Want to know my thoughts on second quarter GDP for this year? First go read this from 2012.

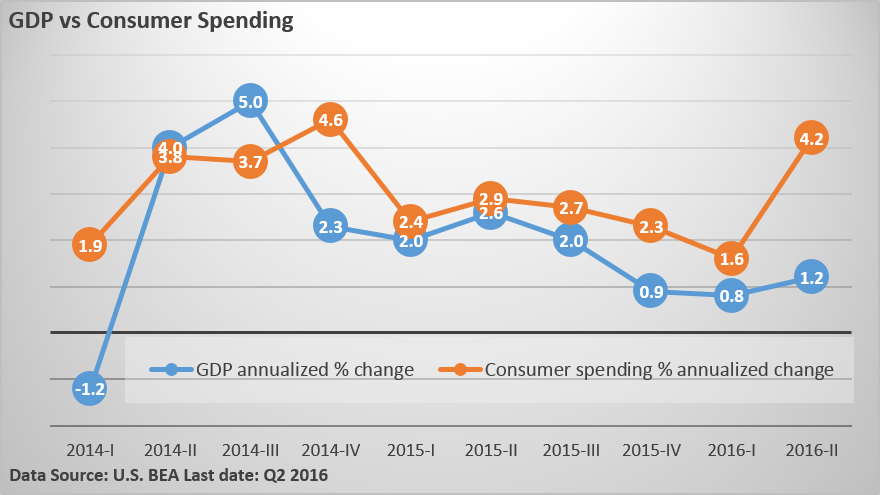

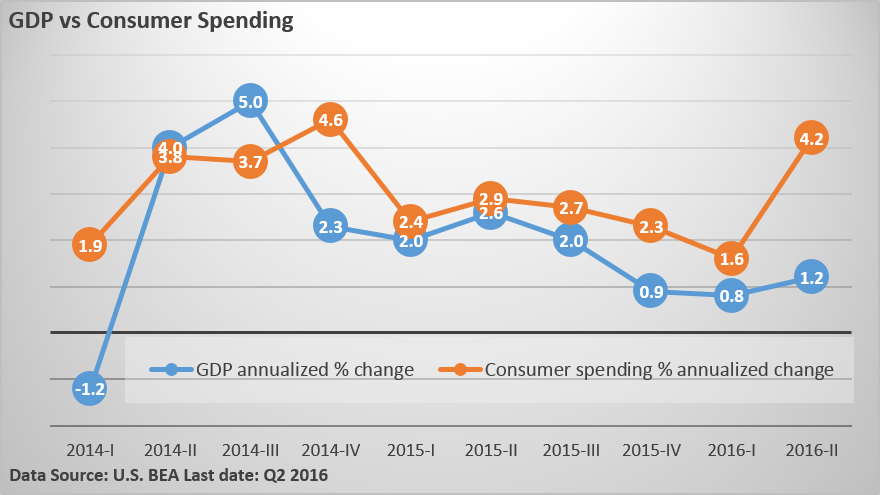

2016 GDP rose at an annual rate of just 1.2% in the second quarter, which is way less than the estimate of 2.6%. To add to the pain, Q1 was revised from 1.1% to 0.8%. So it turns out that 1.2 is not much of an improvement over Q1’s feeble pace.

On the surface, it’s another sign the economy is tepid and has made no progress from its 8-year, subpar pace…as anyone grinding the Obama axe will quickly point out. But…it’s also true and hard to argue otherwise. However, there is one good thing in the report, and that is consumer spending.

Remember, the consumer is responsible for nearly 70% of U.S. GDP. While we had a weak 1.2% reading, consumer spending rose by a much brighter 4.2% annualized pace. See the chart below from Charles Sherry where he makes clear in that consumer spending has outpaced GDP for seven consecutive quarters.

As a result, the data all point to a consumer that is in a pretty good mood. It’s not super-duper (that’s an actual measurement by the way), but I’ll take it.

However, business spending, which includes investment in new factories and new equipment, has fallen over last three quarters and this is weakening overall growth. I really have no lucid explanation why business spending is so poor – maybe it’s just complete exhaustion over regulation. (I mean seriously, you should SEE the crazy regulations in my business AND you should see the +300% increase in our healthcare costs.) Regardless, there is just an extraordinary amount of uncertainty in the business community and this uncertainty transforms into a precautious temperament among owners like Dean and me, who write the checks for anything new.

The Blog

I get a lot of questions about how I write my blog.

