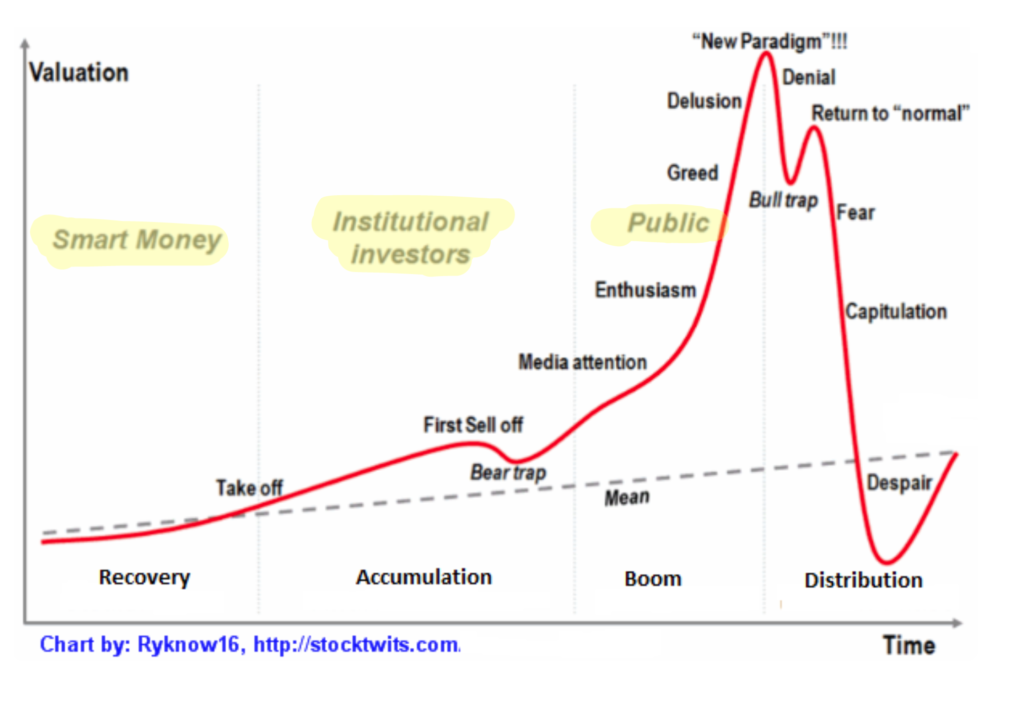

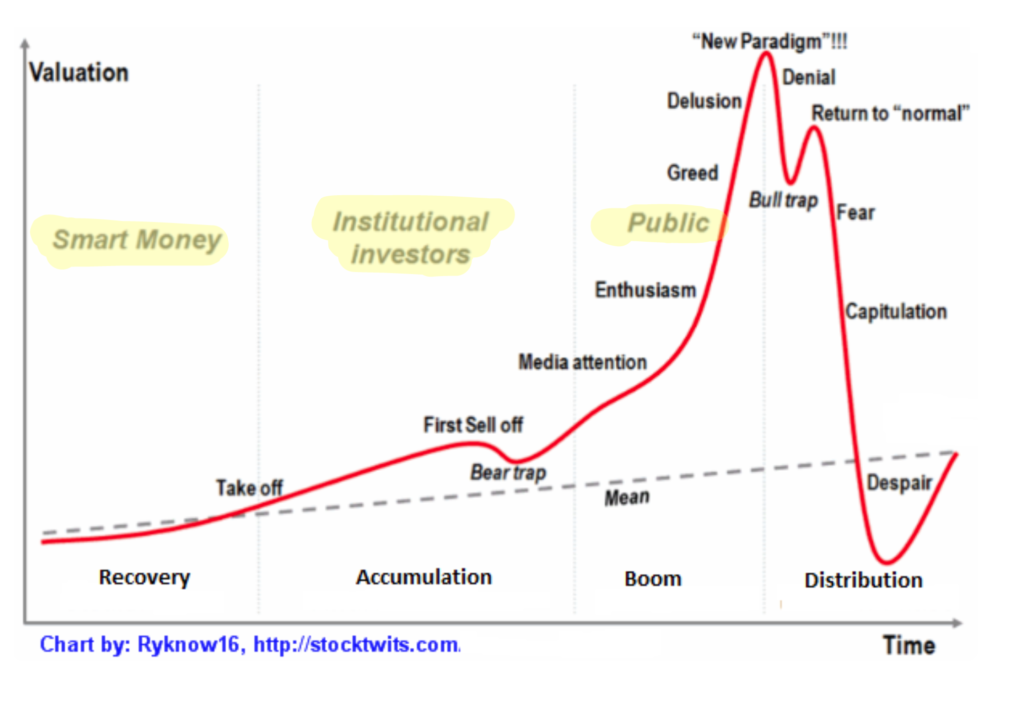

I think we are somewhere between Enthusiasm and Greed. Since I had someone ask about investing in Bitcoin, maybe closer to greed.

