Our thoughts go out to all of those who have been impacted by Harvey and Irma.

There have been a lot of great charitable contributions over the past two weeks but if you are still looking to do something, please consider the animals. As most of you know, I’m one of those people who treats my dogs as if they were humans. If you have been to our offices recently, I’m sure you have met them. One of my passion charities is the local Lab rescue here in the D.C. area. Both of my dogs came from this wonderful organization.

They recently sent their rescue vans down to Houston to get dogs from the shelters most impacted by the flooding. Upon arrival at the rescue they set out to aid, they discovered over 30 dogs who drowned while abandoned in their crates. This is very sad, but the good news is that they are currently in route back to this area with vans full of 24 rescued dogs. If you are looking to adopt, there will be plenty of new dogs to check out. See their adoption page here.

If you can spare a few dollars to help get the new dogs the medical treatment they need upon arrival, please go here.

Here are two pictures from the rescue…look at that cute thing! The second is of the van bringing a load of rescued pups back this way.

The Hurricanes

They are a big deal, but it’s important for me to try to look past the emotional aspects and focus on the longer-term political and economic impacts of the hurricanes.

A lot of people on the news are throwing around a figure that could surpass $300 billion to rebuild. Frankly, this rebuilding could take several years.

I think that the immediate and short-term impact will hurt GDP growth over the next few quarters. However, the rebuilding will eventually reach a breakeven point and then be accretive to growth over 2018, 2019 and probably 2020. I’ve read some naysayers on that subject and while everyone is entitled to their opinions on the micro levels of this (for example, someone made the point that car insurance will not really pay enough for people to go out and replace their old car with a new one…), I just think the big picture (macro) is that homes will be rebuilt, cars will be replaced and furniture and durable goods will be bought.

Don’t ever underestimate the power of those purchases in volume.

Here’s what I think is even more important…tax bill. I’ve been writing about this since last May. My thesis has been that not only will a tax package get done, it may even include enough Dems to be permanent. Here’s a link back to my blog in May and the one from last week. Read at least one of them.

My thinking from May is picking up steam in the mainstream media – thanks to a client for sending me the following picture he took of his TV set. (Why are you watching MSNBC!!!???)

These hurricanes only INCREASE the odds of tax reform bill passing and increase an infrastructure spending program. I’m sure you saw that a continuing resolution to fund the government was tied to the hurricane relief bill…but the really important point is that Trump reached out to the Democrats for support on it…AND GOT IT. He eschewed the right wing Republican conservatives that have been the thorn in his side passing his agenda.

Last night he met with the Dems on DACA.

I’m not saying it’s smart politics, I’m just saying he is signaling that he’s willing to negotiate across the isle in a nose-thumbing gesture that may dislodge some of the hard core “NO” folks on the right.

Here’s the real key to my thinking on this tax reform issue AND NOW infrastructure too – Regardless of party, good luck getting reelected in 2018 if you vote against either of these issues!

Trump and every member of Congress will get their act together and address the need to rebuild the devastation in both Texas and Florida. Tax reform and an infrastructure spending bill will help rebuild, aid the economy and create jobs. Elected officials will use these storms to champion passage of bills and reforms. Trump reached out to the Democrats to get the continuing resolution passed without regard to pissing off the Republican Conservative Right (and maybe the moderates too). He might do the same thing to get tax reform and infrastructure spending done – this is what is being referred to as his “pro-growth” and/or “pro-business” agenda.

Bottom line – if you are a member of the House or the Senate and you vote against the President’s growth agenda after Harvey and Irma then you are BURNT TOAST in 2018. That’s my opinion.

As for the Fed, well they are now going be on hold raising rates until everyone figures out the full impact of both hurricanes on the economy.

As for my opinions on other issues than taxes and politics? I have a few:

- Don’t bet on another rate hike until after the calendar flips to 2018. P.S. This will continue to hurt the U.S. Dollar.

- U.S. corporate profits will be negatively impacted in the near term, but this does not mean going negative…it means they will still grow just not as much as everyone was forecasting. This will slow down the growth stocks (such as the Monument Growth Portfolio) from the absolute tear they have been on this year, but it’s not a reason to change allocations or sell them.

- For reference, according to my trusty FactSet terminal, as of today the Russell 1000 Growth index is up 18.7% YTD and the Russell 1000 Value index is up 4.5%.

