Bottom Line Up Front

The fourth quarter is historically strong and that bodes well for stocks into the end of the year. Earnings should continue to be a boost for the market and the Republican tax plan (vision) which came out last week will continue to be tailwind as well. The end of the third quarter had the S&P 500, Nasdaq and Russell 2000 indices at all-time highs heading into the fourth quarter. The Dow is just under the all-time high, but still posted it’s first eight-quarter winning streak in about twenty years.

So is it time to sell? Read on.

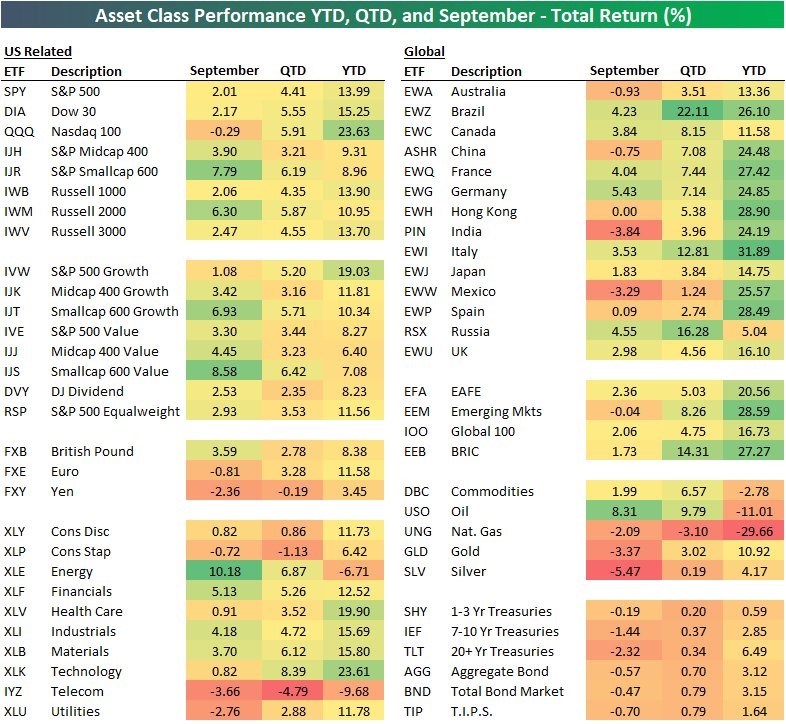

Quarterly Review

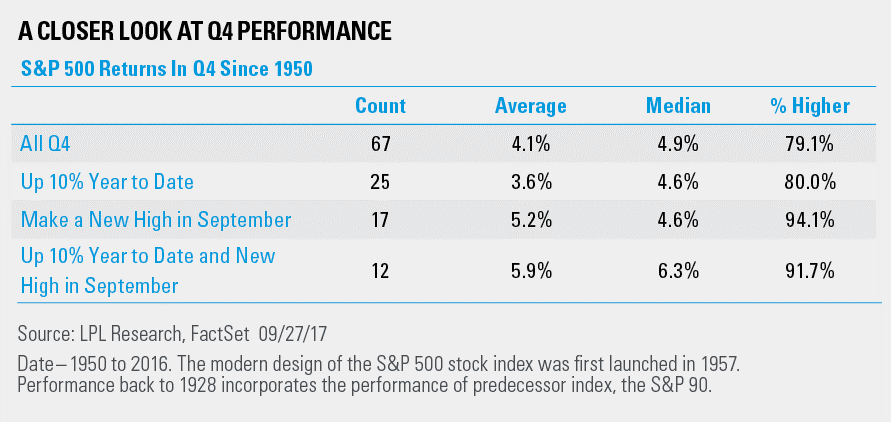

Why bother writing a paragraph when a graphic will do…see below from Bespoke.

I will point out a few things:

- Look at the QQQ’s (third down). The year’s biggest domestic gainer took a breather in September.

- Small Caps did some catching up in September – Look at IJK down through IJS.

- Emerging Markets took a breather, too. Look on the right-hand column and down at EEM.

Time to Sell?

This indicator below said “sell in 1998-ish”, too. Things like this must be taken in context. There is a lot of positive force behind the market right now and action based on one indictor like this could result in misguided selling.

