I have spent a lot of time over the past 30 days reflecting on a lot of different things about my life. Memorial Day weekend usually initiates this for me. Here are some of my friends and brothers who are no longer with us, but who have all gallantly served our great nation.

The Chattanooga Five:

- Sgt Carson A. Holmquist

- Petty Officer Randall Smith

- Gunny Thomas J. Sullivan

- LCpl Squire K. “Skip” Wells

- SSgt David A. Wyatt

Others:

- Sgt Chris McDonald

- Doc John Patrick “JP” Luby

- Sgt John “Red” Walker

- Maj Samuel M. Griffith

- PFC Domingo Arroyo

I’ve written about them before – the Chattanooga 5 and others, Chris McDonald and Johnny “Red” Walker. These posts are all worth reading, whether for a first time or a tenth.

As most of you know, I’ve spent “my entire adult life” (to steal from a famous inside joke) as a Marine Officer. 27 years serving and if I tack on the 4 years I spent in college ROTC as “affiliated” with the Marines, that comes to over 30 years. Time flies.

Last week marked MONUMENT’S 9-YEAR ANNIVERSARY. There is a lot to be said about perseverance when you look at a successful wealth management business that was started in the teeth of the worst economic crisis since the Great Depression. Dean and I are very proud of what we have built and we owe it all to our great clients and our top-notch Team.

Given my weekend of reflecting, I thought it would be worthwhile to review the last nine years in this blog. It puts both long-term and short-term events into perspective.

I’ll start with a twitter quote I read this morning that is a little sarcastic about investor behavior.

Right? It’s almost perfect. It’s the “I’m special” syndrome. It’s summarized well in a quote from Chuck Palahniuk’s, Fight Club which I was reminded of in rereading a chapter in Dr. Daniel Crosby’s book, The Laws of Wealth.

“You are not special. You are not a beautiful or unique snowflake. You are the same decaying organic matter as everything else.”

I’ve opened his book to the same page so many times the spine is conditioned to simply fall open to it. The passage I am very fond of is this:

“Investors who own their own mediocrity are able to rely on rules and systems – they do what works and reap the rewards. Investors mired in a need to be better than average insist on flaunting the rules in favor of their own ideas and pay a steep price for their arrogance.”

Emphasis mine.

Brilliant…and elegant in its simplicity.

He goes on later in the chapter to quote Jeremy Grantham commenting on what investors should have learned after the Great Recession:

“In the short term, a lot. In the medium term, a little. In the long term, nothing at all. That is the historical precedent.”

