Does a Bear Whit in the Soods?

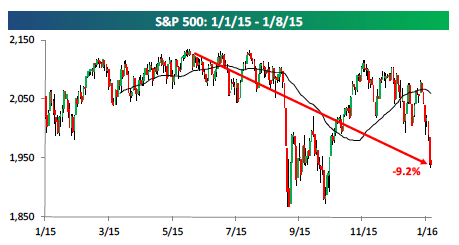

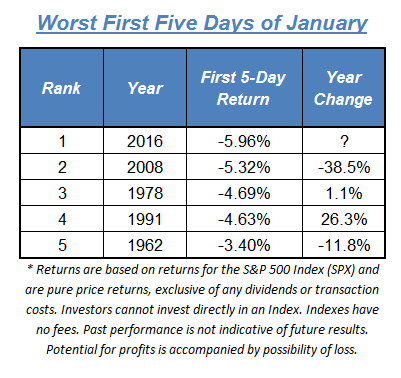

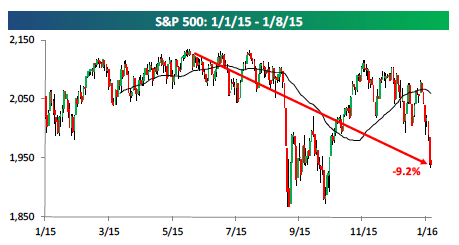

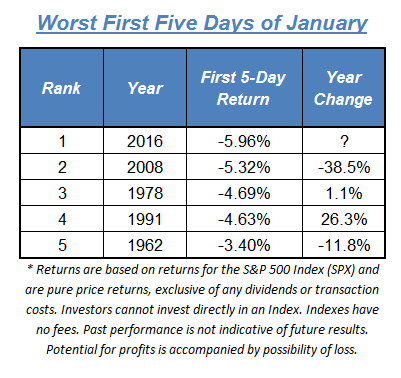

You see what I did there, right? Last week was horrible, I get it. The S&P 500 is down about 6% year-to-date (YTD) in the first week of the year. Furthermore, with the Dow down about 11% from its high last year and the S&P 500 down just a hair under 10% (-9.8%), we are basically in “correction territory”, which is generally defined as a 10% drop from a previous high. Here’s a chart from Bespoke’s Weekly Report.

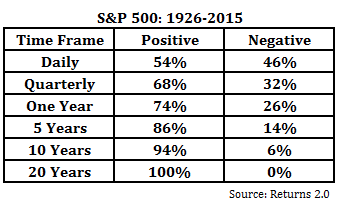

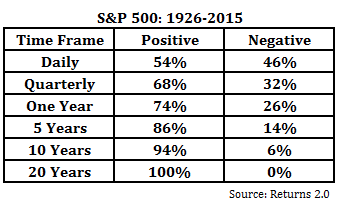

Now, I know it is standard convention to reset investment portfolio benchmarking at the turn of each calendar year, but just remember, if you are a disciplined investor following a long-term plan, a year is NOT a long period of time. You should not let standard convention get in the way of good decision making.

But the thing is, I know it is.

How do I know? Because there is this little thing we say in the office when the market is up or down big for the day…I say, “Spencer, why is the market down today?” and he will respond with, “Because there are more sellers than buyers.”

People were selling. Hopefully, it was not you.

China

Most of the losses from the first five days of the year can be attributed to concerns over China. The beginning of the week saw the blame fall squarely on the Chinese manufacturing report that came in just under expectations. I wrote about this last Thursday in our Special Report and point out that stocks shouldn’t nosedive on minor misses. I also point out that it was more likely policy missteps by China’s central bank that was the culprit, but I’ll now add that a renewed slide in China’s currency, the yuan, contributed to it too.

Another fear, and this is speculation based on common sense, is that China’s leadership is losing control of the situation…and markets aren’t in a forgiving mood.

Other Stuff – Yes, There is Other Stuff

A disappointing ISM Manufacturing report on Monday and a continued drop in oil prices also soured the party. Oh, and there was Wednesday’s claims by North Korea that it had successfully tested a hydrogen bomb.

