**Since today is a big move day in the market, I’ve got a quick thought at the end of this blog.

2015…a year of both expectedness and surprises. The economy trudged along, the unemployment rate fell, and the Federal Reserve finally lifted the Fed funds rate at the end of the year.

Taking a closer look, we see what many people are calling “The Tale of Two Economies.” This is because we saw the service industries expand at a modest pace while the stronger U.S. Dollar caused exports to fall, and we also saw huge reductions in the Energy sector which took a toll on manufacturers.

On the equity (stock market) front, the S&P 500 Index ended the year as a loser for the first time since 2008, and the S&P 500 experienced its first 10%+ correction in four years.

China’s economy got blamed for the late summer sell-off but as I look back on the year, the anxiety attached to the overall global economy provided a great excuse for short-term traders to justify hitting the sell button. It will remain unknown if those traders were good (lucky?) enough to then get back in at the bottom, but long-term investors who had no reason to react saw the losses fill back up pretty quickly. Those who decided to abandon their plans, panic and either decided not to get back in or got back in too late felt the most pain this year.

There is a lesson here and it is this:

You are not able to predict what will happen nor when it will happen…and neither am I.

Only charlatans and fools believe this is actually possible. I reminded everyone of this many times, including in this November, 2015 blog post and this U.S. News and World Report Column I wrote back in, oh, let’s see…2013.

Probabilities and statistics are on the side of the patient investor who sticks with a plan…but let me get back to my thoughts on 2015 before I get too far off on a tangent.

Even though the S&P 500 was slightly negative for the calendar year (-0.7%), according to our trusty FactSet terminal, some sectors were positive: Consumer Discretionary (+8.4%), Consumer Staples (+3.8%), Heath Care (+5.2%) and Tech (+4.3%). It should come as no surprise that the biggest loser for the year was the Energy sector which posted a loss of -23.6% for 2015. Overseas, the strength of the dollar hurt on returns for U.S. (dollar denominated) investors, with developed markets up marginally because of respectable returns out of Japan. Emerging markets and commodities both labored as the increase in the U.S. dollar and the specter of a global growth slowdown (thanks China) acted as a big drag on returns.

With the exception of U.S. high yield, which was crushed due to the weak Energy sector, fixed income markets were essentially flat.

Despite the overwhelming beliefs that we would see a hike in the fed funds rate and the actual trigger pulled by the Fed in December, 10-Year Treasury yields remain at historically low levels. I think this has a lot more to do with the fact that inflation and growth expectations in the U.S. remain low, but it’s also probable that the very low government bond yields in Europe may be playing a role in this as well. In a digital world where cash can rapidly move from country to country, European capital seeking a relatively higher yield in the U.S. will go into U.S. Treasury bonds. This has the effect of driving prices higher, which then drives the yield (the interest paid on the bond) lower…so the U.S. Treasury yields stay lower. (Remember, when dealing with bonds, yields go down when prices go up and vice-versa.)

Looking Out Into 2016

First, let me make sure everyone reading this understands my perspective on calendar year end and start. It is no more significant to the economy or the market than crossing over the North Carolina / South Carolina state border when driving from Washington D.C. to Miami.

Is it an event? Sure. Are there mileage signs reminding you how far away that border is? Yup. Do the mileage signs reset to then tell you how far it is to the South Carolina / Georgia border? You know it.

But does it change where you are going, how long the whole trip is or how you are getting there? Nope.

Gazing into the upcoming year is always fraught with peril. I don’t have a crystal ball…all I have are statistics, probabilities, information and my brain to make sure ideas are grounded in reasonableness. We are now entering the eighth year of this bull market and while that seems to make a lot of people nervous, the length of a bull market does not forecast a demise.

We put out a mid-year review video found here (and we will be out with a 2016 new year review soon) that goes over our thoughts on what really causes recessions. As of now, we do not see many signs pointing to one right around the corner.

How the market does in 2016 will depend on both the economy and corporate profits, but just like crossing the state borders on a drive to Miami, they are essentially meaningless. The start of a new calendar year does not mean that the issues from 2015 (poor corporate earnings, the flat global economy, the strong U.S. Dollar, and low commodity prices/oil) are “last year’s issues.”

First, Let’s Address Earnings.