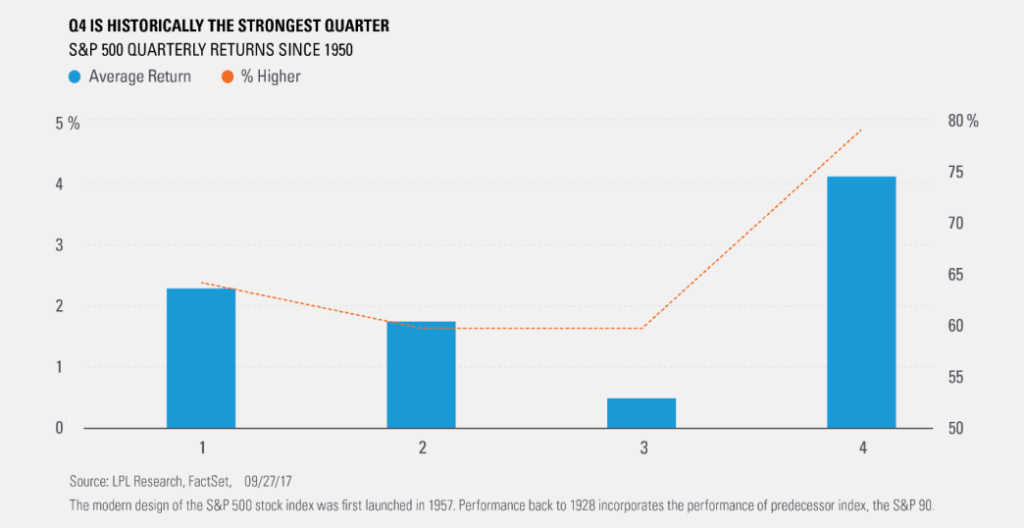

How’s the Fourth Quarter Looking?

