Monument Wealth Management Articles

SALT Tax Deduction: What Business Owners Should Know

Share on your favorite platform, or by email

If you reside in a state that has an income tax system and/or high property tax rates, chances are you’ve been stung by the limited deduction available on your federal return for state and local taxes (SALT).

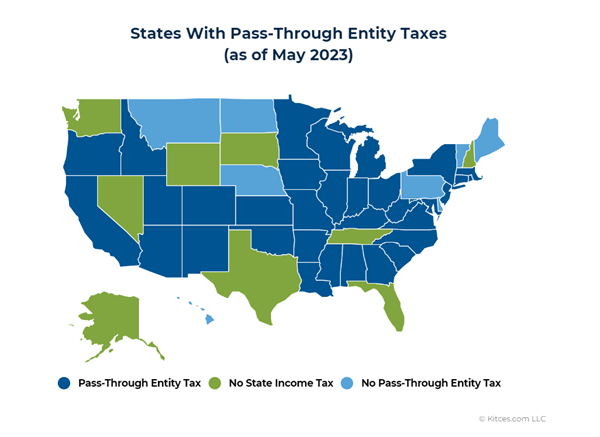

Many taxpayers who itemize have lamented the $10,000 cap on the SALT deduction since the 2017 Tax Cuts & Jobs Act passed. While Congress has been unsuccessful in making changes to or repealing this cap, 33 states have developed functional workarounds to the federal SALT deduction limit for business owners. If you are an owner of a pass-through business entity and live in one of those 33 states (see map below) a Pass-Through Entity Tax (PTET) election may help you reduce your federal tax bill.

What is a Pass-Through Entity Tax?

Usually, owners of pass-through entities pay federal and state income taxes on the net income “passed through” to them on their personal tax returns. The business entity itself does not pay income taxes.

Recognizing that combined state and local income taxes plus property taxes generally exceed $10,000 for many business owners, some states have developed a system where the business entity itself is taxed at the state level.

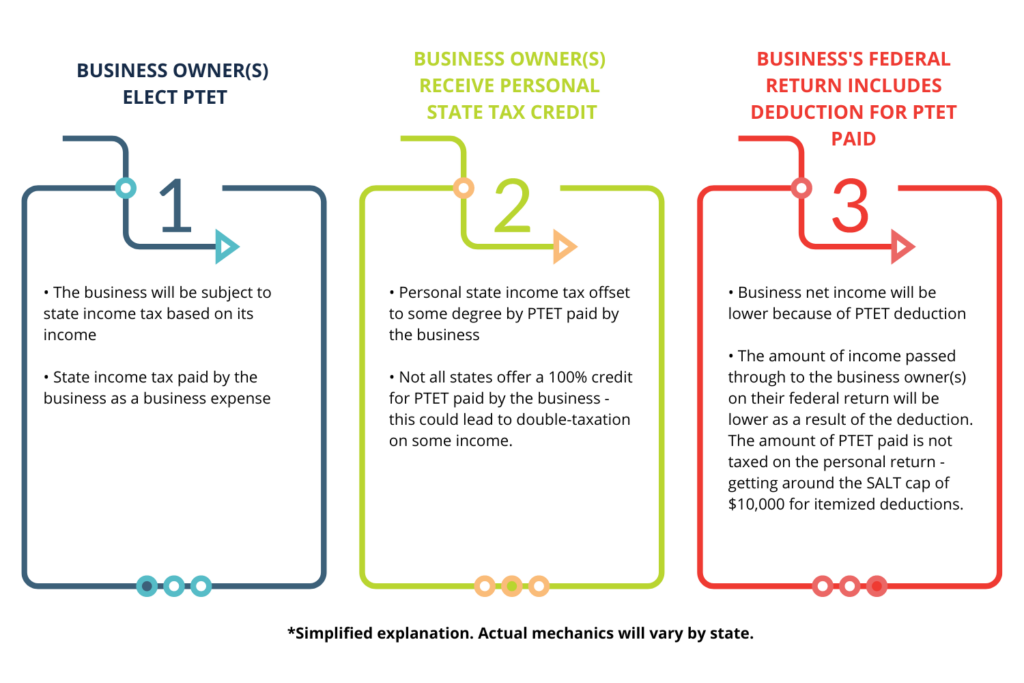

This is a simplified explanation, and the actual mechanics will vary by state, but this is generally how it works:

Tax Savings Beyond SALT Cap Workaround

Business owners who make a PTET election may see other benefits on their federal returns that create total tax savings (depending on their personal situation). When the SALT deduction up to $10,000 is taken on a personal return, it is taken on a Schedule A after arriving at adjusted gross income (AGI). With a PTET election, the amount of state taxes paid by the business are taken as a business deduction and reduce the amount of net income passed through to the owner. This effectively serves as an above-the-line deduction and lowers AGI before personal deductions are taken.

