Since DJT’s (that’s how all the cool DC Republican insiders are referring to him) unanticipated victory, the major U.S. equities indices have been surging past all-time highs. While investors are trying to price in the positive economic impact from an expected infusion of fiscal stimulus (tax cuts and spending – more on that below), some of the rally could also just be cash that had formerly been on the sidelines waiting for the election to pass.

This last week saw the big three (S&P 500, Dow Jones Industrial Average & NASDAQ) up another 3%. Since the election, the S&P 500 is up around 5.8% and the Dow is up an even more impressive 7.8%.

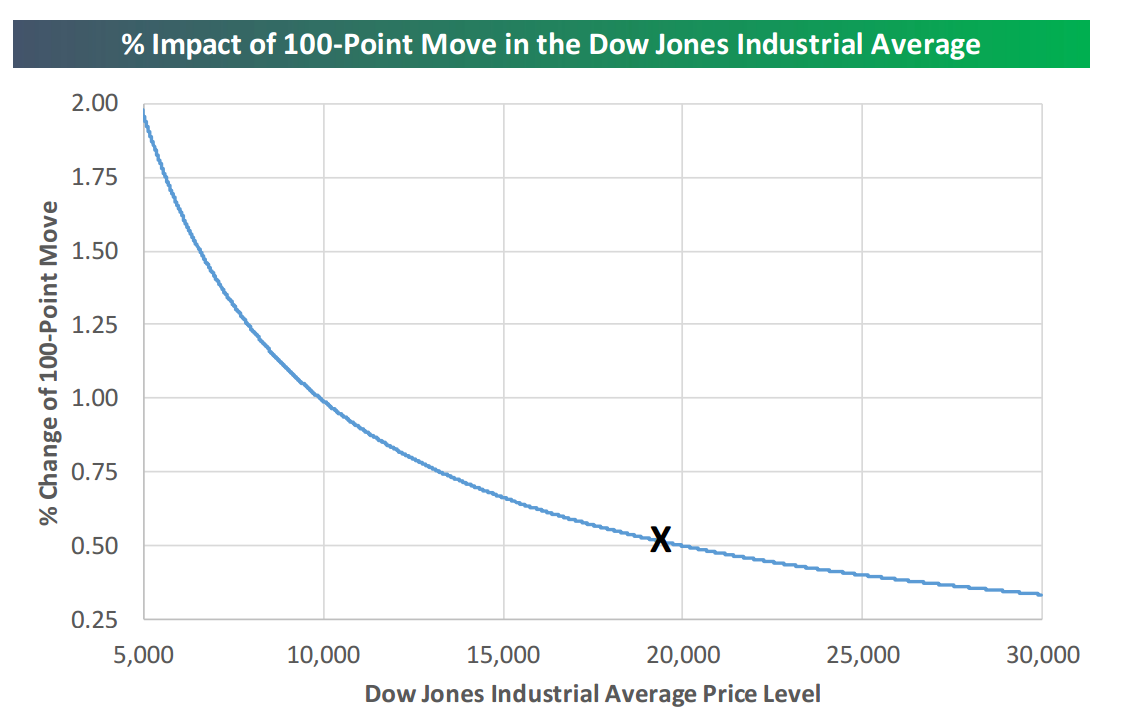

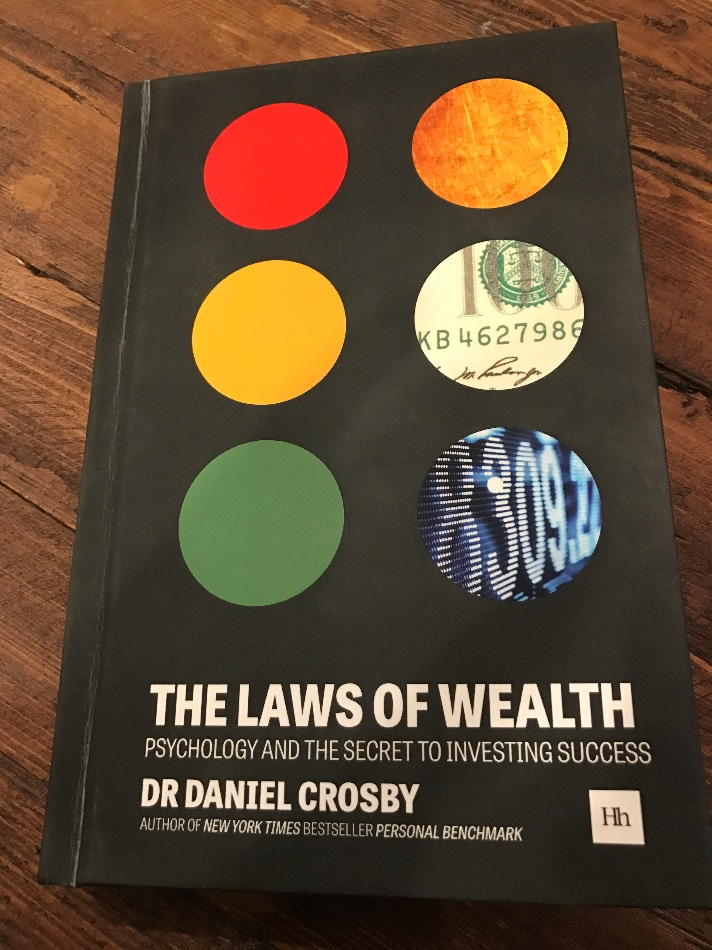

Now remember, the Dow is a price-weighted index and that means the stocks with highest price per share have the largest impact on the index moving up or down.