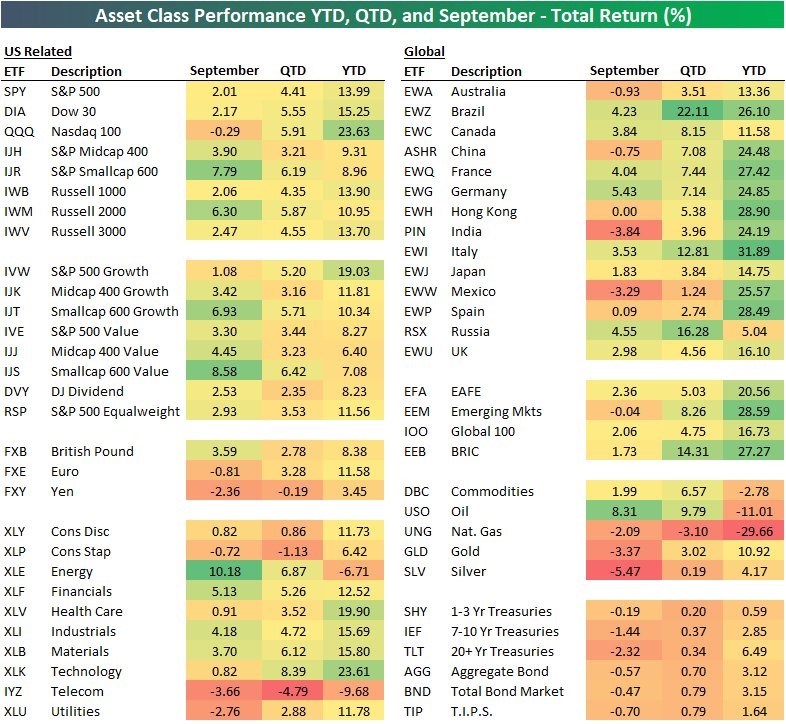

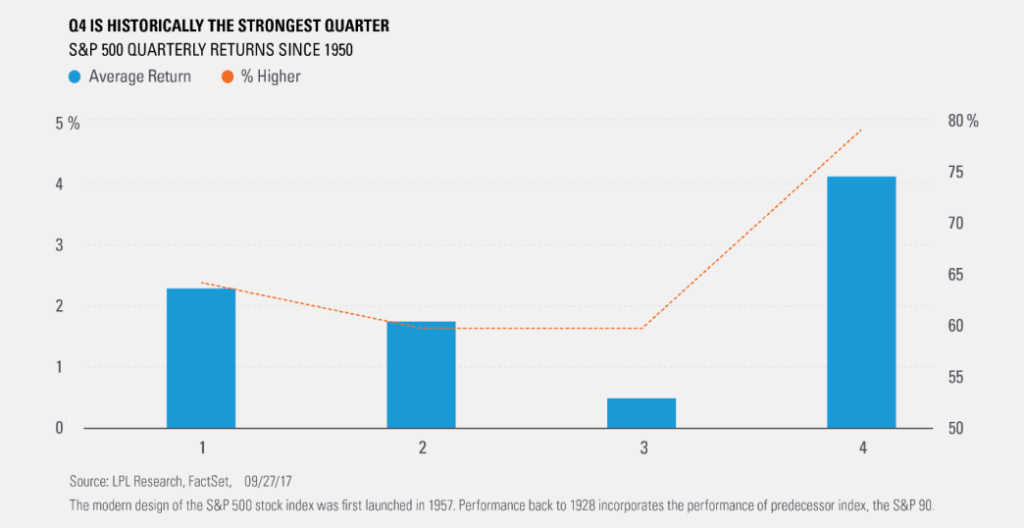

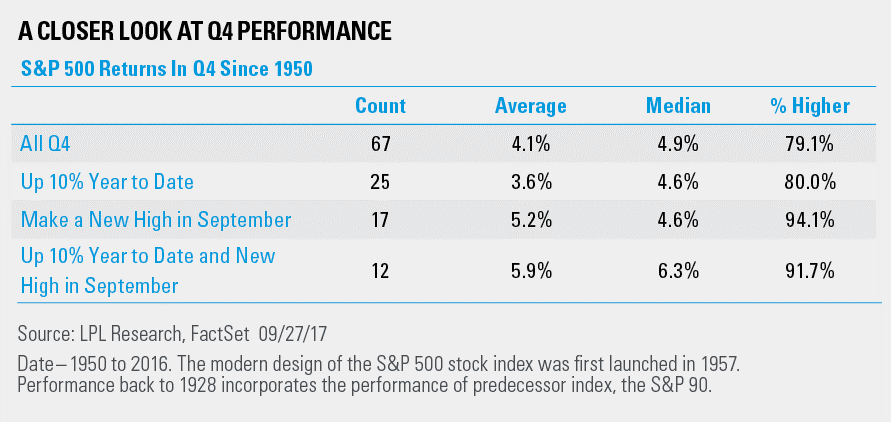

Here comes the fourth quarter – These next few charts are from LPL Research. This first chart shows that the fourth quarter has been the strongest quarter of the year going back to 1950. And don’t forget, September is usually the weakest month of the year.

