Global equity markets ended the week with big losses. The S&P 500, German DAX, and Japan TOPIX were -3.7%, -3.8%, and -1.5%, respectively. Commodity prices hit a 16-year low, which weighed on stocks. I discuss oil in greater detail below, however, markets are now anticipating the Federal Reserve’s interest rate policy decision on December 16th. An interest rate increase is a very high probability (this is a consensus thought in addition to mine) since the Fed really risks losing credibility if they do not raise rates this time around by creating an “if not now, then when?” issue. As for anticipating market action, it’s anyone’s guess, but I don’t think it’s something that any investor should be trying to time or gamble on.

Oil prices experienced a new round of negativity following the Organization of the Petroleum Exporting Countries (OPEC) meeting on December 4th, when the cartel maintained production at its current level of 31.5 million barrels a day. While this was no real surprise, the move essentially removes the cap on OPEC production, which acts to increase production in the middle of the global oversupply. OPEC’s strategy over the past 18 months has been to maintain market share at the expense of other non-OPEC producers, namely U.S. shale players, and ultimately price them out of the market.

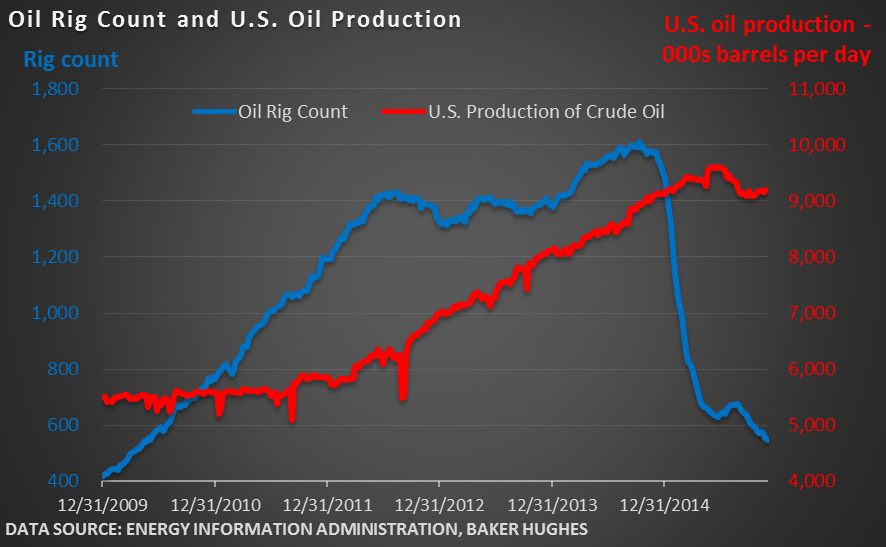

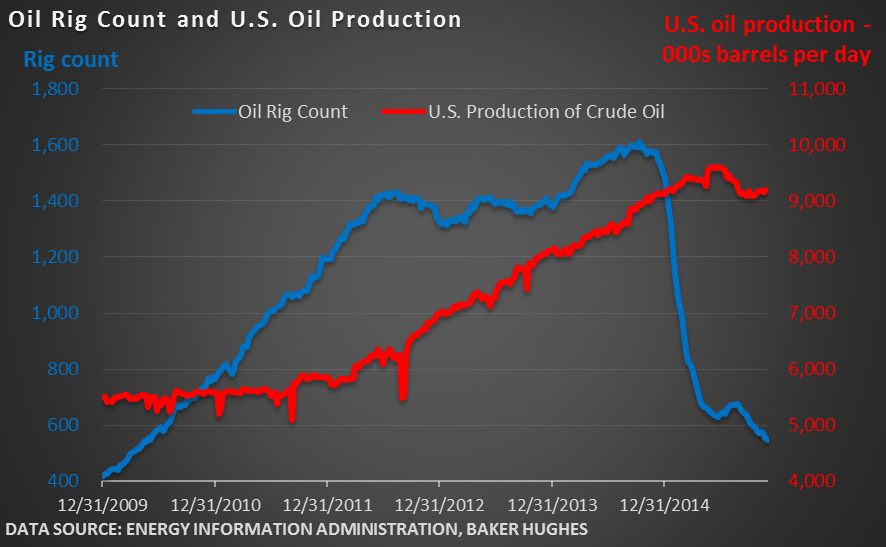

With both U.S. and OPEC production increasing, it would make sense that there is more pain coming in the Energy sector. But even with OPEC’s steadfast policy, or ”strategery”, there have been signs of future declining production in the U.S. as companies scale back on replacement capital expenditures and the number of active rigs in operation continue to decline. The chart below illustrates the oil rig count has dropped dramatically, but U.S. oil production has fallen modestly. It’s a classic case of too much supply and not enough demand to soak up that supply.

