A lot of people seem to be asking some version of the question, “What should I do to my portfolio if the virus continues or Biden wins the election?”

Basically, what people are REALLY asking is, “Should I sell equities in my portfolio because I think the market is going to go down?”

Well, it depends. Let’s review some things.

Building your strategic equity allocation

We recommend that clients maintain or even build towards their strategic allocation to equities inside of their portfolios.

Here are three reasons:

1. We still think that there is upside in the market for the rest of the year.

2. Our suspicion is this recession will likely end (or maybe has already ended) with an economic expansion that could last for several years, making equities a better asset class than bonds or cash.

3. While there are many risks out there in the market, those risks are likely to cause short-term market volatility rather than any serious disruption to a strategic equity portfolio.

Our optimism regarding equities is centered around better-than-expected economic growth, better-than-expected corporate profit growth, low inflation, and interest rates that are way lower than anybody expected with no sign of going up.

As it relates to our thoughts on the rest of 2020 (reason one above), the market usually has a nice seasonal tailwind at the end of the year, and December has, statistically and historically, been a very strong month.

Our recommendation to stay invested in equities is reinforced with how well the equity market has performed over past economic expansions (reason two above). A recent Goldman Sachs report highlighted that the S&P 500 has generated positive yearly total returns about 87% of the time when the economy is growing.

Not bad odds.

Additionally, when you look at the history of economic expansions, the cumulative gains in the equity markets have been pretty large…so even though we have had about a 50% equity rally since the March lows, it’s not unimaginable that we could continue to see additional growth over the next few years.

In other words, don’t think because the markets have rallied +50% that they can’t continue.

The possible downside

Okay, let’s also be realistic…it’s true there could be downside if the virus shows resurgent growth and becomes much more disruptive than anyone expects. There is also the risk and downside of unfriendly tax regulation after the election.

Specifically, it would be the response to any virus growth that would present the most risk. While there have been a few spikes in case rates over the past few months, none of them have been severe enough to require a renewed economy locked down. If economic lockdowns were to happen again, that would certainly be a risk to our optimism about the equity market.

Shifting focus to the U.S. elections, there are definitely some concerns about a Biden presidency as it relates to any sort of tax policy change, and there have been recent concerns over the possibility of a disputed election.

While changes to the corporate tax rates could be a risk to the equity markets, we think that any change to the tax code would more likely be phased in over several years rather than just a wholesale change all at once. We think it is illogical for any new president to come in and immediately disrupt what is already a fragile recovery in the face of fighting the virus.

If Biden wins, he will start thinking about his 2024 campaign on November 6th, 2020…and remember, few things are more damaging to a sitting president’s reelection chances than a bad economy.

What if there’s a tax code change?

