2019 is here and by now everyone has probably overdosed on news about how 2018 closed out. I’m a little late posting this since I took the week off between Christmas and New Year’s to read and relax.

My efforts, as Marine fighter pilot Lt. Col. Wilbur “Bull” Meechum from The Great Santini would have put it, were “grossly insufficient.” However, I did finish reading Anne Duke’s Thinking in Bets and Daniel Crosby’s The Behavioral Investor. I liked them both – they confirm our conviction here at Monument. Call it “Confirmation Bias” if you will…I will acquiesce!

With regards to 2019, I aim to point out some thoughts rather than conduct a wholesale rehash of the markets over 2018.

What’s Important for an Investor to See?

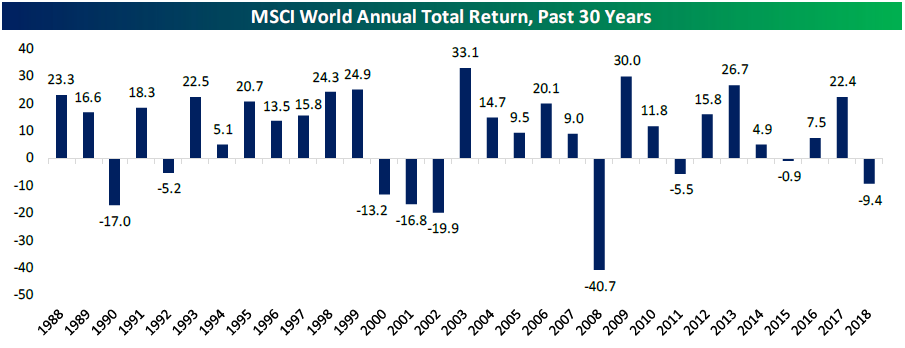

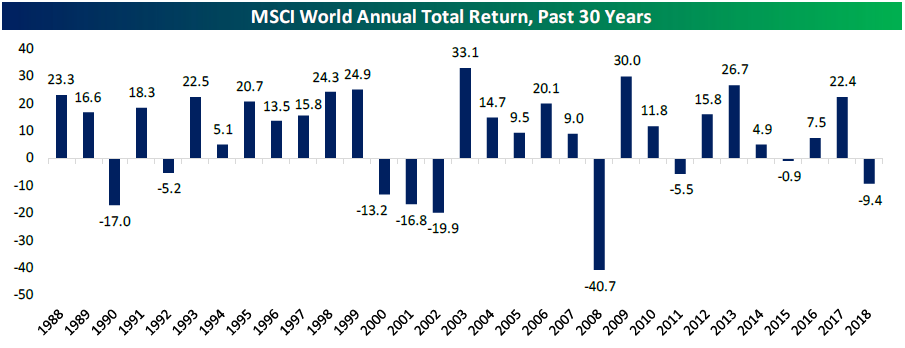

First, here’s how the MSCI World Index performed.

Think of this as, “How did the whole world of stocks do?” The chart below from Bespoke Investment Group shows the past 30 years. What’s the first thing you see? It’s probably that 2018 was down 9.4%. And that hurts…no debating that.

What’s more important to see as an investor is that of the 31 bars on the chart, only 9 are negative and 2015 was barely negative. So, let’s round and say that 30% of the years are negative.

