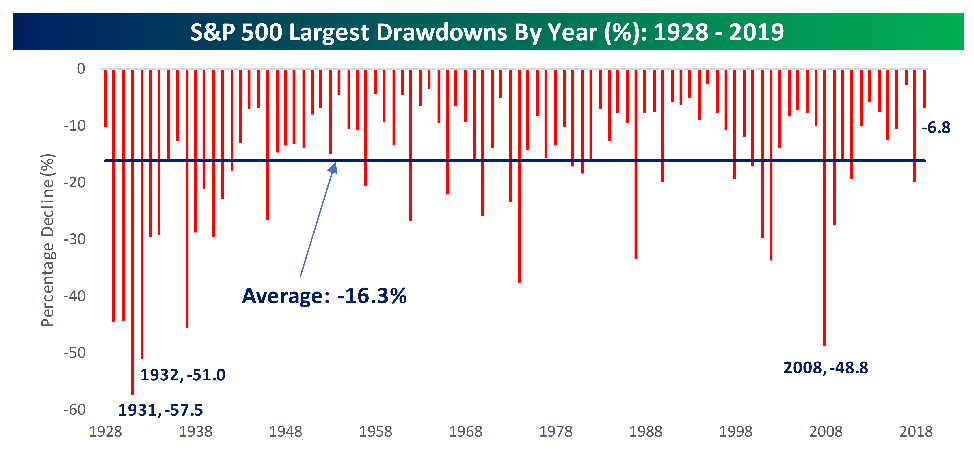

Like late 2011, late 2015, early 2016, and late 2018 and possibly even now. Below is a Bespoke chart that shows the drawdowns from 1928 to 2019. As of today, the S&P 500 is down around 21% (depending on the EXACT time of the day!)

During bear markets where recessions do not materialize, the market recovers quickly relative to a recovery out of an actual recession. We can look at the LPL chart above and see that the bear markets during recessions are much worse than the bear markets outside of a recession.

In fact, here’s what Ryan Detrick, Senior Market Strategist at LPL wrote in a report:

As shown in the LPL Chart of the Day, stocks have dropped 37% on average in bear markets during a recession, while they have lost 24% if a recession is avoided.

This can be seen in the chart.

And he added:

Additionally, five of the past six non-recessionary bear markets saw stocks bottom between 19% and 22% lower, with December 2018 being the most recent case. The only time stocks saw a larger decline without a recession was in 1987, but don’t forget that stocks were historically stretched heading into that bear market, with the S&P 500 up more than 40% year to date in August 1987.

(Emphasis mine)

So, if we know that event-driven bear markets fall less, have the shortest duration and recover the fastest, it lends credence to the constant drum-beat of advice that it’s best to leave portfolios alone, have cash act as your hedge, and be patient.

Now What?

The last 11 years of a bull market provided us with some amazing returns, but now is a good time to assess the level of comfort you have in what you have been doing with your portfolio and your plan and see if there is anything to be learned.

This is important – it is okay if you realize that you had more risk than you actually wanted. It’s okay to say, “jeez, maybe I should not have been so concentrated or had so much in equities. Maybe I didn’t consider having the cash bucket seriously enough because I was swept up in 11 years of gains.”

In other words, if your portfolio fell victim to this correction and caused a level of anxiety that you are uncomfortable with, or you didn’t have a plan, or didn’t have the forecasted cash bucket that acts as a hedge this time around, ALL IS NOT LOST.

You can fix all of that – you just have do some work and be resolved to be patient. You can still build a plan, fix your portfolio, de-risk, build a cash bucket. The market will recover and continue on with what it’s always done.