People ask, “Do you write your own blog?”

Yes. It’s a great way for me to communicate to you what we are thinking in an efficient way. It is in a medium that allows you to digest my thoughts when and where you want, and in whatever quantity you want. But I also need to repeat myself a lot, since I never know who will be reading and how often they will read.

Other Advisors ask, “How do you find the time?”

I just do. To me it’s the same as typing out an email response to someone asking a question.

Another popular one is, “How do you figure out what to write about and how do you organize it?”

So that’s kinda the fun part. My weekend routine revolves around catching up on reading research. I rarely read any in-depth research or articles during the week – I find that reading a stack at once allows for better thesis identification. Then I sit and write about whatever floats my boat. Sometimes I get all revved up about economic data, sometimes I get all revved up about industry stuff and sometimes I see a blog from another advisor and it gets me thinking.

So this week, I want to take a blog from Ben Carlson and add my thoughts into the sections. You should read the whole blog here since I paraphrased some of the below and only copied a few of his questions to preach some dogma. When I read his blog it reminds me that there actually are other thoughtful professionals out there serving in the best interests of their clients in a world saturated by schmucks who are nothing more than gussied up sales people slinging their firm’s bullshit and jacked up products.

“There are good questions that can be helpful but then there are great questions that really change the way you approach a decision or problem…

Here are some more good questions, along with what I consider to be even better questions:

Good Question: How do I keep my investment fees in check?

Great Question: How do I keep my behavior in check?”

Fees are always an issue in the absence of perceived value. At Monument, one of our value propositions is to help keep known behaviors (ours and our client’s) from impacting strategy.

“Good Question: How do I get to the point where I know what to do in every market scenario?

Great Question: How do I get to the point where I’m comfortable doing nothing most of the time with my portfolio?”

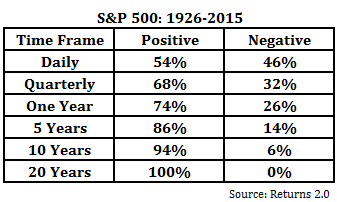

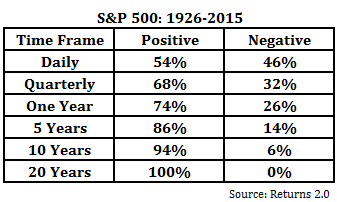

Broken record alert!!! Outline a plan that over time meets your objectives, THEN invest for those objectives rather than the short-term. Time is your friend. Here’s one reason I know…

“Good Question: How do I decide when to add new investments to my current line-up?

Great Question: How do I define what I won’t invest in?”

Have an investment strategy that is an output from your financial planning efforts. IPOs, new catchy funds, Hedge funds, securities that your podiatrist tells you about, and anything you read in any daily periodical as a “recommendation” should fall into the category of things you decide in advance not to invest in. Anything you are just hearing about is probably already well overdone.

“Good Question: What are the general buy and sell guidelines for my investments?

Great Question: What are my checks and balances to ensure I’m not making it a habit of buying high and selling low?”

See above. Seriously, I’m not being lazy, but it’s the same answer. Also, know what you may need money for inside of the next 18 months and have that already set aside in cash. March 8th of 2009 was no time to decide you needed cash. If you don’t need cash, you should have no need to sell low.

“Good Question: What’s my investment strategy?

Great Question: What’s my investment philosophy?”

Tactics = short-term. Strategy = Long-term. Philosophy? Dr. Dave’s opinion is that philosophy is shaped by your experiences. Hint – so are mine. When you start your career (post-training program) in January of 2000 and live through the Tech Bubble, the burst, the recession, 9/11, 2008 and then from March 9th of 2009 on, you develop a philosophy about investing. Mine’s pretty unshakable. And boring…because I believe in probabilities and the statistics. Here’s one reason my philosophy is unshakable…

Oh wait, you’ve seen that before? Good. Action is for Vegas…and they serve free drinks. We do too actually…but for a different reason. Swing by the shop any time.

“Good Question: How do I better understand how the markets operate?

Great Question: How do I better understand how human nature operates?”

Read Misbehaving by Richard H. Thaler. I’m reading it now and really enjoying it.

“Good Question: How can I plan for a unknown future?

Great Question: How do I learn to focus on what is within my control?”

Very little is within your control, BUT, what is within your control should be “sussed out” in your financial planning efforts by identifying your investing philosophy (and/or subscribing to someone else’s…like ours) and a corresponding investment strategy.

