You know we are in an economic expansion, right? Yes, despite the recent drawdown in equity prices and recession fears we hear about in the news, we are in an economic expansion…and remember, a slowdown is not the same as a recession.

How much further can the U.S. expansion go? Frankly, no one knows. It could extend beyond the consensus of 2020.

Here are three reasons why the U.S. expansion has more room to run:

1. Most economic sub-cycles are only near their midpoints.

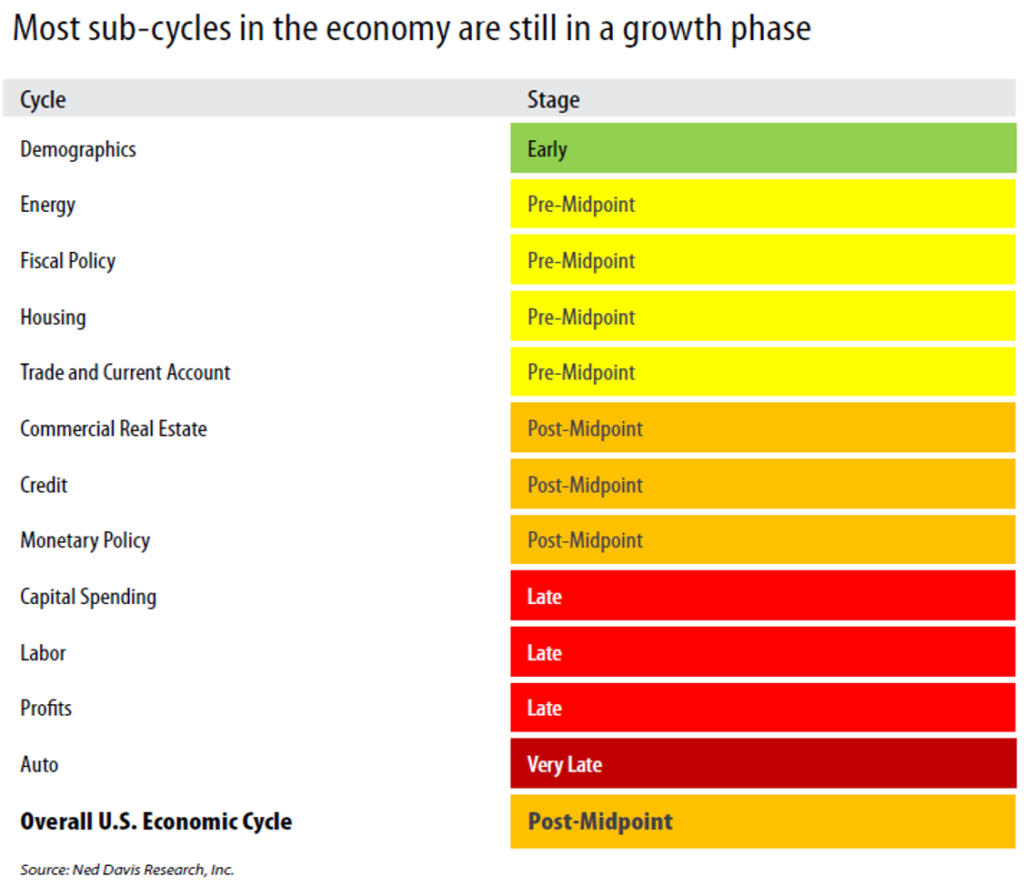

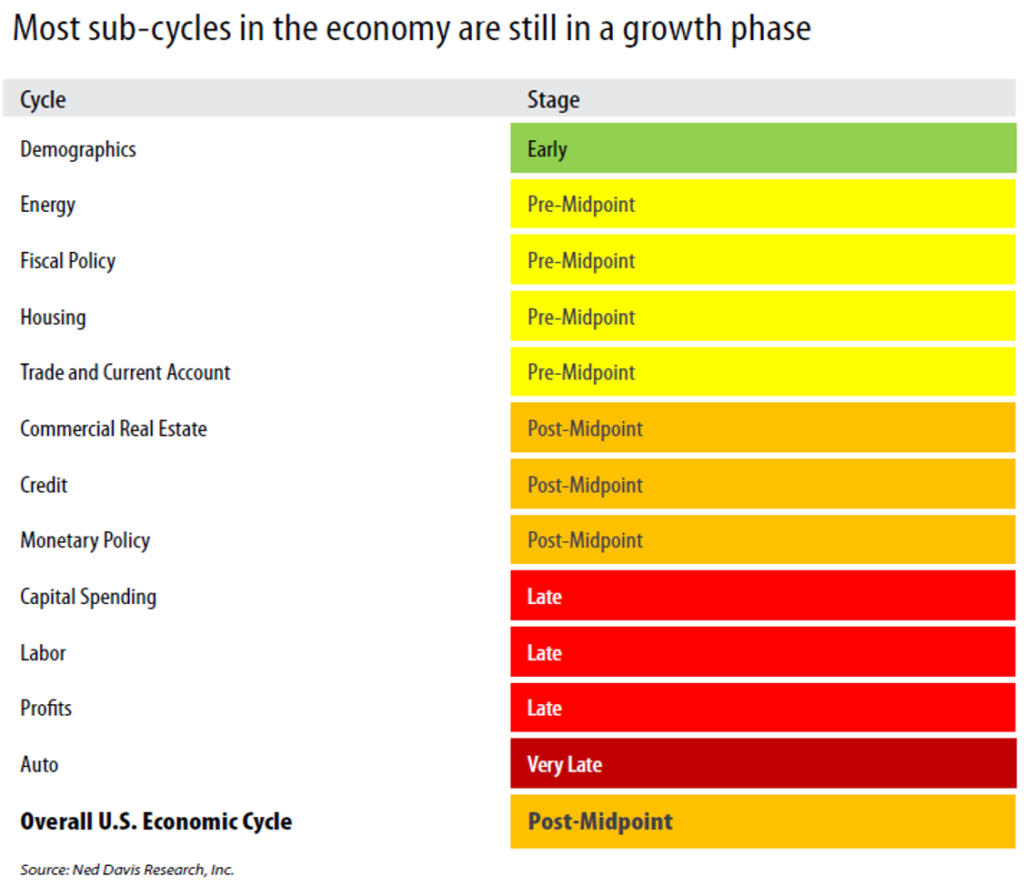

The U.S. economic cycle contains sub-cycles in specific areas, like credit and housing, which move from peak to trough over a complete a cycle. Looking at these sub-cycles can show where we are in the overall economic cycle.

I came across some Ned Davis Research which did a nice job of contextualizing the different sub-sectors and where they are in the cycle. As you can see, most sub-cycles are still relatively young. Sure, there are exceptions—autos, capital spending, profits and labor all are late-cycle—but in total, the sub-cycles suggest the overall U.S. economic cycle is, age-wise, merely beyond its midpoint.

