Whether you’re an executive at a Fortune 500 company or a growing startup, your title isn’t the only thing with a lot of acronyms. Your total compensation likely consists of a plethora of different pieces that you bucket together in your mind as “stock options”–RSUs, ISOs, NQSOs… it’s no wonder you want to simplify. However, those seemingly similar pieces mean different things when it comes to taxes. With big implications for your net worth over time, a cheat sheet to understanding stock option compensation is a must!

One Word Makes a Big Difference–Know What You Have

The word “option” makes you feel good–it denotes flexibility, choice, and gives you a sense of control. However, those “options” may not be the cherry on top of your sundae, perfectly perched on a pillow of whipped cream. They may actually be the sticky hot fudge that melts your ice cream and turns your masterpiece into a soupy mess.

Don’t get me wrong… your company’s stock can be a great way to build wealth over the long term and is a welcomed incentive in your compensation package. But the keyword here is “compensation”.

Oftentimes, the stock you receive is considered another form of compensation that you’re taxed on—even if you didn’t get cash in hand or take any action. As Benjamin Franklin noted, nothing is certain… except taxes. Anyone who has paid taxes knows there’s little flexibility, no choice, and less control than you may like over your taxable income. However, simply knowing what you have and how it works can go a long way in enabling you to take back control in planning for and minimizing taxes.

One of These Things Is Not Like the Other

Restricted Stock Units (RSUs) are a common form of stock-based compensation—but they’re not options and can give you a surprise at tax time if you aren’t prepared. If you think about RSUs as a form of compensation similar to a bonus, you’re off to a good start in planning for their tax impact.

The big difference between RSUs and other forms of stock-based compensation (Non-Qualified Stock Options and Incentive Stock Options) is that you’re not buying shares of your company’s stock. Instead, they’re being given to you and are considered ordinary income when you receive them.

Here’s how they work:

- Your company grants you RSUs, meaning you will receive shares of stock over a pre-determined vesting schedule. There’s no taxable event when you receive a grant.

- Vesting usually occurs in tranches over a period of years to give you a reason to stay on board and create value. For example, you may be granted 5,000 shares of stock, with 25% vesting each year over 4 years.

- If you leave the company before a tranche has vested, you forfeit this future compensation.

- When a tranche vests, the shares you receive are considered income. You now own the shares, but you have a taxable event to report even though you didn’t get cash.

- The Fair Market Value (FMV) of the shares on the date they vest will be reported on your W-2 tax form–meaning you are subject to federal and state income taxes in addition to Social Security and Medicare taxes.

- You may be given different options for handling the tax withholding required for this income, such as selling a portion of the shares that vested.

- The FMV of the stock at vesting becomes your cost basis.

- If you hold vested shares and sell them in the future, the difference between the FMV at the sale and your cost basis will be taxed as a capital gain.

If you have RSUs, it is critical that you:

- Know your vesting schedule–this can help you anticipate when to plan for higher taxable income.

- Keep an eye on the price of your company’s stock–this drives how much taxable income you will have when your RSUs vest and will help in planning.

- Make sure enough money is being withheld to cover the taxes according to your marginal tax rate–or be prepared to make estimated tax payments.

- While taxes are being withheld by your employer, it is often at a rate of 22% for RSUs. It is possible that the combination of the RSUs that vest plus your salary and other sources of income puts you in a bracket above 22%.

- Consult a Certified Public Accountant (CPA) to be sure you have a handle on your marginal tax rate and withholding plan.

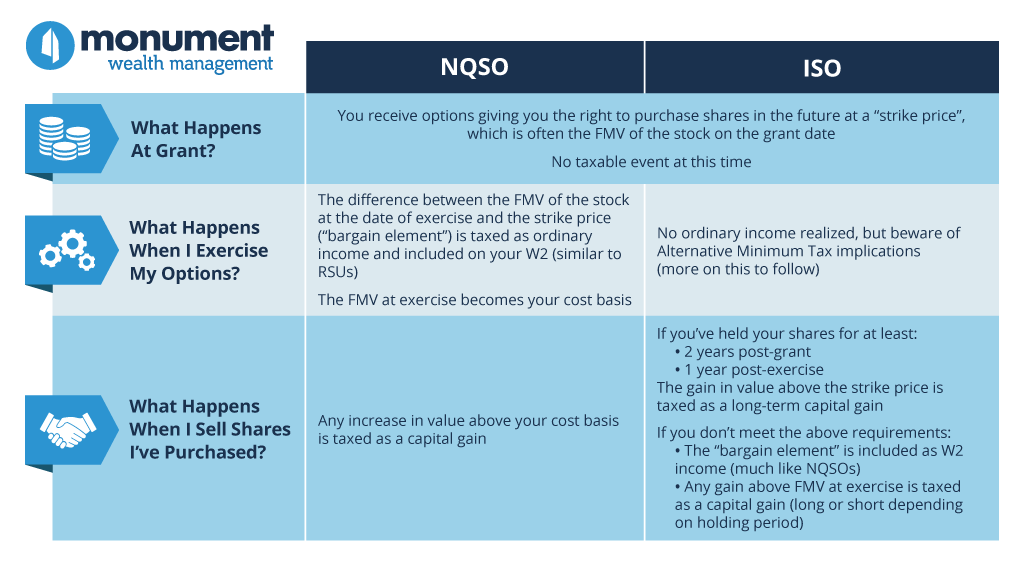

Options with Different Flavors

Non-Qualified and Incentive Stock Options (NQSOs and ISOs respectively) are true “options” in the sense that you have the right (but no obligation) to purchase shares of your company’s stock at a given price, allowing you to benefit from the value you’ve created. Sounds simple, right? While the end result is very similar (you may exercise the options you’ve been granted and buy a given number of shares at the “strike price”), the tax treatment of these options upon exercise is quite different, with ISOs receiving more favorable tax treatment.

ISOs–Not Without Some Twists

Under current tax law, ISOs provide a tremendous opportunity to benefit from your company’s growth without the tax hit that comes with RSUs and NQSOs. While tax-advantaged, ISOs are not without complexity. From strict holding period requirements and plan limitations to the introduction of Alternative Minimum Taxes, ISO exercise requires careful planning.

Unlike NQSOs, which follow straight-forward tax reporting similar to RSUs and require similar planning considerations, ISOs have the potential to trigger payment of the Alternative Minimum Tax when exercised. The bargain element at exercise must be added to income for the purposes of determining whether you’re subject to the Alternative Minimum Tax, which would be higher than the income taxes owed under the parallel regular income tax system. This is a complicated system, and a CPA should weigh in on any planned exercise strategy to ensure you don’t inadvertently create a higher tax bill for yourself.

Everything Working in Harmony

At the end of the day, it’s great to have a form of stock option compensation with the potential to increase significantly because of your hard work and value creation. With careful attention and planning, you can avoid the mistakes and pitfalls that often come with stock-based compensation and result in more of your income going to taxes and less to your personal net worth.

The good news is you don’t have to go it alone. Once you have a handle on what it is that you have, a team of advisors can help you understand how the pieces fit together into your bigger picture. A wealth manager and CPA make a great team in helping you make decisions and develop strategies for maximizing the after-tax value you are left with.

If your life just got more complex, this is your moment. At Monument, we specialize in guiding high-impact decisions across your financial life with strategic planning grounded in what you value and where you’re headed next.