It was another poor week across the board with all major asset classes selling off, the dollar up, and Emerging Markets equities underperforming despite some pretty decent economic data. I think the last few weeks can be summed up as equity markets re-pricing down based on the increasing risk that the Fed will tighten, Greece getting greasy, and the reported illiquidity in bond markets. I think the Greek volatility should begin to fade next month – there will be some eventual compromise on this issue because most Greeks and the rest of the European Union (EU) want Greece to stay in the EU. But even if I’m wrong, the fact that this drama has been going on for so long should not catch anyone off guard.

The S&P 500 may have sold off 0.65% last week, but year-to-date (YTD) the cyclical sectors of the index are doing well. Healthcare, Consumer Discretionary, Tech and Materials are the top for sectors returning 8.9%, 6.4%, 4.3% and 3.4% YTD respectively, versus the S&P 500 at 2.60%. Utilities are down the most at -8.8% YTD.

Why’s that notable? Well, it’s because Utilities were the top performing sector of 2014 at +29%.

Jeezzzz – and how BORING are the Tony Awards?

Valuations

There is a lot of talk about how expensive the market is. Okay, perspective time… and this may be a little jargon heavy, so focus on the big picture… as of the end of May, the S&P 500 is trading at 16.8x its forward Price-to-Earnings Ratio (P/E) and its 15-year average is 15.9x. That means the prices are a little bit more expensive based on future earnings than average.

In March of 2000, right before the tech bubble popped, the forward P/E was 25.6x.

Just because stocks are expensive, it does not mean an investor should be selling. In fact, here’s what I think and what investors should be thinking and what investors should be doing.

- If you think the market is expensive and you are sitting on cash, consider waiting for a pull-back.

- If you are invested in the equity markets, don’t sell just because the equity market is expensive. The market can stay expensive for a long time and the value of equities can keep going up.

- If you need cash for something over the next 18-24 months, consider keeping that amount in cash right now or selling some equities to generate the cash needed. If there is any correction, you will be able to ride it out if you generate your liquidity now.

- If you have 18-24 months of cash on hand and there is a correction, you can safely ride it out.

It’s not as easy as it seems…

- Investors never want to sell high and sit on cash because the euphoria of a bull market is tough to overcome

- Investors never want to invest when the market is cheap. (Question: were you buying in March of 2009 when the forward PE was 10.3x!?! Probably not.)

- Investors are impatient and believe that inactivity is synonymous with doing nothing.

Corrections

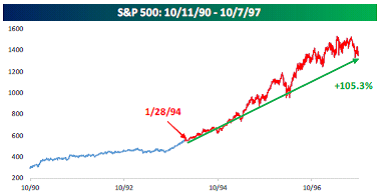

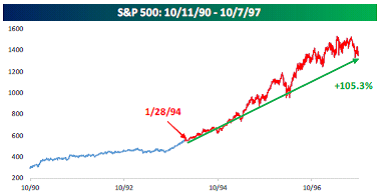

It’s been 1339 days without a correction of 10% in the S&P 500. We came close in October with the Ebola scare (remember that?), but came up just short of hitting the -10% mark. This stretch without a correction is the third longest in stock market history. One stretch that was longer came in the mid-2000s. It was boring so I want to talk about the longest in history.

The longest stretch came in the 1990s. 2,553 days.

On January 28th, 1994, the S&P 500 set a record as the longest streak without a 10% correction. If you used that as a gauge to sell, you would have missed another 105.3% return in the market. See this blurry chart from Bespoke.

Just because stocks are expensive or set some sort of record it does not mean they will start to go down.

Valuations and Corrections – Combine the two and here’s what I think.

Valuations support being careful about getting into the market more than they support a thesis of getting out of the market right now. When a correction comes, be ready to possibly weather a decline that could last one year to 18 months. Raise the cash you need for 18 months now, otherwise, saddle up cowboy. Or cowgirl.

Economy

I’ll break this down.

Jobs and Employment

The May employment report was awesome and showed that 280,000 new jobs were created. In addition to that, previous months were revised upward. Wages also accelerated by 0.3% for the month and 2.3% year-over-year. This was the fastest rate of increase in nearly six years. Why’s this important? Because stronger jobs and wage growth mean consumer spending should increase.

Couple that with gas savings being spent in the future and that’s a nice combo.

Employment

Wages are up (about 2.3% from a year ago), jobless claims are down, non-farm payrolls just printed 280k and more people are re-entering the workforce looking for jobs. Prior jobs reports were revised HIGHER and the employment picture is establishing some momentum after a slow start to 2015. That’s all very good.

First Quarter GDP

Broken record alert… but I think first quarter GDP will be better than the report numbers signaled. Without getting all finance geek speak on you, the Blah Blah Blah Bureau stated that some statistical issues may have caused first quarter growth to appear worse than it actually was, so they plan to remedy these problems at the end of July… I’m betting we see an upward revision of first quarter GDP growth. (Email me if you want to know the boring name.)

Oh, and anyone worried about deflation needs to look no further than car sales. Six years ago, U.S. Automakers were fighting against going bankrupt… now they are selling cars at an annually adjusted rate of 17.71 million cars per year, which is a post-recession high. In fact, that’s the highest annual rate since 2005. I think some of the increase in car sales can be attributed to a reduction in gas prices, so maybe we are starting to see some of the gas savings break loose.

Cars are a pretty good indication that the economy may be doing better than the recent reports suggest. NOTHING DRIVES THE U.S. ECONOMY LIKE HOUSING AND CARS.

We may have had a few bad weeks, but the fact remains that the S&P 500 is only 2% away from setting a new high. Because I know that there are a few of you who do not read my blog every week (shame on you!) here’s a quote from the blog on May 27.

“We believe 2Q will bounce back very nicely and investors SHOULD STAY INVESTED AND NOT MESS AROUND WITH TRYING TO RAISE CASH AND THEN REINVESTING LATER.”

In fact, here’s the best piece of advice I have for you: if you are a current MWM client, go have a good summer and don’t mess around with your investments. We are on top of it and if something needs to be adjusted, we will let you know. Remember, often the best action is inaction.

If you are not a client, forward me the blog of your current advisor. I always enjoy reading the thoughts of others. If your advisor doesn’t have a blog, ask them why.

Please call with questions.

Important Disclosure Information for “Are Things Getting Better While The Market Sells Off?”

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Monument Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Monument Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Monument Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Monument Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.