This is the beginning of the best time of the year. Everyone here at Monument hopes you had a wonderful past few days with family and friends. Now, it’s on to the full-blown holiday season.

Last week was pretty quiet due to the Thanksgiving holiday. The economic data that was reported remained largely positive and investors seemed less concerned about the mounting evidence that the Federal Reserve will raise rates in December. More on that below.

The S&P 500 Index was up marginally for the week. Small-cap stocks outperformed as well as the Consumer Staples and Energy sectors. Oil prices rose slightly and the U.S. dollar advanced against other currencies.

Third quarter gross domestic profit growth was revised higher. The latest reading showed that the economy grew by a 2.1% annualized pace last quarter, rather than the 1.5% rate earlier reported. Final real sales were revised lower, while inventory levels were revised higher. I wrote about the initial GDP report back in early November.

The Christmas shopping season is a BIG DEAL for retailers (which we wrote about a week or so ago and you can read here). It will probably represent about 19% of the retail industry’s annual expected sales of about $3.2 trillion. Let me put that into perspective … the most expensive weapons program in history will be the F-35 Joint Strike Fighter. Over 2,450 total aircraft will be produced at a total cost of … drumroll … $1 trillion. So this holiday season, we will see shoppers spend enough to buy…oh…around 1,200 F-35s.

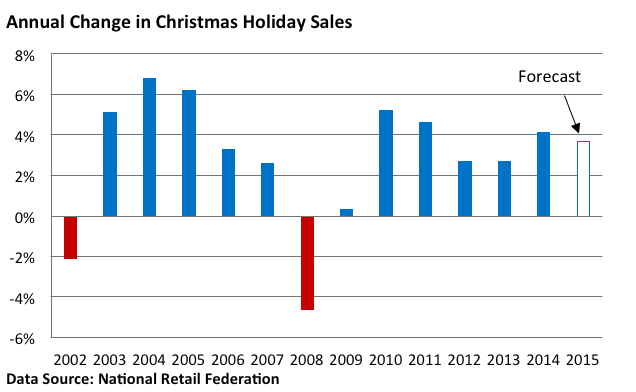

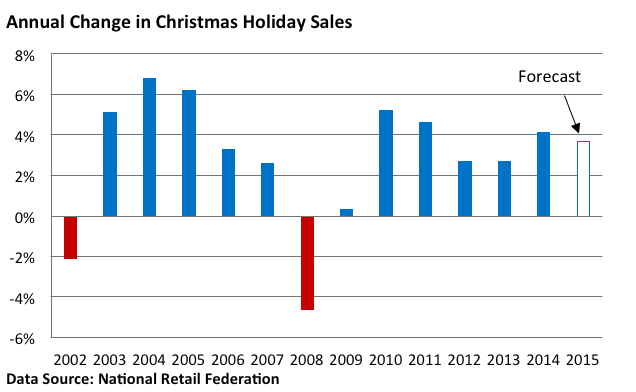

The National Retail Federation announced last month that it expects sales (excluding autos, gasoline and restaurants) during November and December to rise by 3.7% from a year ago to $630.5 billion. This would be above the 10-year average of 2.5%, but below last year’s increase of 4.1%. See the chart below.

The National Retail Federation forecasts that online sales will rise 6-8% to as much as $105 billion as Internet shopping continues to overtake those of brick & mortar retailers.

What About Black Friday?

Let’s be careful regarding early numbers about the success (or lack of) on Black Friday weekend, which runs from Thanksgiving through Sunday. A number of retailers have been spreading out the Black Friday bargains. It’s not unusual anymore to see deals that started last week stretch into today (Cyber Monday)…I’m sure you have received a ton of emails highlighting all the great deals. This ‘stretch out’ could diminish initial numbers that come out for the four-day period. Also remember that the holiday shopping season runs for two months, which has to be taken into account.

HERE’S MY POINT

I really think the season will be a reflection of the current economic environment. Shoppers that are confident tend to spend more liberally during the holidays. Those that are concerned about losing their job or are uneasy about the economy are typically more cautious.

Right now, 2015 Holiday Sales are forecast to be less than last year. After the August-September market cycle and what has been a relatively flat market so far this year, that’s not a huge surprise. In the end, I’ll welcome hitting or exceeding the forecast as a really good indicator of how people really view the current economic situation.

