Okay, so the first ten trading sessions that mark the first two weeks of 2015 are now behind us and every talking head is focused on volatility… again. Yes, we have seen eight triple-digit moves in the Dow Jones Industrials over that time but a 100-point change just ain’t what it used to be. Nowadays, it only amounts to about a 0.60% change in the Dow. With the Dow now hovering above 17,000, a 100-point move is more of an old headline benchmark that just isn’t as relevant as when the Dow was near, say, 6,500, like in March of 2008.

Volatility

If I had a dollar for every time I’ve read or heard something about volatility being high or low since March of 2009, I’d by my biggest client. Do you know what volatility means to the investor who has done nothing except stick to a plan since the spring of 2008?

Squat.

Volatility will always be present but time will always smooth it out for an investor. If you are one of those option trading yahoos on CNBC, then okay, it’s important. But for the normal person, not so much.

An early career mentor of mine once told me, “Saying there is a lot of volatility today is like saying ‘Wow, there sure is a lot of gravity today’.”

His name was Robert Tanner and he was one of the best. He recently passed away but I’ll never forget some of the things he taught me. His lessons on volatility were invaluable. Over the course of my six-month MBA training program at Donaldson Lufkin & Jenrette, I made sure to write down some of my other favorite sayings he had:

- “There’s no monopoly on good ideas.”

- “Cash is a safe way to lose money.”

- “Don’t confuse stock trading with work.”

- “Someone that becomes your best friend in five minutes will become your worst enemy in five minutes.”

- “I don’t know about you, but I wouldn’t fall asleep watching Monday Night Football with my wife in the house if I saw my company’s stock fall over 50% with no hedging.”

The man had a way with words and an even better way of making a point. He was half Corporate Executive and half Marine Corps Drill Instructor… and equally intimidating as both.

Anyway, back to volatility. If January starts out as a negative return month in the equity markets, there are going to be a lot of reports and articles out for the rest of the calendar year reminding you of what historically happens with volatility. Some authors will look at data one way to paint a doom and gloom picture which will support their doom and gloom thesis. Others will paint a better picture by looking at the data another way to support their optimistic thesis.

While it is all going to be interesting reading, I say it’s probably all just a bunch of BUNK.

Here’s why. The market “is what it is,” as cliché lovers like to point out, and since it is not human or emotional at all, it will not care about what it has “usually done” in the past. Want some proof? I had about as close to a 2.0 GPA in high school as you could have and still squeak out a spot in the graduation ceremony. Based on that, and my co-leadership of the Senior Class prank, my high school teachers probably could have made a case that I’d end up being someone who never amounted to much. But I’ve proved them all wrong – just ask my mom.

You all want to know what the prank was, don’t you?! You are just DYING to know…

Okay, real quick. One of my best friends Jen and I gave each person one marble to hand off to the Principle in the “on stage” hand shake. At first, he started to simply place them in his pocket, but after about 150 marbles were in his pockets, he started to have to throw handfuls out of his pockets off the side of the stage. The class ROARED. Good times.

Back to serious stuff.

So far this year the small-cap stocks have been getting hit harder than the large-cap stocks, dividend payers are doing better than low/no dividend payers, and, well basically if it didn’t do well in 2014, it’s not doing well in 2015 either.

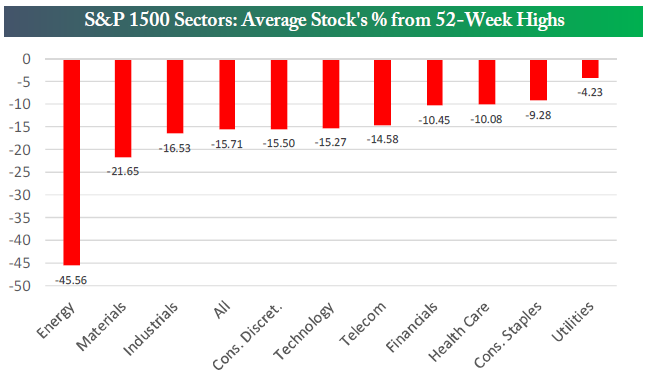

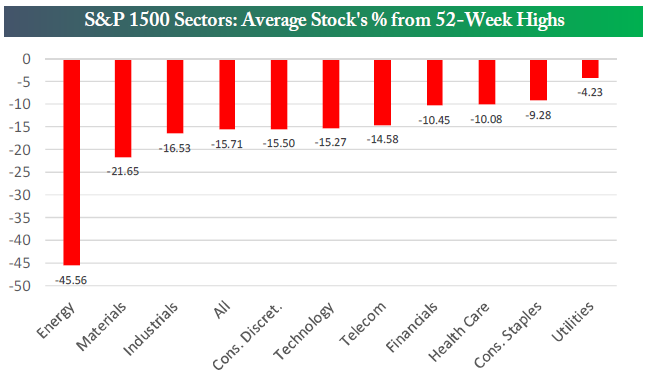

This weekend’s Bespoke Report showed a graph highlighting the ten sectors using the S&P 1500 rather than S&P 500 so as to reflect large, mid, and small-cap stocks of each sector. On average, the stocks in the energy sector are down -46% from their 52 week high, versus all stocks down -16% from their 52 week high. Ouch.

Earnings Season

“Wait, again?” you ask? “I just took down the tree last weekend and companies are already reporting?” Everybody loves earnings season. That’s why they have decided to have it four times per year! It’s like four football seasons per year.

Okay, that’s a stretch.

Alcoa reported last week, which is the traditional kickoff report for the quarterly earnings reporting. In this case, we are talking about public companies reporting how well they did or did not do for the fourth quarter of 2014. The big headline terms you hear are “revenue” or “top line sales,” and “earnings,” which are reported in terms of earnings-per-share (EPS) and are a function of net income. Sometimes you hear slick folks call it “bottom line.” The news and equity analysts will compare the reported EPS against what they all estimated the EPS would be. Everyone is either happy or mad and stocks trade accordingly. Companies also provide some information about how well they THINK they will do going forward, which is called “guidance,” or “forecasts.” This is what the analysts use to figure out what they think the EPS will be for the NEXT quarter. The cycle repeats.

I once knew a dude that had a lot of marbles in his pockets that never would have thought I’d ever be able to explain that…

Anyway…

Each quarter, companies revise their earnings estimates, which are referred to as “estimate revisions.” According to Bespoke, over the past four weeks, “analysts have lowered estimates for 278 more companies than they have raised forecasts for in the S&P 1500.” That number has only been roughly matched two other times in the past twelve months: October and February of 2014.

Why? Mainly oil. And the rising U.S. dollar. Low oil prices hurt the earnings of energy companies. As a made up example, if it costs a company $60 to extract a barrel of oil from the ground and it’s only selling for $45, that’s a problem for the oil company. Also as an example, the stronger dollar hurts companies with international exposure. Think of a U.S. big soda company that sells their soda overseas. It costs those people a lot more to buy that soda if the dollar has strengthened against their currency.

So what’s the good news? Well, Bespoke went on to research how well the S&P 500 does over the earnings season when expectations are low, like now. Drum roll please… the S&P 500 sees positive performance. Plus, I think the power of cheaper oil helps a lot more companies than it hurts over time, the consumer just got the equivalent of a HUGE tax break, and not all companies have international sales exposure.

I’ll have some more earnings news next week as big companies like IBM, Netflix, Starbucks, Union Pacific, McDonalds and General Dynamics report.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.