2. Debt creation is lacking.

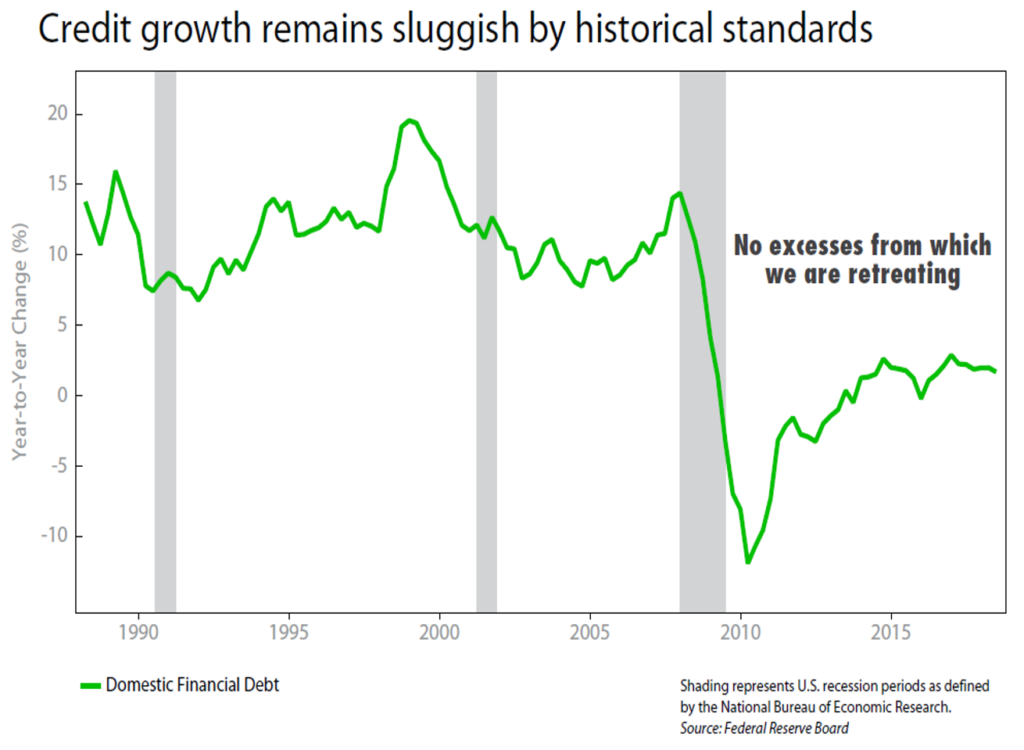

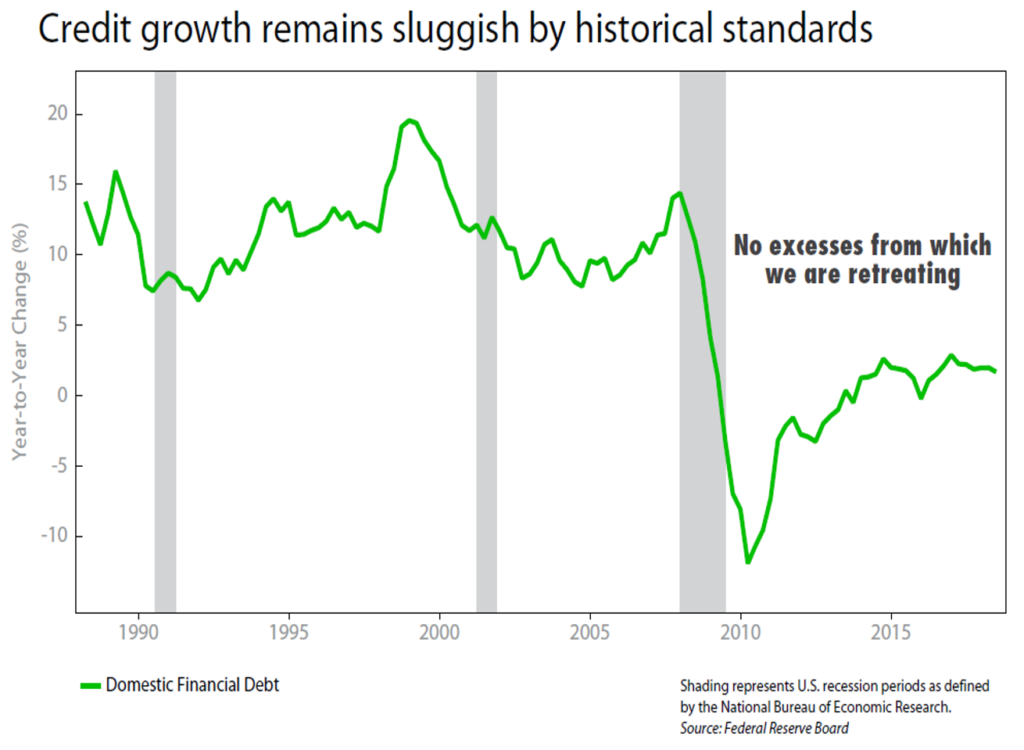

By historical standards, the growth in debt remains slow. Again, from Ned Davis, you can see from the chart below that debt is growing less than 3% annually, which is well below the double-digit rates we have seen during past expansions. This lack of debt creation also reduces the risk of a recession since, as they point out in the chart, there are “no excesses from which we are retreating.”

Everyone knows The Fed has been raising interest rates, but sometimes I think people lose sight that there have been nine hikes since the end of 2015. This acts to increase the cost of borrowing and slows the rate of debt taken on by both businesses and consumers. The Ned Davis report goes on to explain that over time, these hikes have slowed the rate of debt creation by businesses from 9% in 2015 to a current level of only 4.6%.

That’s a big drop.

It’s true that a lot of folks are concerned with the high level of debt (they are clearly not politicians). It’s argued that while new debt creation has slowed, total credit market debt of $70.7 trillion is high relative to GDP at nearly 350%. This could drive investor concern as interest rates rise. However, debt relative to net worth has been falling for households and has been relatively stable for businesses. That’s a signal of a lack of excesses that would typically lead to recession.

