When Will the Next Recession Happen?

Last week we saw the yield curve invert and it sent the expected panic through the market. The big question now – when will the next recession happen?

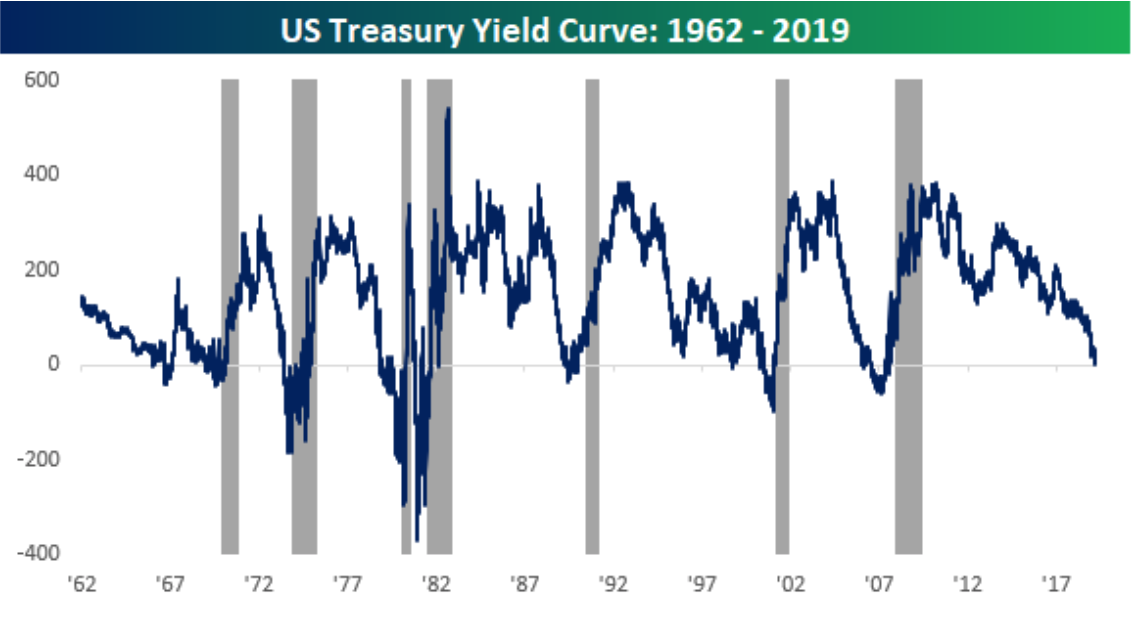

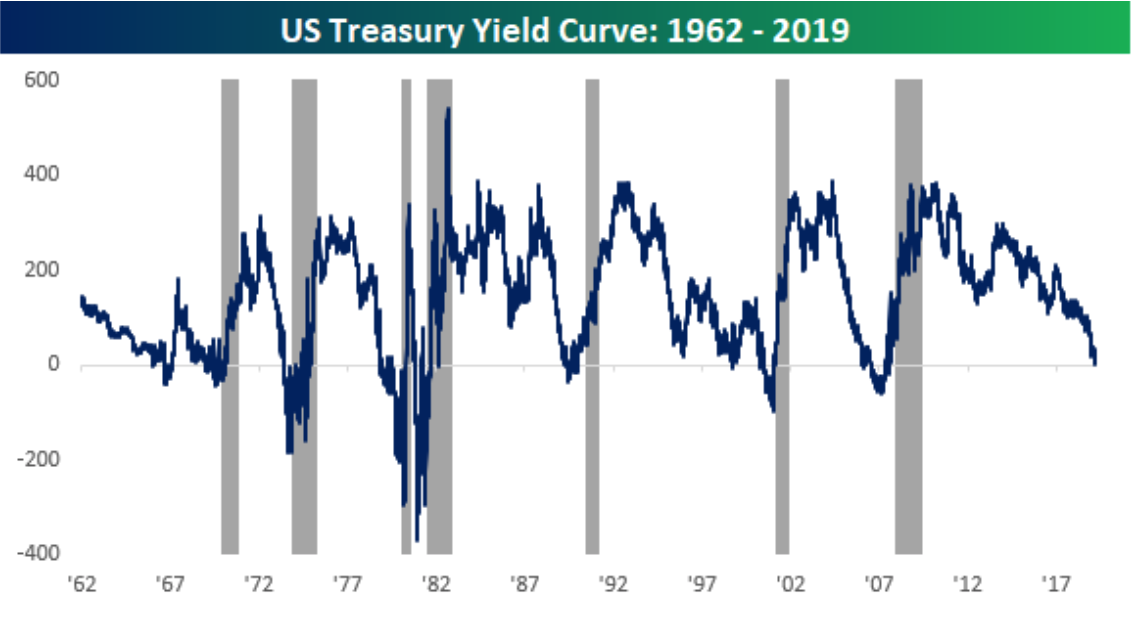

First, here’s what everyone freaked out about: the yields between the 10-year and the 3-month Treasuries went negative. Every recession since 1962 has seen this condition happen before the start of a recession; however, not every inversion has resulted in a recession.

While the 3-month/10-year Treasury spread inverted on Friday, the 2-year/10-year has not yet followed.

According to Monday’s TrendMacro report titled ‘The Curve Inverts, and a Growth Hawk for the Fed”:

“The 3-mo/10-year has a slightly better track record as a recession indicator, but not by much. If the 2/10 inverts, this will be the first cycle in which it did not invert first.”

The following chart from Bespoke is instructive.