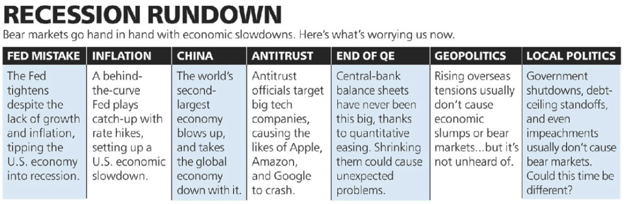

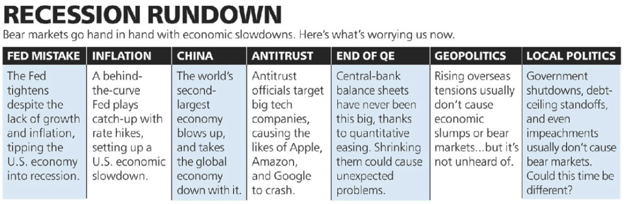

How do you know? Well that’s a “Million Dollar Question.” Barron’s had a great cover page article of some thoughts, but you have to have a subscription to read it…so the graphic I copied below shows some of the worries they address.

They provide no real actionable conclusion, but the theme is basically around the premise that while there are several things that can go wrong, its usually a recession that causes a bear market versus a correction.

Here are some quotes I took my highlighter to:

“Time to freak out about the imminent end of this great bull run? We think not. Neither longevity nor high stock prices, nor political turmoil usually are enough to send stocks into a protracted slide. The culprit in nearly every case is recession. The mystery is what will cause the next one. Fortunately, there likely will be plenty of clues.” – Author, Ben Levisohn (@ben_Levishon)

“During the past three years, the S&P 500 suffered a drop of 7.4% in less than a month of trading in 2014, an 11% tumble over six days in August 2015, and another 11% decline during the first 30 trading days of 2016. All three downdrafts, although frightening, turned out to be buying opportunities. Even the mother of all corrections—the 22.6% plunge in the Dow Jones Industrial Average on Oct. 19, 1987—was followed by a relatively quick snapback that saw the blue-chip benchmark hitting a new high in less than two years. “Those are steep corrections, not bear markets,” says David Rosenberg, chief economist and strategist at Gluskin Sheff.” – Author and David Rosenberg. (Emphasis mine)

Here is my favorite…

“In any case, if individual investors have an advantage, it’s that they needn’t buy and sell during a panic, if their time horizons are long enough.” – Author

Read that again…

“In any case, if individual investors have an advantage, it’s that they needn’t buy and sell during a panic, if their time horizons are long enough.”

I believe that while events can cause corrections (like in 2014, 2015, and early 2016 as mentioned above), I also believe it will be a recession that causes the next bear market. I’m on the record that while we have seen a tepid economy/expansion, I’m not seeing recession signs.

Corrections and Recessions are different. Markets falter all the time – they correct when they get extended based on too much enthusiasm, but recover so long as there is still a growing economy. Even if it’s a tepid economy.

Ask yourself these questions (I’m providing my answers, too):

- Have you seen a year-over-year increase in the Unemployment rate?

- Is the Treasury yield curve inverted?

- Noticed any sharp increase in the inflation rate?

- Do you think the Fed is raising interest rates too quickly?

- No. They could…but they haven’t yet.

- How about a year-over-year decrease in corporate earnings?

- Nope. In fact, it’s the opposite with a 12% increase in the last quarter.

- Is confidence high?

What to Do

The problem is that I’m reading your mind…your emotions are telling you that maybe it’s time to get out. Your gut is telling you that you should be DOING SOMETHING. Selling, raising cash, taking chips off the table, reallocating into some sort of B.S. hedge fund strategy…something.

