It’s the fourth quarter of 2019 and predictions on where the market will end up at the end of the year are popping up all over. The problem with these predictions is that there is no cost for being wrong.

Take for example an article in last weekend’s Barron’s, where they published the “Big Money Poll”. Here’s the first paragraph:

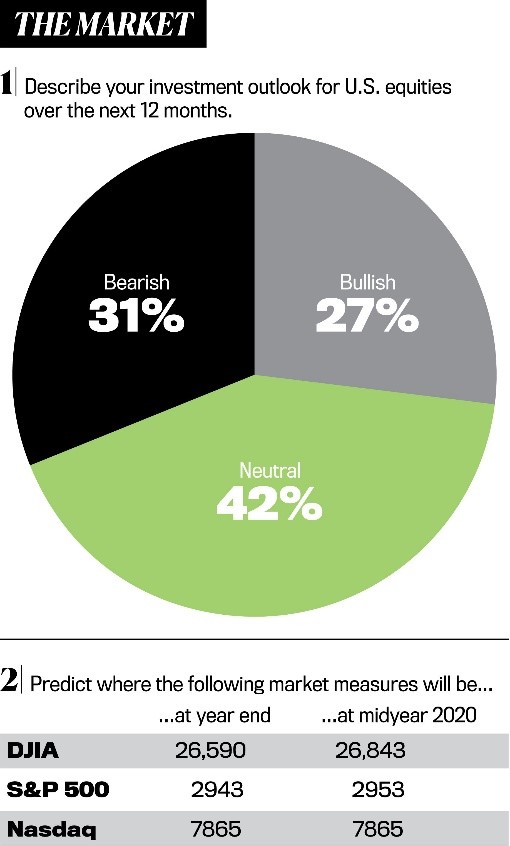

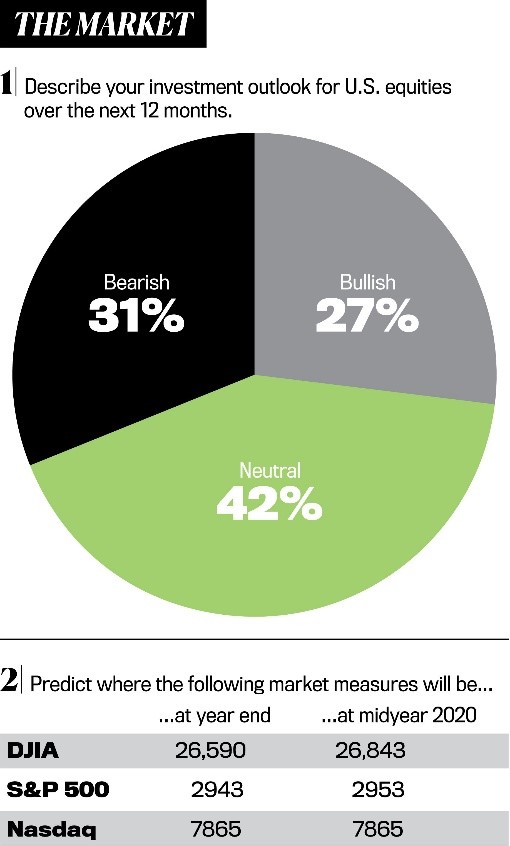

After a big year for U.S. stocks—make that a big 10 years—America’s money managers see trouble ahead for investors. Blame it on the market’s lofty valuation, a muddled economic outlook, or the increasingly fractious political landscape, any of which could stifle stocks’ advance in coming months. Whatever the case, only 27% of money managers responding to Barron’s fall 2019 Big Money Poll call themselves bullish about the market’s prospects for the next 12 months, down from 49% in our spring survey and 56% a year ago. The latest reading is the lowest percentage of bulls in more than 20 years.

Here’s the graphic that accompanied the article–

I’m a CFA, so let me put my skills to use in analyzing the above…

I’ll be a brief as possible…

Here it is…

Okay, okay…I’ll dig in a little more.

If there were 100 money managers (aka, “Big Money Pros”) surveyed, 42 are neutral. Basically, that’s the same thing as saying, “I have no idea.” 100 minus 42 is 58 remaining people who had an opinion. Out of those 58, 27 are bullish (or 46% of the 58) and 31 are bearish (53% of the 58).

So, we are in coin flip territory across the board…42 out of 100 have no idea (neutral) and the remainder are 46%/53% Bulls to Bears.

Technically, the Bears are the majority. But then the article (see same graphic above) goes on to show predictions for year-end 2019 and mid-year 2020. Go back and look at the predictions.

My analysis?

But in case you are wondering, here’s my prediction.

Your reaction? Probably looks like this.