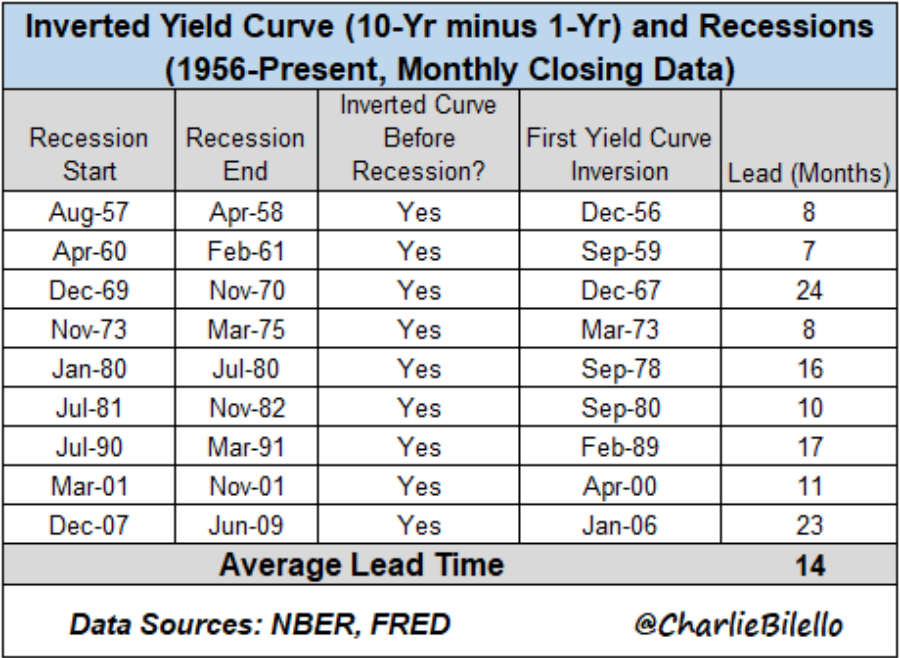

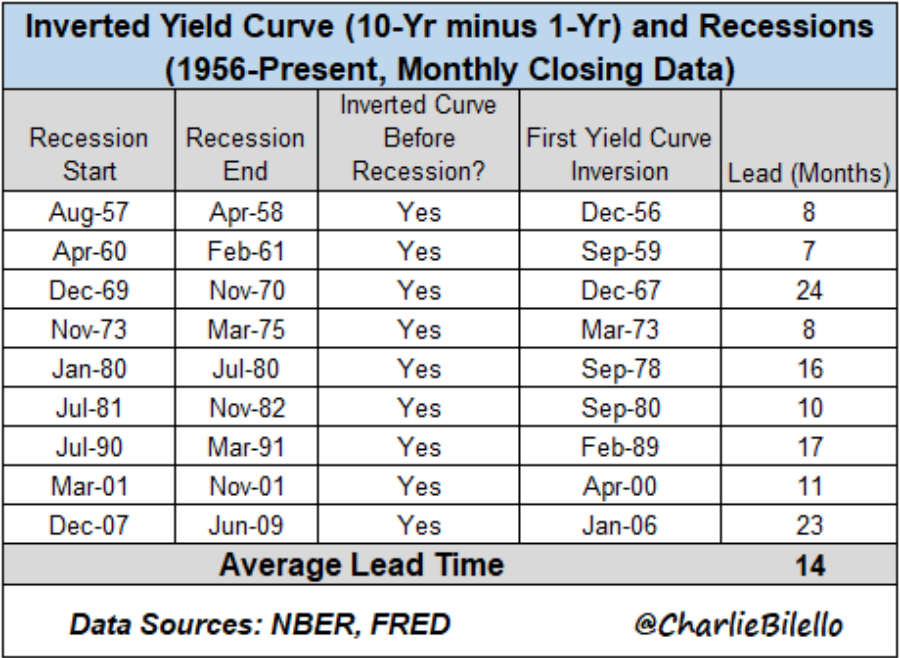

At issue is the timing of the recession. An inversion has been a horrible timing tool. As you can see in the chart below from Charlie Bilello (@charliebilello on Twitter), there is a lot of runway between an inversion and a recession. According to his analysis, the average lead time is 14 months…so, about a year. (Now admittedly, this chart shows the inversion of the 1 to 10-year treasuries, but still….)

