Warning: this piece is meme-heavy.

Jason Zweig published a very insightful Wall Street Journal article last month describing what happens “when what you own becomes part of who you are.” It runs parallel to an op-ed that Jared Dillian wrote for Bloomberg in July, where he discussed the imperative of “checking your politics at the door.”

Both pieces remind me of a now popular meme…and are an implicit, yet compelling, call to arms for trend-following strategies. I encourage you to read both articles in their entirety and to follow each author on Twitter:

Here are my favorite passages from each (bolded emphasis is mine):

That’s what happens when what you own – or scorn – becomes part of who you are. You don’t just invest in gold; you become a gold bug. You don’t merely think interest rates will rise; you turn into a bond bear. You aren’t only skeptical about Amazon; you belong to the value investing community, which regards itself as rational in a financial world gone mad. – Jason Zweig

The point here is not who was right or wrong, but that the goal of an investor should be regime agnostic, able to adapt and make money in all kinds of market conditions. It sounds easy enough, but the problem is that most investors are very rigid about their investing philosophy, which makes them poorly adapted to changing regimes. That’s because their investing philosophy is often tied up in their identity. They say, “I am a value investor,” and they do all the things that value investors do and wear all the same clothes that value investors wear, and drive the same cars that value investors drive, only to find their strategy is out of favor for a decade or more. Why not just do what works? – Jared Dillian

The theme connecting both articles is distilled down to a simple question.

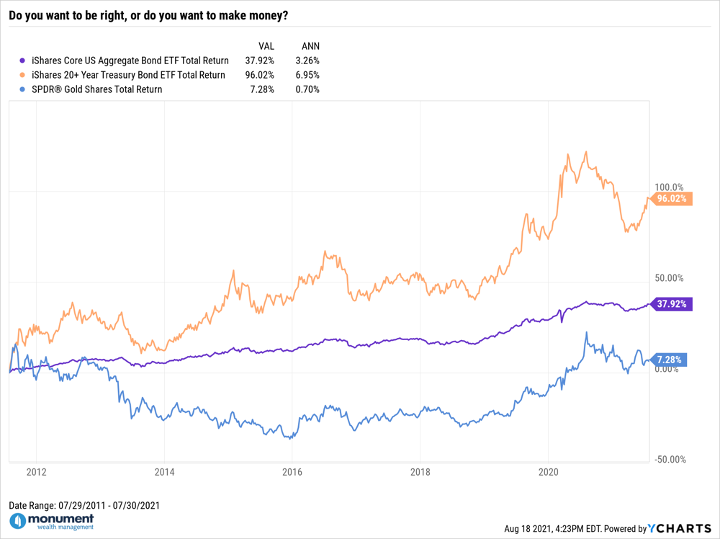

Do you want to be right, or do you want to make money?

I’ll admit that I’ve been a gold bug for as long as I can remember. Mainly because I began my career when quantitative easing burst onto the scene in the U.S. during the immediate aftermath of the Great Financial Crisis. I also blame my politics, intellectual background, and Twitter feed, but I’ve had a litany of quantitative and qualitative reasons for owning gold. But my insistence on holding gold hasn’t worked out well, and that money would have likely been better invested elsewhere. When I started at Monument in 2019, I even got a reputation for being “the gold guy,” even though we never used gold in client portfolios.

As an aside: you never want to pigeonhole yourself into being the [insert niche] “guy/gal.” It’s almost as bad as being labeled a “defensive specialist” on the basketball court. Beware of one-trick ponies!

Bond bears, on the other hand, are the slightly less obnoxious, slightly less paranoid cousins of the gold bugs. And like gold bugs, they have a tremendous amount of data and narrative on their side:

- Gargantuan fiscal and monetary stimulus

- Roaring GDP growth

- Rising inflation…both in official statistics and anecdotal horror stories

I’ve been in the industry for a little over a decade, and the drumbeat has been constant throughout: prepare for a rising rate environment! As a bright-eyed and bushy-tailed analyst at J.P. Morgan – fresh off my collegiate and CFA-level studies – that made a ton of sense to me.

After all, an army of CFA charterholders and PhDs couldn’t be wrong, could they?

