A year ago, I got a dartboard for my basement, and I forgot how much I LOVE darts. I had one in my childhood home that I was obsessed with. It is a game you can play alone, the scoring takes more than simple math (yes, I really do enjoy math that much), and it is a strategy game that requires precision.

Plus, it was pretty cool to be 10-years old whipping sharp, metal-tipped objects at a target. (Especially since most other kids I knew only had plastic-tipped darts if any at all.)

Recently, I was playing a dart game called 501, and I realized my approach to the game is surprisingly similar to how I tackle investment allocation strategies.

Read on for my analogy…

To Grow Your Wealth, Know the Game You’re Playing

The game 501 (sometimes also played as 301) is simple. You throw three darts per round and your score starts at 501. Each dart you throw reduces your score by the amount you hit. If you had 486 points to start the round, and your three darts total 26 points, you’ll begin the next round with 460 points. The goal is to get all the way down to exactly 0 as quickly as possible. Now that you know the rules you can start playing the game.

So, how does this relate to investing? It’s pretty straight-forward: you must understand your goals before constructing your investment allocation. Investing without a specific reason is inherently pointless. Too many times I hear vague goals like “grow my wealth”, but what does that really mean, specifically? And why does it matter to you, personally?

Goal setting is meant to be detailed and inclusive of both 1) purpose and 2) timelines. For example, “I want to retire by 55 and travel internationally twice every year.” This goal allows for actual planning. Simply having goals like “I want to retire early” or “I want to travel” are too broad and can easily feel overwhelming, making them even harder to reach.

WARNING: DON’T BELITTLE THIS STEP. To build wealth with purpose, you must completely flesh out your goals and set time markers for them. Once you’ve done that, then you can start building an investment allocation strategy customized specifically to you that is designed to achieve your ambitions.

To Get the Right Risk Tolerance, Know How You’re Going to Score

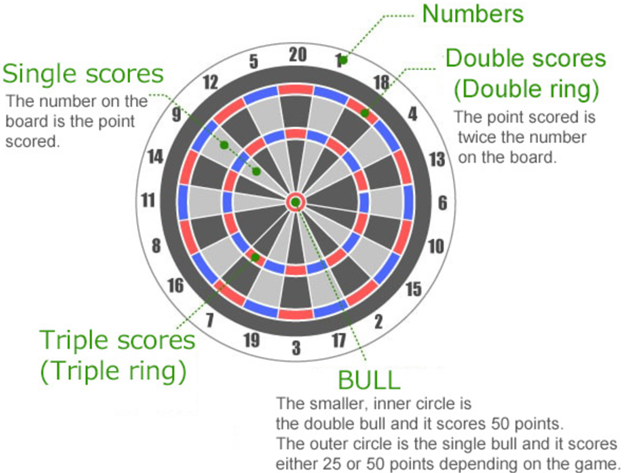

For anyone unfamiliar with darts, intuition leads you to aim for the smaller, inner circle called the “bullseye” or “double bull”. I mean it’s the dead-center; it must be the most points, right? Well, it depends on the game you’re playing, and how it’s scored.

In the game 501, a “double bull” lowers your score by 50 points, but a triple 20 (red space of the inner-most ring in the 20 section) is worth 60 points. If you want the highest score on each individual throw, it’s not the bullseye you’re aiming for.

But be careful because if you miss to the right, you’ll end up with some of the lowest possible scores per throw – 1 to 3 points. Aiming for the triple 20 space is intentionally designed to be high risk/high reward.

Early in the game, when trying to score the most points in each round, I shoot for the triple 20 every time to get the max points per throw. It’s the quickest path to winning, and I’m comfortable taking that risk knowing that there’s a lot of game left to be played. Who cares if I hit a small number on my 2nd throw of the entire match? I still have numerous throws left to hopefully hit lots of triple 20s.

This strategy might not be for everyone since the possibility of hitting a low score may make some uncomfortable. That feeling can lead to emotional reactions that may cause further distractions and even more misses resulting in additional low score throws. But from the start, I mentally prepared by telling myself, “You’re not going to have a perfect game, so expect to miss sometimes.” It’s necessary to have a resilient mindset from the jump and remain focused on the entire game – you can’t be distracted by a single throw.

I think you see where I’m going with this as it relates to investment allocation strategies: the amount of risk your portfolio can take is directly related to your time horizon and your ability to withstand short-term volatility while staying focused on your long-term plans and goals.

Your answer to risk tolerance and time horizon will be different from everyone else’s, so ensure your allocation always factors in your unique preferences.

Know When to Pivot & How to Finish with Precision

In the dart game 501, you need to get down to a score of exactly 0. Meaning if you have 55 points left, and you hit a triple 20 (60 points), your score stays at 55 points, and you’ll have to try to close-out the game again in the next round. You need to find some combination of points to get exactly 55 and bring your score down to 0. Instead of shooting for triple 20s, you would start aiming for a tiple 10, a single 20 & a single 5 or 30+20+5=55.

Now that your goal has changed from scoring the most points each round to scoring a specific amount, your strategy changes too. It becomes about precision and execution. You knew the game was going to end at some point, and you’re prepared. If you want to achieve your goal of winning, now is the critical time to execute.

The same concepts apply to managing your investment allocation strategies: the most crucial time to execute your strategy is right as you’re approaching your goal, and any updates to your allocation should be driven by both expected and unexpected changes in your goals or time horizon; not by short-term negative market reactions.

If You Can’t Play Like a Pro, Pay for a Pro

501 sounds like such an easy game, but it’s much harder when the dart is in your hand. There are entire professional leagues with millions in cash prizes. The pros are incredible. Since I don’t have the time or desire to reach their skill level, if my well-being depended on a darts match, I’d hire a pro.

Managing investment allocation strategies is no different. It’s wise to pay for professional help with your investment management if you don’t have the time or desire to develop the necessary skillset. Your financial well-being is heavily dependent on your wealth plan and investment allocation, so it deserves professional attention.

Investment Allocation Strategies: More Than Just a Game

My dad taught me to play darts when I was 10. Right away he made sure I understood that it was a privilege to use metal-tipped darts and I needed to make responsible decisions. Investing is the same way.

While this isn’t a list, here’s how to be responsible when implementing an investment allocation strategy:

- Know the Game You’re Playing. Define your goals and set a timeframe to reach them.

- Know How You’re Going to Score and Win. Create a concrete plan on how you’re going to reach your goals while factoring in your risk tolerance & time horizon.

- Know When to Pivot & How to Finish with Precision. Understand that the most important time to be aware of your allocation and risk levels is right as you’re approaching your goal. Make changes to your investment strategy only when your goals or situation changes.

- Pay for a Pro if You Can’t Play Like a Pro. Wealth planning and asset management are full-time jobs that require expertise, a creative perspective and dedication to be successfully managed over the long term. If you can’t do that, pay someone who can.

Without proper goal setting, planning, and management, an investment allocation can be hazardous to you, your financial life, and others around you. And trust me, it’ll be worse than a metal-tipped dart to the hand.