I run the risk of being wrong until I’m right, and I get that, but oil is just too large of an input to not matter. I just bought a plane ticket to Orlando for business for $59 one way…First Class was $95. The return from Ft Lauderdale was $78 and $118 for First Class. I splurged and got the First Class tickets – I’ll line my pockets with mini bottles. Oil matters to a lot more than just energy companies, as you can see in the chart about earnings embedded in this blog. Also, please pass along any CNBC footage that you have from when oil was over $120/bbl and someone was saying, “We are going to see a great year in the market with oil this high.”

Fourth quarter (Q4) earnings season begins this week. As I stated in last Monday’s blog, is expected to disappoint, but there is more to it than that. Go read that blog if you missed it.

Positives

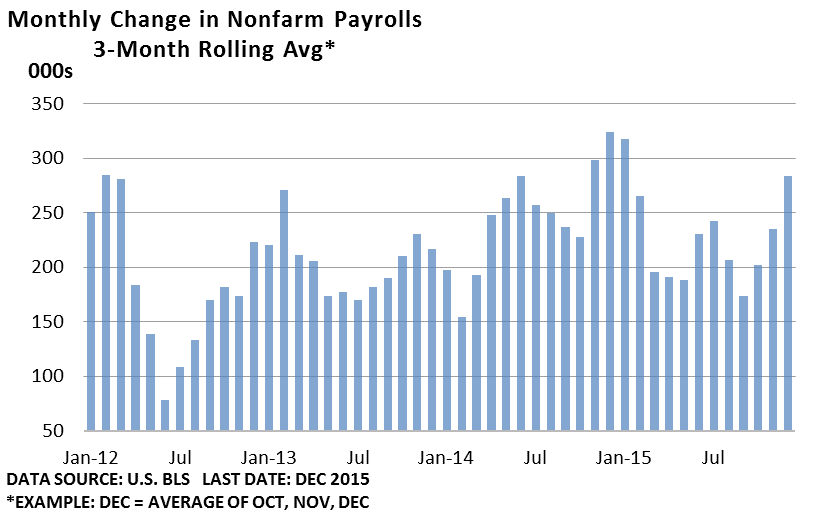

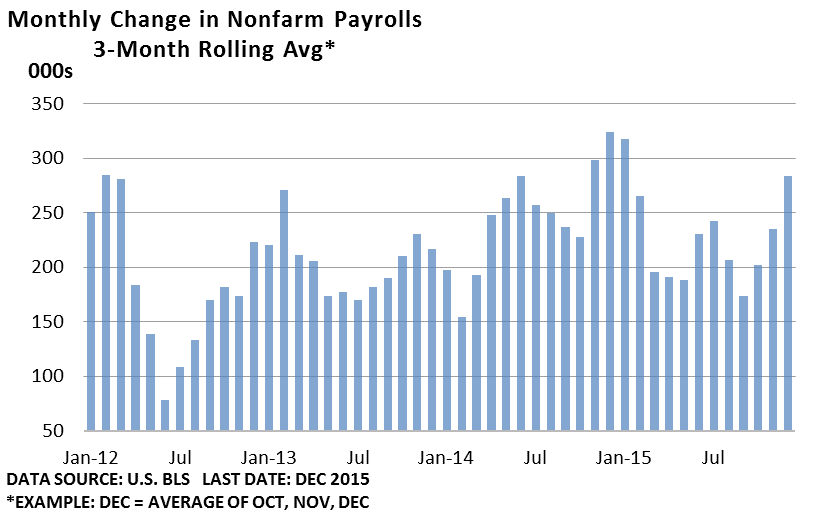

Last week’s 292,000 much-larger-than-expected increase in non-farm payroll employment (together with the 50,000 upward revision to the gains in earlier months – because that happened too), should put to rest any fears that the U.S. expansion is in jeopardy even if Q4 GDP ends up being…hmm, what’s the word I’m looking for…uninspiring. This jobs data shows that the U.S. economy is still growing.

Someone on TV the other day speculated that the reason wages are not growing is that discouraged workers are now reentering the job market, which is keeping the supply of workers higher than demand just enough to keep wages flat. I’m sorry I can’t attribute that thought to someone, but I agree with it. I also think we are close to seeing a meaningful increase in wage growth, just not tomorrow.