Meanwhile:

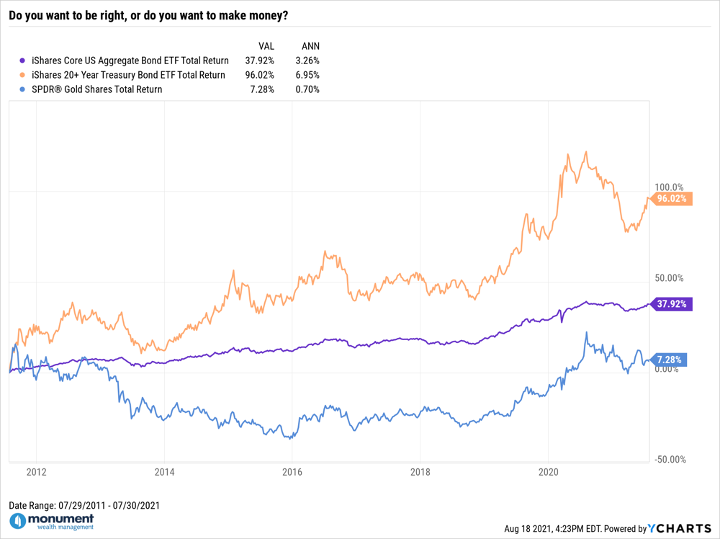

Over the last decade, owning gold and not owning bonds would have been a bad decision. Of course, each asset had its shining moments, like being long gold in the summer of 2011 and short bonds during the “taper tantrum” of 2013. But outside of that, it’s generally been tough sledding.

What the gold bugs and bond bears have in common is they are smart. But sometimes, they are too smart for their own good. So smart that they are…average. In meme parlance, they’re “midwits,” and their investment performance often suffers as a result.

This is where we talk about memes, so buckle up.

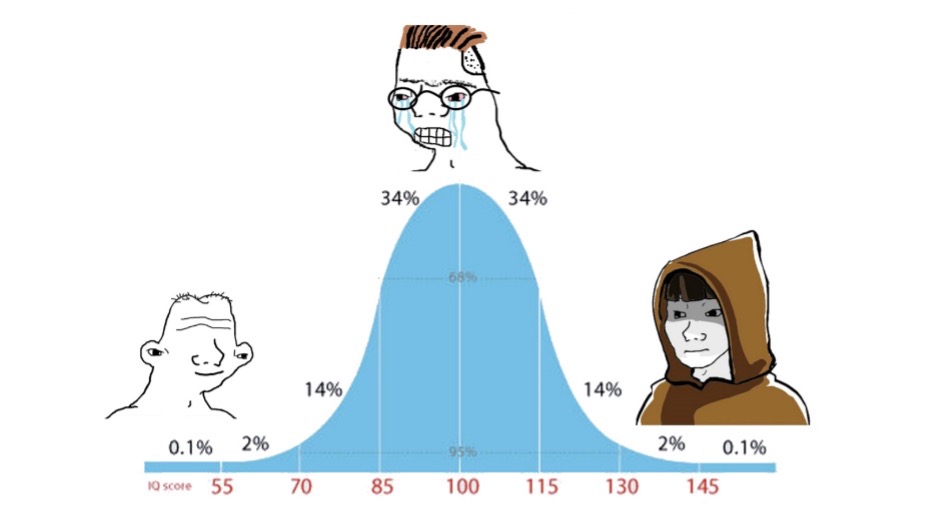

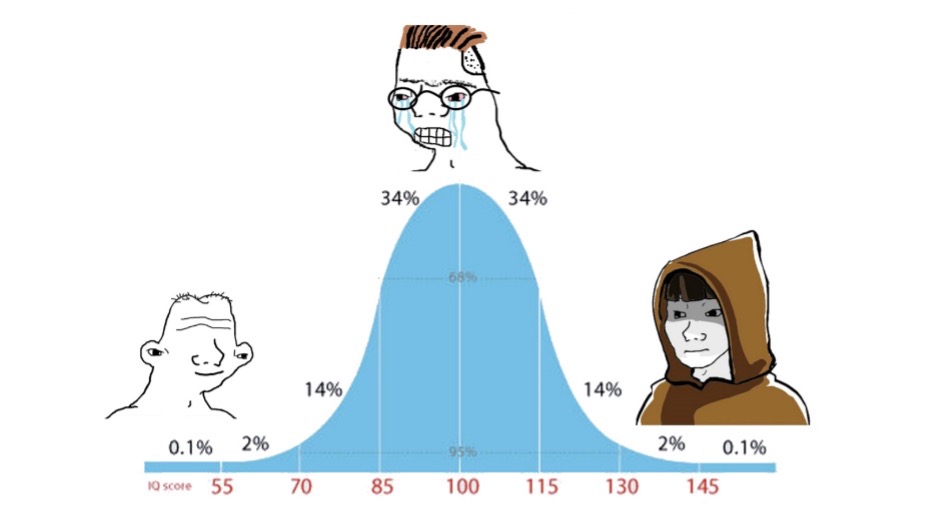

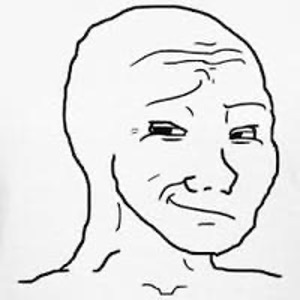

*Midwit refers to a series of memes that use IQ distribution diagrams to mock one of the three main groups represented by the diagram, most often targeting the largest group of people representing average intelligence. The meme utilizes Horseshoe Theory, implying that the groups with low intelligence and high intelligence often choose to follow the same goals while being guided by different reasoning. Those who possess average intelligence are referred to as midwits.