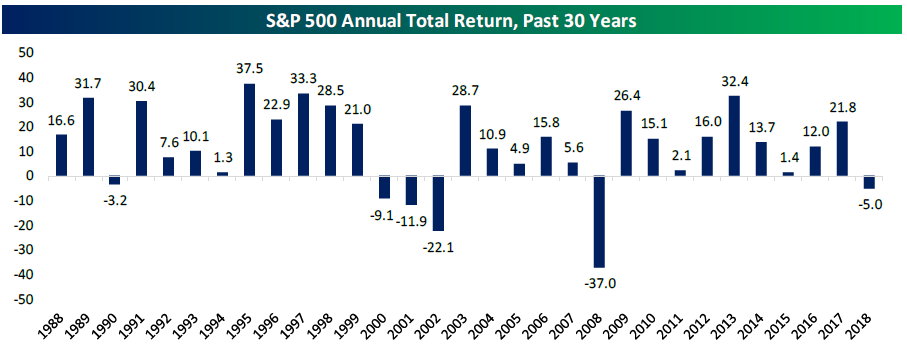

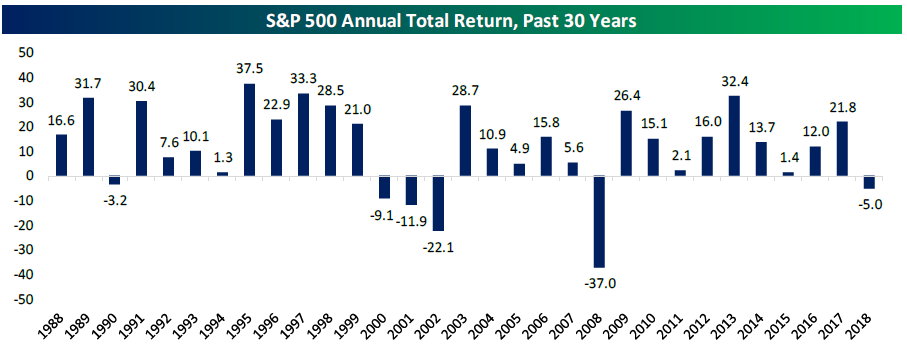

Now for a look at the S&P 500, which is considered U.S. Domestic. This is because it captures roughly 80% of the total U.S. equity market value and around 70% of its revenue is derived from the U.S. (The chart is also from Bespoke.)

Again, what’s important to see as an investor is that of the 31 bars on the chart, only 6 are negative. The difference between the two charts above are 1992, 2011 and 2015. So, let’s round and say that 20% of the years are negative. We can debate if 2015 should be accounted for since it was close to zero for both indices, but my point as you will see, won’t really change much.