- Bad news: People are not making a whole lot more money.

- Good news: Wages drive inflation, and keeping inflation low will keep the Fed from having to raise interest rates too quickly. I think Fed patience is key to extending this recovery/expansion we have been in for several years.

The ISM Services report signaled modest growth, which is good because we are now much more of a services-based economy than manufacturing.

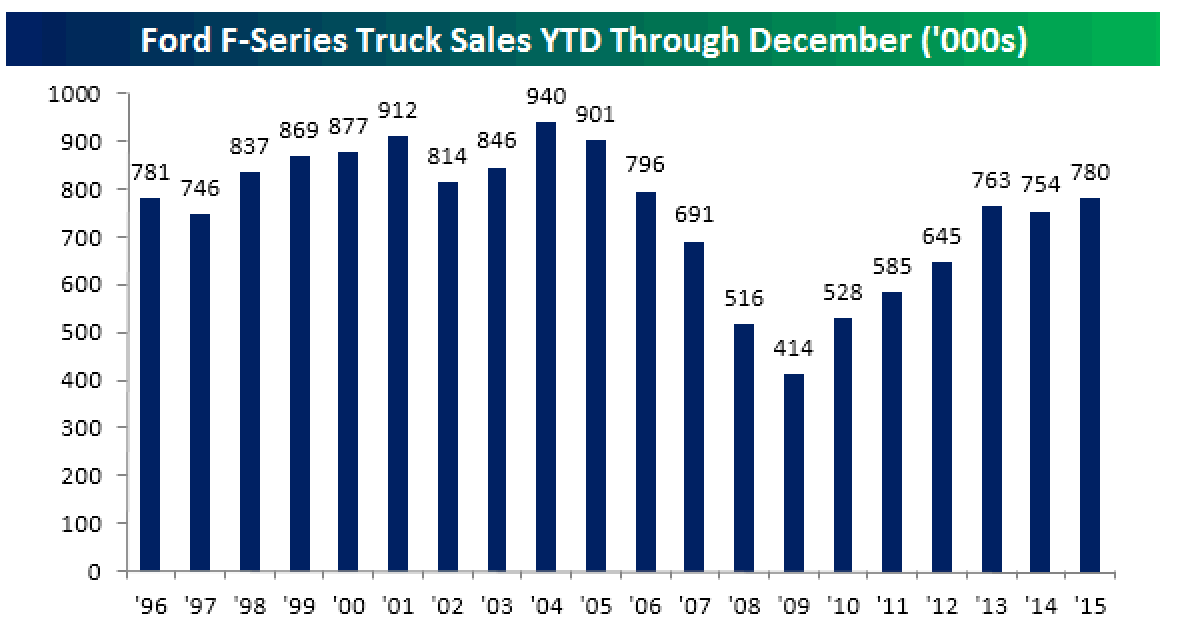

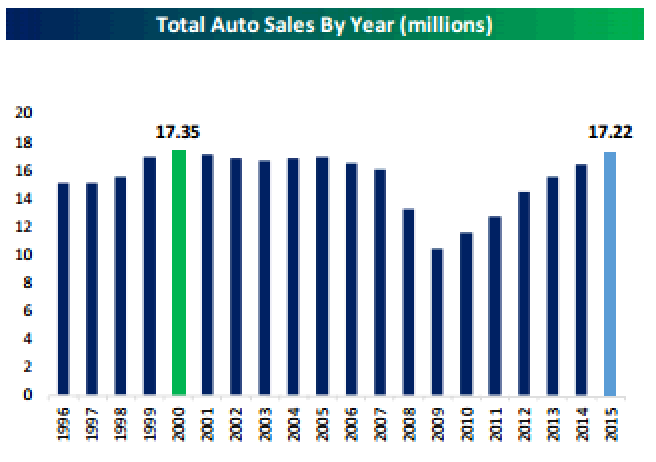

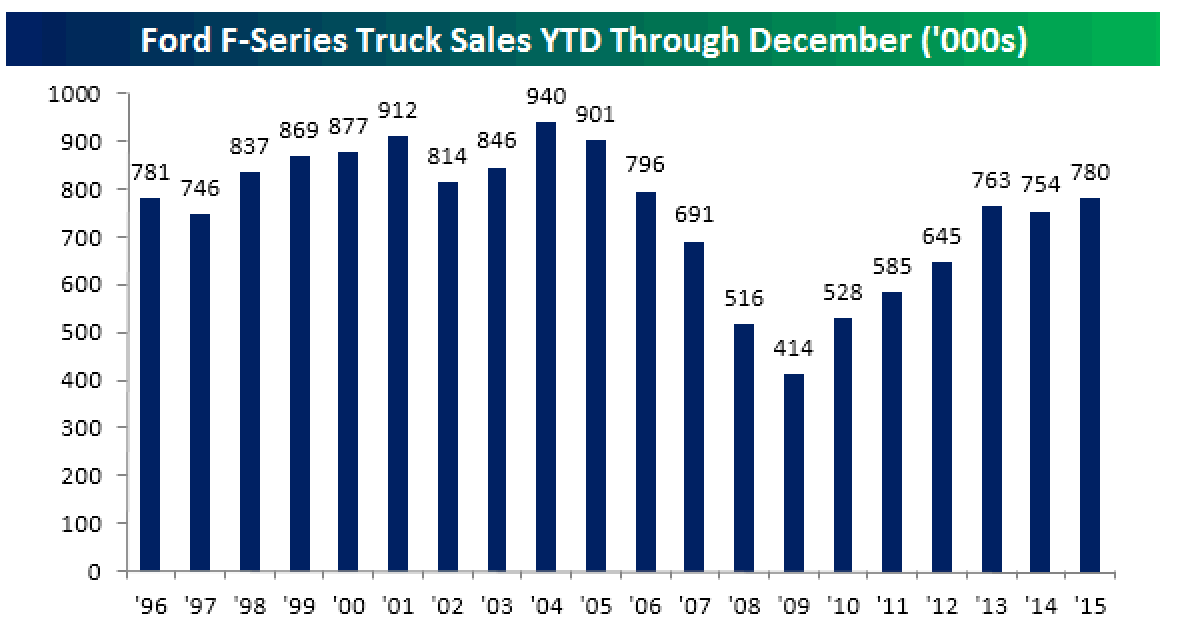

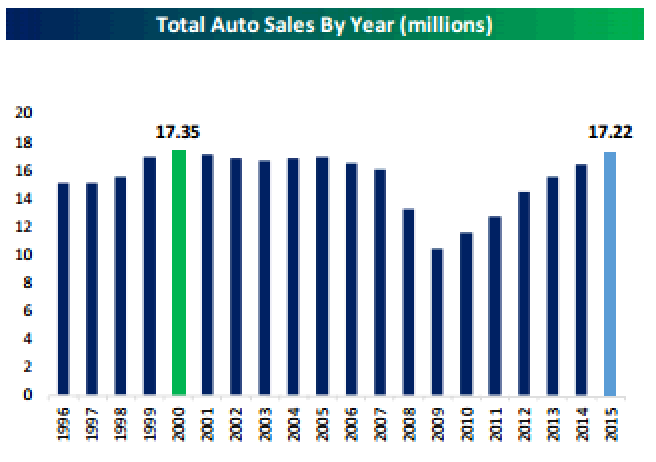

Autos sales moderated in December, but still set a record in 2015 (insert my drumbeat of housing and cars…). I’ve written about why F150 truck sales are a decent indicator to watch, and that is because only a small percentage of people buy F150’s to just cruise around in for looks and Beast Mode Cowboy antics. The rest use them as actual functioning work vehicles to haul pipes, lumber, tools, compressors, dirt and other building stuff…not golf clubs or Tumi luggage. So it’s a good economic indicator.

Employment in construction (boom, boom, boom – housing…cars…housing…cars), which would normally be impacted by nasty weather this time of the year, expanded at a vigorous pace both in November and December. This is good but even if you strip out the construction jobs, employment still grew at a nice strong rate at the end of 2015. Look at this chart from Charles Sherry.

