Ouch – the unemployment report last week felt a lot like a bucket of ice water thrown into your face in desert heat. Couple that with the poor ISM Services report and many investors may be wondering what there is to look forward to over the next few months.

Well here’s some good news – I addressed some of my thoughts on the past few months in a video we posted here last week in lieu of a blog since I was traveling on the west coast.

But for those of you craving more, here you go. Last week, nonfarm payrolls rose by only 38,000 in the month of May. Some of this had to do with a strike at a major telecom company but according to Bespoke Investment Group, the miss was five standard deviations away from the mean economist estimate reading of +160,000 jobs…and a whiff of 122,000. The ISM Services report was 52.9 versus an estimate of 55.3. Anything above 50 is considered expansionary but that’s a decent miss too.

Remember back to December when many were speculating that the Fed would raise interest rates four times in 2016? Yeah, huh? Well the market volatility and poor economic data from January and February threw cold water on that (I’ve got a little cold water theme going) and now most are betting that this recent jobs and ISM number will push any probability of a June interest rate increase down to about…well…zero.

There does not seem to be a lot for the Fed to worry about – interest rates are lower, commodities have come back but are far from spiked, the U.S. Dollar (USD) has been selling off, housing is good, the consumer is far from overleveraged (meaning they have paid down debt) and auto sales have been “strong to quite strong,” to quote a favorite movie.

I think this will all be good for futures earnings too. Remember all the talk about the strong dollar and crashing commodity prices crushing earnings in U.S. companies? Yeah, huh? Stay tuned on that. And in case you missed the issue of Barron’s that came out over the Memorial Day weekend, here are the five reasons they claim that equities still have room to run before we need to worry about a crash.

- Payouts remain healthy: The dividend yield on more than 1,400 dividend-paying stocks is higher than in July 2007, even though interest rates are lower.

- No bubble in housing: The median house price in 2016 dollars is significantly below 2006-2007 peaks.

- Yield curve is in normal range: The difference between the 10-year Treasury note rate minus the 3-month T-bill rate remains above zero.

- No spike in oil price: Recessions have historically been preceded by oil-price spikes.

- Rising new-home sales: Sales of new homes in April hit a new peak for the current expansion.

If that all sounds a lot like what I’ve said in previous blogs and videos I think you’d be right. Housing and cars…no over-borrowing, over-spending or over-confidence.

So where do we go from here? Of course no one knows, but because the markets have been flat for a while now, no one feels particularly good about them. Couple that with the facts I’ve laid out above and I think this is when we could see the market move up in “stealth mode” meaning it won’t surprise me if it actually keeps going up slowly although no one really notices this because it will build on very small gains over time. For example, I’m not sure many people realize the S&P 500 is up over 3% year-to-date which is more than twice it increased on a total return basis from last year. Meanwhile, most people feel the market has sucked this year.