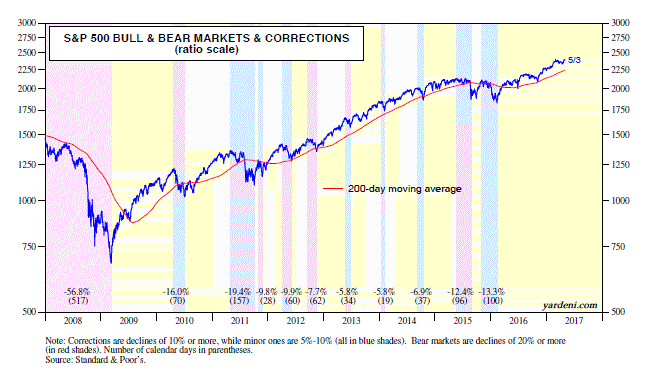

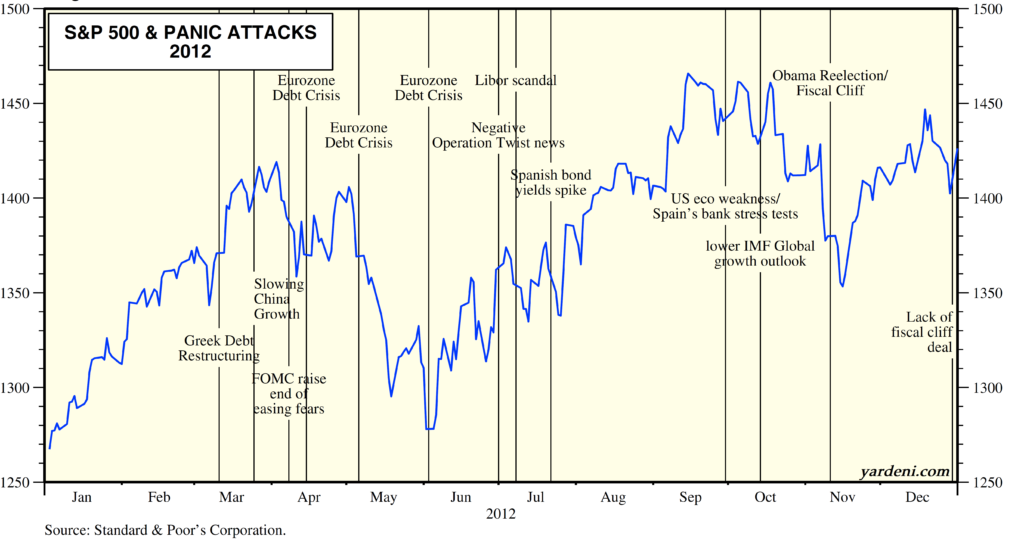

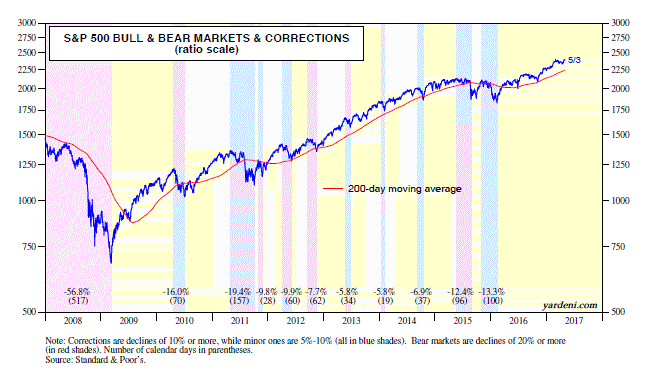

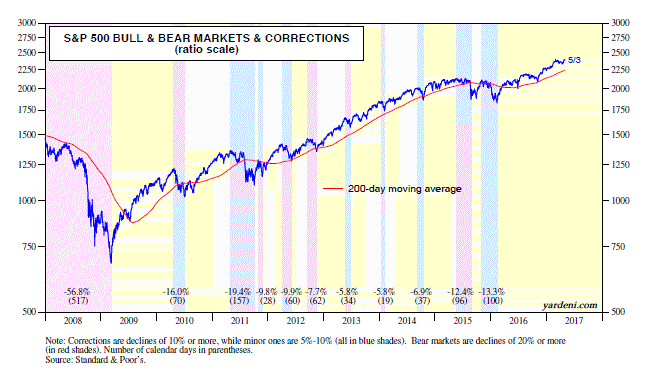

These quotes and thoughts play nicely into reflecting back on the market since the traumatic turmoil of 2008. It’s clear that investors are still impacted by 2008 and are susceptible to the panic attacks that any dip brings on. I’ve seen it in the data and I’ve experienced it in real life, while talking to new clients and seeing their portfolios. Some wounds are self-inflicted and some seem advisor-inflicted. Regardless, the behavioral responses to short-term market gyrations have hurt a lot of investors who fall right square into the Grantham quote above.

Here’s a chart from Ed Yardeni, which shows the S&P 500 and each 5% or greater dip since 2008. Long-term investors with a plan should be happy.

Investors who think that the news cycles give them an edge in knowing when they should get out or in usually time the market in the wrong way. How do I know?

The 2016 Dalbar study.

“DALBAR has been analyzing investor returns for over 20 years and found once again that the average investor did not realize returns that were on par with general market indices. For the 12 months ended December 30, 2016, the S&P 500 index produced an impressive annual return of 11.96%, while the average equity mutual fund investor earned only 7.26%, a gap of 4.70 percentage points. This underperformance is most attributable to January (1.74%) and the “Trump rally” in November (1.13%) and December (1.34).”

Again, emphasis mine.

Why did the market reward investors with a long-term plan?