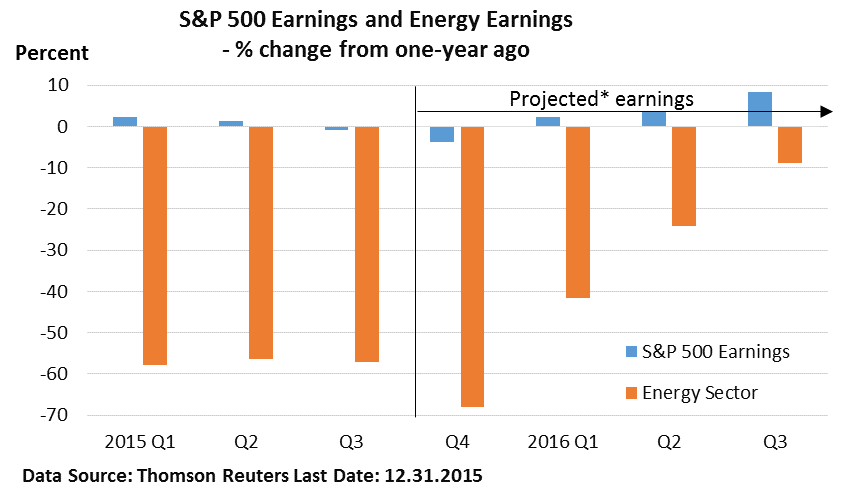

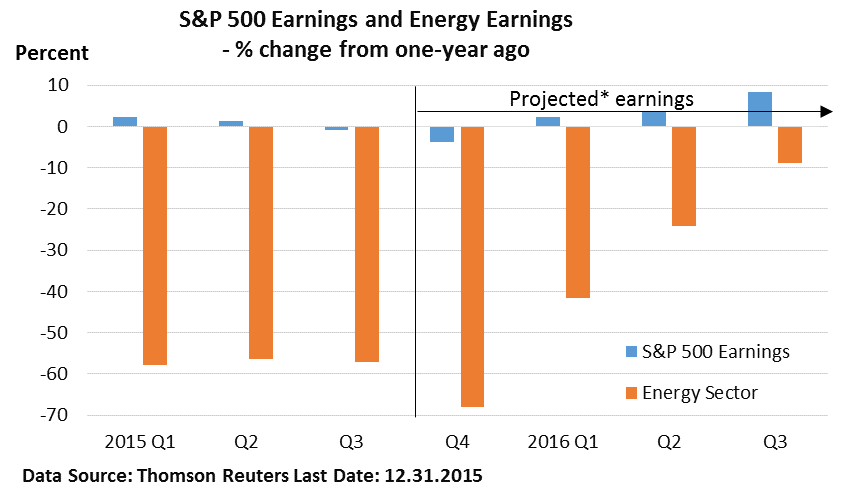

Earnings are a huge deal because there is an almost one-for-one correlation between them and the equity markets. This means the two essentially move in lockstep. Thanks in large part to the steep drop in oil prices, profits at energy-related firms took a huge dive last year (reference the sector return I mentioned above). This created a big headwind for overall corporate profits last year.

I usually write a lot about earnings during the reporting season so I’ll keep it shorter here. Third quarter (Q3) 2015 earnings, which were down -0.8% from the year prior, would have been about seven percentage points higher if Energy had been excluded (according to John Butters at FactSet Research). Just look at this chart from Charles Sherry which uses Thomson Reuters data instead of FactSet. Orange shows the Energy sector earnings and blue represents the earnings of the entire S&P 500 index.

Throw in the stronger U.S. Dollar along with the fact that multinational companies earning money overseas must convert it back into U.S. Dollars and they lose money just because…

The blue bars also show that analysts are expecting earnings to turn positive in Q1 2016 and accelerate as the year progresses. We will see, but even low growth in profits would probably be helpful for stocks in 2016. Also, I think a lot of analysts are expecting earnings to be better based on a continuation of the U.S. economic expansion, a bottom in oil prices, and greater stability in the dollar. Like me, most analysts don’t think a recession is on the cards but the direction of the dollar and oil is a bit…well…vaguer.

Still, the forecast for rising profits is cautiously encouraging. I stay away from forecasting earnings since it’s easier to just look at what all the other CFAs are predicting across all the great research shops and average them together since everyone is making educated guesses based on what companies feel like guiding them on anyway.

Now for Oil, Commodities and the Dollar.

These low commodity prices have benefited nearly everyone outside of the energy industry, emerging market economies and companies in the mining industry.

Blame the drop in commodity prices on China, which seems to be converting from an industrial economy to a balance between a consumer/services and goods producers economy, slowing their appetite for raw materials. When demand slows and supply increases, prices go down…and in this case to the lowest level in over a decade.

Commodities are also massively impacted by the U.S. Dollar because most are priced in dollars. So, our rising U.S. currency puts downward pressure on prices. This is great for consumers but bad for producers. Simple, I know, but worth pointing out.

Falling prices then negatively impact global sentiment, which then makes its way into the broader stock market. From there, you get the Energy sector experiencing sizable layoffs among oil producers and big cutbacks in capital spending. That brings you back full circle to earnings (above).

However, it’s not just the strong U.S. Dollar, it’s also soaring production of shale oil in the U.S., which has helped create a global oversupply of crude and a drop in U.S. imports.