Personally, I think there are a few things that are creating anxiety:

- Political uncertainty – but this happens 12 months out from any election.

- While we recovered nicely off the December 2018 panic sell-off, there is a distinct feeling that the market is moving sideways regardless of the +21% YTD return on the S&P 500. Here’s why:

- The first quarter return on the S&P 500 was about 14.4%.

- Since the beginning of the second quarter of 2019, the S&P 500 is only up about 6.1%.

- From beginning of the third quarter of 2019, the S&P 500 is up only about 2.6%.

- Recession talk – Regardless of the data, people are still feeling like one is right around the corner. Everyone is on the lookout for bad news.

- Slowing GDP – It’s true things have slowed down, but as I always say, slowing growth is not the same thing as zero or negative growth.

- Trade – This will get resolved, but for now it’s causing global jitters.

Sometimes, anxiety causes investors to take action and this is where the cost of being wrong is NOT zero.

I’ll use September 20, 2018 as a starting point, since that was the market high before the sell-off that culminated in late December 2018.

From September 20, 2018 (when the S&P 500 index level was around 2,930) to TODAY, October 29, 2019 (with the S&P 500 around 3,040), the S&P 500 has a gain of +3.72%.

Since anxiety over volatility can cause action, I know that a lot of individual investors sold in a panic during the December 2018 sell-off, saying something along the lines of, “I’ll go back into the market when things look better.” Well, if you look back above to 2.1, a.b.c., I’ll bet that people who sold in December didn’t feel better until April at the earliest and therefore have only participated in the ~6.1% returns for the rest of the year up to today. That would hardly fill the hole of what could have been a 15-20% loss they sold into in December 2018.

That’s an example of where being wrong has a real cost.

Pro Tip: Don’t let the anxiety created by the press cause you to take action that is contrary to your plan. Forget things like the Big Money Poll; they are as practical as using a Tom Clancy book as a guide for creating foreign policy. You never know what you don’t know, and the stark reality is that no one really knows anything that’s not already priced into the market.

Is the Big Money Poll interesting reading? Sure…I mean, I’m guilty of reading it. But there is one important thing to keep in mind about people making predictions – unlike you, THEIR COST of being wrong is essentially zero. Their words are not action and that makes those words costless…By January, no one will remember nor care what anyone said in this Big Money Poll.

How I can help: Are you nervous, feel like your plan is not up to date, or your portfolio is not constructed to reflect the level of risk you are comfortable with? Reach out to me, I can help you. Even if you are not the right fit for Monument, I know great advisors across all kinds of different niches that I’m happy to introduce you to…these are people I like and trust. They are the kind of people I’d send family to.

