Well, the Dow Jones Industrials and the S&P 500 Index have erased all their losses from the Brexit-inspired sell-off. Furthermore, the S&P 500 ended the week one point shy of its all-time closing high of 2,130.82, which was on May 21, 2015.

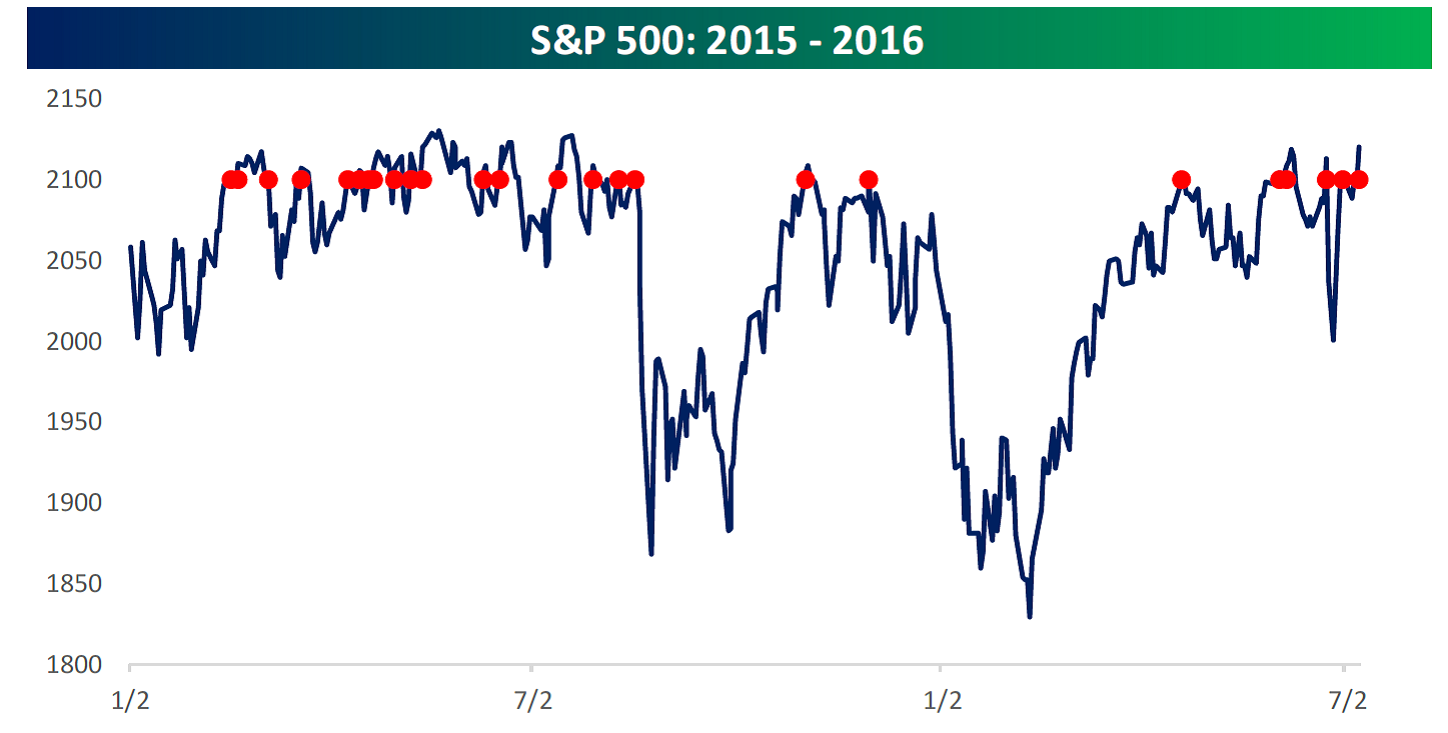

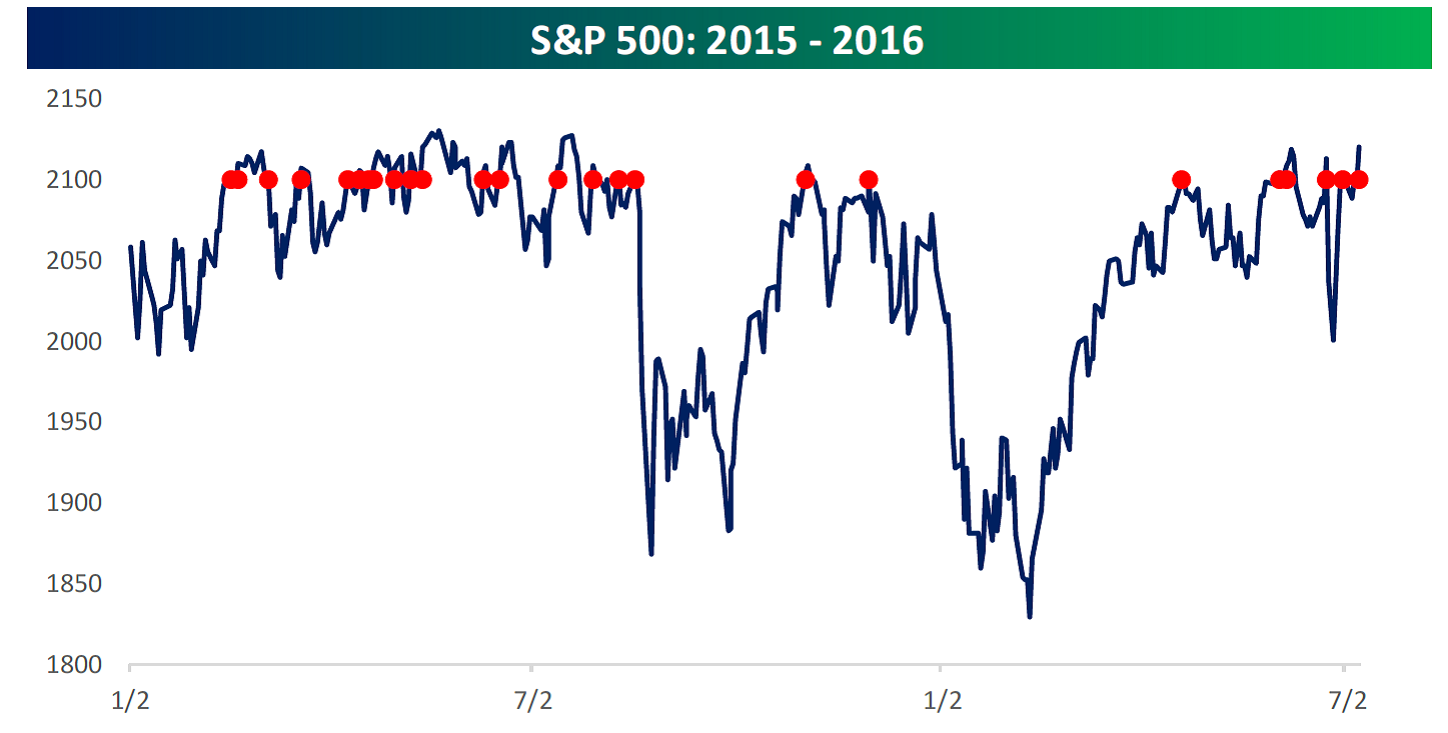

Curious why a 2,100 level on the S&P is important? Well it has only crossed it 25 freaking times since February of 2015. It’s a reminder that positive returns on an equity portfolio have been hard to come by for most investors for the past 18-ish months. Anyway, here’s a blurb from Bespoke who is also credited with the chart below…

The S&P 500 has never closed above 2,100 for more than 14 straight trading days, and in each period where the index crossed and closed above that level, the median number of days it was able to stay above 2,100 was just two trading days (average 3.2 trading days).

3.2 trading days on average…that (and more) is why I stressed, “Control What You Can Control”.

Brexit

So bored of Brexit. Look, I wish that I was smart enough to tell every one of my clients what will happen and when. Like Biff in Back to the Future…he has that book of all the games to bet on. But if I had that, no one reading this would ever see or hear from me again. So that leaves me with knowing what I know…and what I don’t know. So here are my thoughts, which are all opinions, which is 100% a function of my experience in doing what I do, which makes them what I know. Brexit is just one page in the long book of what I’ll call “DBA Experiences”:

- You don’t know what is going to happen in the short-term. Control what you can control. (Hint: it’s looking at you in the mirror.)

- Talking about guessing is fun, but actual guessing is stupid. Just ask anyone who tells you they are a professional Keno player. You have never heard of a professional Keno play? Hummmm….

- If you have to guess, make an educated guess. (Hint: don’t play Keno.)