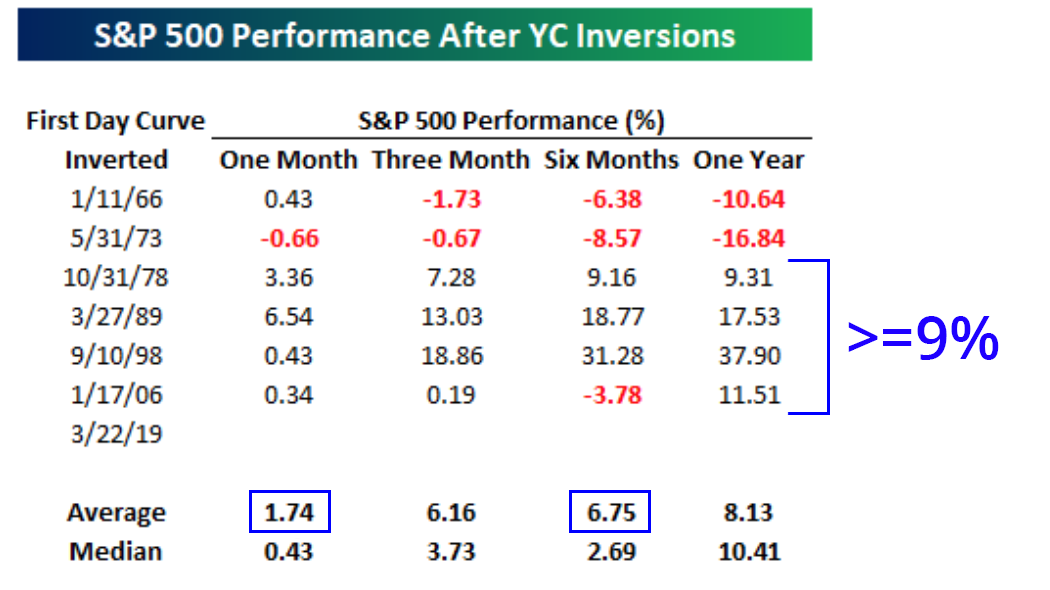

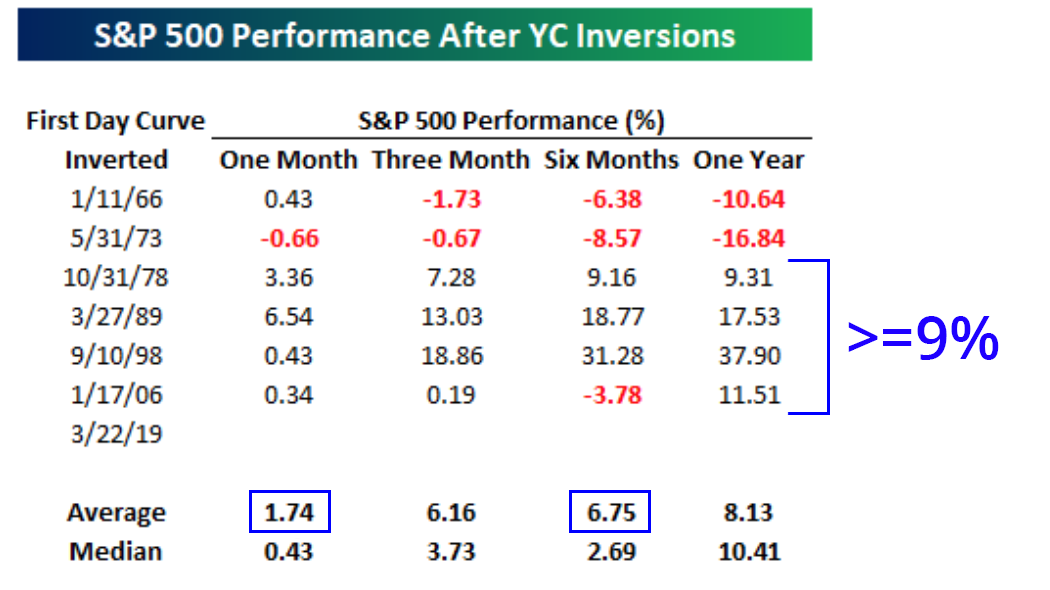

Now below (Source: Bespoke), you can see the performance of the S&P 500 after the first day the yield curve (any section of it) becomes inverted after long periods (500+ days) without an inversion. The latest run without an inversion was 3,030 days. As shown below, forward returns for equities are actually not all that terrifying.

Take a look at the month after the first day of an inversion and you’ll see the S&P has averaged a gain of 1.74% with positive returns five out of six times.

Skip over to the six-month column and you’ll see the index has averaged a gain of 6.75%, but this time positive returns are only observed half the time.

Finally, out to the one-year mark, the S&P was positive the last 4 times we had an inversion with gains of at least 9%.

Now – as an old saying goes, don’t get this twisted…the above Bespoke data is not predictive and I’m not suggesting that it is, but IT IS constructive to know the data.