Don’t. Here’s why…

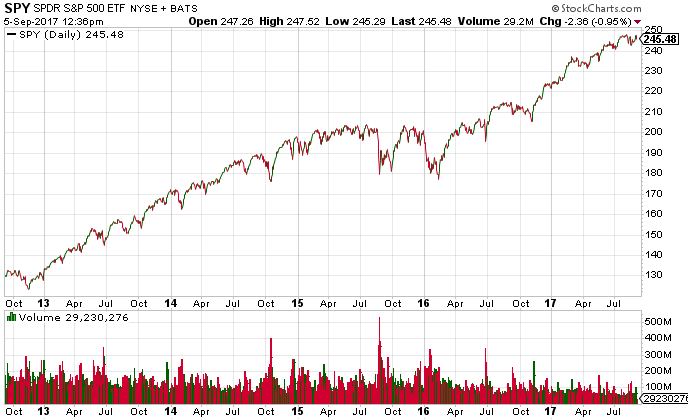

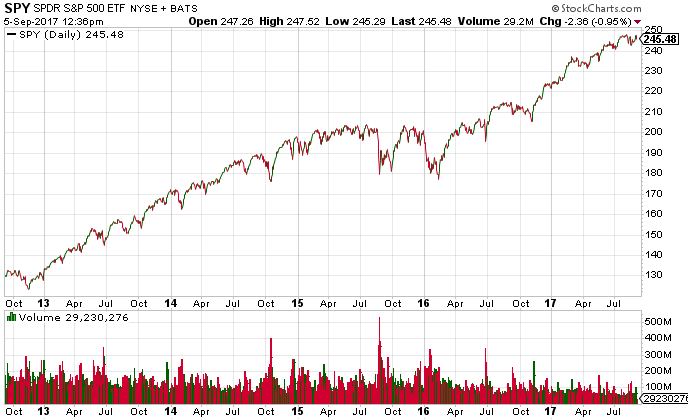

IT WILL BE A TOTAL GUESS. Then you’ll need to guess to get back in. If you look back over time in this chart below (and it’s only 5 years), do you think it was easier to just stay invested or try to get in and out? (I’m not even factoring in all the short-term taxes you’d probably pay getting in and out.)

If you have a long-term plan and investing horizon, just stick with it. I get it that the market seems extended, but it’s impossible to guess if that means it will correct or if earnings will continue to increase to make the valuations seem more reasonable.

This is Important

I think there is still a very, very good chance we see tax reform get done. The Republicans simply cannot fail on that leaning into the 2018 mid-term elections. And they know it.

Bonus points if they can get enough Democrats to vote for permanent tax reform. THIS IS A DISTINCT POSSIBILITY IN MY MIND. Here’s what I wrote in May of this year about the one-page tax idea floated by the Administration:

“In fairness, it’s a one pager…but I find one component interesting and it’s the deductibility of state and local taxes. This is a big deal in the states that have really high state and local taxes because if residents in those states can’t deduct them anymore, that’s bad for them.

States impacted? Well, according to TrendMacro, 50.5% of the aggregate tax deduction amount is shared by 6 states…California, New York, New Jersey, Illinois, Maryland and Massachusetts.

All blue states.

Since the Republicans in the Senate can pass tax changes for 10 years without a single Democrat vote, it’s possible that this becomes a huge negotiating point. The Republicans COULD offer to strip removal of state and local tax deductions out of the plan in exchange for some Dems to vote for the final package. With 60 votes, the tax reform could be permanent and not just 10 years.

The 10 Dems fighting for 2018 reelection in states that Trump carried in the election could be interested in this – especially if the other option is losing the state and local deductions for 10 years in 6 big blue states that make up 50.5% of the aggregate amount. In that case, big blue states lose at the expense of red states.

That’s a tough pig to put lipstick on.

I think there could be a good chance we see permanent tax reform with 60 votes on a package where the Republicans add the ability to deduct state and local tax back into a final Tax Reform package. (*I rewrote this sentence from the original post for clarification. The original sentence in the original post remains the same.)

That could be a catalyst for a continuation of the current rally.”

I’m on the record saying that Tax Reform will get done and I’m on the record that it’s possible it could be permanent. I’ll add that if there is an Infrastructure Bill passed, that will be good for the markets too. Throw in some deregulation and there is a lot more good than bad going into the economy and the markets.

Oh, and I hate to suggest that the economy could get a short-term boost from the catastrophe in Houston, but it probably will. 500,000 to a million cars will need to be replaced, building, stimulus spending on the recovery efforts…it’s going to give the economy a boost.

Some day we will see a recession, but not soon.

Stick with your plan.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.