“Good Question: How can I make better decisions during stressful market situations?

Great Question: How can I automate good decisions ahead of time?”

Oh boy – “see above” alert. Automation can be accomplished by having a financial plan that results in the creation of an investment strategy then outsourcing the day-to-day management of the investing to someone who lives and breathes it every day.

That’s not to say you can’t do it yourself…you can. I can make a big investment in my own lawn equipment, mow my own lawn, do the edging, bag the clippings and sweat my ass off every Saturday OR I can outsource it to a professional landscaping company so I can enjoy my yard, relax and drink beer on Saturday (or read a stack of research on Sunday). Time is a limited resource.

“Good Question: What’s the optimal asset allocation?

Great Question: What’s the optimal way to stick with the allocation I’ve chosen?”

Above!

“Good Question: What’s my investment plan?

Great Question: How do my investments fit into my overall financial plan?”

Above!

“Good Question: How do I figure out who to trust when looking for financial advice?

Great Question: How do I weed out my sources of information to know who to ignore when looking for financial advice?”

Hint: Most sources of information rely on advertising, and advertising is driven by viewership/readership. Any guess on how they keep those metrics up? You guessed it – straight forward conviction about boring time-tested ideas that require broken record alerts…oh, wait…forget all that. You get the point…right?

“Good Question: How can I improve my money management skills?

Great Question: How can I improve my emotional management skills?”

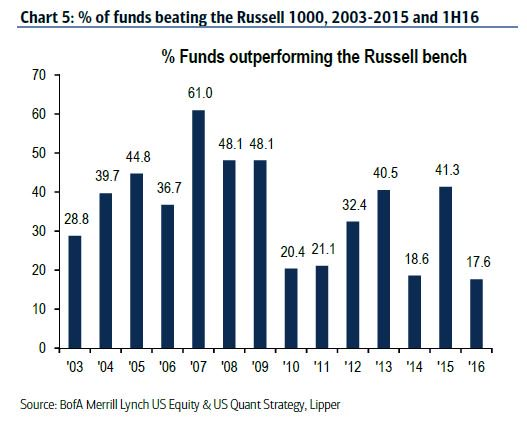

Spend more time understanding Behavioral Finance than you spend on trying to hone money management skills. Again, try picking up Misbehaving. Or stay/become a client and I’ll politely lecture on it because the probability and statistics of investing are fascinating…see this chart:

Whoops, I think I did it again…I played with your heart, got lost in the game…Oh baby, baby…Sorry Miss Spears, I digress. Too many grass clippings in my beer got me revved up on pop culture. Remind me to speak with the landscapers…

“Good Question: How do I plan for an uncertain future?

Great Question: What’s the best way to prepare for a wide range of outcomes?”

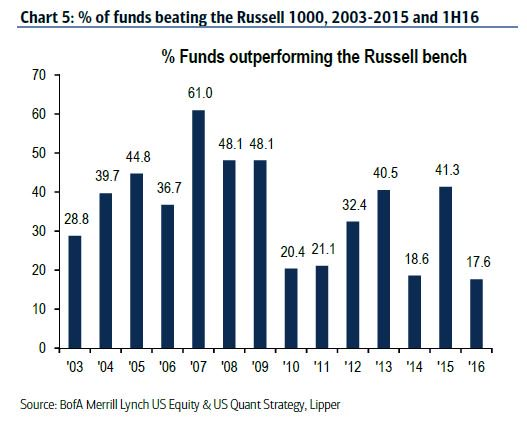

Seriously, I mean this. As much as it may be exhausting to read this point, it is the main bedrock of Monument’s conviction and philosophy…get a plan, create an investment strategy, invest in that strategy knowing the probabilities and statistics of success over the long-term, don’t get swayed by people in this industry with great suits and firm names with something flashy to entice you to buy and go have a beer in your back yard. A good portfolio is good enough…and we believe that it’s a waste of time to try to find silver bullets, mutual funds, “ideas of the day” and products from salespeople at the big Wall Street firms in the equity space. Those firms and salespeople get paid a lot of money to suck. Here’s some proof as I sign off. (Chart Source: Bank of America Merrill Lynch research)

And remember…

Get a plan, create an investment strategy and invest in that strategy knowing the probabilities and statistics of success over the long-term. But, you’ve probably heard all this before.

Please call or email with questions.

Important Disclosure Information for “Second Quarter GDP and Some Other…Thoughts”

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.