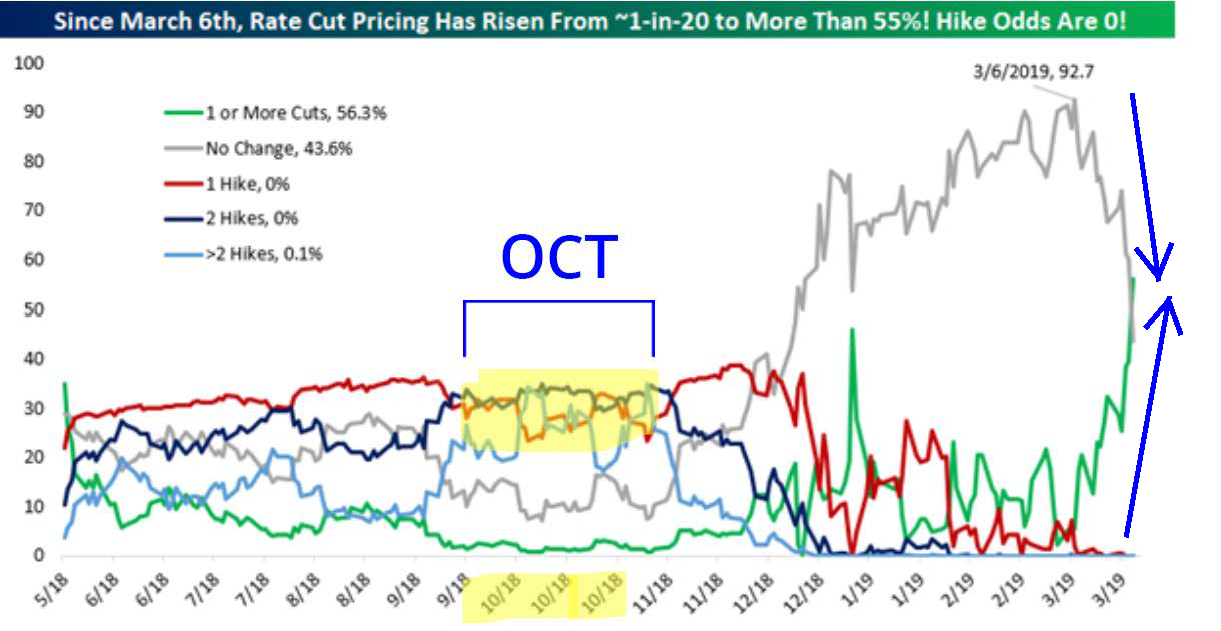

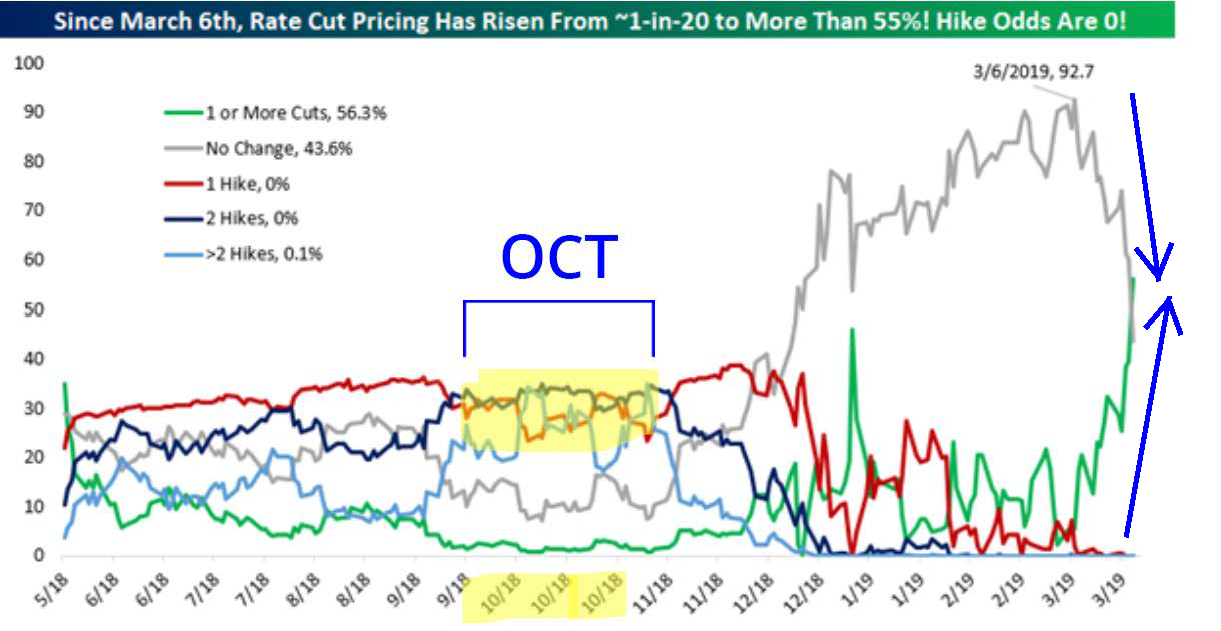

Let’s take a look at the Fed Funds Rate. As you can see below, the Fed Funds Futures market has gone from a 90% chance of no hikes in 2019 (gray line) to a more than 50% chance that we will see a rate cut by the end of the year (green line).

To put things into perspective, if you go back to last October, the odds of either one hike, two hikes, or three-plus hikes were all around 25%. (Trace the red, dark blue, light blue lines back to mid Oct and you’ll see that.)

Source: Bespoke

My Quick Thoughts

I mean look, I like to focus on probabilities, but…it’s fun to pick a side and people want to know what I think. So, in this installment of “Dave Takes an Educated Guess”, I offer this…

We are not heading into a recession. Yeah, yeah, yeah…the yield curve prediction rate is high, but I’m picking the number 15 seed against the number 2 seed here. I think the inversion is based on the EXPECTATION that the Fed cuts rates and I’m not feeling that. So, if they don’t cut, this inversion could be chalked up to expectations vs. economic conditions. Now, I may eat those words and I may have jinxed this, but I’m not convinced the economy is heading towards a recession.

Why?

Have you seen the existing home sales? The National Association of Home Builders reports? Initial jobless claims? Wages? ISM indices? Oil prices? Inflation?

Recession – I just don’t SEE IT. Slowdown? Sure. Recession? Nah.

MONCON

Now, that was fun, but it’s irrelevant. What does MONCON tell us?