- An educated guess must include probabilities. The odds of winning in Black Jack are better than on the slot machines. So if you’re going to play, play Black Jack.

- On a day-to-day basis, the stock market is nothing more than a voting machine – and emotion is always the winner.

- On a long-term basis, the stock market is a function of earnings and dividends rather than hope and speculation. That makes ALL of those things important. Hoping an electric car company can make 500,000 cars when they have never made more than 50,000 cars is, well, hoping.

- Having a long-term investment strategy is the real silver bullet. It eliminates the voting machine, focuses on earnings and dividends and puts the probabilities on your side rather than against you.

PAYROLLS!

So, how about that Nonfarm payrolls report we got last week? It surged a remarkable 287,000 in June following a downwardly revised 11,000 in May. The reality is that the economy probably wasn’t as weak as the May number suggested, and it’s unlikely as strong as June’s report.

BUT:

- Did you know that the weekly jobless claims have held below 300,000 for 70 consecutive weeks? That’s the longest period since the early 1970s.

- Did you know that according to the U.S. Bureau of Labor Statistics, job openings are near a record high?

My point is that while we had a knockout Nonfarm payroll number last week, it’s on the heels of a horrible one from the month before. I always include current economic reports in this blog. However, some of these up and down, back and forth reports can cause investors (and markets) to pay too much attention to a single report that may be irregular. Irregularity can be smoothed away by focusing on trends instead of single data points. Refer back to my “But Bullets”. Yes, I typed “But Bullets”, it’s too funny to edit out and with my 30-year High School reunion coming up, I need to warm up on my juvenile humor a little…indulge me.