The midwit meme is the most elegantly grotesque (and hilarious!) depiction of gold bugs, bond bears and any other niche cohort you can conjure. On the right side of the curve, you have someone with Jedi-level intelligence. On the left, the complete opposite (what is that, a caveman?). And in the middle, you have our midwit.

The meme summarizes why otherwise smart people can struggle with investing. Recalling Jason and Jared’s writing: some investors are so in love with their asset class, their politics, their thesis – or possibly themselves – that they can’t see the forest for the trees. They have every reason in the world to be right. But if the market doesn’t agree, then who cares?

The caveman isn’t sophisticated enough to have a thesis. But he nonetheless arrives at the correct investment conclusion. The Jedi is sophisticated enough to nail the thesis or otherwise adapt to the situation. In both cases, they make money. The midwit, on the other hand, is the odd one out. Hence the crying and gnashing of teeth.

Can we pause for a second to appreciate the midwit haircut?

You’ve probably experienced a version of this elsewhere in your life recently. Do you have friends or family who bought GameStop or Bitcoin? Newsflash: a lot of really smart and really, uh, not so smart, people made a fortune on both assets. For different reasons, of course. The left tail guys likely stumbled upon GameStop because they were locked inside their apartments, got bored, and fired up Reddit. The right-tail guys were possibly George Soros aficionados who properly diagnosed the developing situation. In both cases, they did well. And to clarify: I’m not calling anyone’s cousin an idiot, or worse…advocating that you pile into GameStop yourself. We nipped that in the bud back in January. In fact, a lot of these same investors are likely to revert to midwit status (or worse) in time.

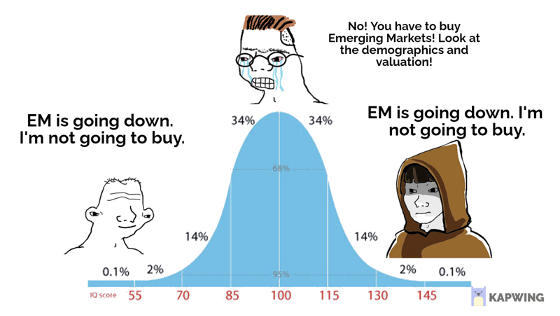

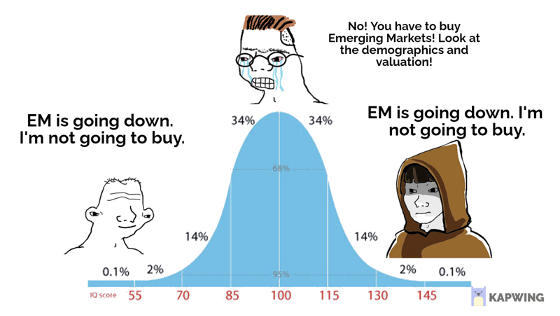

Here’s how I interpret the meme for our purposes today: the middle of the curve represents traditional discretionary investment managers. The credentialed conventional wisdom. The guys on Bloomberg and CNBC. Fittingly, a lot of them wear glasses and say things like:

- No! You can’t buy long-term Treasury bonds when inflation is over 5%! Are you crazy?! Meanwhile, the 10-year Treasury yield sinks to new lows.

- No! You can’t completely ignore Emerging Market stocks. Look at the compelling demographics and valuation! Meanwhile, Chinese regulators continue to pummel EM stocks while domestic stocks hit fresh all-time highs.

- No! You can’t [insert some other well-reasoned conclusion that doesn’t pan out]. Meanwhile, the trend goes in the opposite direction.

What’s the saying? “Intelligence is the ability to adapt to change.”

Do you want to be right, or do you want to make money?

If only there was a systematic way to sidestep the whims and neuroses of the investment midwits without taking large amounts of single stock risk in the process. To remain agnostic and adaptable. To just do what works…even if that means you won’t 10x your money in a month (sorry, r/wsb readers).

Enter: trend-following. A guiding principle of our asset management practice and a concept that anchors Monument’s Flexible Asset Allocation (FAA) strategy.

Gold bugs: sorry, we don’t use gold or any other commodities for that matter…though trend-following has proven immensely successful in that asset class. Bond bears, however, can rejoice. Our multi-asset class strategy is capital efficient and buys bonds only when positive price trends have been established. Said another way: we’re directionally in agreement with the bond bears over the long-term, in that we believe that bonds will likely be a portfolio headwind over the next decade-plus. We’re just unlikely to bet the farm on that call in the interim.

Call it “renting” versus “owning” bonds.

We’ll summarize that with one final meme.

If you’re interested in an FAA deep dive, be on the lookout for a long-form “primer” in the near future. Or better yet, give us a call and let’s talk!