I caught up with a friend the other day over lunch and we inevitably got to talking about how business was going. Monument had a great year last year. He asked, “Why?”

Good question. I think it’s because we stopped trying. Well, not really, but kinda…

Let me explain…

In D.C., monuments are part of our landscape. They are part of what makes our home distinct. They mark pivotal points in history and celebrate the people, moments, achievements, and victories that have and will stand the test of time.

We like to think we’re doing that, too: Building something not just sizable, but significant, memorable, and worthy, something that you cannot just be happy about, but in awe of—something that may very well outlast even you.

Monuments don’t happen by accident or chance.

Mountains…they rise and fall over time. But monuments…well, they are put there on purpose.

Why? Because they mean something. Because they stand for something, in a way that’s permanent and purposeful. Just by their presence they say, “This is important.”

We believe in the name Monument because it signifies that what you build has value and is worth maintaining—and protecting.

At Monument, we give a nod to tradition, but we are not ruled by it.

You see, when an action is valued, repeated, and handed down, we call it tradition. And we perform it in tribute to what we believe in and who we are. But there’s a difference between tradition…and habit. When it comes to growing and managing wealth, certain rules apply.

We respect and revere worthwhile practices and the way wealth works and has proven to grow over time—but we never use any of it as an excuse NOT to look for and find the newest, best, most creative way to meet your ultimate goals.

After all, you don’t have to deny gravity exists to find new ways to fly.

We see wealth differently. We always have.

When we talk about finances, we use a lot of terms: Portfolios. Assets and liabilities. Returns. Net worth. Stocks and bonds. Liquidity. Cash flow.

They all play their roles. But the problem, as we see it, is when you start seeing your wealth, and your worth, in limited terms.

You might keep cash in an envelope. Assets at the bank. Money in your 401K. Stocks in this or that strategy.

But your wealth and potential for growth is much more than the sum of its parts. The point isn’t just to have it and watch it ride the market like a roller coaster, wondering what will happen. The point is to create something of meaning and purpose.

Together, we can build something that lasts.

This is, in fact, both why our clients come to—and stay with—us for the long haul. Because anything worth building is worth doing not just well, but thoughtfully, sustainably, and in a way that matters to you.

Your wealth is not a hot streak or the result of some uncontrolled, external factor. The way we build yours is a direct result of a plan we put in place so that you get where you want—with time to spare.

So, you ask, how did we stop trying?

We stopped trying to build our business with the wrong kinds of clients. Hell, it’s something we should have started years ago. We actually wrote down things that identified bad prospective new clients.

Seriously. Here’s the list we made, it’s called the “They Won’t Like Us” list…

- They love jargon

- They only trust people in suits

- They need the ego validation of working with a big firm

- They just want an order taker or financial custodian

- They want to limit our conversation to asset allocation or money management

- They throw a fit every time the market dips

- They think the world revolves around the daily news cycle

- They try to control the world with their thoughts and are legitimately upset when it doesn’t happen

- They don’t like dogs (Seriously, that’s a deal breaker.)

That prompted us to build the “They Will Love Us” list:

- They appreciate people who don’t just dispense advice, but offer real, unfiltered opinions

- They want to talk plainly and honestly about their finances and are happy to dispense with bullshit and jargon

- They don’t just want an “advisor,” but to plug into a brain trust, a team of seasoned pros who actually know how to have a conversation

- They understand that they cannot control the universe, the market, or really anything else with their thoughts

- More to the point, they understand that their own behavior determines their success more than any other factor, in every area of their life—including their finances

So yeah, we stopped trying. But we also really started focusing.

Clearly it worked. Dean and I were recently added to the Forbes “Best-In-State Wealth Advisors” list for Virginia.

This is the best list out there because they don’t simply rank advisors by how much money they claim to manage. (…and don’t get me going on how many people shamefully lie on these lists out of one side of their mouth while claiming, “Oh, look at me, I’m a fiduciary, it says so right on my website,” out of the other.) No, Forbes starts with nominations…29,334 to be exact. From that list, they invite 5,961 to complete a survey. From there, they do telephone and in-person interviews to arrive at a list for each state.

What are they researching to determine best advisors? Years of experience, no compliance problems, quantitative considerations such as revenue, quality of assets managed and client retention metrics. They also apply a heavy weighting to interviews (mine was over an hour) to determine if advisors exhibit best practices, solid service models, processes, credentials, use of a team versus simply having administrative assistants, and community involvement.

