Monument Wealth Management Articles

What Is an Expense Ratio and Why Is It Important to an Investor?

Share on your favorite platform, or by email

Expense ratios can be confusing. What are they? What do they reveal about a fund? Why should you, as an investor, care about any of this?

What is an Expense Ratio?

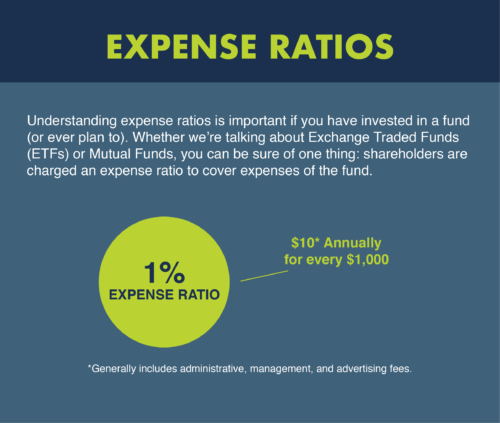

Understanding expense ratios is important if you have invested in a fund (or ever plan to). Whether we’re talking about Exchange Traded Funds (ETFs) or Mutual Funds, you can be sure of one thing: shareholders are charged an expense ratio to cover expenses of the fund.

This charge is not explicitly paid by you, the shareholder, to the fund. Instead, the expense ratio is taken directly from the value of the fund; this reduction in value is reflected in the fund’s daily Net Asset Value (NAV) or, simply put, the fund’s market value per share. Shareholders “pay” the expense ratio indirectly through the value of their investment – as the fund’s returns to shareholders are reduced by operating costs, the value of a shareholder’s investment decreases as well.

The expense ratio is usually expressed as a percent. For example, if the total cost for running a fund is $10 and the fund has total assets under management of $1,000, the expense ratio is 1%. The expenses included in the expense ratio charge vary depending on the fund in question, but generally include administrative, management, and advertising (12b-1*) fees.

One way you can think about the expense ratio (sometimes called the Management Expense Ratio) is as a measure of efficiency. The lower an expense ratio is, the more efficient fund management is with their resources (and your money).

Armed with this knowledge, you may be tempted to pick a fund to invest in because it has the lowest expense ratio you’ve seen and call it a day. However, there are other factors to consider than just the expense.

Here are some things to keep in mind as you apply your expense ratio knowledge to investing…

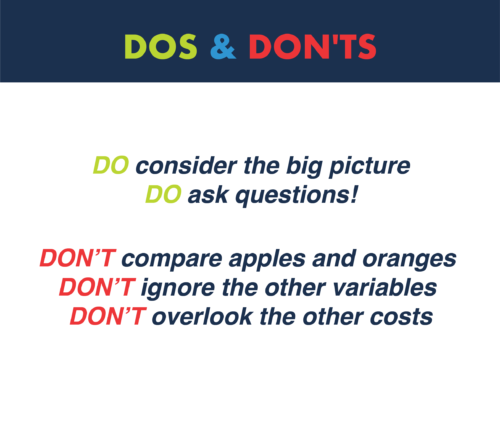

Don’t compare apples and oranges

Just because two things can be compared doesn’t mean the comparison is necessarily valuable. While it’s tempting to compare the expense ratios of two funds, isolated from other factors, to make a quick investment decision – ultimately, it’s not necessarily helpful. This is because funds that appear similar may have different weightings to underlying securities and/or can own different kinds of investments. Because of these underlying cost differences, expense ratio comparisons should be just one factor to consider when evaluating funds that exhibit similar characteristics.

Don’t ignore the other variables

Actively managed mutual funds, for example, tend to have higher expense ratios than ETF’s because they have to pay people to manage the process of selecting securities to buy and sell. Other variables, such as the fund’s classification, investment category, investment strategy, size, and management decisions all impact the expense ratio. This means these fund characteristics impact you, the shareholder, as well.

Don’t overlook the other costs

The expense ratio does not include every fund cost nor any of the costs associated with hiring a wealth manager. The expense ratio is the cost of owning the fund. As such, any brokerage costs, sales loads, transaction fees, advisory fees and any other charges passed on to investors aren’t reflected in the expense ratio.

Do consider the big picture

The expense ratio of a fund is one of many factors that need to be considered before making an investment decision. Rather than getting bogged down in the particulars of a fund, ask your financial advisor how the fund in question aligns with your long-term goals and if the costs are warranted based on the fund’s investment strategy. More importantly, always ask if there are any other funds that have a similar strategy that are cheaper and if they were considered as well before making a recommendation. Not all advisors are required to operate as fiduciaries and therefore do not have to be acting in your best interest.

Do ask questions!

As an investor, you should never feel shy about asking your financial advisor for clarification on something you’re having trouble understanding or for an explanation on any recommendation they are making to buy or sell an investment. At Monument, we encourage our clients to take an active role in understanding how their finances work; after all, wealth management should always be a human conversation, not a numbers game.

*The SEC adopted rule 12b-1 in October of 1980 under the Investment Company Act of 1940, making it legal for funds to pay for marketing and distribution expenses directly from the assets of the fund. The SEC does not limit the amount of 12b-1 fees a fund can charge, but FINRA rules prohibit 12b-1 fees from being higher than 1% of an investors’ assets in the fund per year (.75% distribution fee cap, .25% shareholder service fee cap).

It’s time to find clarity around your finances and remove the anxiety of the unknown.

Read our case study, “High Earners Eye Retirement,” to see how we helped one of our clients with their wealth planning.

Ready for straightforward, unfiltered opinion and tailored advice for YOUR questions, not everyone else’s?

IMPORTANT DISCLOSURE INFORMATION

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Capital Management, LLC [“Monument”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Monument is engaged, or continues to be engaged, to provide investment advisory services. Monument is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice.

A copy of Monument’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.monumentwealthmanagement.com/disclosures. Please Note: Monument does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Monument’s website or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Monument account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Monument accounts; and, (3) a description of each comparative benchmark/index is available upon request.

Please Remember: If you are a Monument client, please contact Monument, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.