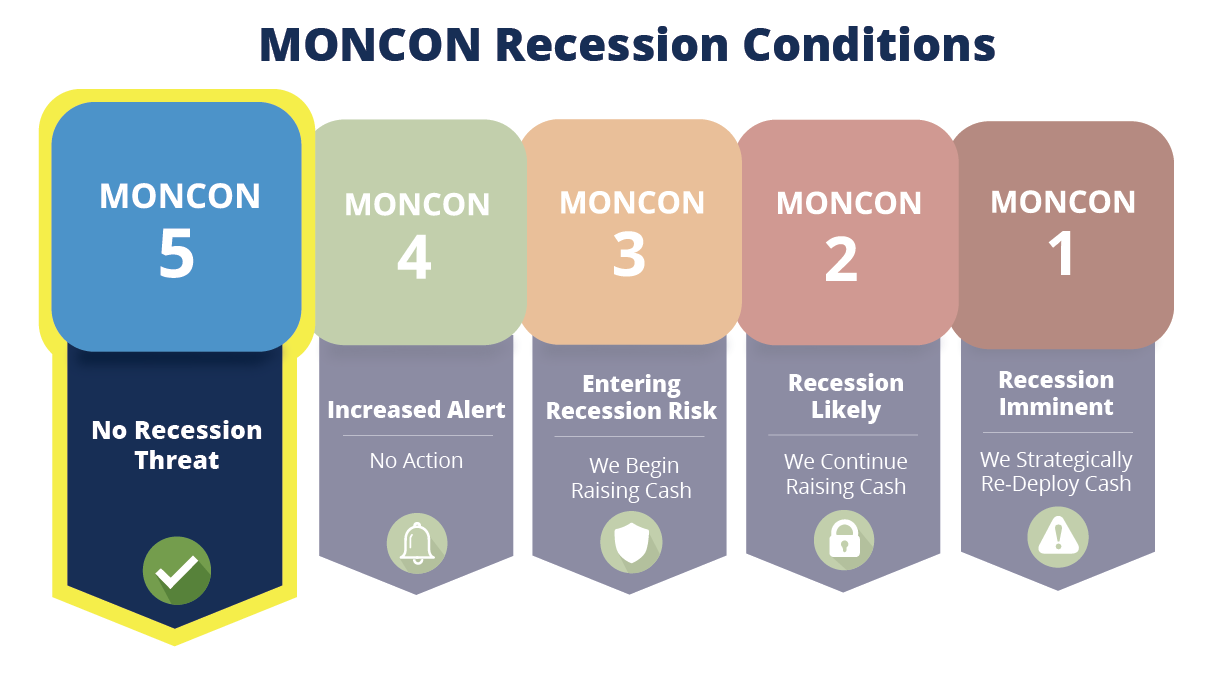

MONCON Recession Tracker

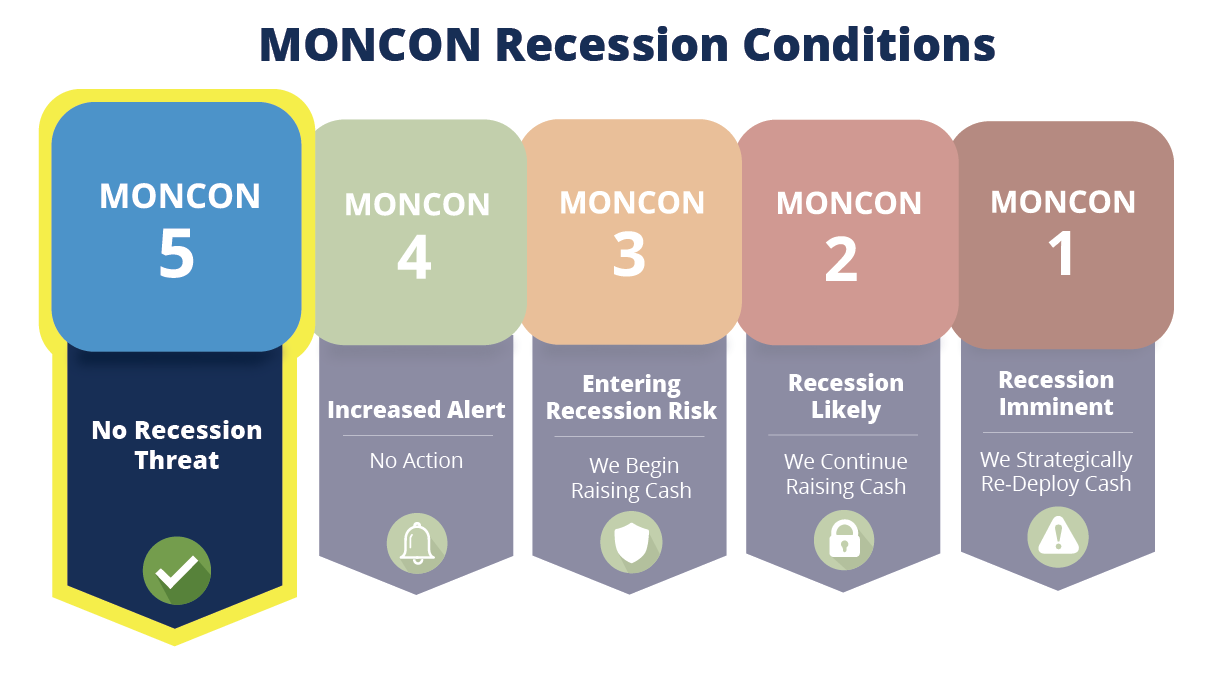

Please remember, the MONCON Recession tracker is NOT designed to predict bear markets or corrections. It is also not ever going to give us signals at the exact top or bottom of any cycle. It is an indication of increases in the probability of a recession developing within a shortening period of time. It relies on actual data, not speculation.