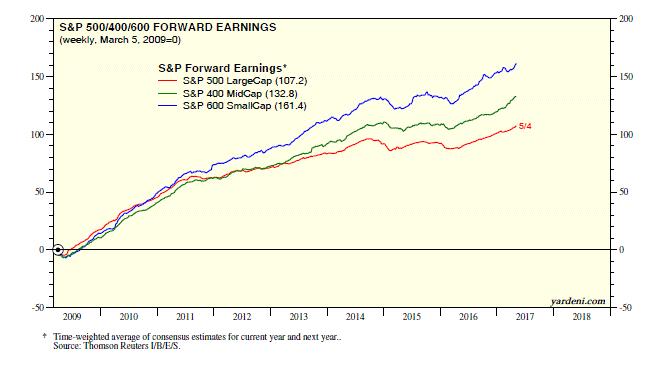

Earnings.

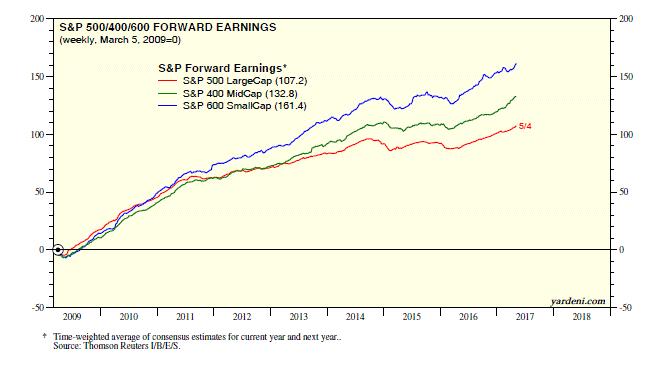

Ed Yardini calls it a “Performance & Earnings Derby”.

Here’s the deal – The S&P 500/400/600 price indexes have all done well since March 9th, 2009, which was the bottom of the crisis. They are up 254.7%, 329.7%, and 368.3% respectively through May 10th, 2017. That’s a lot…but it’s because the forward earnings of the three composites are up 107.2%, 132.8%, and 161.4% over that same period.

Here’s another Ed Yardeni chart, this time showing FORWARD earnings since March 5th, 2009.