Looking ahead, what happens to China and the dollar will likely have an influence on the Commodity sector this year. But what occurs in the U.S. oil fields will also play a role. Greater stability would lessen the uncertainty for investors. However, trends in commodities, including oil, tend to move in long-term cycles.

Finally, without getting too much into junk bonds, there is a fear that the current commodity market issues will cause energy companies to default on their debt. I think that if the Commodity sector remains stable at current levels, this issue will not create the amount of defaults that people fear. Those with long-term debt exposure in this sector should maintain patience. Ask me about my “paper bag full of money” example if you want more of my thoughts on this topic.

Wrapping Up

I still stick to the fact that the consumer is responsible for 70% of GDP, and that housing and cars drive second and third (and more) order effects in our domestic economy, and both are strong.

The most likely path in 2016 is probably just an extension of 2015…kind of like crossing the state border in a trip to Miami. 2016 will probably see a modest, continued and unimpressive economic expansion that adds a little tailwind to corporate profits.

Again, I don’t have any idea what the future holds and no smart investor should rely on anyone that says they do. Ultimately, the U.S. economy has the biggest effect on markets. A lot of fear I hear these days comes from investors who worry about a terrorist attack. One thing worth remembering is that following the 9/11 attacks on our country, the S&P 500 fell around 12% in the first five trading days, but had completely erased losses by October 11, 2001.

BROKEN RECORD ALERT

My recommendations for investors in 2016 are:

- Have a long-term financial plan and an appropriate investment strategy that supports that plan.

- You should have access to cash to meet your liquidity needs for12-18 months so you are not forced to panic or make emotional reactions to market pull backs like we saw last summer, or in 2012…or 2011…or 2008/9.

- Stay invested in sectors of the market which, during the expansion phase of the economic cycle, have a higher probability of outperforming others.

I catch a fair amount of good natured ribbing for espousing the same advice over and over. I get it, a lot of people expect folks in my business to always be “doing something.”

I like defending myself when I’m right…or at least, not wrong…but the reality is that “doing something” seems stupid to me when for the last eight years we have not seen a whole lot of change. We continue to see low interest rates, low inflation, modest GDP growth, and no over-spending, over-confidence or over-borrowing. Not much has changed, except oil prices are putting a lot of money back into consumers’ pockets.

We make tweaks to the underlying sectors and individual stocks in our portfolios but for the most part, staying allocated to small and mid-cap growth, cyclical sectors of the S&P 500 and away from the Value and Defense sectors have been good decisions over the past eight years.

Historically, the long-term investor that adheres to a professionally crafted investment plan is more likely to achieve his or her financial objectives. If your personal situation has changed, let’s talk.

Finally, About Today: January 4, 2016

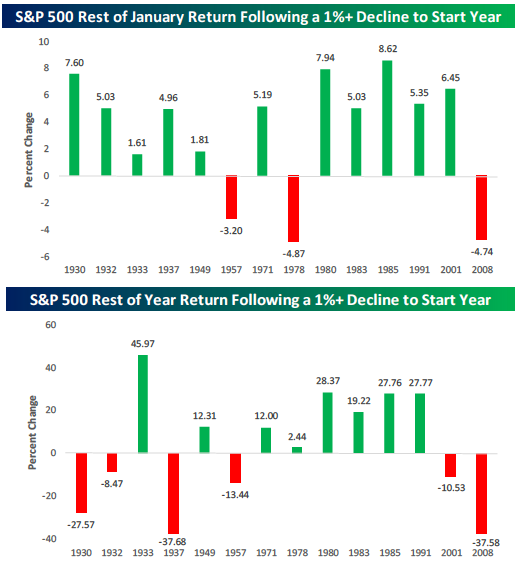

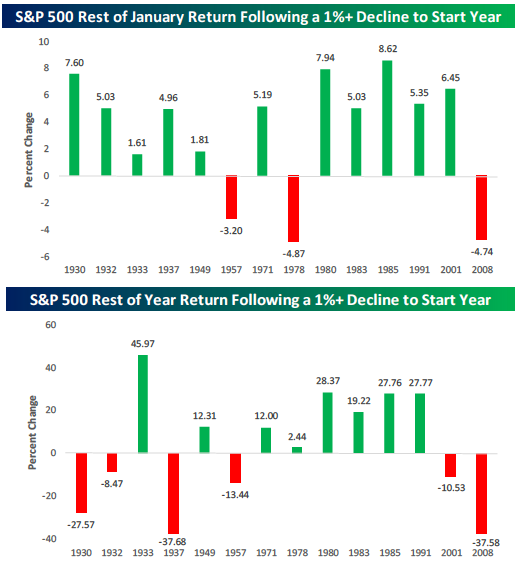

This chart below is from Bespoke. How’s that for a quick thought?

Important Disclosure Information for “I Remember 2015 Like It Was Yesterday”

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.