A recession is an economic term that refers to a significant decline in general economic activity in a designated region, like the US. It has been typically acknowledged as two consecutive quarters of economic decline, as reflected by GDP, in conjunction with monthly indicators like a rise in unemployment.

That kind of data take a long time to come in and frankly, while this current virus has the potential to create a recession, we just don’t know. It takes A LOT to push what was a 2% GDP negative for two straight quarters especially with oil trading as low as it is. Again, I’m not saying it can’t happen, I’m just saying that it takes a lot and there is a huge difference between a recession and a slowdown.

MONCON is a tool that hopefully contains losses to the historical 25% “recession-avoided bear market” rather than participating in the 37% average of the “recession bear market” because the data lags.

For example – some economic facts:

- U.S. small business sentiment held up well in February, with the NFIB index topping economists’ forecasts.

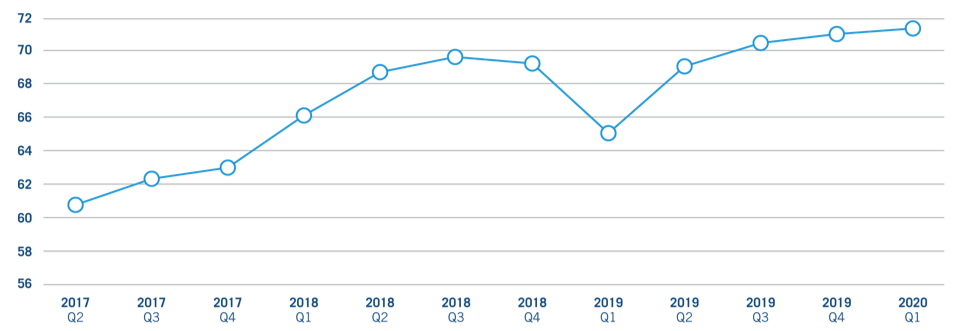

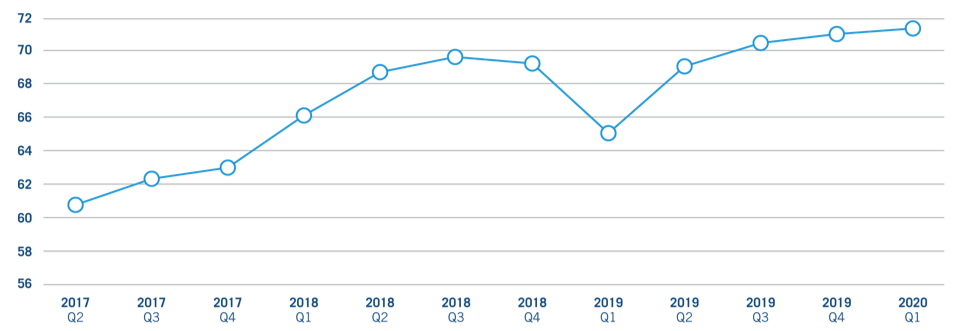

- The NFIB Small Business Optimism Index shows:

a. Hiring has been robust

b. Firms are boosting compensation

c. Job openings continue to be hard to fill

d. The outlook for general business conditions has actually improved

e. Small businesses are optimistic about being able to access credit

- A report from the U.S. Chamber of Commerce also showed strengthening confidence.

SMALL BUSINESS INDEX: HISTORICAL CONTEXT

(Source: https://www.uschamber.com/sbindex/summary )

That’s data. That’s current data. And MONCON uses current data, so it makes sense that it lags the market. It makes sense that it’s not signaling a recession.

As the data changes, MONCON changes.

People are apt to say, “But it’s so obvious what’s happening!”

No, it’s not. Without data, it’s a guess.

True, the worst could materialize, and we plunge into a recession…but what if we don’t?

