The Election

Someone please tell Ball Park Franks they HAVE to hire Anthony Weiner to make a spoof YouTube ad for next summer. I mean, it’s a layup.

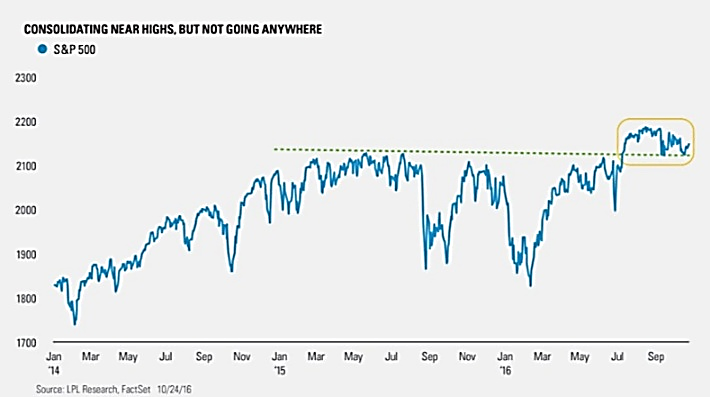

Other than that, I’m not touching the election. The only points I’ve made about it can (and should) be read in one of my earlier blog posts. You can already see how the market will react to any surprise election results that do not come out in favor of Clinton by looking at Friday’s market action in response to “Clinton Email Issue Version 1.23 x 105.”

GDP Report

On the surface, it looks like the U.S. economy got good news on Friday morning – but as my High School Mechanical Drawing teacher, Mr Kenneth H. Weber (the guy was a glider pilot in Market Garden in WWII) would say, “Now you just hold the damn phone!”

Gross Domestic Product (GDP) grew by 2.9% in the third quarter, which was the fastest pace in two years. This was up from a (ahem – tepid) 1.4% in the second quarter.

While this was better than expected, there is reason to hold the damn phone.

Soybeans.

Soybeans?

Yeah, soybeans.

The GDP report showed that the nice number came from two things…inventories and trade.

Over the weekend I read a note by Neil Dutta, from Renaissance Macro, which said that inventories added 0.61 percentage points and trade added 0.83 percentage points to the report.

Basically, that means GDP, excluding inventories and trade, rose at 1.4%. Those still holding the damn phone will realize is the same as the second quarter.

Let me cut to the chase. South America exports a ton of soybeans to the rest of the world and Farmer Ted (my Sixteen Candles reference for you Millennials) said they had a poor crop this year.

So guess who filled the gap? Yup, the good old U.S. of A.

This distorts the numbers, so we can’t count on it going forward.

The increase in inventories basically means that companies restocked warehouse shelves. The value of inventories increased by $12.6 billion in the third quarter after a $9.5 billion decline in the second quarter. So that’s not bad.

Bottom line – I don’t think much has changed. While no one likes tepid economic growth, it’s not negative and it’s something we have become used to as the “new normal” over the past 8 years.

There is a ton of political pressure for the Fed to raise interest rates in December, but this report is not “accretive” to that position.

How David Letterman can help you be a better behaving investor.

It’s rare that I read the New York Times anymore. I’m not sure why. I suppose I could blame it on the fact that I’m probably as sick of the non-financial print media as I am of the televised financial media, but I think it has more to do with how I consume news these days through my Twitter feed. Given that, I’m not sure what prompted me to click on and read a recent NYT interview with David Letterman, especially since I was never a David Letterman fan.

Go figure. But check out the article.

Low and behold, there was this amazing example of human emotion that is worth pointing out since I’ve commented on over the years. He said, “Maybe life is the hard way, I don’t know. When the show was great, it was never as enjoyable as the misery of the show being bad. Is that human nature?” (Emphasis mine).

Oh Dave, it’s human nature for sure and in the world of Behavioral Finance, it’s called Prospect Theory and it has implications for investors AND advisors everywhere. I’ve referenced it recently in other blog posts. I’ve also written more extensively about it in one of our most popular blog posts of 2014. If you are new to reading this blog, think you may have skipped it or don’t remember it and want a refresher, it’s worth the 5-7 minutes it takes to read. Finally, two articles I penned back in 2011 and 2010 for U.S. News and World Report titled, “4 Reasons You Stink at Managing Your Own Money“ and “Investors: Please Behave Yourselves.”

Here’s how Prospect Theory works. It basically states that losses have more emotional impact than the same amount of gains. For example, you SHOULD feel just as good at making $6,000 in a stock as you SHOULD feel if you made $10,000 and then lost $4,000 for the same net gain of $6,000.

I already know you don’t even like READING that second part let alone experiencing it.