With Goldman Sachs trading at around $241 a share, that company carries a lot of weight in how well the overall index does. In fact, it’s the highest priced stock in the Dow…and it’s up around 33% post-election. It carries about an 8.4% weighting in the calculation of the index. That equates to almost 410 total points of the Dow’s gain since the election (on a price move of $182 to $214).

So that explains some of the gap between the Dow and the S&P 500.

The second highest priced stock, 3M at $176 a share, is only responsible for 33 points of the Dow’s gain since the election.

And only 6 stocks in the Dow have traded lower since the election.

Just so you know.

Bottom line – watch the S&P 500, it’s just a better gauge of the overall market regardless of the celebrity of the Dow.

The US Dollar is up, equity indices in France, Germany, Russia, Spain, Mexico, and even Italy are all also posting impressive post-election gains.

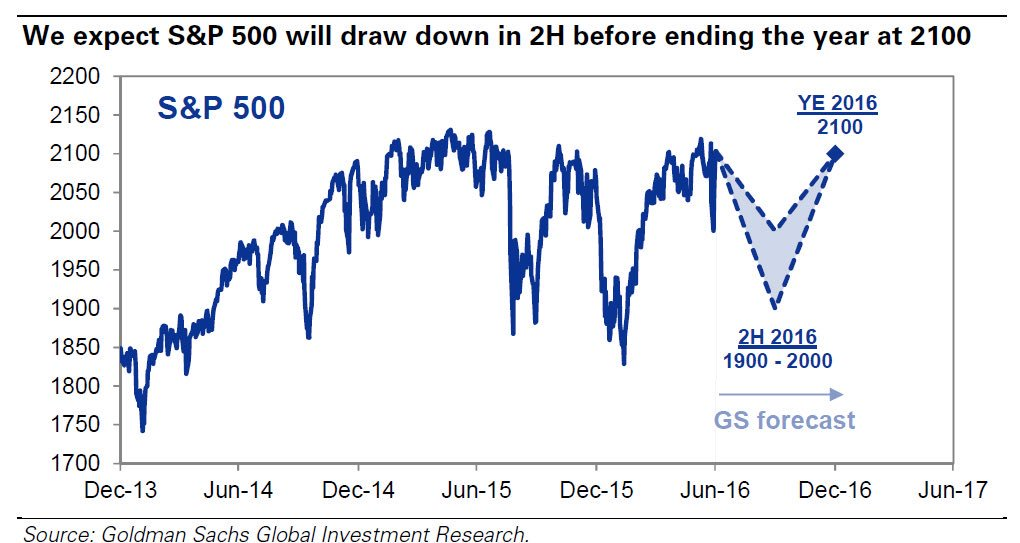

But the real question is, “How do the new highs make you FEEL?”