So we are proud of this recognition. We are proud of our reputation and most importantly we are proud of how our colleagues in the industry view Monument. In fact…

Colleagues…I’ve been invited to be one of two people conducting the final day Key Note Presentation at the upcoming Barron’s Top Independent Advisor Summit the end of the month. It’s titled, “Regulation & Oversight – a View to the Future,” and I’ll be interviewing Michael Piwowar, Former SEC Commissioner in an “Ask Me Anything” format. I’m going to get the answers to the questions advisors really want to know. And this is not going to be some watered down, haughty, self-congratulatory moment on stage but some real life, straight-at-ya questions.

Kind of like AOC grilling that fool Michael Cohen the other day. Send me any questions you think I should ask–I’m building a nice list.

As always, keep looking forward.

Dave

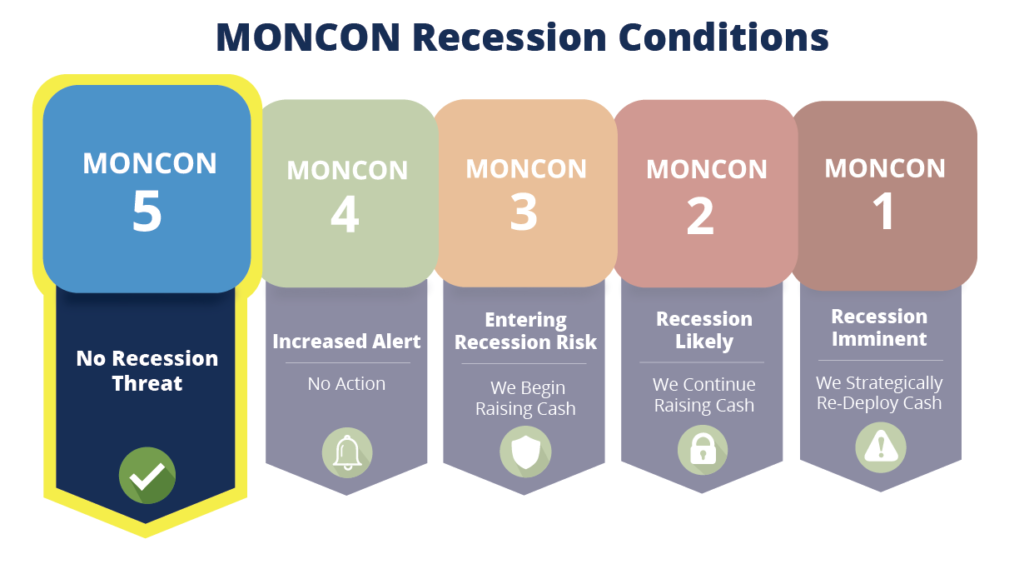

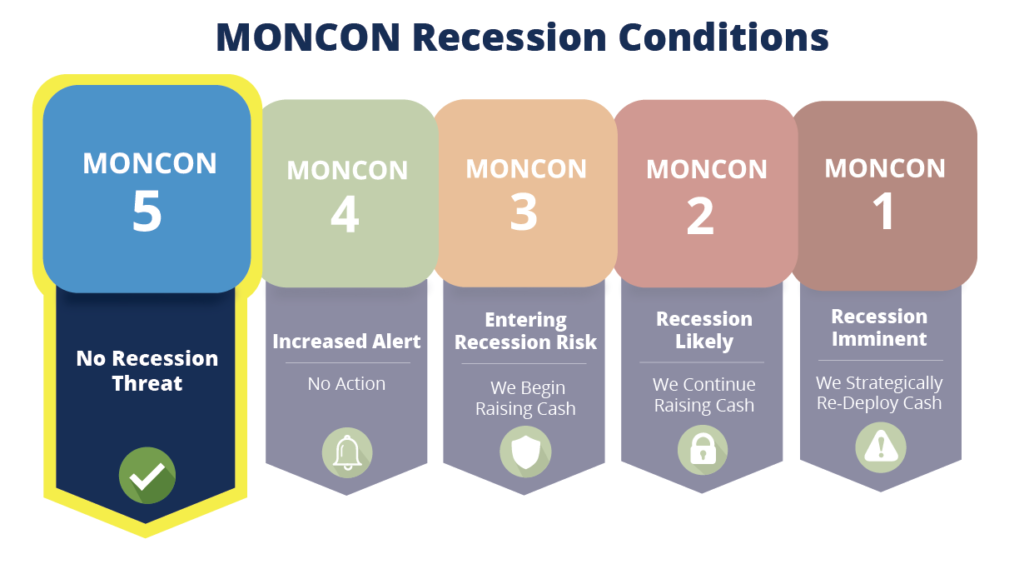

We remain at MONCON 5. We see no data on the horizon that has increased the probability of a recession anytime soon. When that changes, because one day it will, we will have an immediate blog announcement. But for now, it’s MONCON 5 and chill. See more of an explanation by reading this blog post, “How to Forecast and Manage a Recession.”

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice.

A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.