In Oct of 2018 I wrote about how we look at recession: https://monumentwealthmanagement.com/weekly-market-commentary/how-to-forecast-and-manage-a-recession/

“People ask all the time when we think there will be a recession. I can say for sure that we will have a recession…the problem is I don’t know when. Clients and other readers are running “emotional fire drills,” but they want to know we have a plan and they want to know what it is now. While the yield curve has a great track record for alerting us to a future recession, it is not a good predictor of timing. Recessions are the real killer of bull markets and we want a simple way to let people know where we sit on the topic. This is why we have decided to publish a simple, multi-model based gauge.”

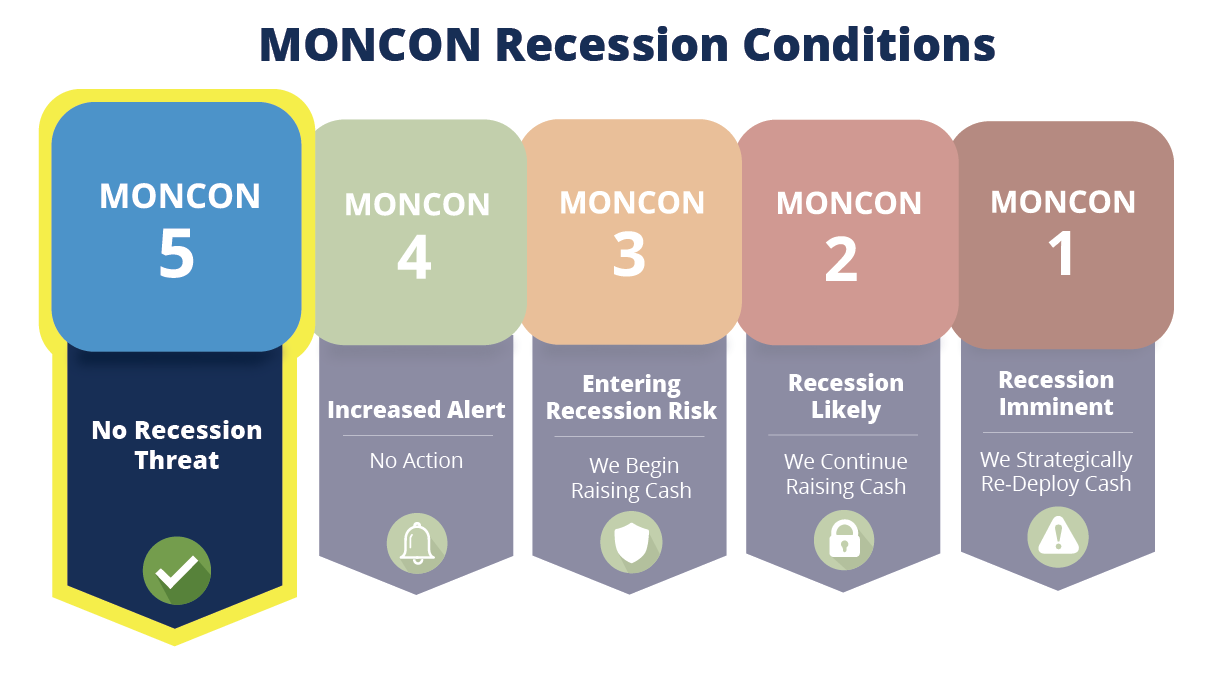

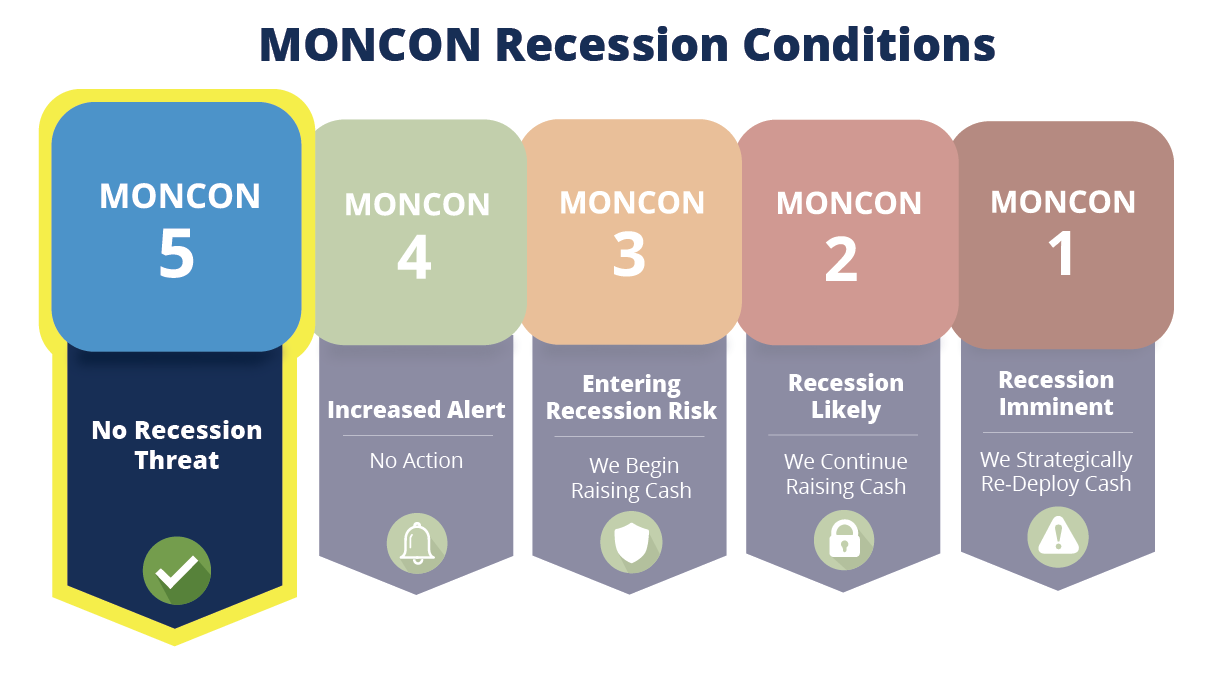

We call that gauge “MONCON” and the 6 input models are described in detail in the linked blog above. We try to make it elegant in its simplicity…it’s MONCON 5 to MONCON 1 with 5 being the lowest probability of a recession to MONCON 1 which indicates a recession is imminent.

It’s all about trying to assess the probability of a recession starting inside of a 6-month window. IT IS NOT ABOUT TIMING A RECESSION…it is about assessing the probability of a recession.

Right now, we are at MONCON 5. This means none of the 6 input models are in recession territory. That should make sense since an inversion has that 14-month lead time.

MONCON 5 – We are not taking any actions inside of our portfolios. When one of the 6 models move into recession territory, we move to MONCON 4 and so on.

MONCON 5 backs up my “Dave Takes an Educated Guess.”

The Media

REMEMBER – The news needs to feed viewers drama to keep them tuned in so they can sell advertising. Just look at the non-stop coverage of the Muller investigation…literally DAYS of coverage on a document that NO ONE had even read. Same with things like the coverage of an inversion…drama.