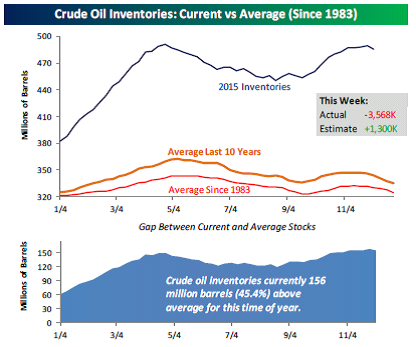

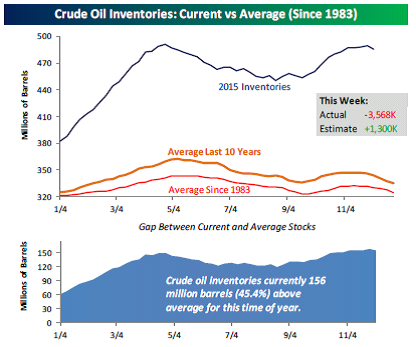

Speaking of supply, here’s a chart from Bespoke that shows the current versus average Crude Oil Inventories. I’m pretty sure the chart does not need more explanation than the picture.

Sooner or later, these measures will lead to less output in the longer term. According to research from J.P. Morgan, agencies such as the Energy Information Agency and International Energy Agency expect “U.S. production to decline by 0.5 million barrels per day and demand increasing by 1.6 million barrels per day in 2016.” Energy-related securities will probably experience difficulty over the near/short term, but according to Goldman Sachs research, “value may be found in companies with low debt levels, efficiencies of scale and strong balance sheets who can successfully manage through the current low price environment.”

We do not maintain any concentrated equity allocations to the Energy sector since we favor the Consumer Discretionary sector. According to the S&P Dow Jones Indices webpage, as of November 30th, energy stocks only comprise 7.1% of the total S&P 500 while Consumer Discretionary is almost double that at 13.1%.

Consider this from the S&P Dow Jones Indices Senior Index Analyst, Howard Silverblatt, that I read over the weekend: “From oil’s June 2014 $105 price, the S&P 500 Index is up 5.27%. But ex-energy’s 38.19% decline, the S&P is up 10.58%.”

I’ll maintain that the savings seen at the pump is translating into consumer savings and consumer spending / retail sales. In fact, Americans have increased their spending going into the holiday season. Retail sales rose 0.2% in November with gains seen in electronics, apparel, and food services expenditures. Additionally, U.S. consumer sentiment rose to 91.8 in November. With the consumer responsible for over 70% of Gross Domestic Product, lower fuel prices will be a very powerful economic lever.