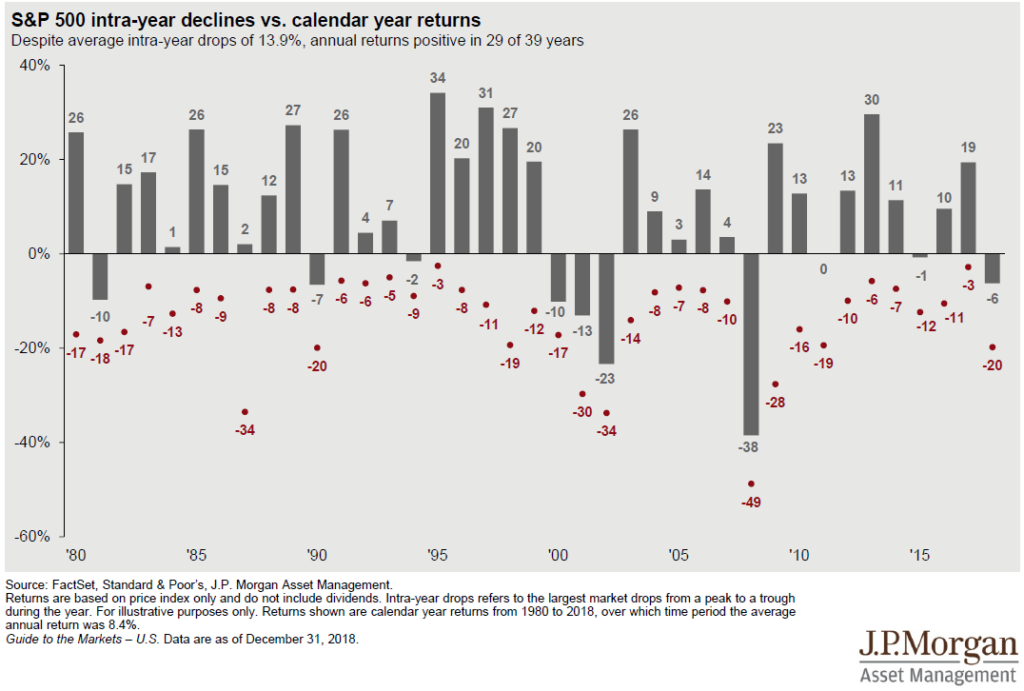

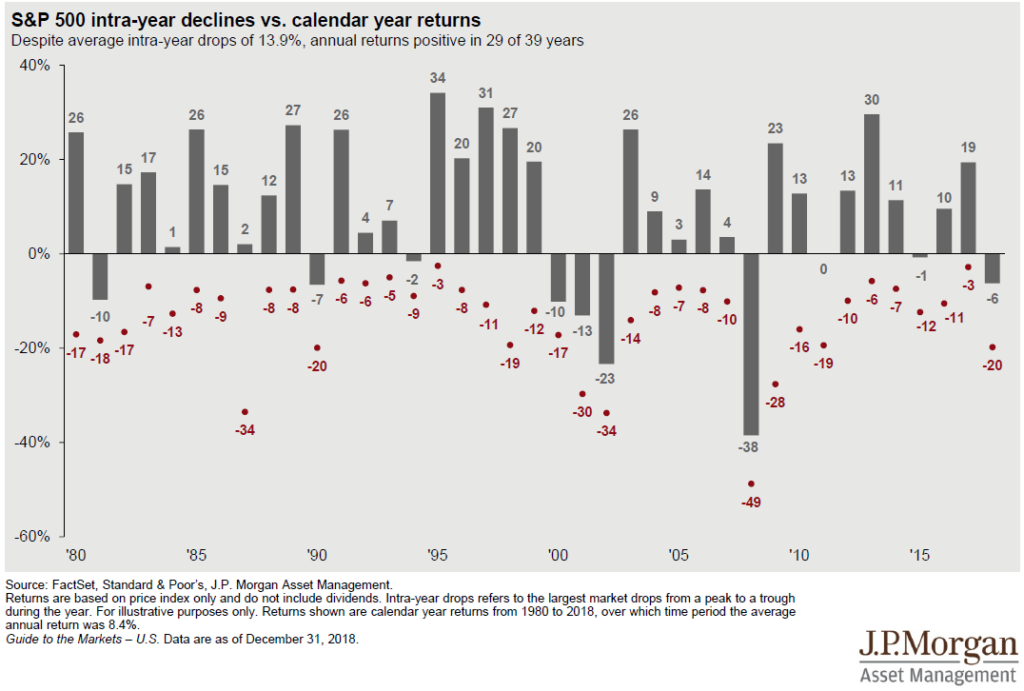

Finally, I’ve used this J.P. Morgan Asset Management chart in previous blogs, but here’s the new one updated through the end of 2018. If you head back to our blog post from the end of November, you’ll see what it looked like before the December sell-off.

(Disclaimer: The Bespoke charts above use Total Return and this J.P. Morgan chart uses Price Return. The difference is that Total Return accounts for the dividends while Price Return simply shows the return based on the index level changes. Total Return will always look better than Price Return; 2015 is a good example of this.)

What Should Investors Do Now?

What do we know? Well, we know that years like 2018 and months like December happen. No one likes them and no one knows that more than the Monument Team.

IF YOU ARE SKIMMING, PLEASE STOP AND READ THIS PART VERY CLOSELY – THIS IS WHERE INVESTORS ALLOW THEIR EMOTIONS TO INTERFERE.

THIS IS WHERE THE BIGGEST MISTAKES ARE USUALLY MADE. DON’T MAKE THE CLASSIC EMOTIONAL MISTAKE BECAUSE IT IS IMPOSSIBLE TO TELL WHAT WILL HAPPEN TOMORROW AND BEYOND.