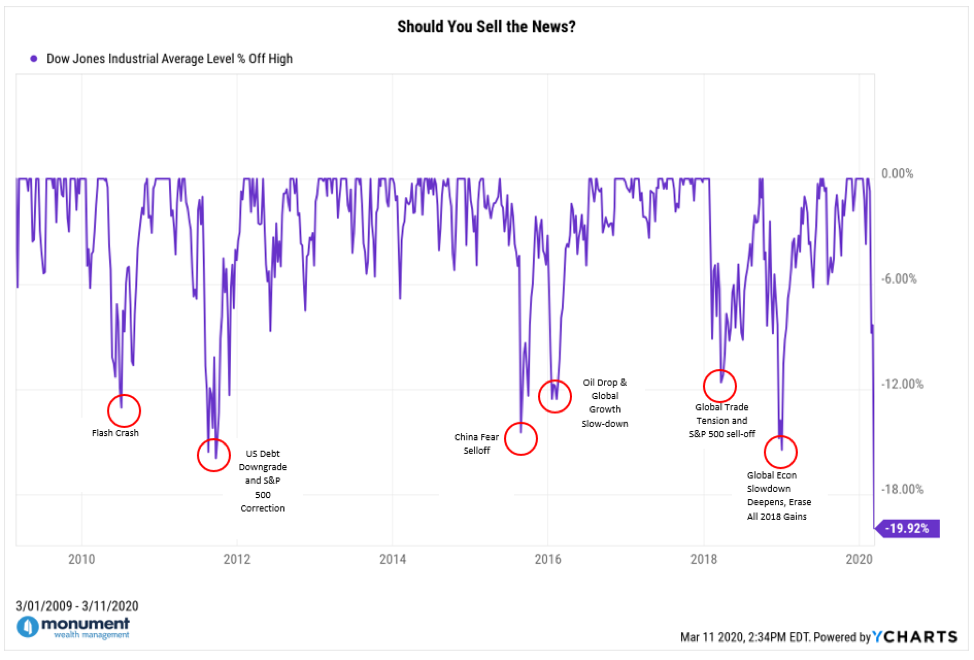

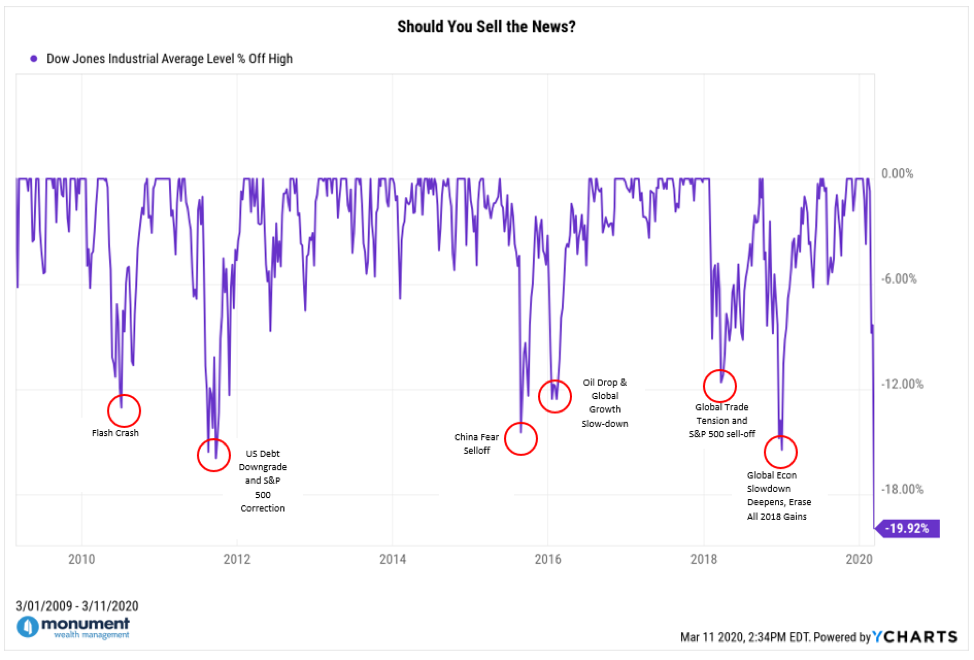

What if it’s like all the past corrections over the last decade that didn’t become recessions? Chart below…

MONCON helped us avoid the emotions over those events. There was a lot of “But it’s so obvious what’s happening!” at each of those circles…but the data never supported the forecast of a recession and we recovered quickly.

MONCON kept the portfolios invested to recover before most traders were able to realize the storm had passed and the sun came out.

If I tried to make MONCON do something else, I’d be trying to create a great guessing machine – which is impossible.

It’s true, the odds of us having a recession have increased significantly over the past two weeks, but at this point, the data is not pointing to one in the United States. MONCON updates every Monday for the previous week, so this next Monday will see some data from the start of this. (In other words, the MONCON reading from this past Monday, March 3, 2020 was with data through February 28, 2020.)

I fully acknowledge the uncertainty, but at this point, I know the virus event will someday end and I expect economic growth will re-accelerate again. The next update to MONCON may show a move to MONCON 4 or MONCON 3, and if it does, I’ll be out with a blog quickly. Remember, MONCON 4 is no action and MONCON 3 is when we raise cash in our managed portfolios to hedge against further down turn. MONCON 1 is full blown recession…that’s when we’d put the money back to work.

It may not be perfect, but it’s been working better than speculating and guessing. We have not fell for any of the recession call head fakes over the past decade and that has added a lot of value to our clients.

Keep looking forward. Storms don’t mean the sun will never shine again.

Dave

What’s Next?

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice.

A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.