I’ll get to the markets a little farther down but today I’d like to share a story about a Marine Brother I spent some time this past weekend remembering. In case you missed my tribute from last year, please see the Memorial Day Weekend blog about Sergeant Chris McDonald.

Sergeant John Adam Walker, aka “Johnny Walker Red,” was killed in a horrible military parachuting training accident on August 12th, 1997 while serving with 1st ANGLICO at Camp Pendleton, CA. I had recently left active duty from the same unit where I had served as a Jumpmaster, so the story made it to me almost immediately. During the training, he landed off the drop zone and drowned in Pulgas Lake under the weight of his gear. John was a great Marine, well liked and even more importantly, well respected from the most senior officer down through the youngest Marine in the unit.

I remember reading the investigation almost 20 years ago. It wasn’t any one Marine’s fault but rather a fatal combination of errors chained together. It was tragic and there was a lot to be learned from it.

I learned a lot from it.

I learned the importance of never making an assumption when you can find out the actual facts…especially by double checking.

I think about him often and I recently saw a CrossFit WOD dedicated to him. I never have a scotch without a quick thought of old Johnny Walker Red. You are missed often…and by more brothers than just me.

Semper Fidelis Brother.

Quick Market & Econ Recap

While we have seen some good solid gains on the employment front, retail sales came in flat for April. This is further evidence that consumers continue to save money rather than spend. We have written about this in the past, specifically how consumers are putting the savings from lower gas prices into their savings accounts. We think it’s because consumers used their savings to pay off a lot of accumulated debt and now feel a responsibility to replenish their savings accounts before embarking on a new spending journey While we expect that spending will rise in the coming months, the fact is consumers are not currently helping economic growth as much as many anticipated.

Warning – 1Q Gross Domestic Product may be revised lower and may even come in negative for the 1Q as the first revision is reported this week. Recall from a previous blog where I wrote about the recent GDP report that Q1 Gross Domestic Product grew just 0.2% on an annualized basis. This past week I started to see a lot of economists predicting a revision to show the economy actually contracted in Q1…meaning GDP could ultimately be a negative number for the 1Q 2015. These predictions could be due to some economic data that is signaling the economy has not gained much steam; indications include:

- Poor consumer spending due to a cold winter

- Muted exports because of a strike in a west coast shipping port

- Declining oil prices

- Poor manufacturing data

We think this is all behind us. As we look into 2Q 2015, we are already seeing improvement. In fact, I was just reading the recent report on Leading Economic Indicators that showed it improved at a rate a faster than any other of the previous 9 months.

Why?

- Oil prices have stabilized

- Consumers feeling much better about their personal finances (see above about savings accounts)

- Housing market is getting stronger – THIS IS A HUGE ECONOMIC LEVER

- Continued improvement in the labor markets

We believe 2Q will bounce back very nicely and investors SHOULD STAY INVESTED AND NOT MESS AROUND WITH TRYING TO RAISE CASH AND THEN REINVESTING LATER.

The Federal Reserve – Still Eyeing a 2015 Rate Hike

My first thought is, “Yeah, we’ll see about that….” Federal Reserve Chief Janet Yellen reiterated in a speech last Friday, the central bank remains on track for a 2015 rate hike. But she also remains cautious since inflation is still low and more needs to be done to create new jobs. I wrote about employment in a recent blog found here.

Here’s what she said, “I think it will be appropriate at some point this year to take the initial step to raise the federal-funds rate target and begin the process of normalizing monetary policy. Delaying action to tighten monetary policy [fancy pants talk for raising interest rates] until employment and inflation are already back to our objectives would risk overheating the economy.”

That comment distanced her from some other Fed officials who want to wait until 2016 before boosting rates. So there is some disagreement in the ranks.

While Janet Yellen had originally believed a six month window between the end of its bond buying program last October and the first rate increase might be appropriate, it seems the Fed is once again grappling with a slowdown in economic activity.

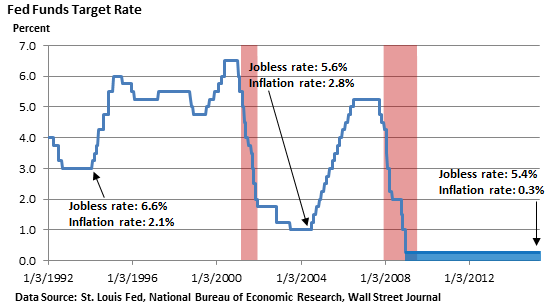

Here’s a Fed Fund Target Rate chart that shows jobless and inflation rates compared to the different times in history:

Yellen, like a lot of people, thinks the slowdown is mostly due to temporary factors and that faster growth should resume.

We agree with her. Weekly jobless claims released by the Dept. of Labor show layoffs remain at low levels: indicating firms are more reluctant to lay-off workers, equity markets remain near their highs and longer-term Treasury yields continue to hang near the highs of the year. Falling long-term Treasury yields (meaning that people were buying bonds) are generally a sign of economic weakness.

This all suggests to us that investors anticipate the extended lull in the economy will eventually give way to faster growth.

Earnings

First quarter (1Q) earnings season has come to an end. While Alcoa’s earnings report traditionally kicks off earnings season, Walmart is the report that ends earnings season.

According to Bespoke, here’s how it ended:

The percentage of companies beating their revenue estimates for the 1Q of 2015 came in at 50%. This reading is well below the average of the 60% that we’ve seen since 2000 and well below the final 58.1% from the 4Q of 2014. Since the revenue readings bottomed out in the 4Q of 2011, quarter-over-quarter readings have ping-ponged but the trend has been positive for revenues. We will see how things end up next quarter; however, we don’t think this is a trend especially since the last few 1Q reports have been weak coming off bad winters.

The percentage of companies beating their earnings estimates came in at 60%, which is below the average of 62% dating back to 1998, and close to the 61.1% final reading from the 4Q of 2014.

Bespoke also publishes a chart that shows the spread between companies guiding future earnings higher or lower on a percentage basis. Up until the 1Q of 2014, the spread had been negative for the past TEN quarters, meaning there were more companies stating they would earn less in the upcoming quarter than the same quarter a year prior. That’s 2.5 years of pessimism coming out of corporate America.

The current reading got better and better over the reporting period and ended up at -2.9%. Even though it is a negative reading, it’s a huge improvement from the 4Q reading of -9.4%. The silver lining is that -2.9% is about the average for the past 4 years.

Here’s what I think about future earnings guidance…it doesn’t mean anything other than corporate leadership massively lowers expectations for the next quarter in order to look good when they come out and “beat” the expectations.

It’s like when my Dad would ask me what I thought I would be earning for a grade in my college classes. If I thought I’d get a B+, I’d lead his expectations with a B-. I called it “parental expectation management.” He’d usually hit me with a $20 for doing better than I thought. Same thing with stocks – they get rewarded for doing better than everyone thought they would.

Please call with questions. If you want to know what to do now, please see the comments from my blog last week…or see the advice from at the bottom of this blog called Irrational Exuberance, which I penned in December…of 2011. Until something dramatically changes in the economy, our advice, which so far has been solid, remains the same.

Important Disclosure Information for “Memorial Day – Personal Reflection & Some Market Stuff Too”

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.