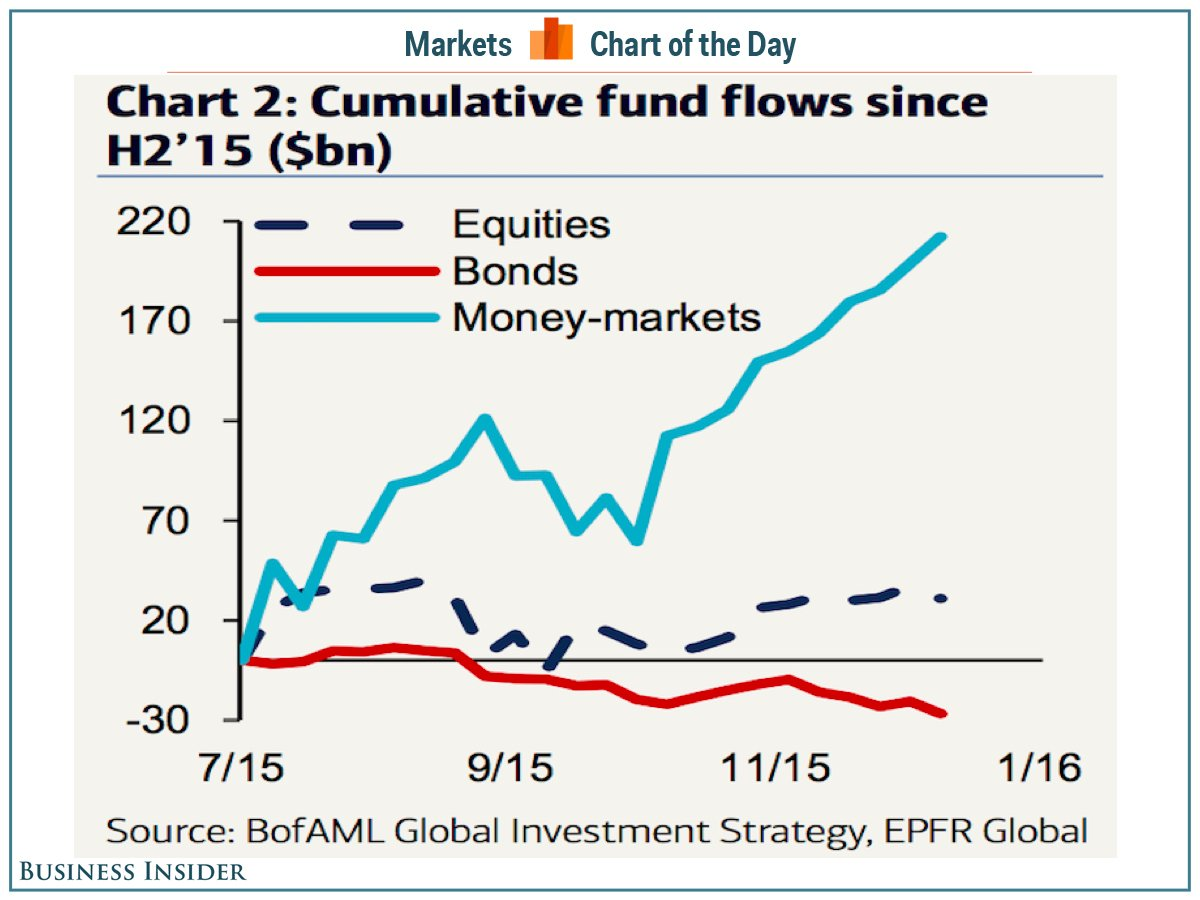

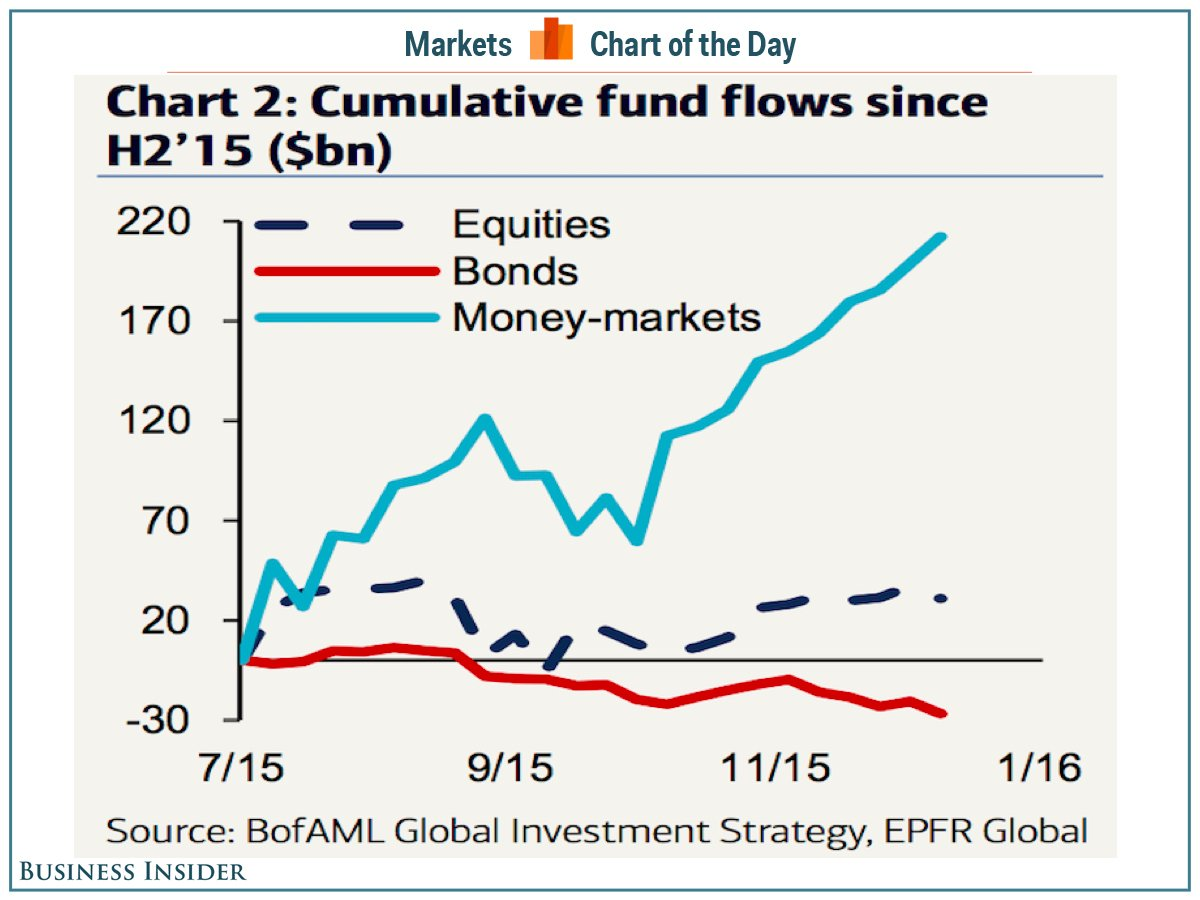

Many investors are wondering why this has not yet materialized in higher GDP and/or equity market prices, but things like this can often test investor patience. If it was point-in-time predictable, it would be arbitraged away. But cash is building up in money market funds that essentially pay ZERO, which means it is losing money when you apply inflation. Analysts at Bank of America Merrill Lynch have highlighted in a recent report that over the second half of 2015, money-market funds have received $212 billion in inflows…over the same period of time, only $31 billion has moved INTO stocks.

Preservation of capital has clearly been the popular trade, but that’s not my point. Whether raising cash was right or wrong, that $212 billion has a high probability of going back to work in investments since the purchase power of cash is eroded by inflation. Whether it is spent on goods and services (consumer spending), reinvested in the market, used to pay down debt or used to buy a house, it’s all good for the market. Here’s a chart I plucked from Business Insider that graphically shows the flow of funds since the summer.

So What Do We Think?

For right now, I don’t think there are any allocation changes that should be made based on recent events. Here are my opinions that I think investors should consider:

- It’s possible that corporate earnings are still weak into the first half of 2016.

- The low unemployment rate and rising wages will probably continue be a drag on profits.

- However, I don’t see a recession in the near future.

- Low commodity prices will help control inflation. This is good because it lowers the need for more Fed rate hikes.

- Good employment picture suggests consumer spending should increase.

- Increasing wages, low unemployment, continued low interest rates and low gas prices suggest a lot of dough is sloshing around.