3. Consumer confidence remains high.

Consumer confidence, which is driven by a combination of jobs, wages, the stock market and housing prices, remains high. This is another buffer against recession. Remember that the American consumer drives more than two-thirds of the economy.

The 2017 Tax Act seems to have improved consumer confidence. Lower individual income tax rates led to American consumers having more disposable income, which boosted their spending in 2018. In fact, new sites report that in the third quarter, consumer spending grew at around a 3.6% annual rate. That’s in line with the average, BUT, consumer spending over the past two quarters was the strongest it has been in the United States since early 2015.

We’d need to see a big decline in consumer confidence before anyone could presume that consumer sentiment could trigger a recession. The Consumer Confidence Index, a measure of how consumers feel about current conditions and the future, typically drops sharply before recessions. Right now, confidence remains high and seems far from collapsing.

MONCON Level

We remain at MONCON 5. See more in our recent blog post. It’s not designed to call a recession, but rather to alert us to the increasing probability of a recession. Since the model is not signaling that the probability is increasing in any meaningful way, a U.S. recession doesn’t appear to be around the corner.

So WTF? Why does everyone seem so BEARISH?

In a nutshell, everyone thinks that tighter government policies will plunge us into a recession. Throw in some consternation over trade tariffs and fear over how long the current expansion has been going on and you have a recipe for a conclusion that predicts a recession right around the corner.

I just don’t see it that way. It’s not illogical; I get the extrapolation taking place. It’s just that the data are not supporting the emotions…and emotions are still very raw from 2008.

I do think that there will be some slower economic growth going forward. We could see the current GDP growth slow from 3% now to around 2% in the next year. That’s not a prediction as much as it is an example…because 2% is a far cry from recession.

Keep in mind that from 2007 to 2009, GDP nosedived by -5.1% from peak to trough. By December 2008, GDP had collapsed to a -8.9% annual rate. Of course, stocks followed suit over that time…everyone remembers the -50% (roughly) drop in equities.

Again – that is a FAR CRY from a slowdown from 3% to 2% GDP growth. Economic expansions don’t die of old age, but rather from over-investment, tighter financial conditions, and shocks. None of these factors currently exist.

What To Do Now?

Most people’s problem isn’t so much a lack of vision, but the fact that they keep looking down.

We’re well aware of the triggering, panic-inducing ride that the market can present for investors. But unless you were trying to become rich overnight (which we advise strongly against), the day-to-day shouldn’t be causing you a spike in adrenaline or a dark spiral into despair—or worse, a series of recession fear-based decisions and reactive behaviors that cause you to get in your own way and obstruct the path to wealth.

We work with our clients to shovel that path clear, so they know exactly where they’re going. And every time you let external factors affect your mood or decisions, it’s the financial equivalent of plowing yourself in; you’re going nowhere fast.

Your behavior, not the market, determines your success with us, and everywhere else. And we believe that if you can keep looking not just up, but out at what’s ahead—instead of down (at your phone, at the market, etc.), and trust the path you’re on, you will get where you need to go.

Our conviction remains the same…pullbacks like this are best ridden out by relying on a cash cushion that every investor should have. If you have a need for money NOW, you should be using your cash cushion…removing any need to sell for cash during a correction. A cash cushion allows you to look at the landscape “peak to peak” rather than “up from the valley.”

Ben Carlson penned a great blog post the other day called “Prediction vs. Preparation.” This one made me say “Yasssssss.” Here’s a blurb:

“Prediction is about trying to be right while preparation is about setting the right expectations. And investing has a lot more to do with setting reasonable expectations than being right all the time because it’s hard to be right in the markets.”

And man let me tell you there are a lot of folks out there with completely misaligned expectations! We have a saying here:

“It’s better to prepare than to repair.”

You need to know what the right amount of cash is to get you through the inevitable downturns in equities.

If you are not already a client, we can help. In fact, if you need help and Monument is not the right solution, I WILL HELP YOU MEET SOMEONE ELSE WHO CAN HELP. I have a ton of friends that I like and trust and I’m more than happy to connect you. Seriously.

Keep looking forward,

Dave

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice.

A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.