Imagine if the weather channel was running non-stop coverage over the prediction of a hurricane that may or may not show up in the late summer of 2020!

Focus

A recession is always coming.

A bear market is always coming.

In fact, both of them are always coming.

We just don’t know when.

So have a plan – it’s as simple as that. Go through the options I wrote about here: (https://monumentwealthmanagement.com/weekly-market-commentary/investing-how-to-look-ahead-in-2019-part-2/) Run fire drills…the market has rebounded nicely since Christmas Eve. Were you freaking out about the market back then? If so, fix your plan and your portfolios now. 18 months of cash need is a decent target to consider for planning. Your own personal situation will dictate adjustments up or down from that number.

And that is what we really need to focus on – the plan. We don’t know when a recession (or bear market) is actually coming.

So, we focus on the PROBABILITY of a recession inside of a particular window.

That’s what MONCON does.

Wrapping Up

Last week, I was out in Salt Lake City for the Barron’s Top Independent Advisors Summit. I was honored that Sterling Shea invited me to represent all of my RIA/Fiduciary colleagues as the Summit’s closing “co-keynote” for a topic titled, Regulation and Oversight – a View to the Future.

In an “Ask Me Anything” format, I sat down with Michael Piwowar, a former SEC Commissioner to discuss the regulatory landscape as we look out into the future of our industry. It was a great opportunity to get the answers to a lot of the questions I crowdsourced from the industry over social media. I’ll have a link as soon as it’s made available. Thanks again to Barron’s…it was humbling and an honor. And yes…I was in a suit. Shocking I know.

Keep looking forward,

Dave

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice.

A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.