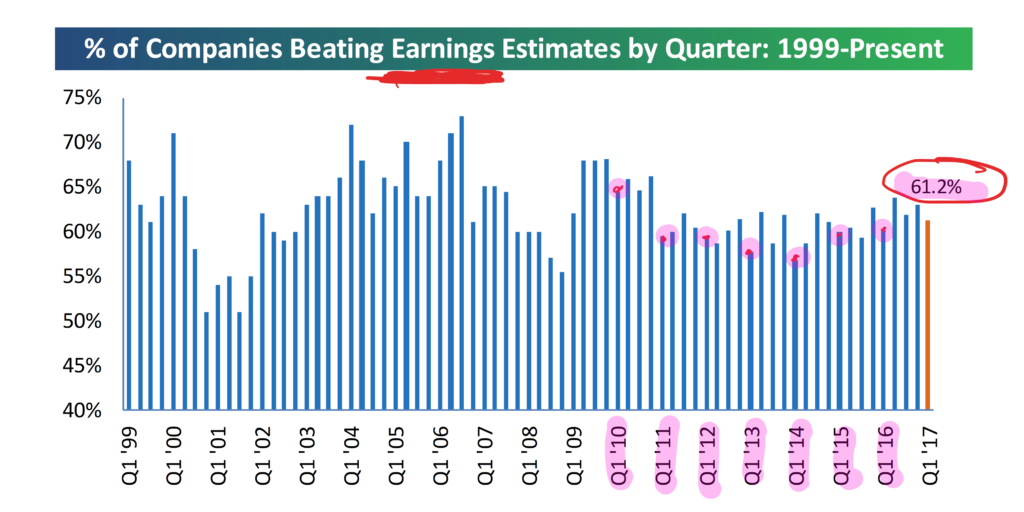

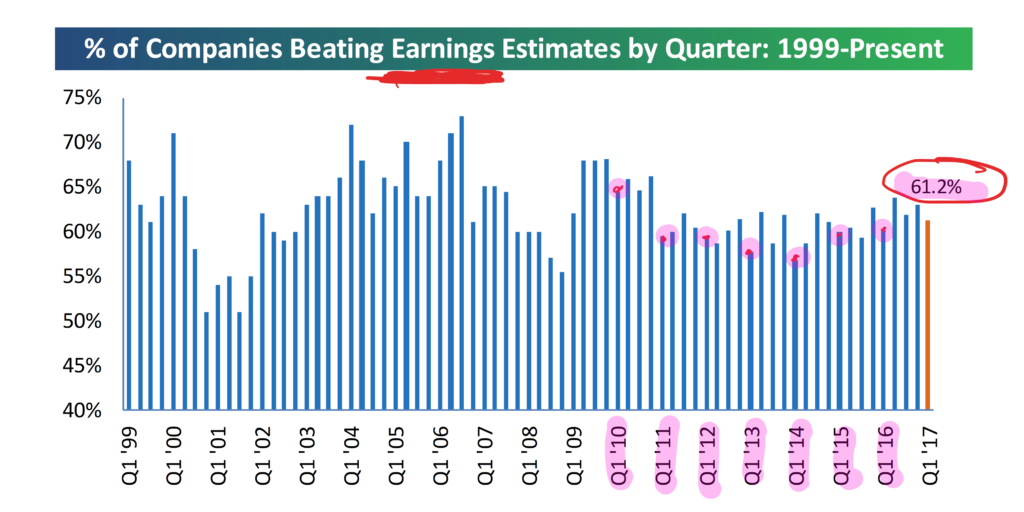

Walmart reported earnings on Thursday, May 18th, bringing the “official” earnings season for first quarter (Q1) 2017 to a close. Here’s how we ended up.

2,450 companies reported in Q1. 61.2% reported better than expected “bottom line” earnings (AKA a “Beat Rate”), 29.8% missed, and 9% came “inline”.

As you can see in the chart below, they didn’t end up as great as the season started, but they were pretty good! In fact, it was the best beat rate for the first quarter of the year going back to 2010.