While investors’ long-term goals must always be kept in mind, I think it’s probable that most feel a sense of…elation…well, elation tinged with fear since stocks have entered uncharted territory.

This happens a lot…a rising stock market creates wealth and that makes everyone feel good, but then there is also this nagging.

You know. You know exactly what I’m talking about. It’s that almost insuppressible feeling that a new high is a call to cash it all in and move to safety.

I’ve written about this before. Cashing out is never that easy. In this case, a new high in the market is not necessarily a reason to sell. In fact, it is really not a reason or even a signal to do ANYTHING. It’s no more significant that driving from DC to Miami and crossing the NC/SC state line. It’s a milestone, but it’s really not important in the overall drive to Miami.

Unless you want to stop and buy fireworks.

Anyway, let’s look at some numbers. The S&P 500 Index eclipsed its October 2007 high in April 2013. From there, it went on to record 107 all-time highs between April 2013 and May 2015. You can quickly verify this on any online chart service.

From there, the S&P 500 then entered into a sideways pattern, which included two 10%+ corrections, before posting a new high last July. From there, we picked up 16 more closing, all-time highs.

But, when you take a wider look, there is an interesting, similar pattern. Hat tip to Charles Sherry for pointing this out to me last week. If you go all the way back to 1946, the S&P 500 Index has spent some part of 37 calendar years at levels that exceeded any past peak.

That equates to something like 53% of the total. Then if you look at the twelve months after closing at a high, the index was about three times more likely to be higher than lower (that data was from Bloomberg).

Disclaimer – I get it, these are simply historical averages. The real issue is that 2017 performance and beyond will depend, in large part, on the economy and corporate profits and perceptions of valuations…

Oh, and Federal Reserve policy.

I’ve written about this several times in the past. Timing is hard and the odds are against you since it’s a coin flip getting out and a coin flip getting back in.

But Charles Smith from Fort Pitt Capital Group, Inc. summed it up this way, “The market tends to take the stairway up and the elevator down, [and you just] don’t know when the elevator is going to go down.”

Why is the market higher post-election?

For starters, because there have been more buyers than sellers.

That was supposed to make you smile and as everyone at Monument knows, it’s the first response I make anytime someone sees the TV and says “Why is the market up?” It’s easily inverted when the market is down.

But there are a few other reasons I see – they are:

• The expectation that GDP will be growing more than it has been growing over the past 8 years. Confidence drives consumption – it’s a simple cause and effect. And there is a lot of confidence right now.

• That drives future inflation expectations up. Inflation is not all bad…one thing it means is that companies make more money. If you recall from some of my early 2016 blogs, there was a lot of consternation over low oil prices and the impact on energy company earnings on the overall earnings picture. Well, guess what costs more and guess what sector has been doing REALLY well post-election? Yup. So if the market did poorly due to low oil price and poor energy company stock prices…I’m going out on a limb and invert that logic.

• Finally, the labor market is doing well. I wrote about that last week and a few weeks ago and well basically for like 6 years now BUT it’s true…the labor market is good. And the Bureau of Labor Statistics recently released data that shows that the amount of people quitting jobs is hitting a recent high. People don’t quit their jobs unless they think they can get better jobs that will pay more money.

