I’ll assume that everyone is following the news and doesn’t need a recap here other than to point out that this is a difficult situation – globally, nationally, economically and financially. Here are some quick facts, then, more importantly, I’ll get to some thoughts that I hope are relevant to you. I’ve been writing this for two days and with all the changes, and I’ve found it hard to hit “publish.”

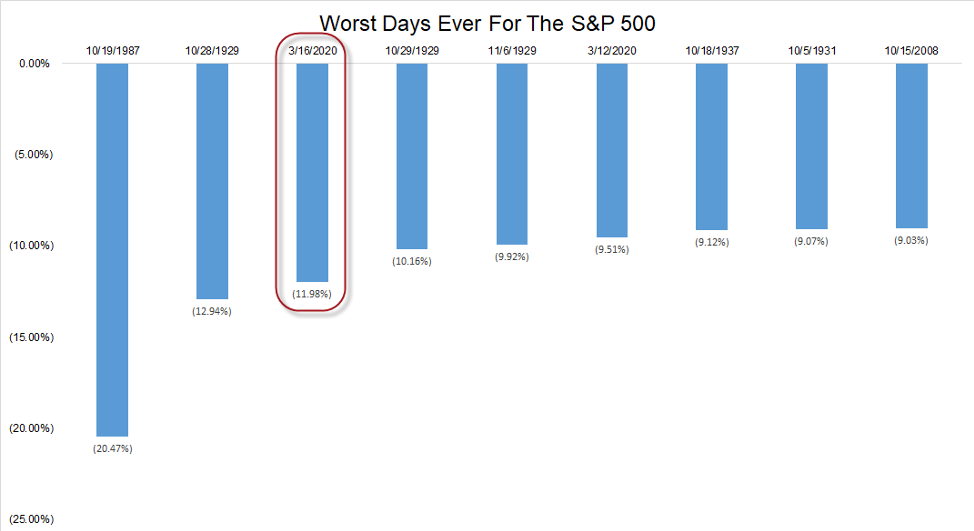

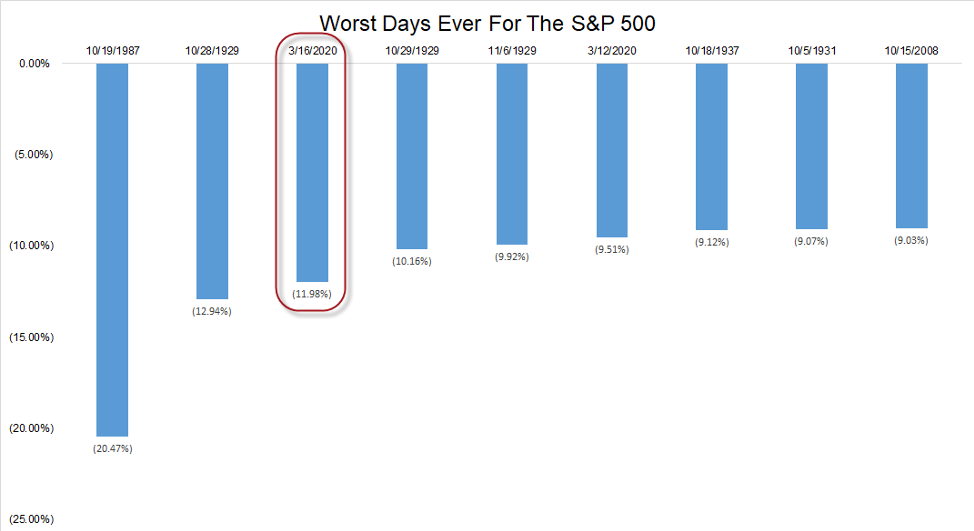

- Yesterday, Monday, March 16th, 2020 made it six consecutive days where the S&P 500 changed at least 4% (up or down), tying the record from back in November 1929. Let’s see what happens today. [Update: As I edit this post, the S&P 500 closed up ~6%.]

- Yesterday was also the 3rd worst percentage drop in history for the S&P 500. Only October 1987 and October 1929 were worse.

- It was also the 4th worst percentage drop for the Dow…only December 1914, October 1929, and October 1987 were worse. So basically, the Great Depression and Black Monday.

- Finally, yesterday was only the second time in history the Dow changed 9% or more for three consecutive days – the other was in October 1929.

(Chart: @LPLFinancial @RyanDetrick)

You know it’s severe when we are comparing the percentage sell-off and volatility with trading days during the Great Depression.

Relevant Thoughts

The markets have priced in a recession, so if I’m looking for something good to extract, it’s if a recession DOES materialize (more below), a lot of the sell-off has already taken place. We may not be at a low, but the below should give some hope to those who are holding true to their personal strategies and can hold tight by not liquidating anything in their portfolios.

