Monument Wealth Management Articles

Survive Turbulent Markets With A Good Cash Strategy

Share on your favorite platform, or by email

It’s safe to say that most investors share a common goal: to have enough money to comfortably live their life without financial fear or worry. The simplest way to do that is to have a good cash strategy. One that is data-tested and designed around your specific plans, assets and needs.

Doesn’t sound too hard right? Well, the devil is in the details.

To me the challenge of executing a financial plan really boils down to how you manage the inevitable market ups and downs along with your cash needs. Whether it’s for ongoing living expenses, paying for your kids’ college, a large purchase like buying a beach home, or going on that bucket list vacation, you need cash and having enough on hand is an asset to your financial life.

A well-crafted cash strategy should help confirm you have enough cash to carry out your plans, while also helping you avoid selling assets from your portfolio during “bad” markets. With a full cash bucket ready to be used during turbulent times, you can still meet all your daily needs, and ride out the market swings without being required to sell from your investments.

In other words, the goal is to never be a forced seller during market pullbacks. If you’re selling during tough market environments, it means you might be locking in losses that could otherwise only be temporary if/when the market recovers. And selling your investments when the market is down can be detrimental to your financial longevity.

Why? It boils down to what is called Sequence of Returns Risk.

What is Sequence of Returns Risk?

Without a strong cash strategy designed to avoid selling assets at depressed prices during volatile times, you might be exposed to the well-documented financial risk called Sequence of Returns. Its title kind of explains itself, but essentially: if you are withdrawing funds from your portfolio, the order (or sequence) of your investment returns can significantly change your plan’s long-term probability of success.

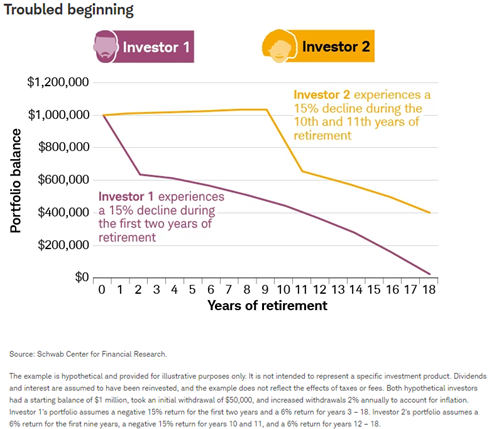

I think this concept is best explained visually by this hypothetical example below from Schwab. It shows the outcome for two nearly identical investors, but with a key difference: the point in time at which they experienced market declines.

Both investors initially start with $1M and begin taking annual withdrawals of $50,000 with a +2% per year increase to factor in some rising cost of living. Both investors experience a -15% decline in value, but it happens at different points in time. For Investor #1, it happens during the first two years that withdrawals start. For Investor #2, it occurs during years 10 & 11.

It’s no surprise that Investor #1 ran out of money much sooner than Investor #2 under these circumstances. Investor #1 could never fully recover from their early losses, especially since they had to constantly be selling from the portfolio to meet their ongoing cash needs. They were frequently forced to sell from their investments, which locked-in losses and left less funds to participate in the future market recovery.

You can see the long-term effects this had on their projected future portfolio balances. Investor #1 is in danger of running out of money around year 18. If only these hypothetical investors had a cash buffer to tap, they maybe could’ve delayed any portfolio sales until the market had rebounded.

Reduce Sequence of Return Risk with Cash – Not Exotic Hedging Strategies

This is why I will continue to preach the need for a solid cash management strategy. It is so impactful in reducing Sequence of Returns risk when you are drawing from your assets.

I’ve frequently seen investor portfolios constructed with too much risk given their income needs. That is why we focus on cash-based financial planning at Monument. Investment gains are only paper gains until they are realized and sold to create cash. That’s why we pay special attention to cash as an asset class and plan to use it as a buffer against the inevitable downturns in the market.

Some advisors prefer to use other more expensive, exotic hedging strategies that revolve around using options or futures contracts. While these products can help offer protection against specific portfolio risks that might happen, we find that not everyone needs or benefits from that level of complexity. For many investors, all they need is simply an appropriately sized cash bucket.

Is there a perfect level of cash reserves that can withstand all market volatility?

In short, the answer is no – there isn’t some perfect level of cash that can withstand any and all market volatility. Each individual investor must determine their own “standard” cash bucket. Normally we recommend our clients carry around 12 to 18 months of living expenses in something that is liquid and earns a competitive yield. A good example is a government money market mutual fund. As of January 2024, most are yielding significantly more than your average bank account thanks to the higher interest rate environment we are in.

Cash is King: The Cheapest & Most Flexible Hedging Strategy

Cash is one of the cheapest and most flexible hedging strategies.

We view cash as an asset class that should help to reduce volatility in your financial life. If you need cash and want to reduce some risk, you might increase your cash levels. If you have low or no cash needs, you might instead look for opportunities to increase risk in your portfolio in hopes for potentially higher future returns.

Ask yourself: Do I currently have 12-18 months of cash reserves in my portfolio? If not, should I look to replenish it now? Is 12-18 months my “standard” or should it be something else?

If these are unanswered or tough questions for you, maybe it’s time to take another look at your wealth plan and investment strategy. Getting this right can be the difference between successfully navigating decades of spending that supports your dream lifestyle versus running out of money while you’re still alive.

Proper asset management is driven by proper risk management, and a key component to successfully executing both is having a disciplined, detailed cash strategy.

There’s a reason why we named our office front door guardian, “Cash”. He’s always standing there, welcoming everyone, and reminding them that Cash is truly every “man’s best friend”!

10 Things All Investors Should Know

Looking for No B.S. Wealth Management?

IMPORTANT DISCLOSURE INFORMATION

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Capital Management, LLC [“Monument”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Monument is engaged, or continues to be engaged, to provide investment advisory services. Monument is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice.

A copy of Monument’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.monumentwealthmanagement.com/disclosures. Please Note: Monument does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Monument’s website or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Monument account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Monument accounts; and, (3) a description of each comparative benchmark/index is available upon request.

Please Remember: If you are a Monument client, please contact Monument, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.