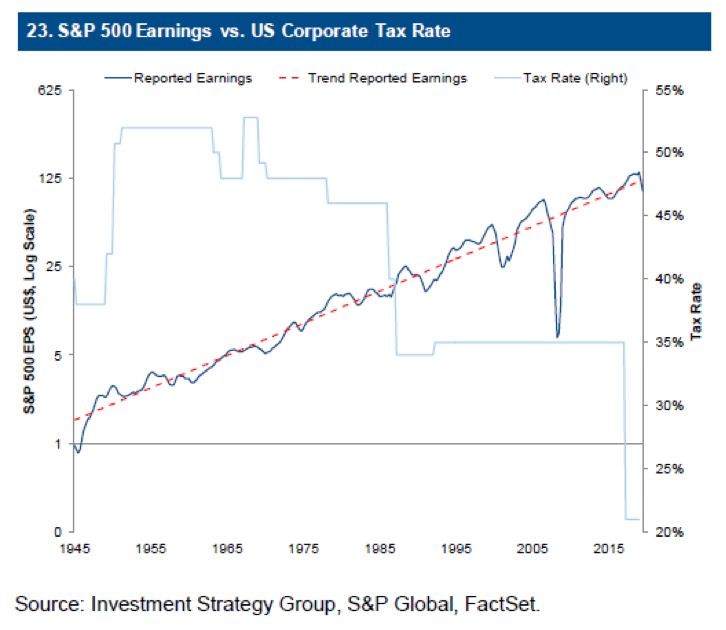

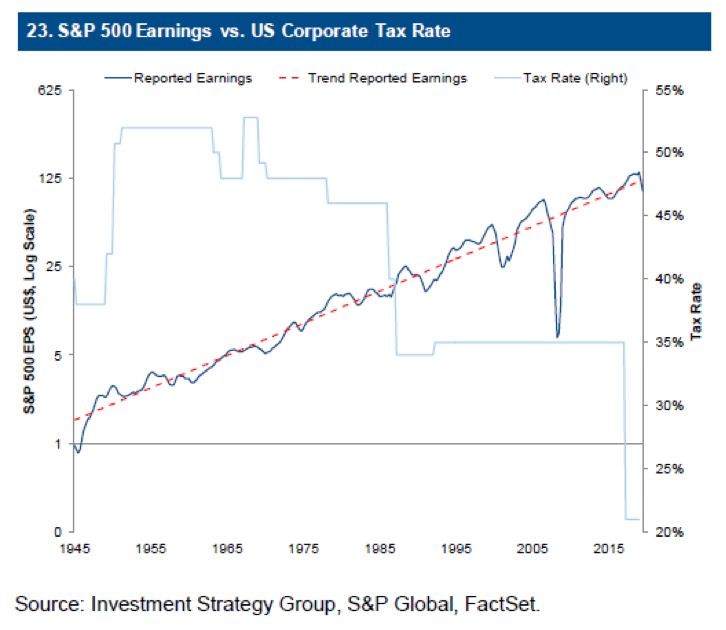

Interestingly, this chart from Goldman Sachs shows that the rate of change in corporate earnings power and the trend of reported earnings are relatively unaffected by tax code changes.

So, while those risks could be disruptive enough to cause short-term market volatility, we don’t think they are enough to reverse what should be a terrific longer-term economic expansion going forward out of this recession.

Plan for the long-term while protecting against short-term volatility

To sum it all up, we just don’t think that the odds of the risks outlined above are great enough to recommend changes to long-term strategic equity allocations or long-term financial plans.

Short-term, sure, we could see some market whipsaw, but equities are going to advance longer-term on the back of the massive monetary stimulus, continued positive economic growth, improved corporate earnings, continued progress on fighting the virus, vaccine advancement and improving hospital treatments.

So, hold or continue to build towards the strategic equity allocations you have in your wealth plan and continue to model a mid-range, single-digit annual equity growth rate. Equity returns will always be volatile, but they are likely to be better than rates of returns anyone can expect in the cash or bond markets over the long-term foreseeable future.

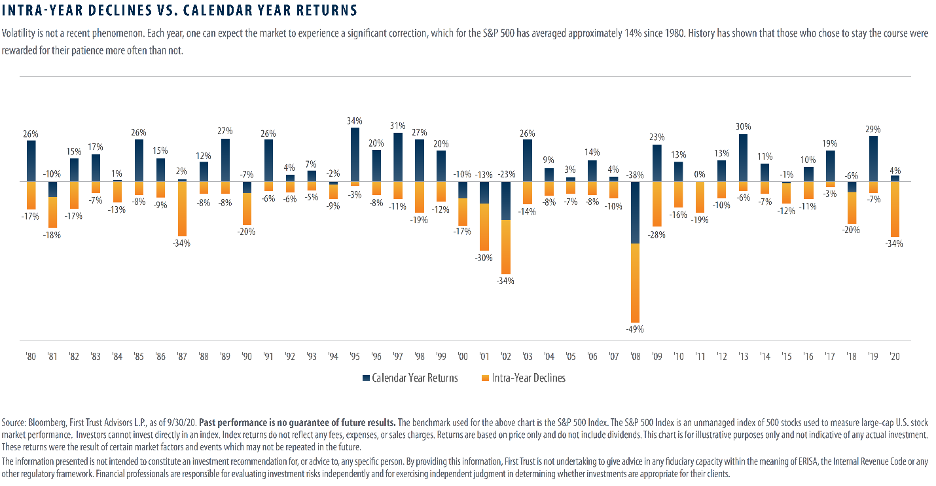

Remember, there will ALWAYS be market volatility, so investors need to reduce the risk of short-term volatility impacting their lives by having cash and using it as a cheap hedge…a hedge against both losses AND against panicked decision-making.

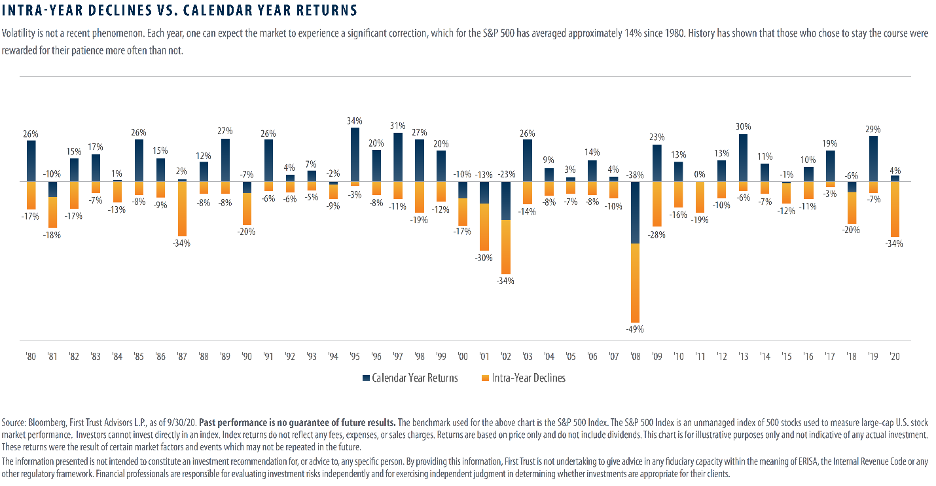

In the chart below, you can see that EVERY YEAR since 1980, the S&P 500 has had a negative correction that moves the index into negative territory for the calendar year, yet only NINE of those years also had an overall calendar year loss. (Chart: First Trust)