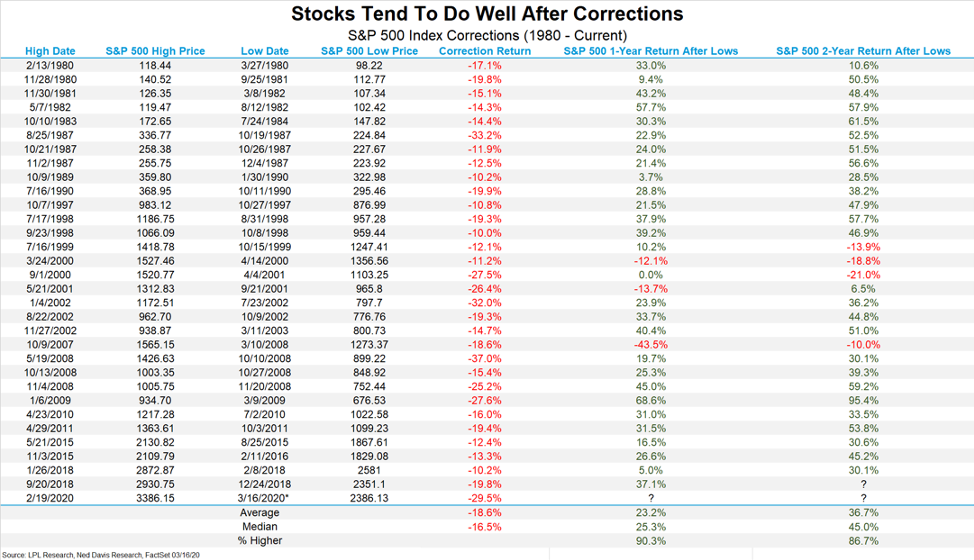

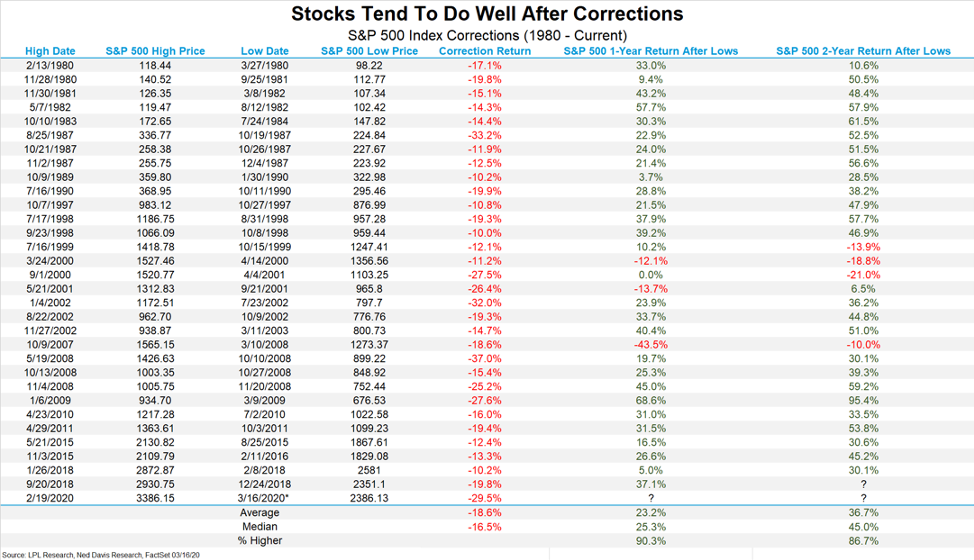

(Chart: @LPLFinancial @RyanDetrick)

You can see above that correction losses recover within one year in all but three instances, and recover within two years in all but four instances (which sounds weird but see the red numbers above). Additionally, average and median returns one and two years after lows are well higher than the average and median losses.

The problem with the above is that we don’t know if we have hit a low. But we will hit a low at some point and when we do, the statistics should help frame decision making.

But decisions have to be made within the context of the best information available and using the best data and stats. As I have said numerous times in the past, investing is about probabilities more so than possibilities.

I can’t tell you what will happen tomorrow, the next day, the next month or even quarter. Still, I can look at that data and say, “There is a very good chance that if you STAY invested or invest any cash you have TODAY, you will celebrate March 2030 with some very, very good returns in your portfolio.”