Next Topic: Probabilities

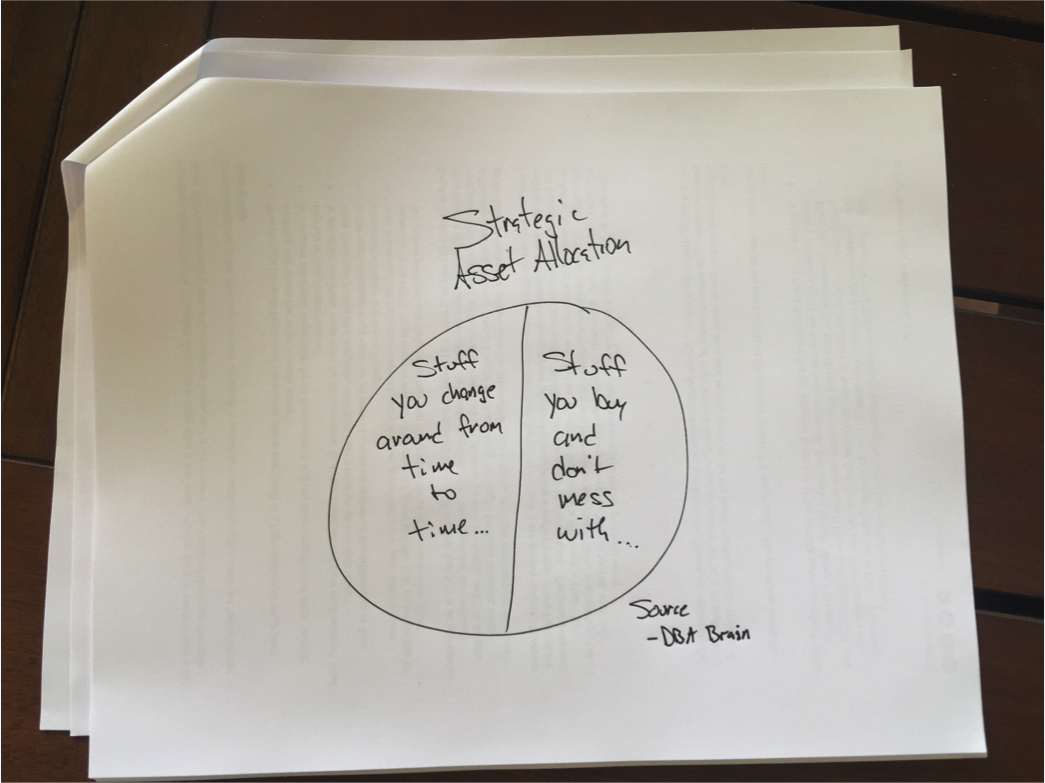

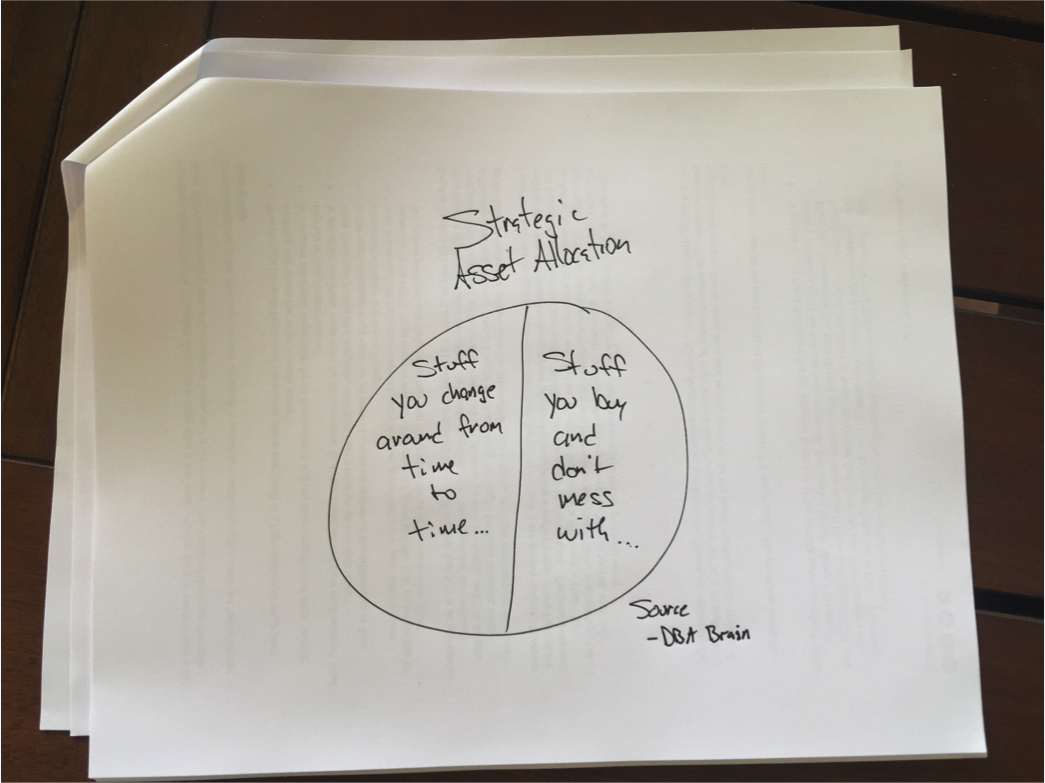

I was at a conference in Phoenix the week before Memorial Day and I sat next to a new college graduate who was there sponsored by of one of the firms presenting at the conference, so he could network and learn more about the industry. At one point he asked me to explain what they were referring to and I drew the below diagram for him. I saw a light bulb come on as I channeled my inner professor and thought it was worth showing everyone who is reading today. I added the source after I decided to snap a pic of it in case I need to protect this breathtaking piece of intellectual property.

