Many clients (and a handful of advisors) I’ve met believe dividend stocks are only for investors that need income. On the surface that makes sense, as dividend payments helped support cash needs during a period of historically low interest rates. But if you look behind the curtain, only using dividend stocks for income seems short-sighted.

Whether you have guaranteed lifetime income or are living off dividends, utilizing a strategy designed to invest in “quality” dividend paying stocks might be right for your wealth plan.

Make Sure to Look at the Total Picture

Investors who claim their investment objective is “Growth” aren’t simply asking to increase risk in hopes of more return. What they usually want is to focus on their portfolio’s total return, which is comprised of two pieces: Price return and Income return. For example, if you bought something at $5 and sold it for $13, your price return is $8. But if you also collected $3 of income through dividends, then your total return is $11 ($8 Price return + $3 Income return).

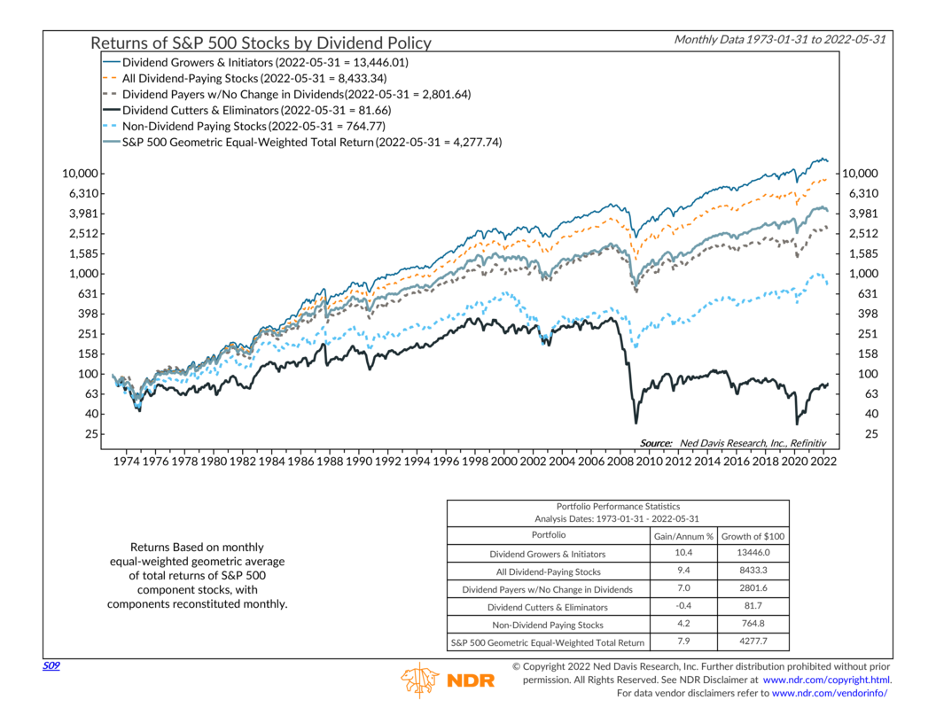

Below is a great chart that clearly illustrates the impact investing in dividend paying stocks can have on long-term total returns. Focus on the yellow dashed line, 2nd from the top. Those are the S&P 500 stocks that pay a dividend while the solid gray/teal line, 3rd from the top, is the entire S&P 500. This chart shows “All Dividend Paying Stocks” have outperformed the broad market from February 1973 through May 2022. (Thanks to Ned Davis Research for their permission to use this chart.)

The very top line represents stocks that initiated dividends or have been increasing their dividends over time. Having reliable cash flows and consistent profit growth allows a company to not only meet its ongoing dividend payments, but ideally increase them. Stocks with growing dividends can provide increased income for those living off dividends and can usually offer compounded, long-term growth that suits a more aggressive investor as well.

Signals of Possible Distress

I don’t know about you, but I’m also interested in the bottom line that is noticeably below the others. I’m wondering, which stocks are those and how can I avoid them?

Those are stocks that have reduced or eliminated their dividends. Remember: a company doesn’t have to pay dividends and if they are, they can change the terms anytime they want. If a dividend paying company is experiencing distress, they may cut or eliminate their dividend to conserve cash. The market can sometimes sniff out financial issues before a change to a company’s dividend occurs and investors will sell, driving its price lower. There are many factors you can use to try and identify potential future dividend cutters, but there are two I normally review first: yield and payout ratio.

Dividend Stock Yield

The amount of dividends paid is quoted as a stock’s “yield.” A stock’s yield is calculated by dividing the total annual dividends by its price per share. So, if a stock’s price moves lower, it can make its dividend yield look extraordinarily high. Don’t be fooled by a high yield. Just because you may get a nice sized payment, a high yield can be a sign of distress, and a change to the company’s dividend could be coming.

Dividend Stock Payout Ratio

The other factor to consider is called “payout ratio.” Payout ratio is the percentage of a company’s earnings that are distributed to investors as dividends. A lower payout ratio usually means a more “stable” dividend. Some dividend payers have ratios near 100%, which means they are using all their earnings to pay dividends with nothing leftover to help finance future growth. Even worse, there are companies with payout ratios over 100% which indicates a company may be incurring additional debt to pay its dividend. No surprise here, but that can be an unstainable business model.

Don’t Settle for Just Living Off Dividends… Make Them Work for You

Dividend stocks make sense for a variety of investment goals and can be used as one part of your larger wealth plan. Investors living off dividends can choose to keep the cash to support their lifestyle while investors who don’t need the cash can choose to reinvest it to hopefully compound their potential long-term growth.

Remember these tips when evaluating dividend payers and growers:

- Don’t just pick the highest yielding stocks to get the highest payment, as it could be a sign that the company is in distress.

- Make sure you check the payout ratio, because a high payout ratio may mean the dividend is on an unsustainable path.

Reviewing these factors, along with others, can help identify stocks that pay a “quality” dividend and avoid investing in stocks that might cut their dividend someday.

If you don’t have the time, desire, or expertise to sort through the various factors and unpack the possibly conflicting signals for each individual company, find a wealth advisor that will do the research and break it down in a simple way that is meaningful to you and your wealth plan. Stocks and their underlying metrics can move extremely fast, so make sure your advisor is acting as the financial equivalent of a charcoal water filter. They should be consistently screening your portfolio for toxins, garbage, and other debris that might muddy your wealth plan’s probability of success.

Most importantly your specific circumstances and goals need to be front of mind when setting your investment objective; be it “Growth,” “Income” or anything else. But remember to keep an open mind about how you reach your goals, especially when considering dividend stocks. While using dividends strictly for cash flow can be a great strategy, the reason to hold dividend stocks generally goes way beyond the hunt for income.