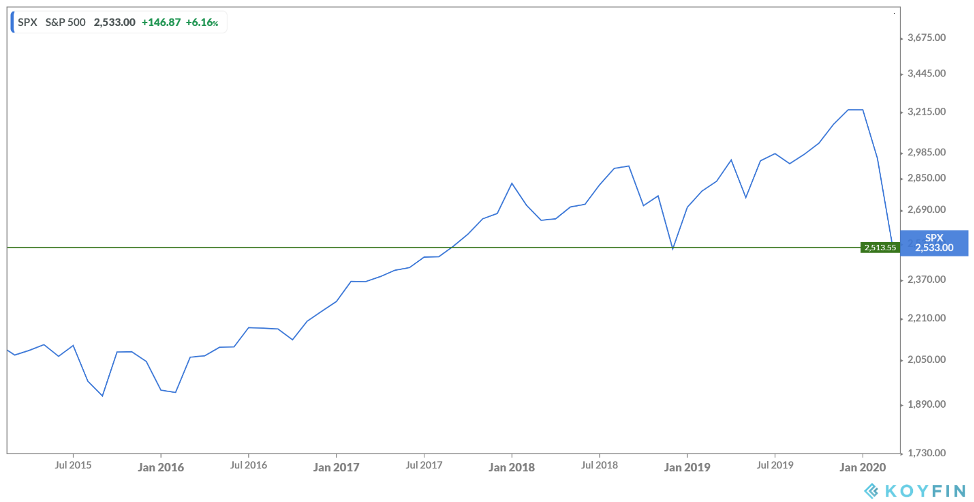

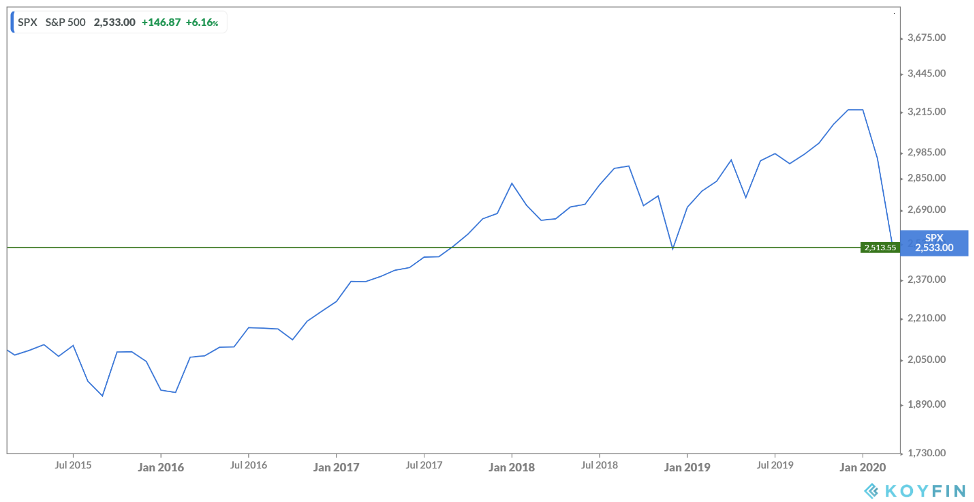

Or, from a different perspective, how many people said last year, “Man, if I could ONLY GO BACK to Christmas Eve 2018 and load the boat in my portfolio…I guess I’ll have to wait.”

Well…

As most of you know, we subscribe to the following philosophy–investing is about patience and discipline combined with having a process for decision making that removes emotional behavior and uses time to capture the full compounding effects of investing.

Also–Trading is not investing.

What’s Gone Right – Making Lemonade out of Lemons

As most clients know, we run models for our different equity strategies. To recap, while each model is scoring different inputs, they all have the same operational framework, which is to own stocks until the score on a stock that we hold reaches a predetermined sell level. At that time, we sell the stock, no discussion, no debate, no human emotion. It’s gone. That’s by design–a process that removes the emotion.

Once a stock is sold, we run the model to re-score a list of stocks and select a top scoring stock to replace the one we sold.

There is a little more to it than that, but that’s general enough for this discussion. We have always maintained that in a volatile market we would exercise the sell and rather than immediately replace it, we will sit on cash to wait for things to settle down.

We have been doing that across all Monument managed equity models except the ETF model (more below on that).

[NOTE: Please do not confuse selling securities in the normal course of actual portfolio management and deciding to sit on cash with market timing or “selling just to sell” out of fear. The securities sold are ones that don’t belong in the portfolio anymore. The only difference now is we are waiting to buy new ones when things settle down.]

The models don’t sell stocks just because they go down in price, they sell stocks because something is structurally or fundamentally changing in the company or sector it is in. For example, if a company in the Dividend strategy looks like it will have a problem paying a dividend in the future, it will reduce the score of the stock.