People get bored and frustrated with the stuff on the right hand side of my sketch above. It’s a common behavioral trait to want to see ACTION.

This is a lead-in to a quick point – a point that I’ll refer to as “Short-termism”.

I’m seeing a lot of this not only across the human behavior spectrum but also at industry events, in research reports and in the financial press. In the Marines we have a saying, “Hope is not a course of action!” and I think it applies equally to the realm of investing. While I was out in Phoenix, I listened to another advisor the first night at the dinner table advocating outsourcing portfolio management to a centralized group of analysts and used the well-worn fact that removing the so called “FANG” stocks meant that the S&P 500 would have been negative last year.

(Sorry, but for compliance purposes, you are going to have to Google “FANG Stocks” because some regulatory agency is currently claiming that my inclusion of any specific company names in my blog can mislead readers…Whatever, it’s getting fixed.)

His point? “Were you smart enough to have those stocks in your portfolio?”

I almost spit an asparagus spear across the table.

Two of those stocks have PE ratios at or above 300. My opinion is that when you start buying stocks like that, you are buying a slice of hope. I’m not saying they won’t go up more, I’m just saying that when something is ALREADY that expensive, you are basically purchasing hope…you are hoping they go up more.

Me? I’d rather play dumb and stick to the probabilities and leave hope to the people in my industry not smart enough to have any other strategy than guessing.