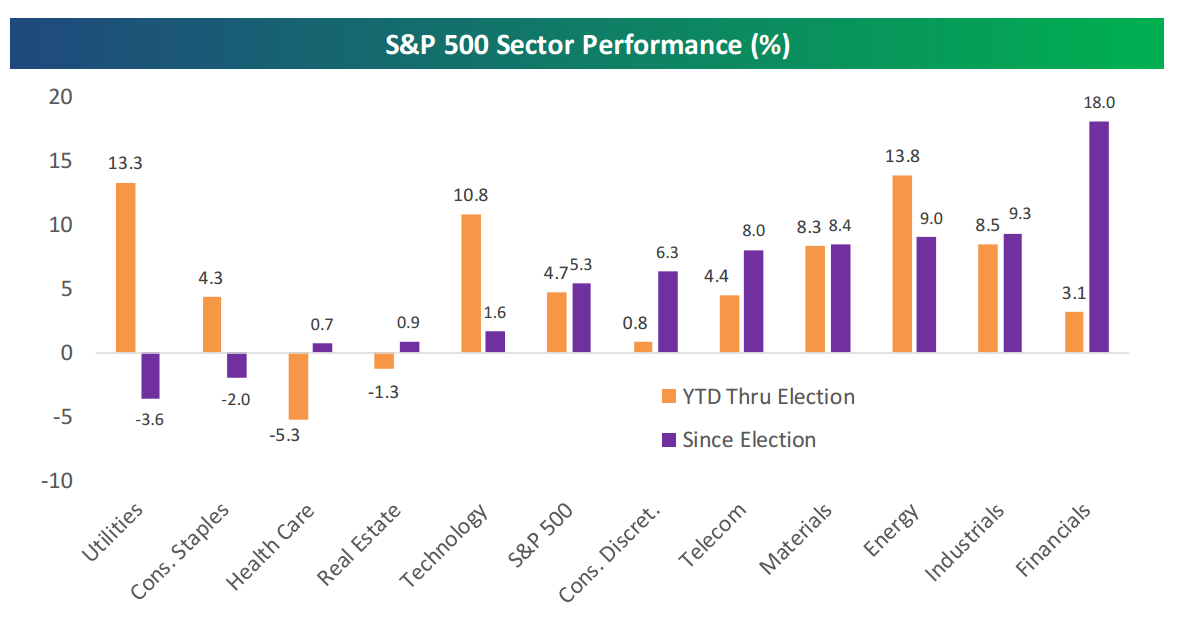

Note the Sectors

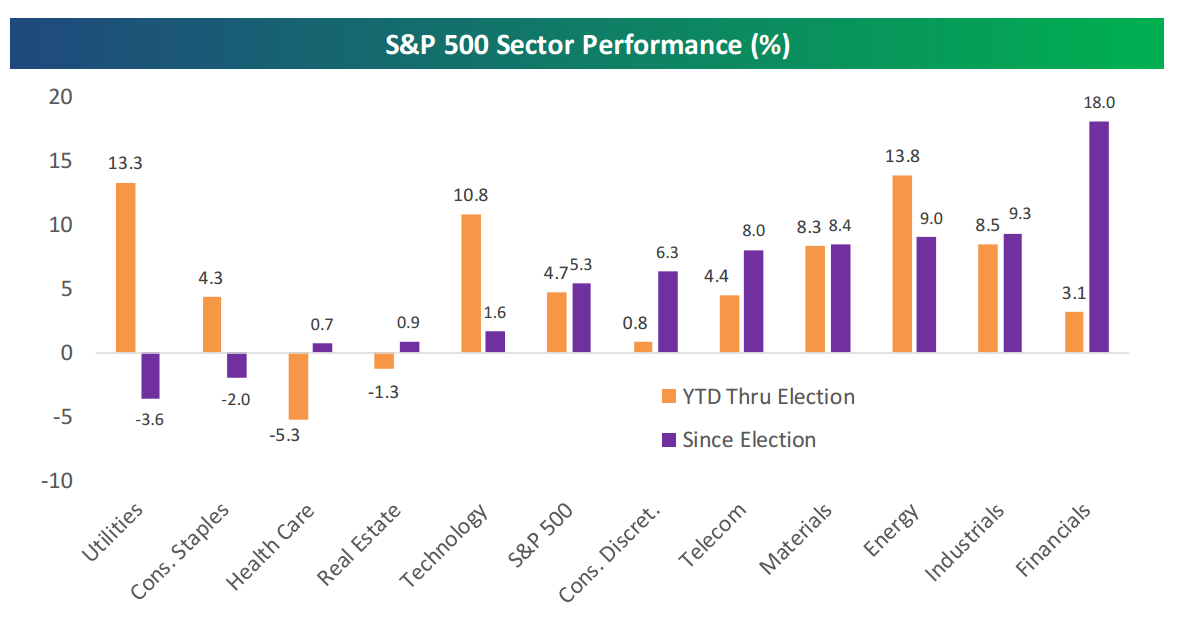

While major market indexes are pushing upward, it’s important to point out that not all sectors have participated equally since the election.