Why does this matter?

- AGI drives the ability to deduct certain other personal expenses (like medical, which are only deductible when they exceed 7.5% of AGI), eligibility for some tax credits, and determines whether you are subject to the Net Investment Income Tax of 3.8%.

- AGI (with some modifications) is also a driver for eligibility to make Roth IRA contributions, which can help a business owner build tax-free wealth outside of their business.

Generally, it is advantageous to lower AGI as much as possible through the use of above-the-line deductions.

A PTET election may also reduce the amount of income subject to self-employment tax and the 0.9% Additional Medicare Tax, which can create meaningful savings for those business owners whose business income is all considered self-employment income.

Proceed with Caution – PTET isn’t a No-Brainer

It’s clear that high-income business owners in states with high property taxes, state and/or local income taxes may be able to deduct more of those taxes when electing PTET at the entity level and reserving the $10,000 SALT deduction for personal property taxes. Even so, deep analysis of the holistic tax picture is required to make PTET a clear-cut winner.

A few things to be mindful of:

- Not all states offer a 100% credit on a business owner’s personal state income tax return for PTET paid by the business. This means that some amount of income may be double taxed by the state at the entity and personal level.

- Electing a PTET could mean paying more in state taxes than a business owner would as an individual.

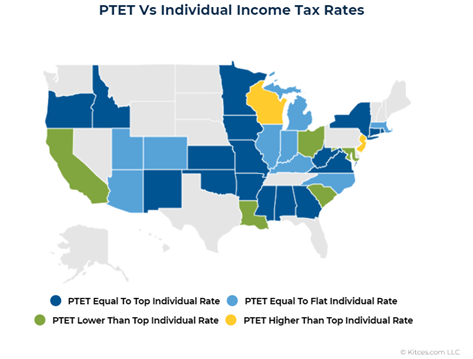

- Many states have a flat rate equal to the highest income tax rate for pass-through entities in lieu of progressive rate. Some states (see the map below) even have a higher tax than the highest individual income tax rate specifically for PTET elections (though some are also).

- Additionally, a larger amount of income might be subject to taxes when paid at the entity level because personal deductions and exemptions won’t be taken (including retirement plan contributions deducted on the personal federal income tax return).

- Things get very complex when doing business in multiple states or when owners are located in multiple states – especially if those states treat PTET differently in terms of rates, credits on personal returns, and eligibility rules. It’s best to leave these nuances to an accountant familiar with the ins and outs of how a business operates.

- Sole proprietors and single-member LLCs may not be able to make a PTET election. These owners may need to elect to be taxed as an S corporation to take advantage of PTET, which will require legal and tax advice.

- A PTET election may yield so little in federal tax savings that it isn’t worth the effort – this is highly dependent on the personal circumstances of each business owner and the state in which they live and do business.

How to Know if PTET is Right for You

Nothing can or should replace a thorough analysis completed by an accounting professional who is familiar with a business owner’s personal and business tax situation. However, there are a few things to think about when deciding whether a PTET election may create enough total tax savings to make sense. As a starting point, consider:

- Your business structure – are you an S Corporation or LLC with multiple owners? This is the primary eligibility criteria for PTET.

- Your state of residence and its income & property tax rates. If property taxes are high AND there’s an income tax system, chances are your total SALT paid exceeds $10,000.

- Your federal income tax bracket. Taxpayers in higher brackets see greater tax savings for deductions (i.e., a $20,000 deduction is worth $4,400 in tax reduction at a 22% bracket vs. $7,400 at a 37% bracket).

Business owners have so many decisions to make on a daily basis and it can feel overwhelming to think about adding something as complicated as PTET to the calculus. The potential for total tax savings is worth partnering with professionals who can help you cut through the B.S. and understand your options for tax-smart moves that help you keep more of what you’ve worked hard to build.

Want to suggest a correction to this article? Email us at info@monumentwm.com. Please note that Monument Wealth Management and its advisors are not tax advisors, and this article is not a replacement for professional legal, accounting or tax advice.

Learn How Chuck & Kelly Prepared for Their Business Sale

Is Your Wealth Advisor Proactively Looking Out for You and Your Business?

IMPORTANT DISCLOSURE INFORMATION

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Capital Management, LLC [“Monument”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Monument is engaged, or continues to be engaged, to provide investment advisory services. Monument is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice.

A copy of Monument’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.monumentwealthmanagement.com/disclosures. Please Note: Monument does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Monument’s website or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Monument account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Monument accounts; and, (3) a description of each comparative benchmark/index is available upon request.

Please Remember: If you are a Monument client, please contact Monument, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.