The Fed and Interest Rates

Just a real quick thought here, because man, I’m tired of Fed talk and I’ll bet you are too. First, you simply can’t play the Fed. There is no “Fed Play,” there is only sound, long-term investing. However, here’s one thing worth pointing out. Business investment is the purchase of goods used in the process of production, which includes construction of factories, offices, machines, computers, and any other equipment used by manufacturing or services companies. Historically, business investment is not strongly impacted by Fed tightening, and since corporations have very strong balance sheets (they are hoarding TONS of cash) they are less likely to need to go get loans for business investment down the road. Combine the lack of impact that tightening has on business investment with the strong balance sheets of corporation and I just don’t think the Fed tightening in December will impact business investment.

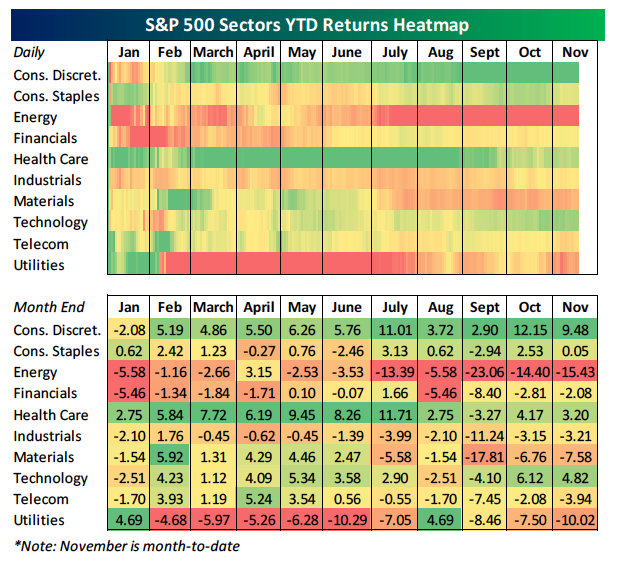

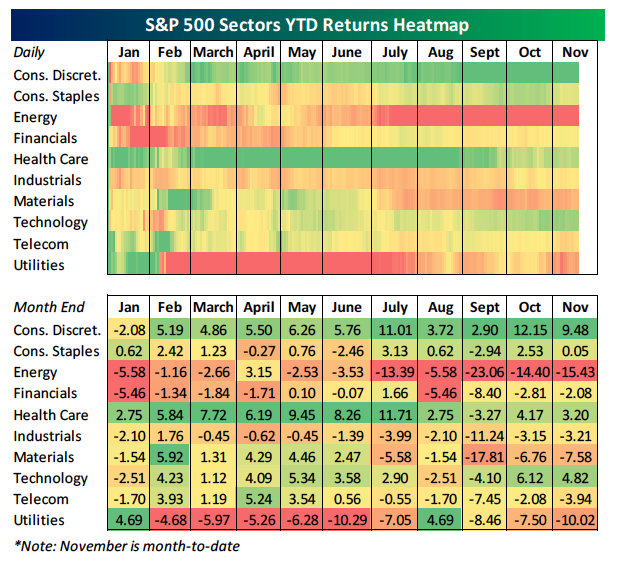

Year-to-Date Sector Performance (Through November 20, 2015)

Yes, August and September hurt most investors, but by glancing across the top chart from left to right you will see green is good and red is bad. We’ve been proponents of the Consumer Discretionary and Health Care sectors for the whole year. Investors who were in defensive sectors like Utilities, Energy and Telecom did poorly. See the bottom half of the chart for monthly returns. Pay attention to August and September returns, specifically the losses in Utilities, Energy and Telecom. Materials got HAMMERED too. (Chart thanks to Bespoke)

Final Third Quarter Earnings

Earnings are done. Earnings season unofficially opens with Alcoa and ends with Walmart.

The percentage of companies beating their revenue estimates for quarter three (Q3) of 2015 ended up at 47%, which was well below the average of the 60% that we’ve seen since 2000. It’s been a really poor showing for revenue over the past three quarters.

The percentage of companies beating their earnings estimates ended up at 59%, which was below the average of 62% dating back to 1998. Last week we stood below the average so it was a nice move to the upside over the past week. If the 63% reading holds, it will be the best reading since Q4 of 2010.

Bespoke publishes a chart that shows the spread between companies guiding future earnings higher or lower on a percentage basis. The final reading for Q3 of 2015 shows that the spread between companies posting negative guidance versus companies posting positive guidance was at -4.3%. This is far from the worst spread reading which stood at -9.4% in Q4 of 2014, which was also the worst reading since the last two quarters of 2008.

Of the last 17 quarters, two were about flat and the rest were negative. It’s interesting to me that companies are guiding lower as the market goes up. If I see this invert, it will have my attention – it could be a good indicator of corporate over-confidence.

Important Disclosure Information for “The Beginning of the Holiday Season”

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.