Financials are leading the way amid rising longer-term bond yields and expectations that regulations will be eased under a Trump administration. Rough math puts the sector’s gain at over 18%.

In addition to the Financial sector, stocks that are more dependent on the economy have also outperformed, including industrial, energy, and commodity-related firms.

Oh, and then there is the consumer discretionary sector…the sector is made up of all the stuff we tend to put off buying in a weak economy like pricier items, autos, travel, leisure, etc.

On the other side of the coin are defensive sectors which have lost ground, including those that tend to pay higher dividends. These include utilities due to their interest rate sensitivity and consumer staples which is the sector that represents all the stuff we tend to keep buying no matter how poor the economy is doing like groceries, diapers, toothpaste, beer and cigarettes.

My point – not all rallies are created equal and that’s why it’s important to remain diversified. Here’s a visual from Bespoke.

Random Parting Thoughts

Many of you know I write my blogs in spurts and try to weave it all together over the weekend. Below are some random thoughts I want to share as stand-alone thoughts verses incorporating them into the whole blog.

Here they are.

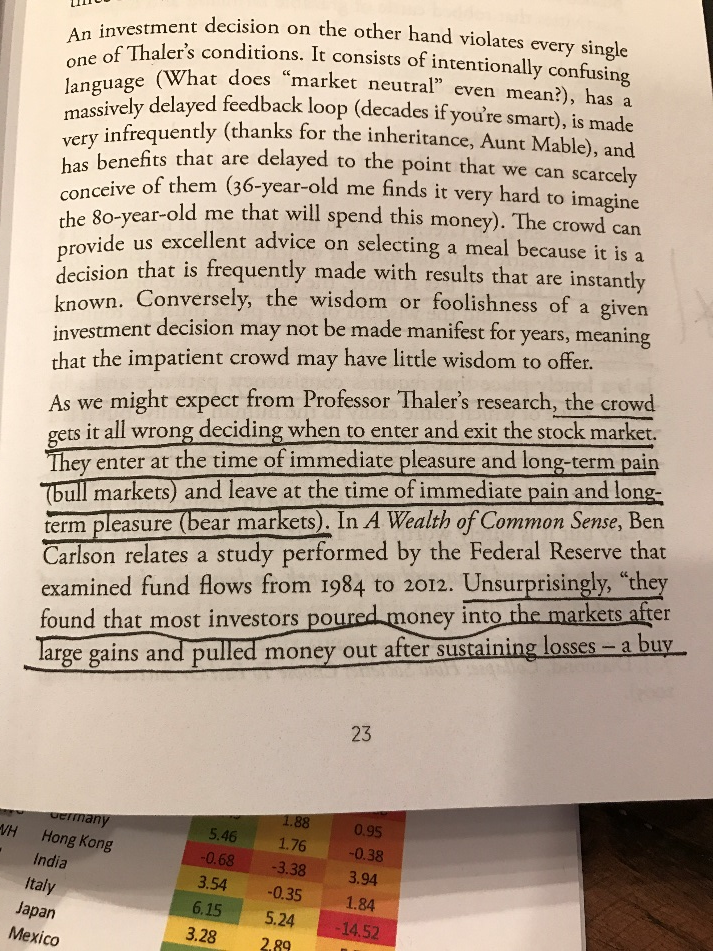

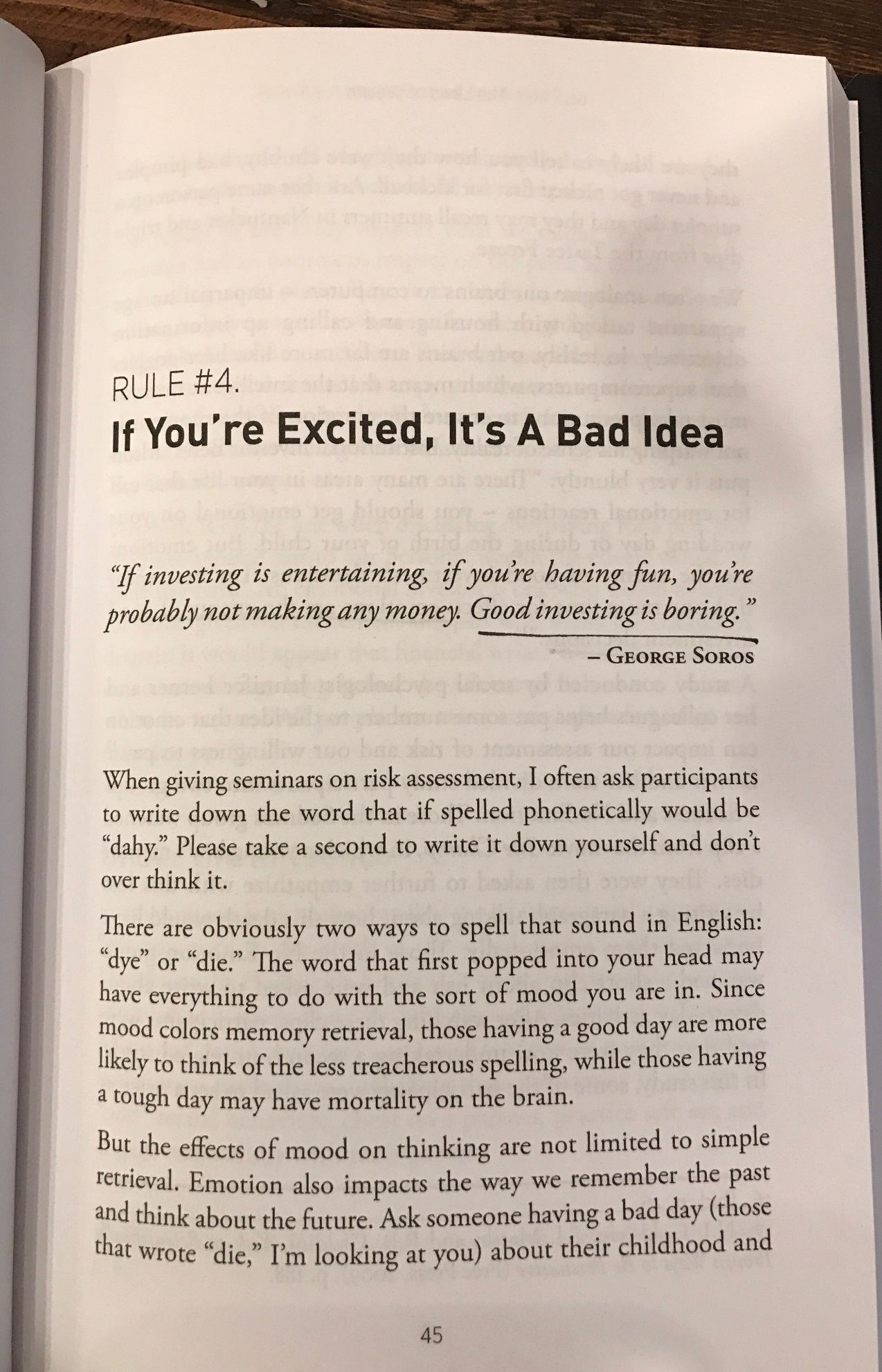

I started reading this book over the weekend. I thought the underlined passage was…well, sage…and relevant. Pick it up over the holiday.

Here’s a great chart that sums up what I was writing about last week – the mathematical fact that it takes a smaller and smaller percentage move in the Dow to cross each 1000 level. From Bespoke.