- The banking system is largely removed from energy financing and the pain being felt there…unlike the mortgage financing. The energy pain should stay contained.

2016 Thoughts

You can’t swing a dead cat without hitting a Wall Street strategist talking about his or her 2016 outlook. I’ve become cynical about annual outlooks – there is nothing really magical about the change from one calendar month to another, since it does not signify any real impetus for economic change. Things just don’t change that quickly and I feel like my thoughts are always…how do I put this…rolling. So while the following are some thoughts for the next 12 months and they are coming in December, I’m not really sure they are any different than my thoughts from July.

Every year since March of 2009, investors have witnessed negative events, news stories and market shocks right alongside constant negative investor sentiment. However, somehow the economy has accelerated and equities have ranged from buoyant to outright resilient. I think the next 12 months will bring more buoyancy than outright resilience to the equity market. Concerns like a strong(er) U.S. dollar, declining oil prices, anemic manufacturing and a shift in Fed policy can exacerbate negative investor sentiment, but I believe it’s important to also focus on all the good things from above: positive consumer spending, the improving labor market, rising wages, and cheaper gas. These should offset the concerns. When the Fed starts raising rates, it will not be by a lot and will not be quarter-over-quarter, which means the Fed will remain accommodative to equity investors.

Finally, we are always on the lookout for over-borrowing, over-spending and over-confidence as a prelude to any recession. We see none at this time.

I don’t see any reason why a long-term investor would move away from the equity markets or get defensive within the equity market over the next 12 months, which is something we have been saying for a long time.

Important Disclosure Information for “Oil, Oil, Everywhere”

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.