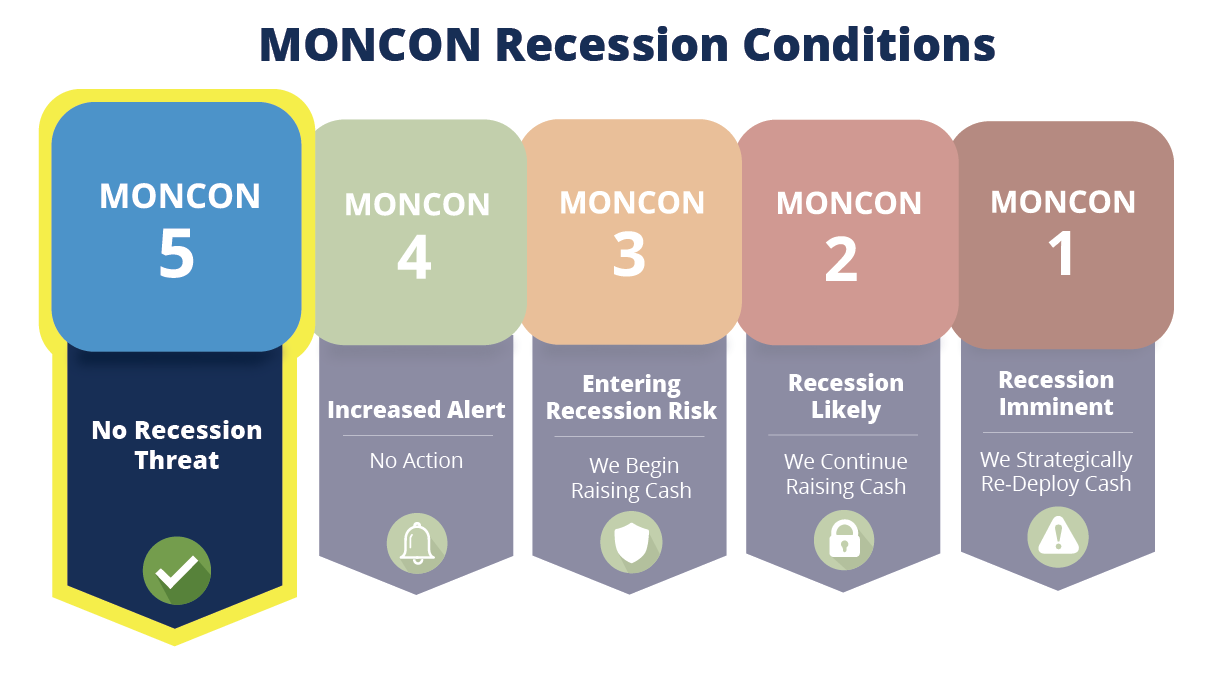

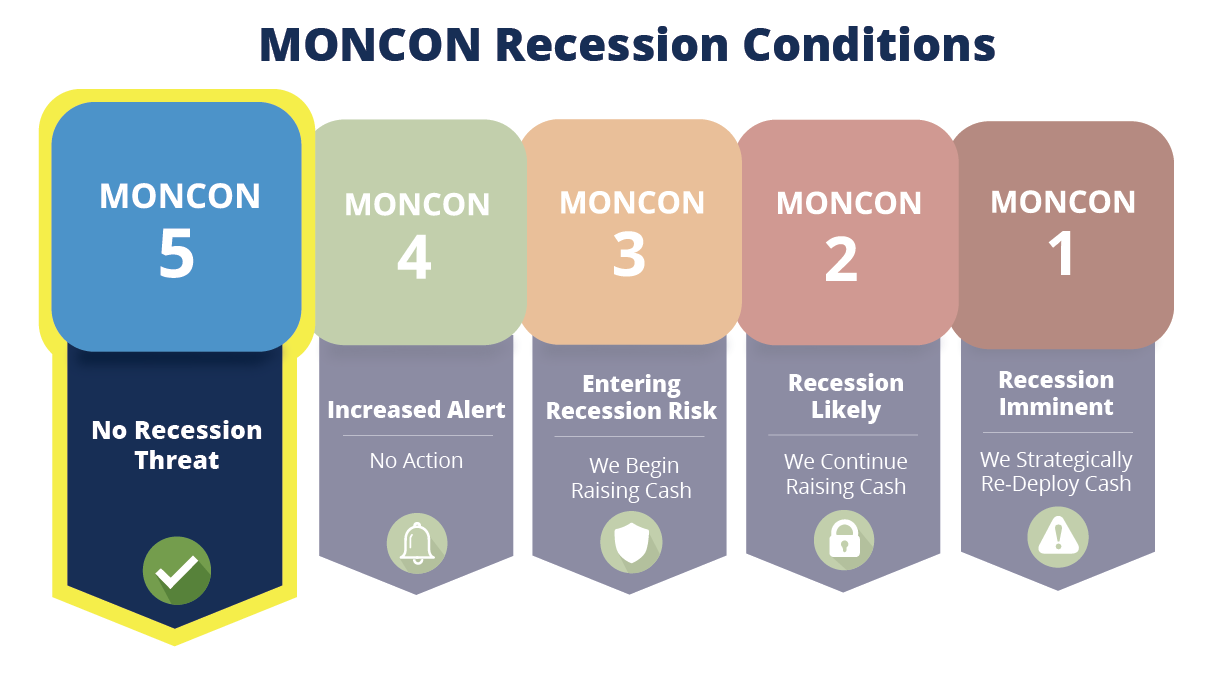

As for MONCON – Lately, we’ve seen some data that is not very good flow into the model. The model measures a lot of different things, so while the news may be bringing attention to some of them, the model remains at MONCON 5.

For those of you wondering if the model is broken or not reflective of reality, I counter with this…have you considered that it is right?

The S&P 500 was at 2,869.16 when the yield curve inverted (I’m using 8/27/19) and there was nothing but fear, human emotion and “Special Reports” on CNBC.

Today? The S&P 500 is at 3,039, an increase of 5.9%

For those of you who like the Dow, the reading was 25,777.90 on August 27…today it is just about 27,090, an increase of 5.1%.

People who reacted to the news or acted on a hunch and sold because the yield curve inverted have missed these returns.

Again – We will have a recession; I just don’t know when. But I’m tracking the PROBABILITY of one in the next 6 months. The data are just not moving the needle into a range that suggests the probability has materially increased.

If it moves to MONCON 4, I’ll let everyone know immediately. REMEMBER – MONCON 4 is not an actionable event, since it has a 50% chance of reverting back to 5.

Keep looking forward,

Dave

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice.

A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.