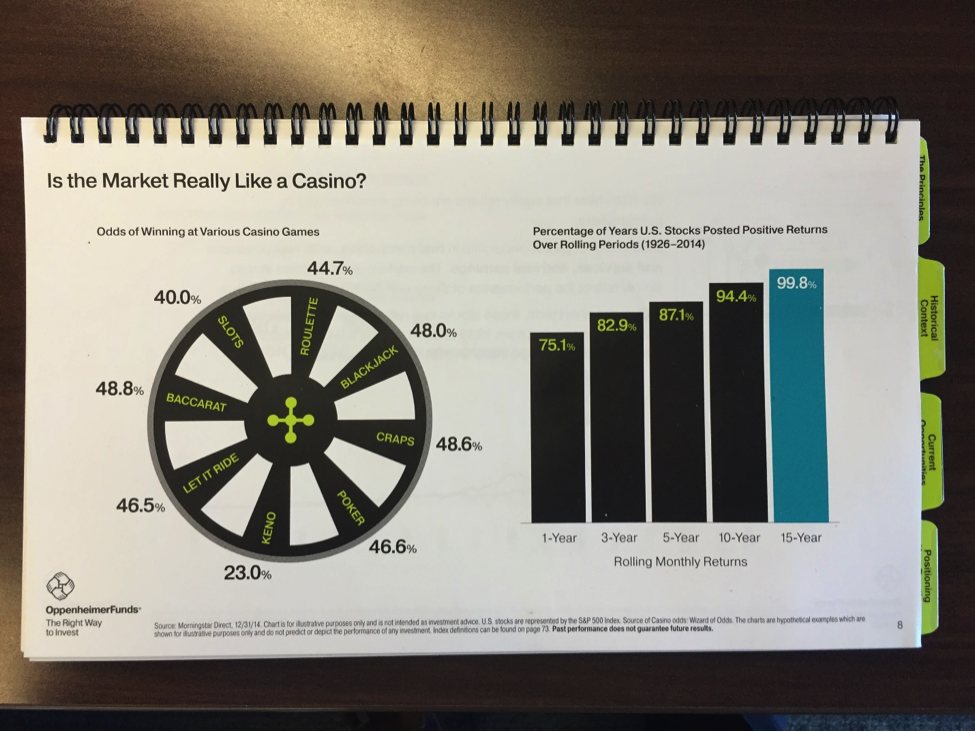

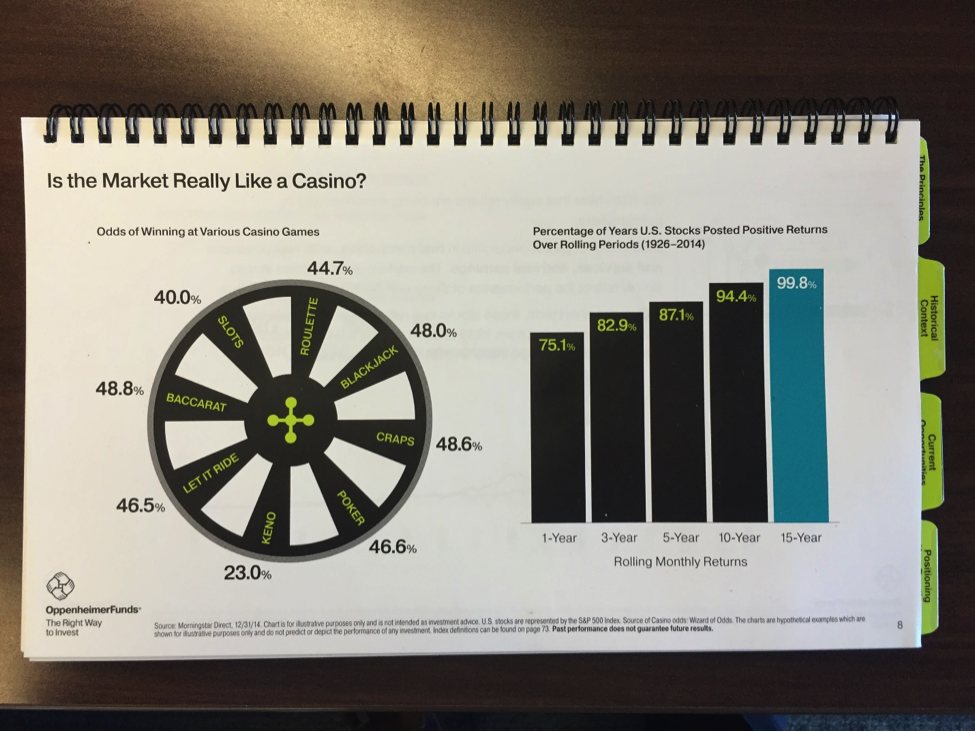

Guessing is stupid and here is how I know – casinos. No game on the casino floor has odds in favor of the gambler greater than 49%. Casinos know that no matter how hot the tables get, time will equalize that and gamblers will eventually lose. The only thing they need to do is wait.

Do you see the embedded analogy? Sure, casinos go out of business, but that’s due to poor financial management. There is a reason the large casinos have their own private jets to fly in big gamblers and comp them the high roller suites. It’s because they know the big whale will lose over time on odds close to 49/51 in favor of the casino.

Think of Craps. The most likely number combo is 7. Any wonder why that’s the number that ends the game and the casino sweeps all the chips off the table? (I’m keeping it simple here to make a point.)

So how does that apply to you? Well, have I got some odds for you. Did you know that the Dow Jones Industrial Average turned 120 years old on May 26th? Over those 120 years, the Dow has been UP 78 of those years or close to 65% of the time.

Compare that to the 49% odds a gambler has (or the 51% the casino has) and tell me why you’d ever play a guessing game or invest in “hope.”

Here’s a snapshot of a book that I picked up from Oppenheimer Funds the other day that shows the percentage of years U.S. stocks have shown positive returns. If a casino had those odds, everyone would go there until it went out of business.

Fiduciary Standard versus Suitability

There is much talk around the investing world about the latest Department of Labor rule. I won’t bother you with wonky regulatory babble, but it’s been quite interesting for me to see how this has morphed into the marketing and branding of specific firms. What I’ve been seeing lately is a lot of firms messaging that they are “fiduciaries” and they are held by law to act in the best interests of the clients.

Don’t get me wrong, that is a great thing and as an RIA we here at Monument are all fiduciaries…but it’s a sad commentary that it’s becoming a bigger marketing ploy. This industry is a lot like other industries that we all deal with on a daily basis and it should be grounded in trust. It’s unfortunate that I see brand messaging centering around how they now act in their client’s best interests. Haven’t they always done this? Does it take a change to a business model to act in the best interest of clients?

How sad that this is now branding.

Have a great week – call with questions.

Important Disclosure Information for “Jobs – Swing and a Miss”

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Subscribe to our blog here!