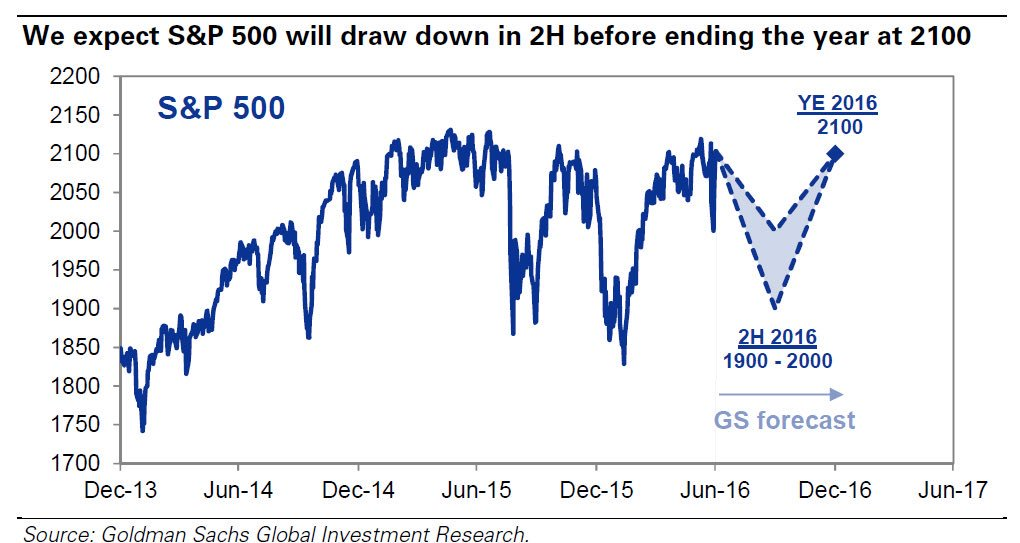

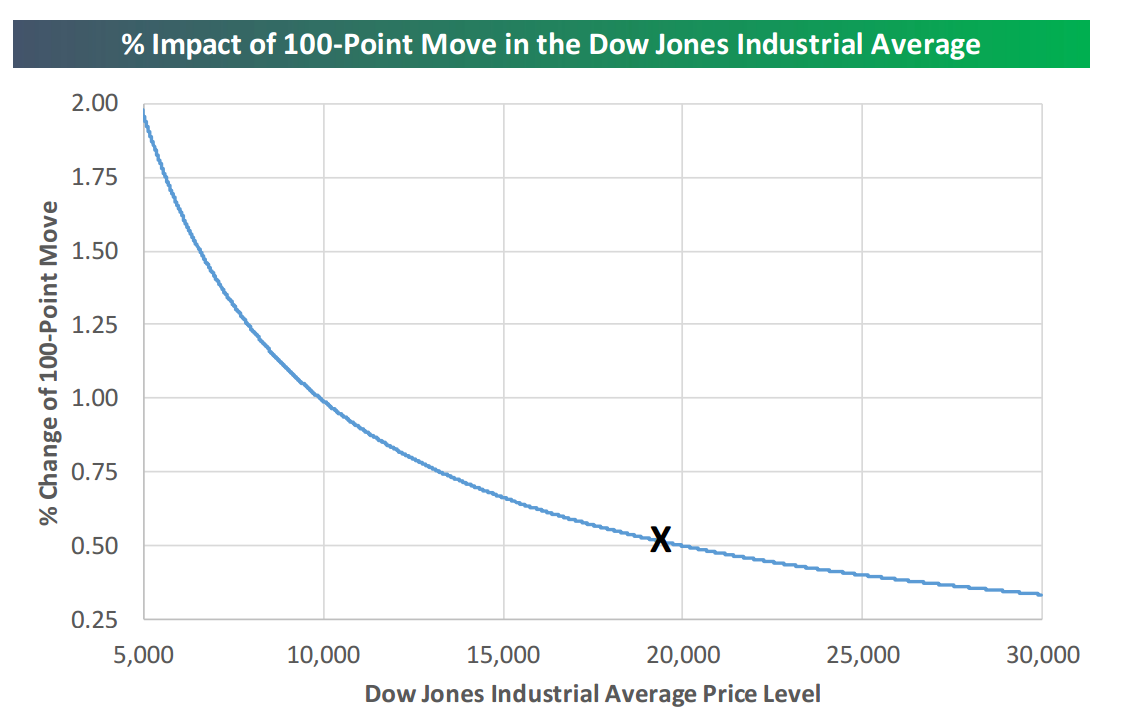

It’s worth an ironic chuckle that the firm that published the below chart is the same one that is responsible for most of the gain in the Dow this year. I get it, this is an S&P chart and I’m referring to the Dow…but still. Anyway, I’m glad that the chart is wrong (so far) and I’m glad their stock is up 33% post election.

Finally – another page and underlined statement in Daniel Crosby’s book.

Call with questions.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.