However, despite the fact that you still end up with a $6,000 gain in either case, most investors view a single gain of $6,000 more favorably than gaining $10,000 and then losing $4,000.

Here’s what else it does. It increases the tendency for investors to hold on to losers for way too long and to sell winners too soon. The most rational thing to do would be to hold on to the winners in order to promote further gains and to sell losers to prevent escalating losses.

We see this play out when we have people take our Riskalyze test and, to invent an example for the purposes of this point, settle for a lower guaranteed gain of say $1,000 compared to choosing a riskier option that either results in a gain of $2,000 or $0. Investors seek to cash in on the amount of gains that have already been guaranteed.

It does not seem like it, but it’s a sign of risk-averse behavior. I’m not saying it’s bad, I’m just pointing out that emotions are at work and it’s good to be aware of them.

David Letterman hits the nail smack on the head. People feel the effect of loss and agony to a greater extent than they feel the impact of a corresponding amount of reward or pleasure. This causes investors to tend to hold on to the losers because if they don’t actually sell the loser then they don’t have have to admit that the trade didn’t work…avoiding some measure of pain. The opposite effect is that investors sell winners as fast as possible to avoid “giving back the gains.”

The solution is not complicated. It requires discipline. It is for this very purpose that adherence to models is front and center in most of what we do. It’s never been easy to make the trades that our models call for, but I can attest to the fact that it is easier and I believe more profitable than trying to navigate the markets without models.

Be sure to call us if you want to know more about how we use models in our decision making process.

(Side note: I worked on this blog for a great deal of the weekend only to see a popular blogger reference this NYT article on a late Sunday blog post of his own…jezzzzz. Anyway, just wanted to vent.)

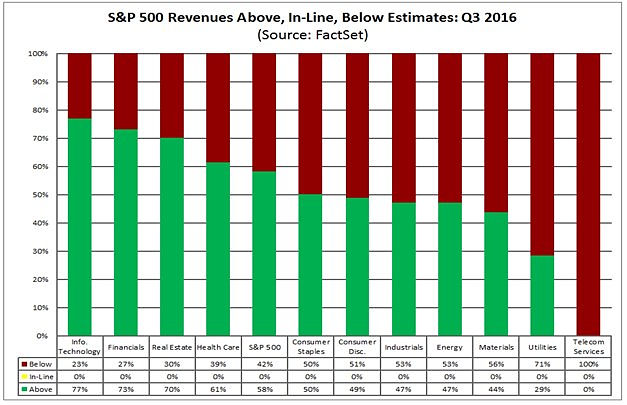

Earnings

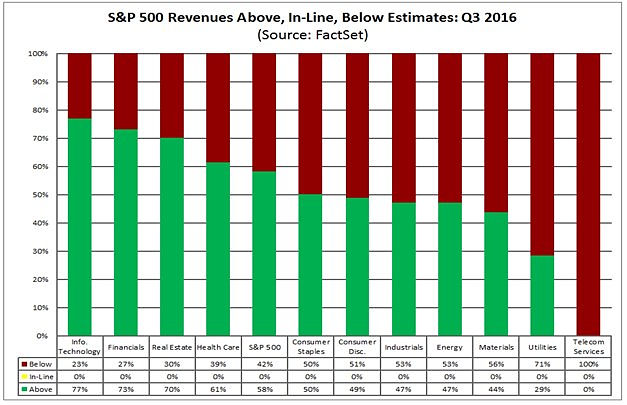

Since I wrote all of the above, I’ll keep the technical stuff as short as I can. As earnings go, FactSet shows that 58% of the S&P 500 companies have beaten sales estimates (revenues) for the third quarter (Q3). This is above the 5-year average of 54%.

