Tax Season FAQs

Below are some questions we often hear from our wealth management clients when they’re prepping for tax season.

If you do not find an answer to your question here, please email our Team at support@monumentwm.com or call us on the Private Client Line.

When will my tax forms be available?

Schwab’s first production run happens in late January to early February for accounts where Schwab has all necessary tax information, such as:

- Accounts that did not have any sales in December

- Accounts that do not hold fixed income securities and other income-producing investments, such as REITs

- Accounts that received income where the issuer providing the tax classification has either provided reclassification information prior to the production run or has not reclassified dividend income in the past three years

The second production run happens in mid-February for all accounts not included in the first run.

TDAI has four production runs, with some occurring later than Schwab’s.

Tax Form Production Schedule:

Why aren’t they available all at once?

Many custodians produce consolidated 1099s in two or more waves depending on the types of investments an account holds, the reclassification status of dividends received, and when trading has occurred in the account. Because corrected 1099 forms are triggered as a result of securities with reclassified income or wash sales with deferred losses resulting from January purchases, a second, later production run can limit the number of corrected forms sent out.

Why did I receive so many 1099s?

You will receive 1099s in the mail from each financial institution that held your accounts throughout the year (1099s for taxable non-retirement accounts and 1099-Rs for retirement accounts from which you’ve taken a distribution).

How will the TD Ameritrade Institutional (TDAI) merger with Schwab in 2023 impact my tax forms?

You can expect tax forms from both custodians for tax year 2023 for your accounts managed by Monument. The form from TDAI will cover any reportable activity from January 1, 2023 through September 4, 2023 and the form from Schwab will cover reportable activity from September 5, 2023 through the end of the year. These are not duplicate forms – both are required to complete your tax return.

Reclassification: What is it and what do I need to know?

Income reclassification is an annual process where security issuers change the tax characterization of distributions that were paid during the tax year. Often, the result of income reclassification is a more favorable tax treatment.

The income reclassification process takes place after the end of the tax year, during the first quarter, when security issuers announce their income reclassification for the previous tax year. The income reclassification process affects the tax nature of income distributions you may have received during the previous tax year.

The IRS requires final income reclassification to be reported to you on Form 1099. All financial industry firms receive reclassified data from the issuers.

This reclassification process may result in corrected consolidated 1099 forms being issued later in the tax season. If you are invested in income-producing strategies that hold securities like REITs or Business Development Companies (BDCs), you may receive an initial consolidated 1099 and a corrected consolidated 1099 around March or April.

Schwab will produce corrected 1099s every two weeks following the mailing of the second original production run, then weekly at the end of March through the April tax filing deadline.

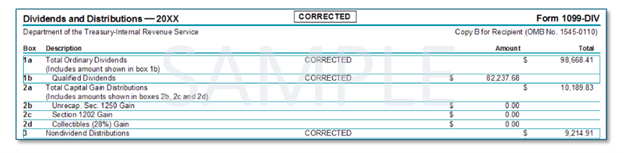

When a reportable item has been changed, the item(s) will be marked as “CORRECTED” on the 1099 (example below).

Will each of my accounts generate a tax form?

Schwab and TD Ameritrade will apply Internal Revenue Service (IRS) “de minimis” rules to determine if a tax form needs to be produced for the 2023 tax year. This will decrease the amount of tax forms generated and allow for fewer corrections.

A form will be produced for an account only when at least one of the following conditions are met:

- The account receives at least $10 in dividend income.

- The account receives at least $10 in interest, royalties, or original issue discount (OID) income.

- A Form 1099-B reportable transaction occurs in the account (e.g., a sell or a buy to cover).

If the account did not include any of these activities, a 1099 will not be generated for 2023.

How do I get my tax forms online?

You can access your tax forms on the Monument Client Portal for accounts held at TDAI or Schwab. TDAI and Schwab forms will also be available at Schwab Alliance and may be available sooner than on the Monument Client Portal. If you don’t see a form you are expecting, please contact the Monument Team so that we may help.

If you have an account with Jackson, Lincoln, American Funds or another institution, your statements will come directly from them, or their online portal, if there is any taxable activity to report.

Who should I contact with questions about my 1099s or investments as they relate to my taxes?

Our Team at support@monumentwm.com is a good starting point for these questions, but your CPA will be your best reference for tax advice.

**Remember, Monument is not an accounting firm, and no portion of our website content should be interpreted as accounting or tax advice. That said, we are happy to provide you with names of accountants who we and other people we know like and trust to help with your taxes. Let us know if you’d like us to make an introduction.