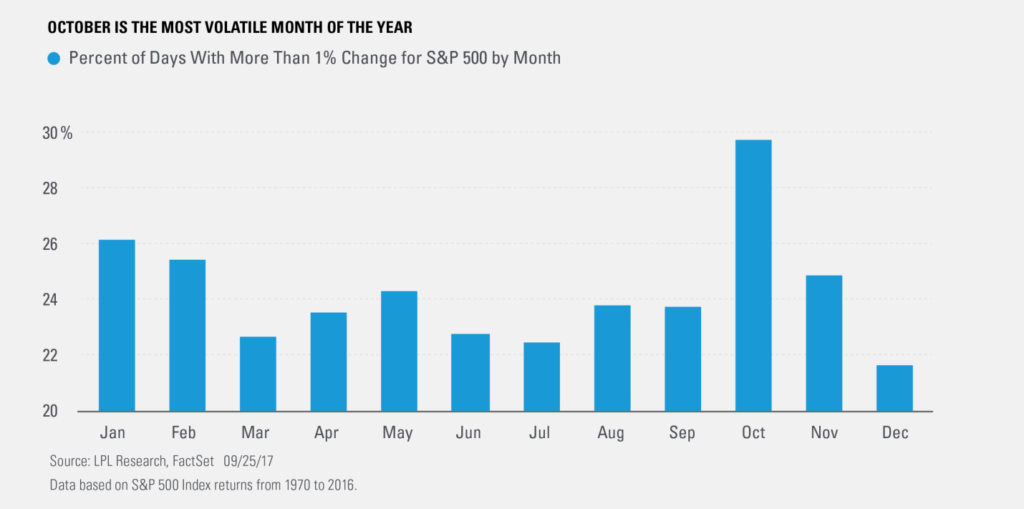

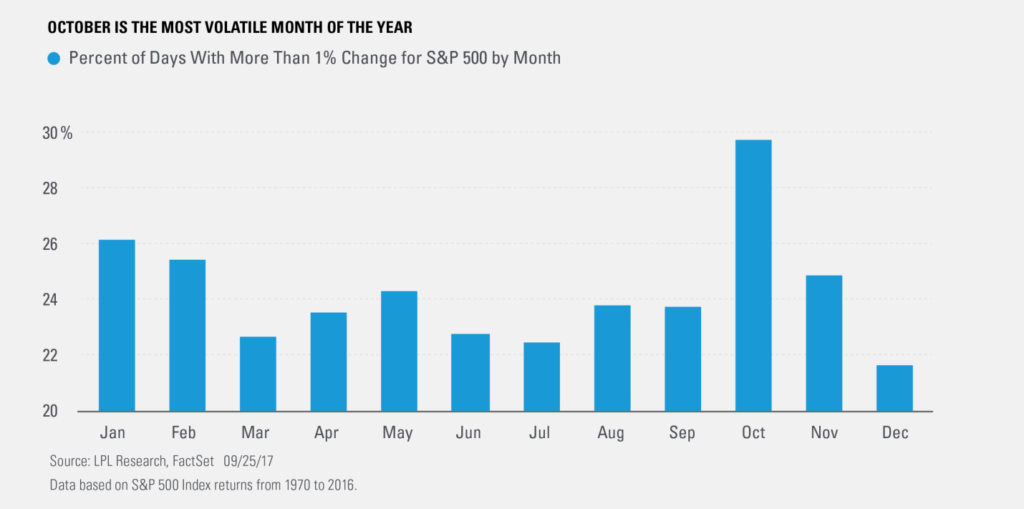

And don’t forget it’s October.

However, LPL Research also notes that October is the most volatile month of the year dating back to 1970.

Finally, LPL Research points out there have been twelve fourth quarters since 1950 that have had both a +10% year-to-date return AND a September that has seen the S&P 500 print a new high…in those twelve quarters, the average return has been 5.9% and 91.7% of those quarters have been positive.

I’m not suggesting everyone should expect a 5.9% return, but what I AM saying is that if you, like me, like to assess the PROBABILITY of things then I’m saying that there is a very strong probability that the rest of the year has a positive return on top of what we already have year-to-date.

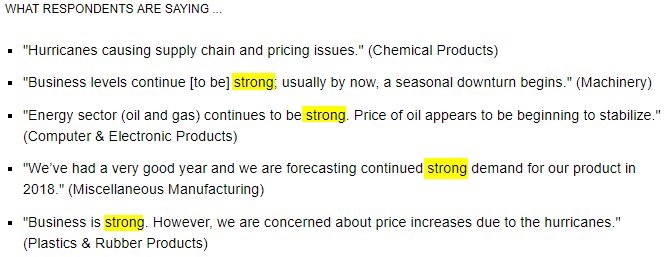

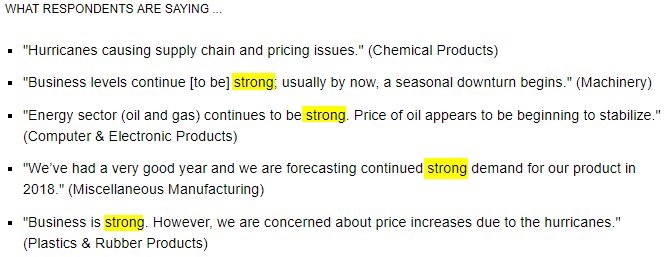

Today’s ISM Manufacturing Report

In one word: STRONG. See below from Bespoke, highlights are theirs.

Today’s reading surged from 58.8 in August to 60.8 in September…the highest reading since May of 2004.

Politics

Taxes are politics, so I have to chat about politics a little and that’s always dangerous…look, I get it, people don’t like the President.

But I also try to look past the emotion and see the facts. As unpopular as this next statement may be to my democrat friends, I completely oppose the view that the Trump Administration is too inept to effect tax cuts by the end of the year. I think the selection of John Kelly to replace Reince Priebus as Chief of Staff has been the reason the leaks have really died down and is also the catalyst for the seemingly increased competency within the Administration. [Insert a Marine Corps Ooo-Rah]

But pay attention to who is shepherding this tax package to the general public – Treasury Secretary Steven Mnuchin. Hate the President all you want, but it’s tough to say that this guy has been anything short of perfect in advancing the Administration’s pro-growth case. Remember, this guy got Paul Ryan and Kevin Brady to abandon their plans for a border-adjusted cash flow tax (BAT) and if you watch him you will see a demeanor is that is 100% professional – he’s calm, cool and collected anytime he’s chatting about tax cuts.

The House is pro-Trump when it comes to tax reform. They all know that 2018 could be a bloodshed if they don’t hand the Senate a tax reform package. Even the hard right of the party are going to abandon any demand of revenue neutrality to allow for a tax cut package, even if it raises the deficit in the beginning, because they understand the concept of accelerating economic growth…which increases tax revenues and will improve the debt.

It’s like borrowing money to go back to school to get a master’s degree so you can increase your salary to pay down your debt…in the long run you are better off.

So that leaves the Senate.

Here’s my thinking. If the repeal attempt of Obamacare that actually went to vote failed by one vote, then I think that tax cuts will accomplish in the Senate this year. I know that’s not serious analysis steeped in data and research, but that’s just what I’m thinking.