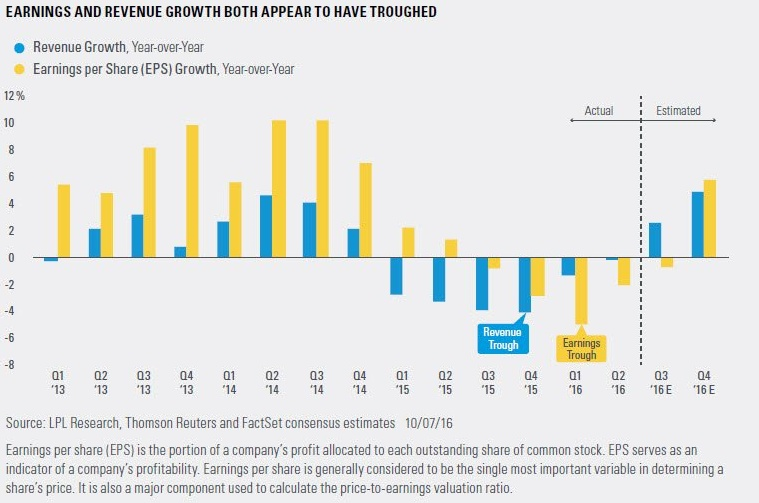

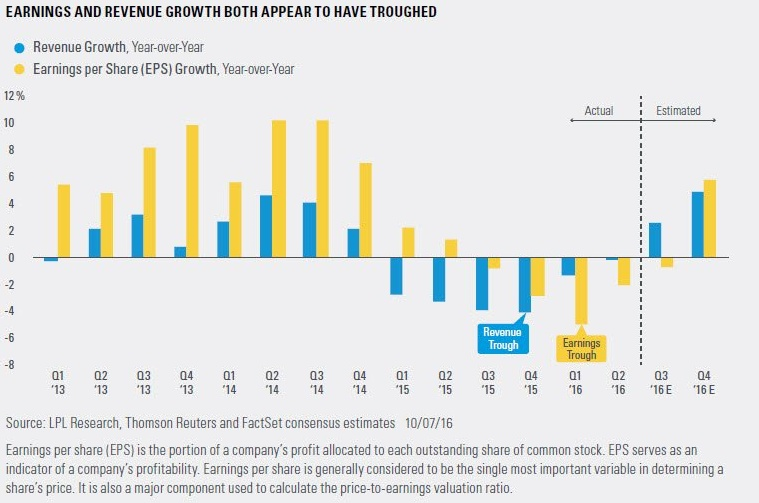

Burt White from the LPL Research Department thinks revenue and earnings have “troughed.” Here’s his proof.

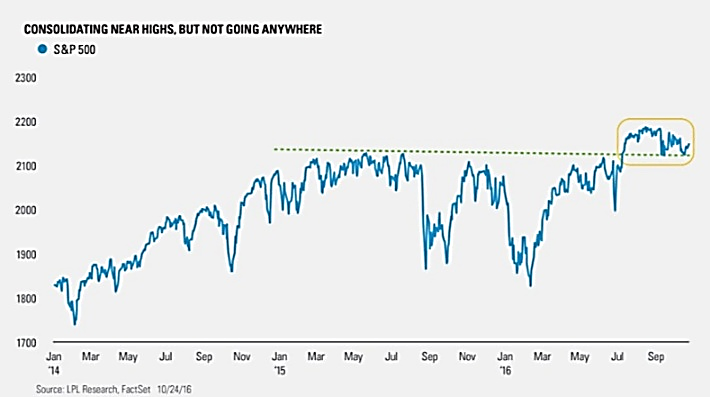

This is good news for those feeling like their portfolios have not really gone anywhere.

Other things I found interesting this week

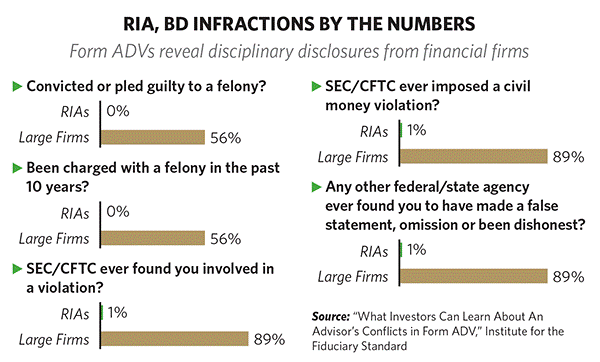

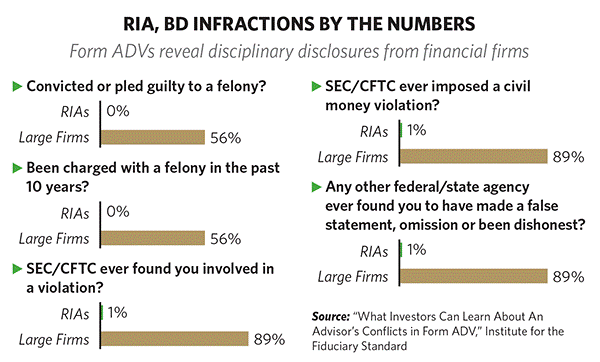

We are really proud of what we have built here at Monument and think it’s a pretty special place. If you missed how we were selected to be one of Entrepreneur Magazine’s 2016 Entrepreneur 360 companies, be sure to see it here (https://features.entrepreneur.com/entrepreneur-360/). That said, competition is stiff in this business and the large firms are the greatest source of competition we come across (and frankly the biggest source of opportunity for us as well).

The chart below makes me wonder why anyone would choose them. Since I cannot be objective on the topic, I’ll let the information below from the Institute for the Fiduciary Standard address the topic.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. All indexes referenced are unmanaged and cannot be invested into directly. The economic forecasts set forth may not develop as predicted. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.