Oh, and that upward trend (+292k and the 50k revisions) for Q4 2015? That came during the same time we saw the ISM Manufacturing report signal a contraction in manufacturing.

P.S. The manufacturing sector added 8,000 jobs in December.

Perspective Please…

Now go back to August of last year. Remember that was when angsts over China forced a swift correction in U.S. markets? Remember all that talking head noise on TV saying, “blah, blah, blah, I manage $1.5 billion of assets for clients and this China slowdown will hit the global and U.S. economy…blah, blah, blah, look at my red tie and snappy suit…”?

Well, hotrod, it turns out that U.S. job creation has improved. So go eat your tie and write another check to your PR firm to get you back on CNBC real soon.

I can’t wait, because it turns out that even though China is the world’s second largest economy, U.S. exports to China account for less than 1% of U.S. GDP, and sales of S&P 500 companies to China account for just 2% of revenues. (I read that in a Goldman Sachs Investment Research report.)

It’s noise because by itself, it’s simply not enough to trigger an economic downturn at home.

Now, keep this in mind. None of that means volatility is behind us. Markets will continue to struggle with the news from Asia, but it should only matter to traders, not you.

…because you have a good plan and a solid long-term investment strategy…right?

What To Do & What I Think

Aesop, the slave and great story teller, wrote the famous story about the Tortoise and the Hare. You know the story…

I’m a tortoise. I just am. I know the stats and I know that only charlatans and fools think they can predict what will happen. Just like over time, the two dice on the craps table will combine to equal seven more times than any other number…OVER TIME. Tables get hot and tables get cold but there is no skill involved and the casino always wins over the long run.

Want proof?

Think I’m alone? I’m not the only one that admits no one can forecast the future. See this article from the Sunday Edition of the New York Times where Jeff Sommer highlights research that should be recognized if you have been reading my blog since, I don’t know, like whenever.

I meet people all the time who are in search of the silver bullet – the investment product, idea or manager who has a complicated strategy explained in slick brochures with a ton of “Finan-glish”.

It does not exist. I promise.

In my opinion, simplicity and consistency is the name of the game. Let the other guy go chase the silver bullets (and let those big Wall Street firms profit off them rather than you).

Also, don’t let gobbledygook (yeah, you, Mr. Red Tie) interfere with letting time, your plan and your investment strategy work for you. Your plan should address your specific needs, goals and objectives. Focus on what you can control about your plan and investment strategy, which by the way are primarily your behavior and emotions.

Unsuccessful investors focus on the irrelevant gobbledygook – exposure to too much data – and I believe that 97% of it is the wrong kind. While it’s easy to do, don’t confuse trading with long-term investing.

Howard Marks, who writes a lot about the industry and markets, said something along the lines of, “You can’t predict, you can only prepare.”

Below are a few paragraphs I wrote back in August when the Dow got pasted with a 1,000 point decline at the open. You can find the whole blog here. Go re-read every single word in this blog…like, now. Here’s a snippet:

“You should know how much liquidity (cash) you need out of your portfolio and have it ready. You should not have to panic and ever say “What should I do now?” Have a plan and stick to it. Take a look at your fire drill now. If you don’t like it, rework your plan. It’s okay if this recent market activity got you to a point that you realize you don’t actually like the current riskiness of your portfolio. But panicking is not a way to change your plan.

If you have a plan, stick to it.

If you have long-term cash, consider investing it now.

This may not be the bottom, but if you buy right now, I know you’ll be happy with where the investment ends up five years or so from today.

Don’t listen to Charlatans or Fools … now or ever.”

As an investor, you should never be unprepared for a major market disruption. If you are cringing at a 5% five-day sell-off or what has amounted to a 10% correction off the high, you have misjudged your risk tolerance. It does not mean you should panic, it just means you need to connect with us (or your advisor) and talk about it.

No one likes losing money, but the markets have never grown in a straight line and they never will. Time is your friend.

Finally – I bought Powerball tickets so if after the next drawing you never hear from me again you will know that I’m on an epic “Pool Snob” journey where I relax around all the world’s finest pools.

Important Disclosure Information for “Does a Bear Whit in the Soods?”

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.