If you are an INVESTOR and you don’t need significant cash over the next 12-14 months, don’t let your emotions take over. If you catch yourself saying, “I’m just going to sell until the markets calm down,” or you have any thoughts along those lines, you are experiencing LOSS AVERSION.

Loss Aversion

It’s natural and there is a cure: bone broth. (You know, the latest cure-all fad? Sorry, it’s not gonna help you out here.) There is a great section in Daniel Crosby’s book I mentioned above that dives into the brain. Our 200,000-year-old brain is wired to SURVIVE. It’s wired to TAKE ACTION! It’s wired that way because for a huge chunk of that 200,000 years, humans had to survive against nature, bears, lions and those squeegee men that used to terrorize drivers near the Lincoln Tunnel in NYC.

So, what has replaced nature, lions, bears and squeegee men? The fear of losing money and the brain equating that to survival. The media is in your face with hundreds of people blabbering on and on predicting sh*t they can’t even begin to forecast. It’s causing your brain to see a bear in the bushes about to pounce on you. Your brain is screaming, “SPEED AND ACTION – NOW!!!!!”

The problem is that the market does not reward true investors for speed and action. It rewards investors for PATIENCE AND CONSISTENCY.

Need proof? It’s above:

- Only 9 of the past 31 annual observations of returns for the global equity markets are negative.

- Only 6 of the past 31 annual observations for U.S. returns are negative.

- In the J.P. Morgan chart, 29 of 39 historical observations are POSITIVE despite average intra-year drops of -13.9 percent. I can’t find a year without a red dot that represents an intra-year drop.

Sure, there is the period from 2000-2002 where back-to-back losses were observed, but take a look at 2008 and 2009. If you followed your brain and sold your portfolio to satiate your brain’s need to “quickly take action and survive” you probably would have missed out on 2009 and 2010. 2008 was -37%, 2009 was +26% and 2010 was +15%.

The entire Monument Team understands Loss Aversion well. That’s what makes us strong in our convictions – we understand the behaviors behind these conditions and want you to understand them as well.

We know that Loss Aversion says an investor will feel twice as much pain with a -10% loss than they feel satisfaction from a +10% gain.

We also know the excitement over the POTENTIAL to win is more powerful than actually winning.

HERE IS AN IMPORTANT REAL-LIFE LESSON…I just experienced it myself in Las Vegas. I was so excited to win in the sports book for college games on New Year’s Day. I placed my bets expecting to win every game. After winning my first game and doubling my money, I was happy…BUT not as excited as I was about the anticipation of winning the next game. In fact, I was SO excited that instead of pocketing the money, I rolled it into another game. At the end of the day, the net result was a loss. (Thanks Ohio State for not covering the spread by one freaking point.)

The excitement to win more than my ho-hum $500 drove additional risk-taking…but then I ended up closing out the day down $250 and was completely pissed.

See how losing hurts twice as much as feeling good? Anticipation and excitement drives poor risk management.

Now let’s apply this to investing.

Loss Aversion for Investors

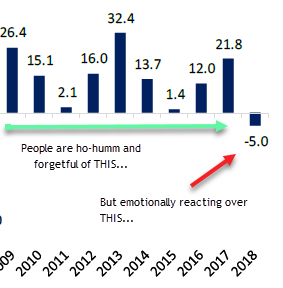

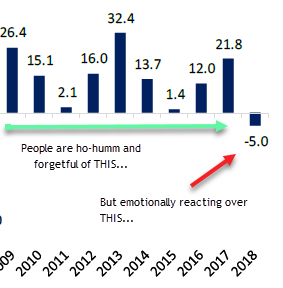

The S&P 500 finished up +12% in 2016 and +22% in 2017. Now that 2018 finished down 5%, everyone on TV is screaming bloody murder!

In fact, let me highlight this even more for you in a section of the Bespoke chart….

It hurts more to lose.

I’ll follow up with a “what to do now” blog later this week. Until then…

Keep looking forward,

Dave

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice.

A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.