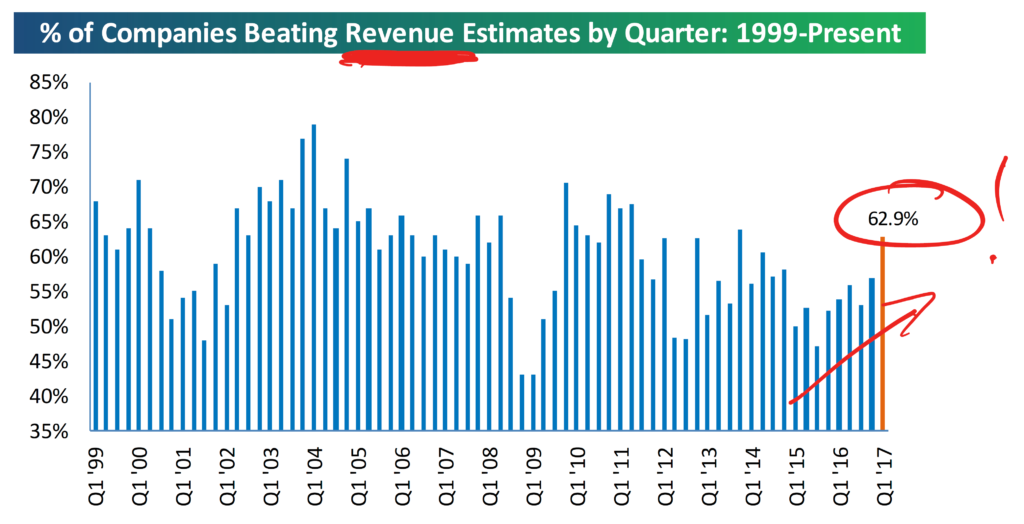

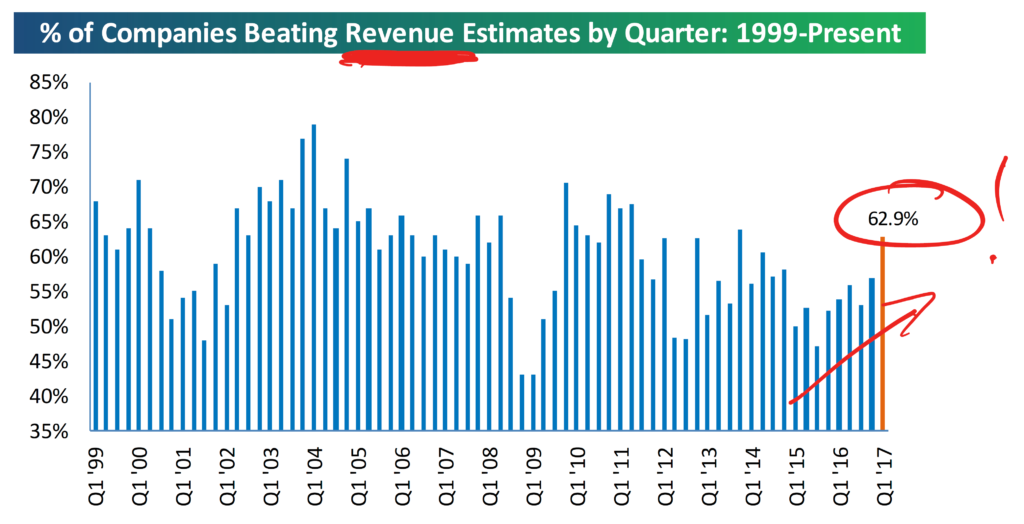

However, it was the revenue, or “top line” beat rate that was stellar. That beat rate was 62.9 and as you can see below, it was the best we have seen in a LONG TIME.

I know a lot of people are worried about the market being at a high and all the political tension. However, this point in time should be no different than any other point in time FOR THE LONG-TERM INVESTOR. There will always be drama.

On that, I’ll leave you with one thought and a final chart.

Thought: If you have cash, I don’t think it would be a bad bet to leg into the market slowly. If you start legging in with cash now, you will either keep putting money to work as it’s getting cheaper or you will at least start to get in NOW if it keeps going up. Being frozen can really work against you WITHOUT A PLAN TO LEG-IN if the market goes up…or down.

If you have this issue and would like to speak with us, please call or email. We are always happy to share our thoughts with folks struggling with this decision.

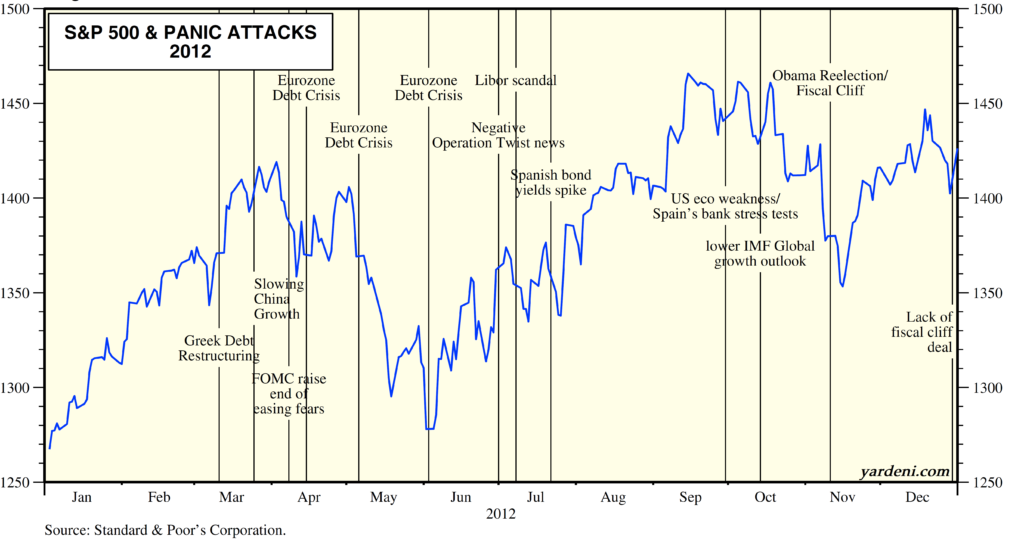

Chart from Yardeni: Shit happens. Look at this… DO YOU REMEMBER 2012!!!???

Now look at this (again).

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.