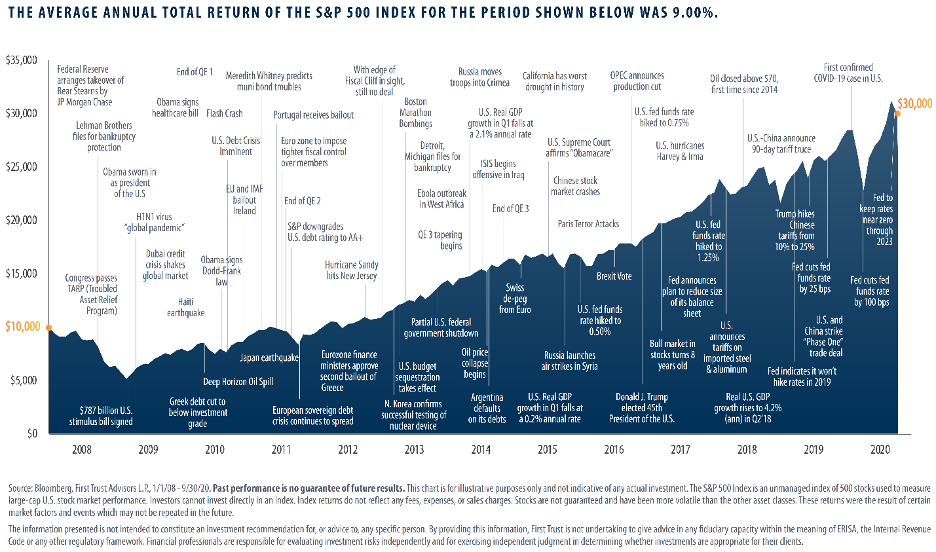

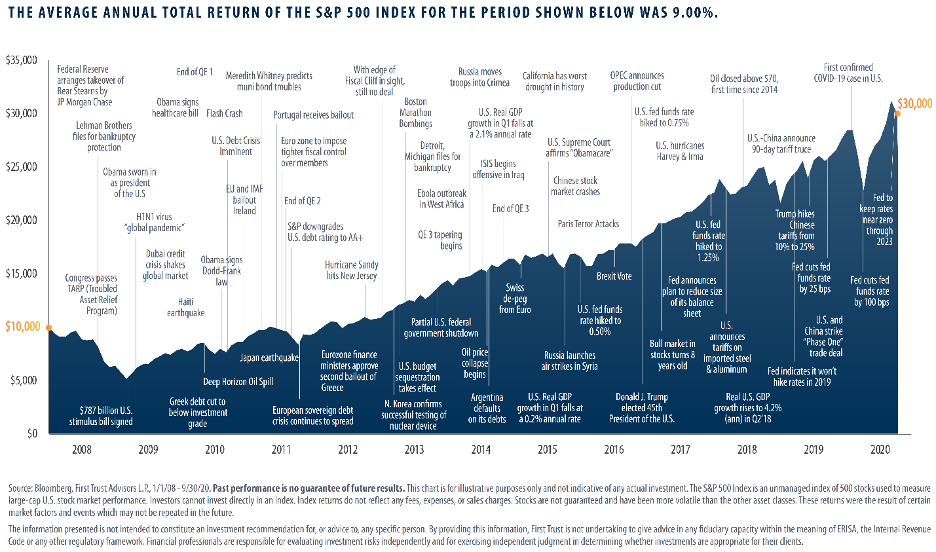

The reality is this – regardless of the press attention that surrounds elections, there are plenty of events EVERY YEAR over the past decade that could have caused an investor to have concerns…In fact…(Chart: First Trust)

As always, the most important thing an investor can do is forecast their cash needs for the next 12 to 18 months in order to reduce any impact that short-term volatility can have on an overall financial plan and an investment portfolio.

We simply cannot stress enough that forecasting and maintaining 12-18 months of cash is the most important thing investors can do when it comes to wealth planning.

This way, if the market whipsaws around after the election, you won’t have any anxiety about having to raise cash amid event-related volatility.

Keep looking forward,

What’s Next?

IMPORTANT DISCLOSURE INFORMATION

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Capital Management, LLC [“Monument”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument.

Please remember that if you are a Monument client, it remains your responsibility to advise Monument, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request.

Please Note: Monument does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Monument’s web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Please Also Note: IF you are a Monument client, please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.