First and foremost, what happened last weekend was horrible and our hearts go out to everyone impacted by this terrorist attack. I hope that the world sees peace at some time in my remaining life. People are putting themselves in harm’s way every day trying to keep us all safe. We remember them too. It’s a sad world we live in.

Now to the Markets

Ugh – last week was a 3.6% setback in the S&P 500. While retail sales were the main headliner, there was also earnings news and general malaise over the usual suspects like valuations and the Fed raising rates. Seems like it was just a few months ago that the markets didn’t like the fact that the Fed was not raising rates, and now it seems like the market is fretting over raising rates.

You know what that means? Worrying about the Fed is, and I use this word with all seriousness, stupid.

Retail Sales

As for consumer spending / retail sales, I have a bullet list of thoughts:

- My belief is that housing and cars drive the economy more than anything else. I talk about it more in this video.

- I haven’t been to “the store” in years, yet just this week I have purchased a new vacuum, refrigerator, microwave, metal folding chairs, snow boots, dog food and a lamp…all online.

- Have you been to Macy’s lately?

- How about Best Buy?

- Sub-sectors of the retail space that have performed well relative to others are auto, home-related and internet retailers.

- Go re-read the first two bullets.

- I think this is more about WHERE people are spending vs. whether they ARE spending.

- Post-2008, people are saving more money. It’s just a fact.

- Wages are growing, so people are making more money.

- Just because traditional retail stocks look like a disaster, it does not mean the consumer is a disaster.

Earnings

Over 2,400 companies have reported their third quarter (Q3) earnings. While Alcoa’s report is the traditional start to earnings season, Walmart’s is the traditional end. That report comes out tomorrow, November 17th.

The percentage of companies beating their revenue estimates for Q3 of 2015 stands at 47% which is currently WAY below the average of the 60% that we’ve seen since 2000. It’s been a really poor showing for revenue over the past three quarters and we have not had a revenue beat rate this low since 2012.

The percentage of companies beating their earnings estimates stands at 60%, which is below the average of 62% dating back to 1998.

Bespoke publishes a chart that shows the spread between companies guiding future earnings higher or lower on a percentage basis. Up until Q1 of 2014, the spread had been negative for the TEN previous quarters, meaning there were more companies stating they would earn less in the upcoming quarter than the same quarter a year prior. That was 2.5 years of pessimism coming out of corporate America.

After two flat quarters in Q1 and Q2 of 2014, we saw Q3 of 2014 revert back to a negative reading, and this reading never looked back. The current reading for Q3 of 2015 shows that the spread between companies posting negative guidance versus companies posting positive guidance is at -4.0%. This is far from the worst spread reading which stood at -9.4% in Q4 of 2014, which was the worst reading since the last two quarters of 2008…but still negative

Of the last 17 quarters, two were about flat and the rest were negative. It’s interesting to me that companies are guiding lower as the market goes up. If I see this invert, it will have my attention – it could be a good indicator of corporate over-confidence.

More About Earnings

I understand that a lot of the earnings data above is repetitive. The reason for that is because not everyone reads the blog every week and I think earnings data is important.

But what about digging in? 2,400 companies is a lot, so I took a look at the earnings of just the S&P 500 stocks. It turns out that on a year-over-year basis, (meaning comparing now to this time last year), both revenue and earnings appear set to decline.

What About Q4?

- Revenue – For Q3, Energy and Materials had the worst year-over-year drop in revenue (sales) while Telecom and Health Care reported the highest year-over-year growth in revenue.

- For the 2,400 companies, the worst are Materials, Utilities and Industrials and the best are Telecom, Tech and Health Care.

- Earnings – For Q3, Energy and Materials had the worst year-over-year drop in earnings while Telecom, Health Care and Consumer Discretionary reported the highest year-over-year growth in earnings.

- For the 2,400 companies, the worst are Utilities, Materials and Energy and the best are Telecom, Tech and Health Care.

You really have to look close at how the Energy sector is impacting the overall revenue and earnings picture because, according to FactSet, this sector is the biggest contributor to the projected Q4 earnings and revenue declines. Oh, and for all of 2015 too.