Within the stock models, the proceeds from any sales will remain in cash until we have some more clarity. We believe that will help hedge against any further short-term downside and allow some data the models use to score to stabilize. We are not market timing, but this seems to be prudent in the context of portfolio management and security selection. While each portfolio is a little bit different, we have been generally successful in raising some cash before a lot of the big sell-off happened. Some strategies had things sell faster than others. It’s not a ton of cash cushion, but every bit helps.

We will have details of all transactions in our next Portfolio Update that goes out to clients.

Within the ETF model, we are selling a few holdings to cash while also tax-loss swapping out of some ETFs and exchanging into others issued by another company that tracks the same sector. This was a successful tax strategy in 2008, and we are utilizing it again. This will hedge the portfolio with some cash in case we experience a more prolonged downturn while harvesting losses and replacing some other ETFs to maintain market exposure. The loss harvesting will help out on 2020 tax returns while keeping the portfolio invested for a recovery.

Recession and MONCON

Lots of questions about MONCON are coming in. No, I don’t think it’s broken and no, it’s not a failure. But it clearly requires an explanation.

The reality is that there are no leading economic indicators or models for foreseeing these “black swan” events. MONCON included.

I’m sure this event will eventually have out-sized effects on most, if not all, of the leading economic indicators used in MONCON, but this event simply happened too fast for this or any other model that uses data to guide portfolio decisions which would have avoided recent losses.

I wish the tools and data we use to help make good decisions in normal times were able to help predict a situation like this, but they simply can’t – any more so than they can predict a car crash.

Economic data can’t predict specific events; it can only help assess changing probabilities.

This is an event that will cause economic pain. However, anyone claiming to know how much, how long, when it ends, or how it ends is guessing, and I still don’t subscribe to uninformed, fact-less guessing as a way to manage wealth. Even after all of this.

While we were hopeful that this situation would not develop into a full-blown recession, that positivity is obviously in jeopardy. The best we can hope for is a short slowdown, but that does not seem likely at this point. I think it’s clear that the response to this virus will have some level of recessionary effect that isn’t a function of the typical economic cycle.

Typically, the economic cycle causes a recession…in other words, if this event didn’t happen, I don’t think we’d have been entering into a recession. MONCON backs that up.

Remember, when we developed MONCON, it was designed to look at data series (economic indicators) over time and calculate any increase in the probability of a recession occurring over the upcoming months. This current event happened too fast and the market reacted more swiftly than at any other point in history (see above charts).

So, while MONCON didn’t help us here, it has MOST DEFINITELY helped us up to this point. It has helped us avoid the head fakes that we saw several times over the past seven years. Specifically, it helped remove the emotions from the decision-making process, keeping clients properly invested and eliminating the tax ramifications that are inherent in selling.

December 2018 is a great recent example. When it was commonly accepted that the economic and interest rate environment was setting the U.S. up for a recession, the market sold off almost 20% from the high over the three months of the 4th quarter. MONCON kept our emotions out of it and kept us invested. As most remember, the market roared back, quickly restoring the temporary loss of wealth for those who had a plan, were patient, and stayed invested.

The Hard Part

But now here’s the hard part to admit. It’s the hardest sentence I’ve had to write in years…

I was wrong.

It’s hard to admit, but I’ve always said when I’m wrong, I’ll admit it…I hate that I was wrong. I learned to deal with it as a young officer in the Marines. It was part of being a leader. Obstinate leaders who can’t admit when they were wrong will never learn. And that gets people hurt.

I will learn from this, but it also reinforces something I know to be true from past mistakes – there are two different kinds of wrong, there is being wrong because I made stupid uninformed decisions…and there is being wrong because I made decisions based on the facts I had in front of me at the time, and the information/event/data changed.

I believe I was wrong due to the latter and not the former. If you disagree, you are welcome to write or call and tell me that. I’ll listen.

Meanwhile, I will continue to learn. You have my pledge that I always have and always will do my best to anticipate and predict what lies ahead to the best of my ability. I will continue to navigate while using the facts and data I have to course correct in real-time and not rely on emotions. I will form opinions and I promise to continually communicate them. And I will continue to always listen, especially to that which I don’t want to hear while learning from experiences and applying what I’ve learned in the future, just as I have always tried to do.

Finally, I will continue to lead and improve myself while always elevating others – especially those here at Monument and more importantly, you.

Storms don’t mean the sun will never shine again, and across this valley, there is another peak – These things I know.

While I write this blog by myself, the entire Team at Monument believes all of this and we all stand together ready to help in any way we can, field any questions you have, even if it’s just to chat.

Keep looking forward,

Dave

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice.

A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.