In fact, as I’ve written about before, I think there could actually be 60 votes to make this permanent.

I just think that there is a good chance (remember, I like probabilities) that there will be some Democrat crossover and that means if there are some difficult Republicans during the vote, tax reform can still pass. This means another type of McCain defection at the last minute on the Republican side is unlikely to derail the current tax cut drive in the Senate.

Yes, I want to throw my phone across the room at most of the dumb-ass tweeting from the President, but he’s advancing the tax issue on a daily basis with the general public who will be going out to vote in 2018. The public is expecting something out of Congress. This year.

That means you can bet the President will take to Twitter and hold every Senator accountable for how they vote on a tax package…and that scares them all across party lines. Again, think 2018 elections.

Regardless of how the debt ceiling negotiations between the President and the Dems played out in the media, remember, if the Republicans didn’t like it, they would have never brought it to the floor for a vote. But they did and passed it…basically the next day! So they liked the deal to punt the debt ceiling and here’s one reason why…it’s now off the table for 2017 and will not resurface until well into 2018.

Why’s that important? Because the rest of 2017 will focus on tax cuts and hopefully an infrastructure bill as well. I’ve already written about the low odds of surviving 2018 elections if a Member votes against these bills after the hurricanes.

Here’s the real key to my thinking on this tax reform issue AND NOW infrastructure too – regardless of party, good luck getting reelected in 2018 if you vote against either of these issues!

Trump and every member of Congress will get their act together and address the need to rebuild the devastation in both Texas and Florida. Tax reform and an infrastructure spending bill will help rebuild, aid the economy and create jobs. Elected officials will use these storms to champion passage of bills and reforms. Trump reached out to the Democrats to get the continuing resolution passed without regard to pissing off the Republican Conservative Right (and maybe the moderates too). He might do the same thing to get tax reform and infrastructure spending done – this is what is being referred to as his “pro-growth” and/or “pro-business” agenda.” – Hurricanes, the Economy and Tax Reform

Finally, I get it that the information released to date is sparse and incomplete. Don’t let the media fool you on this. There is no sense in the Administration publishing anything more than a vision – the details are what Congress is supposed to be drafting. This sparse amount of information is designed to get people talking and speculating so that deals can be cut and negotiations happening. Trump’s recent tour promoting tax reform in states that he carried in the election who have vulnerable Democrat Senators prove to me he’s aiming for permanent reform and not just 50 votes. His threat of eliminating the ability to deduct state and local taxes on federal returns is his big stick to use in negotiations. I think he swings this stick hard to secure the Democrat votes he needs to hit 60 votes toward the end of this.

Here’s what I wrote in May of this year about the one-page tax idea floated by the Administration:

In fairness, it’s a one pager…but I find one component interesting and it’s the deductibility of state and local taxes. This is a big deal in the states that have really high state and local taxes because if residents in those states can’t deduct them anymore, that’s bad for them.

States impacted? Well, according to TrendMacro, 50.5% of the aggregate tax deduction amount is shared by 6 states…California, New York, New Jersey, Illinois, Maryland and Massachusetts.

All blue states.

Since the Republicans in the Senate can pass tax changes for 10 years without a single Democrat vote, it’s possible that this becomes a huge negotiating point. The Republicans COULD offer to strip removal of state and local tax deductions out of the plan in exchange for some Dems to vote for the final package. With 60 votes, the tax reform could be permanent and not just 10 years.

The 10 Dems fighting for 2018 reelection in states that Trump carried in the election could be interested in this – especially if the other option is losing the state and local deductions for 10 years in 6 big blue states that make up 50.5% of the aggregate amount. In that case, big blue states lose at the expense of red states.

That’s a tough pig to put lipstick on.

I think there could be a good chance we see permanent tax reform with 60 votes on a package where the Republicans add the ability to deduct state and local tax back into a final Tax Reform package. (*I rewrote this sentence from the original post for clarification. The original sentence in the original post remains the same.)

That could be a catalyst for a continuation of the current rally. – Recovery, Accumulation, Boom and Finally Distribution

Bottom line: As more meat gets put on this bone of what could be a strong, pro-growth tax plan, it will provide more fuel to equities going into the year-end during a quarter that is already historically very strong to begin with. I feel like the markets are actually starting to believe that something will get done on taxes. If they get done, it will be a powerful boost to the economy leading to accelerated growth, higher stock prices and an increase in bond yields (steeper yield curve). Be invested.

Vegas

I’m just finishing this up for publishing as word on this tragedy is coming across the news in greater detail. It’s a horrible situation and our thoughts go out to everyone affected by this tragedy. There are truly some sick people out there.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.