- Multinationals companies will gain even more from a weakening dollar as they convert their profits between currencies. We have recently reallocated from U.S. exposure to more multinational exposure in our Global Macro Opportunities ETF Portfolio. Clients – you will read more about this in our next portfolio update.

- Financials have taken it on the chin and we have a 10% position in this sector in our Global Macro Opportunities ETF Portfolio. I’ve come close to liquidating that position three times in as many weeks, but here’s why I’m staying. Financials are suffering because the yield curve is flattening (I wrote about this here, please read it for more detailed explanation), but now I’m thinking that hurricane rebuilding in Texas and Florida will lift loan growth causing the yield curve to steepen, especially as longer-term gains offset the near term economic weakness.

What To Do Now

If you are an investor and have a long-term plan with a well-constructed portfolio, I think the above points should be encouraging and reinforce your investing decisions. Your existing portfolio will benefit if the above plays out. I don’t think the market believes that this tax deal gets done.

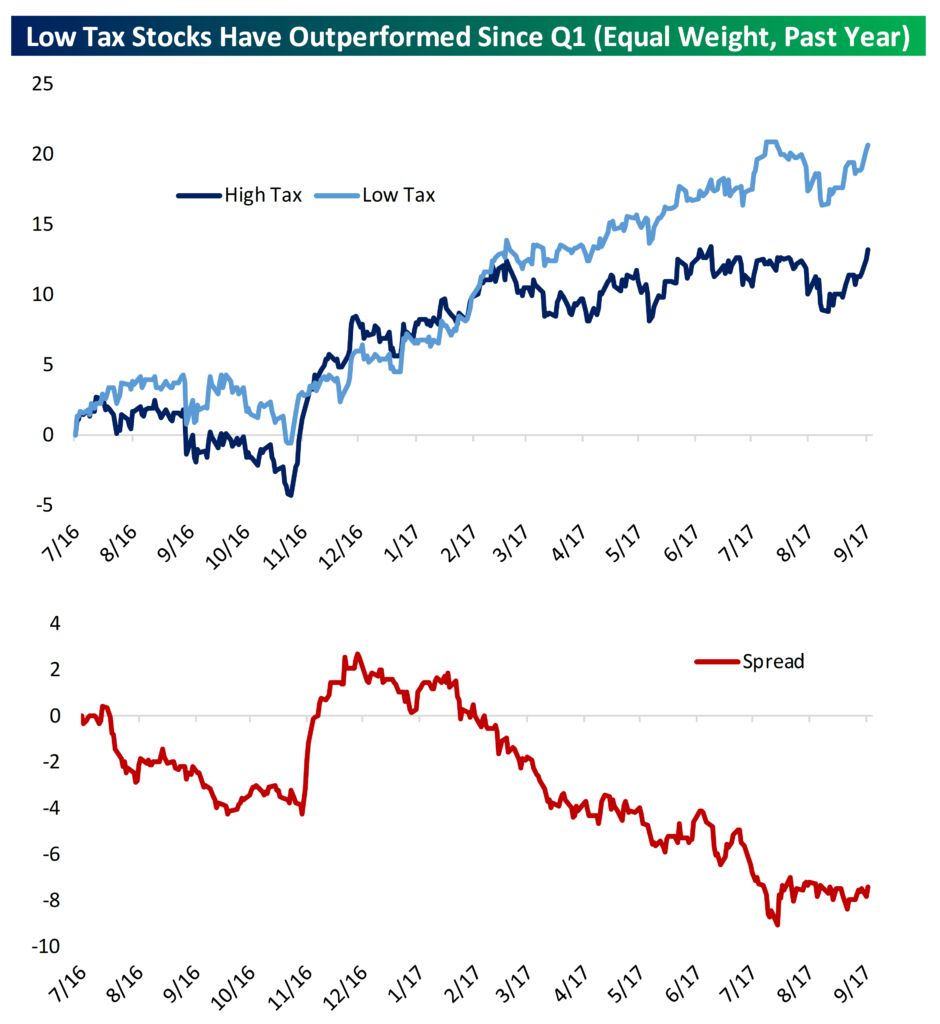

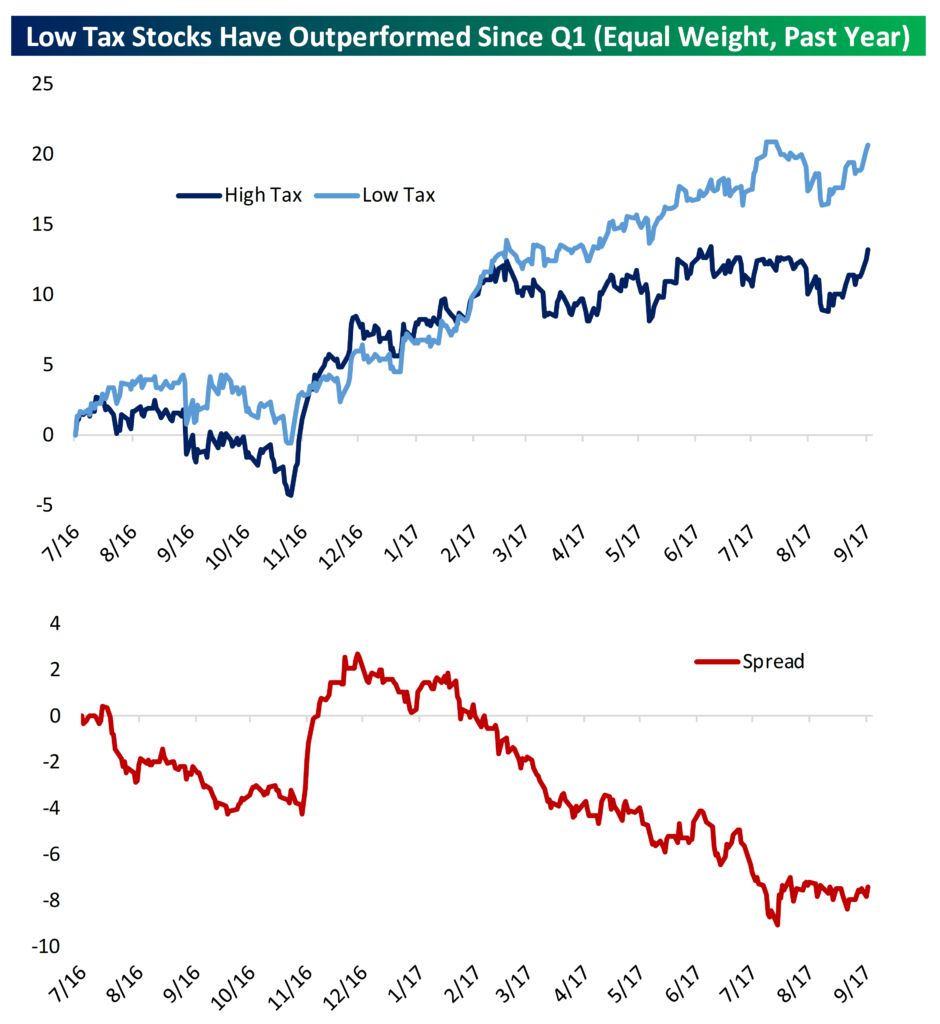

Below is a chart from Bespoke. I could write a two-page blog on this chart, but to spare you, here’s what it says: Companies (and their stocks) that have high tax rates SHOULD be outperforming those with low tax rates. This is because you would expect tax reform to add to corporate earnings (again, another popular blog topic of mine that you can see here). But the opposite is and has been happening…look at the downtrend in the red line at the bottom.

Translation – the market does believe tax reform will get done. I think it will. If I’m right, it’s not as priced in as people may think.

SO…

If you have a plan AND you have cash you have been waiting to put to work, but you are scared that markets are at a high, I think you should seriously reconsider being out of the market in cash.

Successful investors look way beyond short-term noise like the negative impacts to our economy triggered by the hurricanes…they instead look out with a longer time horizon at the prospective gains that are likely to occur at some point.

In other words – LOOK FORWARD.

We still think that domestic large cap indices, financials, industrials and FAIRLY VALUED tech companies (or equal weighted ETFs/indices versus market cap weighted) are the best domestic sectors to be overweight. As for overseas, except for Japan, we like more of the developing countries versus developed. This is all reflected in our flagship Global Macro Opportunities ETF Portfolio.

Call us if you have questions. If you overhear people complaining about their advisors, please point them in our direction, we love bragging about our firm.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.