For more thoughts that came out of the May report, see my blog “A Swing and a Miss” from June 6th where I discuss the May report of 38,000 jobs.

So What Happened?

Frankly, it’s hard to say on the Monday after the actual report, but I’m thinking that several statistical quirks in the data are probably responsible and this report was probably a catch-up following May’s weakness.

About that 287,000 June report…remember it will be revised two more times. I think the big take away is that it alleviated lingering worries in some corners over the state of the economy. Moreover, it follows two better-than-expected ISM Reports on the Manufacturing and Services sectors. Here is how those reports stacked up. Remember anything above 50 is considered expansionary.

ISM Non-Manufacturing (Services)

- Last report: 52.9

- This report: 56.5

ISM Manufacturing

- Last report: 51.3

- This report: 53.2

The point is that these reports are far from recessionary, which was a big word just a few months ago. Be sure to see our last video where I explain the “over-index” which we follow as one signal of recession probability.

I know everyone has already gone back to that “Swing and a Miss” blog I linked to above and fully read and absorbed it all, but for those one or two people that skipped it, here’s a blurb from that blog.

In case you missed the issue of Barron’s that came out over the Memorial Day weekend, here are the five reasons they claim that equities still have room to run before we need to worry about a crash.

- Payouts remain healthy: The dividend yield on more than 1,400 dividend-paying stocks is higher than in July 2007, even though interest rates are lower.

- No bubble in housing: The median house price in 2016 dollars is significantly below 2006-2007 peaks.

- Yield curve is in normal range: The difference between the 10-year Treasury note rate minus the 3-month T-bill rate remains above zero.

- No spike in oil price: Recessions have historically been preceded by oil-price spikes.

- Rising new-home sales: Sales of new homes in April hit a new peak for the current expansion.

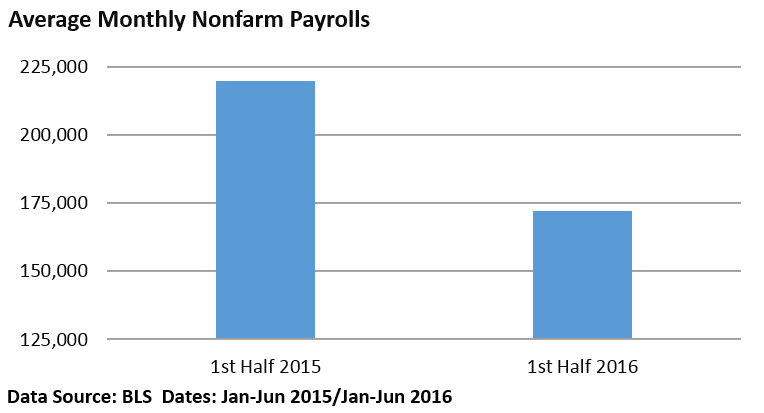

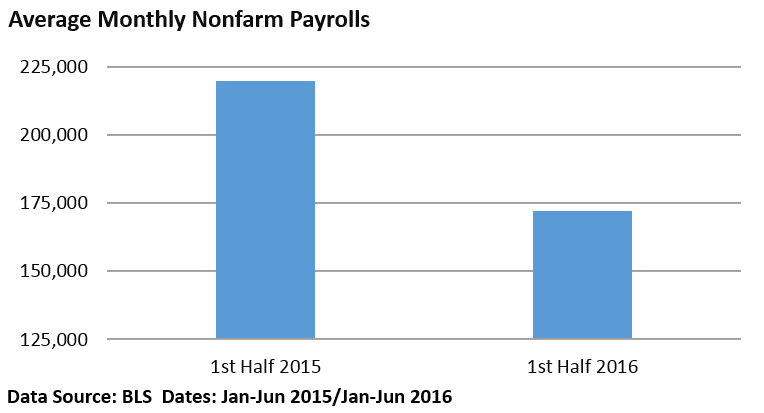

One thing I do want to point out is that while the economy remains in a modest pattern of tepid growth, job growth has actually slowed from a year ago. See this chart from Charles Sherry below.

It’s hard to pinpoint the reason for this disparity, but the fact that we are well into this economic recovery may mean that there are simply fewer qualified workers available to fill open positions.

The economy isn’t all that great but it’s also not crappy either (tepid, Dave, tepid). The good news is that the data show it’s not as bad as some had been saying earlier in the year. Everyone remembers February, right? Take a moment to read “Why the Market is Whipsawing” from back in February of this year.

That leads us to where we are now…and oh boy here we go… second quarter earnings season unofficially begins this week.

Get ready for plenty of comments about the international situation, how the dollar is impacting the bottom line, and any “guidance”. (Guidance is what company leadership says on their “earnings calls” about their future earnings.)

Remember, earnings are important. I think they are much more important than most of the other “news” that drives the daily voting machine.

Please call or email with questions.

Important Disclosure Information for “June Payroll Report Was A Grand Slam, But Is It Important?”

Important Disclosure Information for “June Payroll Report Was A Grand Slam, But Is It Important?”

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.