Energy revenue and earnings are expected to decline -34.2% and -64.3% respectively for Q4, and by the end of 2015 are expected to be -34.4% and -58.5% respectively for the entire 2015 calendar year. What happens if you remove Energy from revenue and earnings? For Q4, revenue and earnings growth would be +1.2% and +1.6% and for the 2015 would be +1.9% and +6.9%, respectively.

Health Care got clobbered in the August downturn yet is the second highest earnings growing sector of the ten S&P sectors. Five of the six sub-sectors reported growing earnings. What’s the best sub-sector? Biotech. Health Care also has the second highest revenue growth of all ten sectors.

Finally, let’s talk about Consumer Discretionary (CD). As mentioned above, this sector has the third highest earnings growth. According to FactSet, there are 31 sub-sectors in the CD sector and 18 of those sub-sectors have earnings growth. Of those 18 sub-sectors, 12 are showing double digit earnings growth.

Let that sink in…almost 40% of the sub-sectors in the CD sector are reporting DOUBLE DIGIT EARNINGS GROWTH.

What sub-sectors lead? Oh, just Automobile Manufacturers, Internet Retailers, General Merchandise Stores and Home Furnishings. So in other words, housing and cars.

So Now What?

Honestly, given the recent events in Paris I would have expected a big sell-off today. But no one reading this is a day trader so that does not matter, right?

I think housing and cars continue to do well. I think people are getting paid a little more. I think that oil prices are helping people out a lot. I think Health Care got clobbered in an emotional downturn and if you hold it in a portfolio, now is not the time to sell it.

I think the strength of the U.S. Dollar has hurt a lot of companies. Here’s a quote from the Delta Airlines conference call on October 14th, “Our revenue was flat despite facing a $235m headwind from foreign exchange.” Or this one from GE, “Foreign exchange was a $1.2b drag.” Imagine when the dollar comes back down.

I think low oil prices will help more than just the consumer. Take this statement also from Delta, “…our total fuel expense declined by over $1b in the [last] quarter.”

I just don’t see anything in the economy that is flashing warning signs. Be sure to take a few minutes to see what I say about over-spending, over-borrowing and over-confidence in the last part of a three part video series we put out over the summer. When these three things combine, it’s usually not a good sign for the economy. Right now, all three are very low.

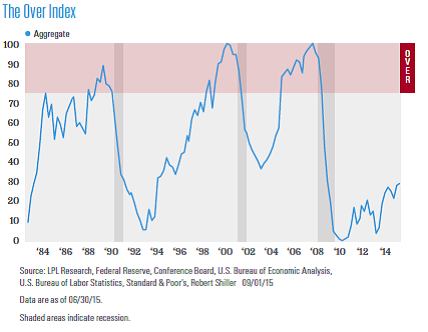

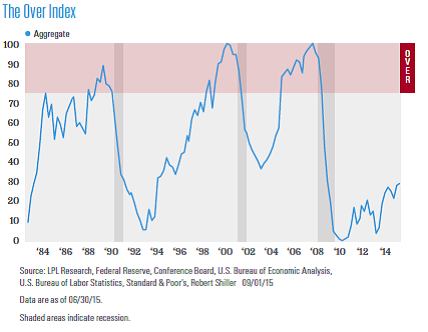

In more exciting news, LPL Research is out with a chart that explains just those things. Burt White calls it his “Over Index.” By adding together the readings from indicators like credit card debt, consumer debt payments, business debt, commercial loan growth, consumer confidence, valuations, wages, spending, commodity prices and a few other ingredients he computes a composite.

This is great timing because a picture is worth a thousand words, right? It goes back 35 years and covers three recessions. See a trend? This reading averages about 90 one full year before a recession.

Currently, I see it right around 30…

I don’t know what the market is going to do in the short-term. As I’ve said before, anyone who says they do is either a charlatan or a fool.

What I Think is:

- If you are invested now, you should stay that way.

- If you have cash, now is a good time to invest if you are looking out at the 5-7 year mark as a time horizon.

- If you need money in the next 12-18 months, you should raise it now – it may be a volatile 12-18 months…because it’s the stock market.

- If you have a portfolio that is invested to capitalize on an economic expansion (versus being defensively invested for an economic recession) you should stay that way.

- If what happened between August and today made you lose sleep, you don’t have a properly constructed portfolio and you should call you advisor.

Important Disclosure Information for “Paris and More”

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.